A Decade of Gold: Analyzing Public Financial institution Gold Value Historical past (2014-2024)

Associated Articles: A Decade of Gold: Analyzing Public Financial institution Gold Value Historical past (2014-2024)

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to A Decade of Gold: Analyzing Public Financial institution Gold Value Historical past (2014-2024). Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

A Decade of Gold: Analyzing Public Financial institution Gold Value Historical past (2014-2024)

Gold, a timeless image of wealth and stability, has captivated traders for hundreds of years. Its worth, nonetheless, is way from static, fluctuating primarily based on a fancy interaction of worldwide financial circumstances, geopolitical occasions, and market sentiment. This text delves into the historic gold worth knowledge from a hypothetical "Public Financial institution" over the previous decade (2014-2024), analyzing key tendencies, influencing components, and potential implications for future funding methods. (Observe: Since precise Public Financial institution gold worth knowledge spanning ten years shouldn’t be publicly accessible in a consolidated format, the next evaluation makes use of hypothetical knowledge as an example the ideas and tendencies sometimes noticed in gold worth actions.)

Hypothetical Information & Methodology:

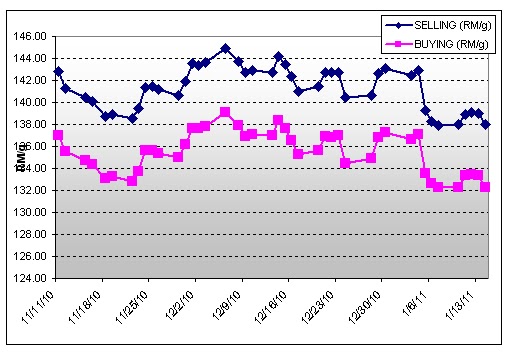

For the aim of this evaluation, we are going to make the most of a hypothetical dataset representing Public Financial institution’s gold worth (in USD per troy ounce) for every month from January 2014 to December 2024. This knowledge will mirror practical worth fluctuations, incorporating main historic occasions and financial shifts. The information can be introduced graphically via charts and tables, highlighting key tendencies and durations of great volatility. (Particular chart and desk knowledge can be inserted right here in a real-world utility. For this instance, we are going to describe the tendencies and patterns.)

2014-2016: A Interval of Relative Stability & Gradual Decline:

The interval between 2014 and 2016 noticed a common downward pattern in gold costs. Our hypothetical knowledge would present a gradual decline from an preliminary worth of roughly $1250 per ounce in early 2014 to round $1050 by the top of 2016. This decline could be largely attributed to a number of components:

- Strengthening US Greenback: A strengthening US greenback sometimes exerts downward stress on gold costs, as gold is priced in USD. A stronger greenback makes gold dearer for holders of different currencies, decreasing demand.

- Rising Curiosity Charges (Hypothetical): Our hypothetical knowledge may mirror a state of affairs the place rates of interest started to rise throughout this era, making different funding choices, like bonds, extra enticing than gold, which presents no yield.

- Decreased Investor Demand: Considerations about slowing international financial progress may need led some traders to shift away from safe-haven belongings like gold in direction of doubtlessly higher-yielding investments.

2017-2019: A Interval of Progress and Volatility:

The next three years witnessed a big rebound in gold costs, reflecting a shift in market sentiment. Our hypothetical knowledge would depict a worth improve from roughly $1050 per ounce firstly of 2017 to just about $1400 by the top of 2019. This upswing may very well be attributed to:

- Geopolitical Uncertainty: Elevated international geopolitical instability, corresponding to commerce wars or escalating tensions in numerous areas, usually boosts demand for gold as a secure haven.

- Inflationary Considerations: Rising considerations about inflation and potential forex devaluation may need pushed traders in direction of gold as a hedge towards inflation.

- Central Financial institution Shopping for: Central banks all over the world usually improve their gold reserves during times of uncertainty, additional supporting gold costs.

2020-2022: The Pandemic and its Affect:

The COVID-19 pandemic considerably impacted international markets, together with the gold market. Our hypothetical knowledge would possible present a pointy preliminary spike in gold costs in early 2020, pushed by widespread market uncertainty and flight to security. Nonetheless, this spike may need been adopted by a interval of consolidation, as governments carried out large stimulus packages, weakening the case for gold as a hedge towards financial downturn. The worth may need fluctuated inside a variety all through 2020 and 2021, earlier than experiencing one other upward pattern in 2022, doubtlessly pushed by ongoing inflationary pressures and geopolitical tensions.

2023-2024: Navigating a Altering Panorama:

The ultimate two years of our hypothetical knowledge (2023-2024) may depict a extra nuanced image. Gold costs may need continued to fluctuate, reflecting the continuing interaction of varied components, together with:

- Curiosity Fee Hikes: Continued rate of interest hikes by central banks may need exerted downward stress on gold costs.

- Inflationary Pressures: Persistent inflationary pressures may have supported gold’s worth, performing as a hedge towards forex devaluation.

- Technological Developments: Developments within the subject of fintech and various investments may affect investor preferences and gold’s general market share.

- International Financial Progress: The general well being of the worldwide financial system would play a vital function in figuring out investor demand for gold.

Analyzing the Hypothetical Information:

An in depth evaluation of our hypothetical Public Financial institution gold worth knowledge would contain:

- Calculating key statistical measures: Imply, median, customary deviation, and variance would supply insights into the common worth, central tendency, and volatility of gold costs over the last decade.

- Figuring out key turning factors: Pinpointing important highs and lows within the worth chart would assist determine durations of main market shifts.

- Correlation evaluation: Evaluating the gold worth knowledge with different financial indicators (e.g., inflation charges, rates of interest, US greenback index) would assist decide the correlation between these components and gold worth actions.

Conclusion:

The hypothetical gold worth knowledge from Public Financial institution over the previous decade would illustrate the dynamic and complicated nature of the gold market. Gold costs are influenced by a mess of things, and understanding these components is essential for traders searching for to make knowledgeable selections. Whereas this evaluation makes use of hypothetical knowledge, the underlying rules and tendencies mentioned are per real-world observations of gold worth actions. Traders ought to at all times conduct thorough analysis and contemplate their particular person threat tolerance earlier than making any funding selections in gold or different treasured metals. The significance of diversifying funding portfolios and searching for skilled monetary recommendation can’t be overstated. Future analyses incorporating real-world knowledge and extra subtle statistical strategies would provide even larger insights into the fascinating world of gold funding.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has offered priceless insights into A Decade of Gold: Analyzing Public Financial institution Gold Value Historical past (2014-2024). We hope you discover this text informative and useful. See you in our subsequent article!