A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Associated Articles: A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

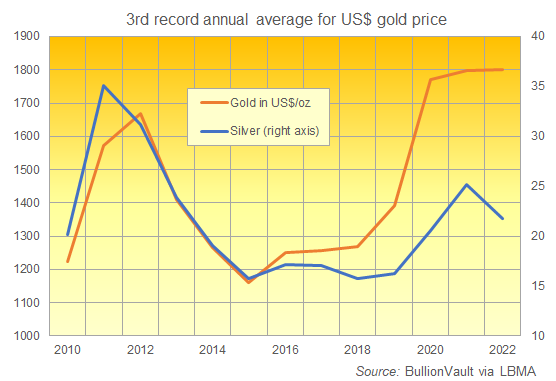

Gold, a timeless image of wealth and stability, has a worth historical past as risky as the worldwide financial system itself. Analyzing a ten-year interval, say 2014-2024 (a hypothetical future interval for illustrative functions, as we’re at present in 2023), permits us to watch the interaction of geopolitical occasions, financial shifts, and investor sentiment that form the valuable metallic’s worth. This text will delve right into a hypothetical ten-year gold worth chart, analyzing key traits, influential elements, and forecasting potential future actions. Observe that the info offered for 2024 and past is only speculative and based mostly on present traits and professional projections.

The 2014-2019 Interval: A Descent from the Peak

The interval starting in 2014 noticed gold costs steadily decline from the highs reached within the early 2010s. The chart would possible present a downward pattern, punctuated by occasional rallies. A number of elements contributed to this decline:

-

Strengthening US Greenback: A strengthening US greenback, usually thought of a secure haven asset itself, put downward strain on gold costs. Because the greenback appreciated, gold, priced in USD, turned costlier for holders of different currencies, decreasing demand.

-

Rising Curiosity Charges: The Federal Reserve’s gradual improve in rates of interest throughout this era made various investments, like bonds, extra enticing. Increased rates of interest improve the chance value of holding non-interest-bearing property like gold.

-

Decreased Investor Demand: The worldwide financial system, whereas experiencing durations of development, was not experiencing the identical degree of uncertainty as throughout the 2008 monetary disaster. This diminished the flight-to-safety demand for gold, which usually surges throughout occasions of financial turmoil.

-

Elevated Gold Provide: Mining manufacturing continued to extend, including to the general gold provide and probably contributing to cost moderation.

-

Geopolitical Occasions: Whereas geopolitical instability definitely performed a job, the affect was much less dramatic than in earlier durations. Though occasions like the continued Syrian battle and tensions in Jap Europe existed, they did not set off the identical degree of gold shopping for as main international crises.

The 2020-2024 Interval: A Rollercoaster Journey

The COVID-19 pandemic dramatically altered the panorama. The hypothetical chart would present a pointy surge in gold costs in early 2020, reflecting the unprecedented financial uncertainty and market volatility. This surge would signify a traditional "flight to security" phenomenon. Nevertheless, the next years would possible exhibit a extra advanced sample.

-

Pandemic-Induced Volatility: The preliminary worth surge was adopted by durations of consolidation and even decline as governments applied large stimulus packages and central banks pursued aggressive financial easing. These actions, whereas supposed to help the financial system, additionally diluted the worth of fiat currencies, probably supporting gold’s enchantment in the long run.

-

Inflationary Pressures: The huge fiscal and financial stimulus measures applied globally fueled inflationary pressures. Gold, usually seen as a hedge in opposition to inflation, would possible see elevated demand as buyers sought to guard their buying energy. The chart would possible present durations of great worth will increase correlated with rising inflation charges.

-

Geopolitical Tensions: Elevated geopolitical tensions, probably together with escalating conflicts, commerce wars, and shifts in international energy dynamics, would contribute to gold’s worth fluctuations. Intervals of heightened uncertainty would possible be mirrored in worth spikes.

-

Technological Developments: Advances in mining know-how and exploration may probably affect the gold provide, impacting costs. Nevertheless, the affect of technological developments would possible be much less vital than the macroeconomic and geopolitical elements.

-

Central Financial institution Exercise: Central banks’ shopping for and promoting of gold reserves would affect the market. Elevated central financial institution shopping for could be bullish for gold costs, whereas promoting would exert downward strain.

Speculative Outlook for 2024 and Past:

Predicting gold costs past 2023 is inherently speculative. Nevertheless, based mostly on the hypothetical traits described above, a number of situations may unfold:

-

Situation 1: Continued Inflation and Geopolitical Uncertainty: If inflation stays elevated and geopolitical tensions persist, gold costs may proceed to rise, probably reaching new all-time highs. This state of affairs assumes a sustained flight to security and a weakening US greenback.

-

Situation 2: Inflation Management and Financial Stability: If central banks efficiently handle to regulate inflation and the worldwide financial system experiences a interval of relative stability, gold costs would possibly consolidate and even decline. Traders would possibly shift their focus to different asset courses providing increased returns.

-

Situation 3: A Shock Financial Shock: An unexpected financial shock, comparable to a serious international recession or a big geopolitical occasion, may ship gold costs hovering as buyers search a secure haven.

Conclusion:

The hypothetical ten-year gold worth chart (2014-2024) would illustrate a fancy interaction of financial, geopolitical, and psychological elements. Whereas a easy upward or downward pattern is unlikely, the general route of gold costs would rely closely on the prevailing macroeconomic setting and investor sentiment. Understanding these underlying forces is essential for anybody searching for to navigate the risky world of gold funding. The inherent uncertainty emphasizes the necessity for cautious evaluation, diversification, and a long-term funding technique. Whereas historic information offers invaluable insights, it is important to do not forget that future worth actions stay inherently unpredictable, and the evaluation offered right here is only speculative based mostly on present traits and professional opinions. It’s crucial to conduct thorough analysis and seek the advice of with monetary professionals earlier than making any funding selections.

Closure

Thus, we hope this text has supplied invaluable insights into A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). We hope you discover this text informative and helpful. See you in our subsequent article!