A Decade of Fluctuations: Analyzing the Zinc Value Chart (2014-2024)

Associated Articles: A Decade of Fluctuations: Analyzing the Zinc Value Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to A Decade of Fluctuations: Analyzing the Zinc Value Chart (2014-2024). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

A Decade of Fluctuations: Analyzing the Zinc Value Chart (2014-2024)

The zinc market, an important part of the worldwide economic system, has skilled a rollercoaster trip over the previous decade. From durations of strong development to important downturns, understanding the value fluctuations of zinc requires analyzing a posh interaction of things, starting from provide and demand dynamics to geopolitical occasions and technological developments. This text delves into the zinc value chart from 2014 to 2024 (projected), inspecting the important thing drivers behind its volatility and providing insights into potential future developments. Notice that knowledge for 2024 and past is projected primarily based on present market developments and professional predictions, and thus carries inherent uncertainty.

2014-2016: A Interval of Decline and Consolidation

The interval between 2014 and 2016 witnessed a common downward pattern in zinc costs. A number of elements contributed to this decline:

-

World Financial Slowdown: The worldwide economic system skilled sluggish development throughout this era, notably in rising markets like China, which considerably impacted demand for zinc, an important metallic in building and manufacturing. Diminished industrial exercise instantly translated into decrease zinc consumption.

-

Elevated Provide: A number of new zinc mines got here on-line throughout this time, rising the worldwide provide of the metallic. This elevated provide, coupled with weakening demand, put downward stress on costs.

-

Stock Ranges: Excessive stock ranges additional exacerbated the value decline. Producers and merchants held important stockpiles of zinc, resulting in a surplus out there and additional miserable costs.

The worth chart throughout this era reveals a gradual lower, with occasional durations of slight restoration, however general reflecting a bearish market sentiment. The worth hovered across the $1,800-$2,200 per tonne vary for a lot of this era.

2017-2018: A Resurgence Pushed by Demand

A noticeable shift occurred in 2017 and 2018, with zinc costs experiencing a big upswing. This resurgence was primarily pushed by:

-

Strengthening World Financial system: A renewed interval of worldwide financial development, notably in developed economies, boosted demand for zinc throughout numerous sectors. Building exercise picked up, and manufacturing output elevated, resulting in larger zinc consumption.

-

Provide Constraints: Whereas new mines continued to come back on-line, a number of present mines confronted operational challenges, together with disruptions because of labor disputes and environmental rules. These provide constraints helped tighten the market, pushing costs larger.

-

Elevated Galvanizing Demand: The galvanizing trade, a serious client of zinc, skilled important development, additional contributing to the rise in demand.

The worth chart throughout this era reveals a steep incline, with costs reaching ranges not seen in a number of years. The worth peaked above $3,300 per tonne in 2018 earlier than experiencing a correction.

2019-2020: Commerce Wars and Pandemic Influence

The years 2019 and 2020 introduced a blended bag for the zinc market.

-

US-China Commerce Battle: The escalating commerce battle between the US and China created important uncertainty within the world economic system, impacting demand for numerous commodities, together with zinc. The disruption to world commerce flows negatively affected zinc costs.

-

COVID-19 Pandemic: The onset of the COVID-19 pandemic in early 2020 introduced the worldwide economic system to a close to standstill. Lockdowns, manufacturing facility closures, and decreased building exercise considerably decreased demand for zinc, resulting in a pointy value drop.

The worth chart displays this volatility, exhibiting a decline in 2019 adopted by a extra dramatic drop in early 2020. Nevertheless, the market started to get well later in 2020 as economies step by step reopened.

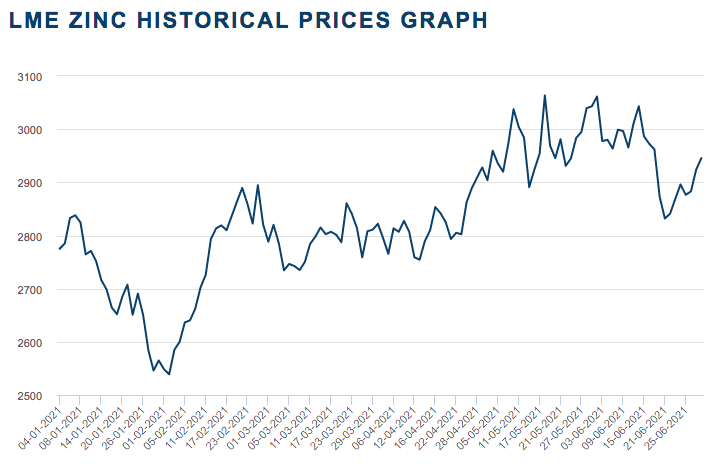

2021-2023: Restoration and Renewed Development

The interval from 2021 to 2023 witnessed a powerful restoration in zinc costs, fueled by a number of elements:

-

Put up-Pandemic Rebound: The worldwide economic system rebounded strongly from the pandemic-induced stoop, resulting in a surge in demand for zinc throughout numerous sectors. Building and manufacturing actions picked up tempo, driving larger zinc consumption.

-

Provide Chain Disruptions: World provide chains confronted important disruptions as a result of pandemic and different geopolitical occasions. This led to shortages of varied uncooked supplies, together with zinc, additional contributing to cost will increase.

-

Inexperienced Initiatives: The rising concentrate on inexperienced applied sciences and renewable power additional boosted zinc demand. Zinc is an important part in photo voltaic panels, wind generators, and electrical automobile batteries.

The worth chart throughout this era reveals a constant upward pattern, with costs reaching ranges akin to the height in 2018. Nevertheless, the market skilled some volatility because of ongoing provide chain points and issues about world financial development.

2024 and Past: Projections and Uncertainties

Predicting zinc costs for 2024 and past is difficult because of a number of uncertainties:

-

Geopolitical Dangers: Ongoing geopolitical tensions and potential conflicts might disrupt world provide chains and impression zinc manufacturing and commerce.

-

Inflation and Curiosity Charges: Excessive inflation and rising rates of interest might dampen financial development and cut back demand for zinc.

-

Technological Developments: Technological developments might result in the event of different supplies, probably decreasing the demand for zinc in sure functions.

-

Sustainability Considerations: Rising issues in regards to the environmental impression of zinc mining and processing might result in stricter rules, probably affecting provide.

Based mostly on present market developments and professional predictions, a comparatively secure value vary is anticipated, although the precise trajectory stays unsure. The continued development of renewable power and electrical automobile sectors might assist zinc demand, whereas potential financial slowdowns or provide chain disruptions might exert downward stress on costs.

Conclusion:

The zinc value chart over the previous decade reveals a dynamic market influenced by a posh interaction of things. Whereas durations of decline have been punctuated by important upswings, the general pattern suggests a comparatively sturdy underlying demand for zinc, notably pushed by industrial exercise and the rising adoption of inexperienced applied sciences. Nevertheless, navigating the way forward for zinc costs requires shut monitoring of worldwide financial situations, geopolitical occasions, and technological developments. The inherent volatility of the market necessitates a cautious strategy, with traders and stakeholders needing to rigorously assess the dangers and alternatives introduced by this important metallic. Additional analysis and evaluation are essential for a extra exact understanding of the long-term trajectory of zinc costs.

Closure

Thus, we hope this text has offered invaluable insights into A Decade of Fluctuations: Analyzing the Zinc Value Chart (2014-2024). We hope you discover this text informative and useful. See you in our subsequent article!