Chart of Accounts for a Thriving Retail Enterprise: A Complete Information

Associated Articles: Chart of Accounts for a Thriving Retail Enterprise: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart of Accounts for a Thriving Retail Enterprise: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts for a Thriving Retail Enterprise: A Complete Information

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

A well-structured chart of accounts is the spine of any profitable retail enterprise. It is the organizational framework that categorizes all monetary transactions, offering a transparent and concise image of the corporate’s monetary well being. And not using a strong and meticulously maintained chart of accounts, correct monetary reporting, tax compliance, and knowledgeable decision-making turn out to be extremely difficult. This text delves into the important elements of a chart of accounts particularly designed for a retail enterprise, providing insights into its construction, frequent account sorts, and finest practices for implementation and upkeep.

Understanding the Construction: The Basis of Monetary Readability

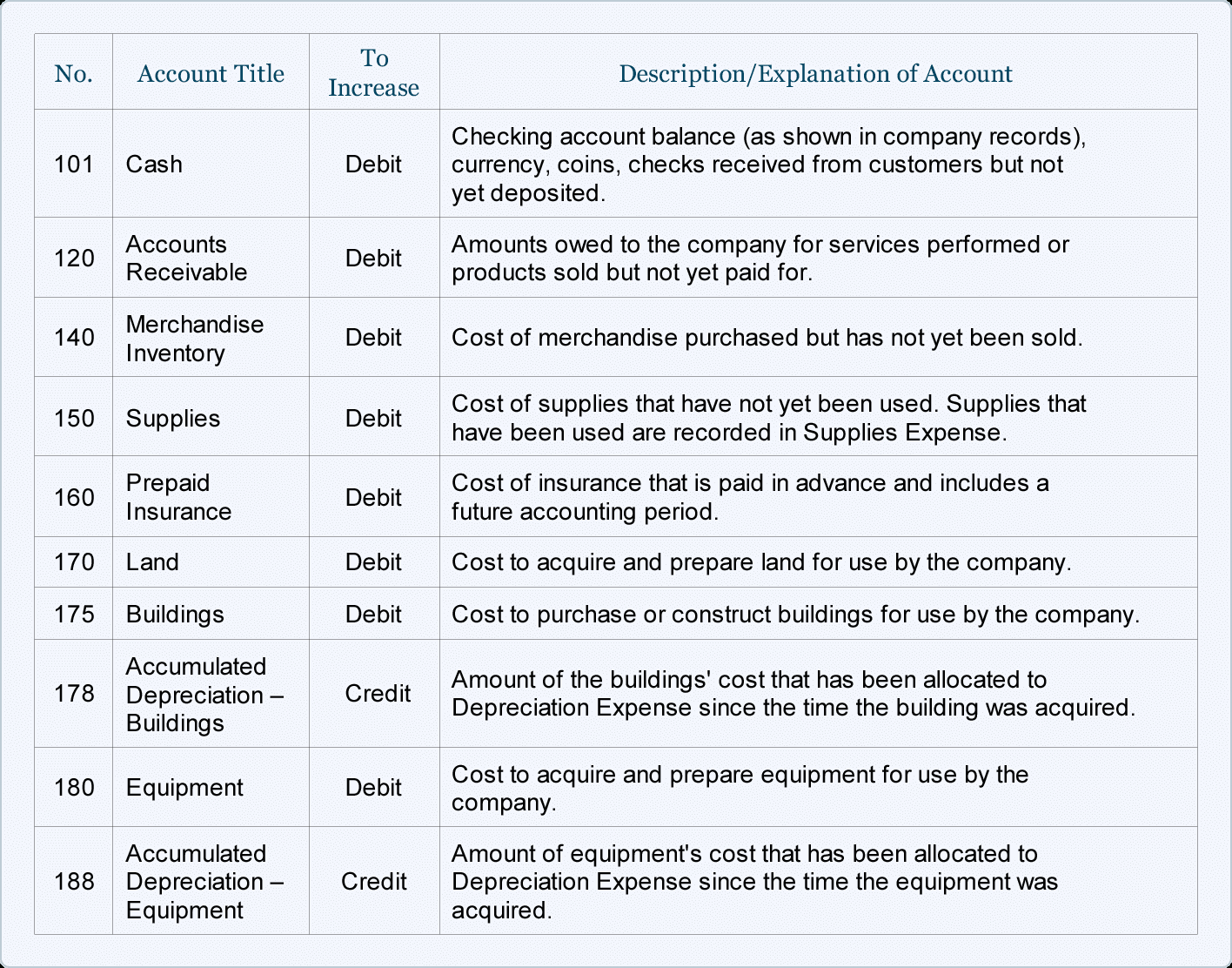

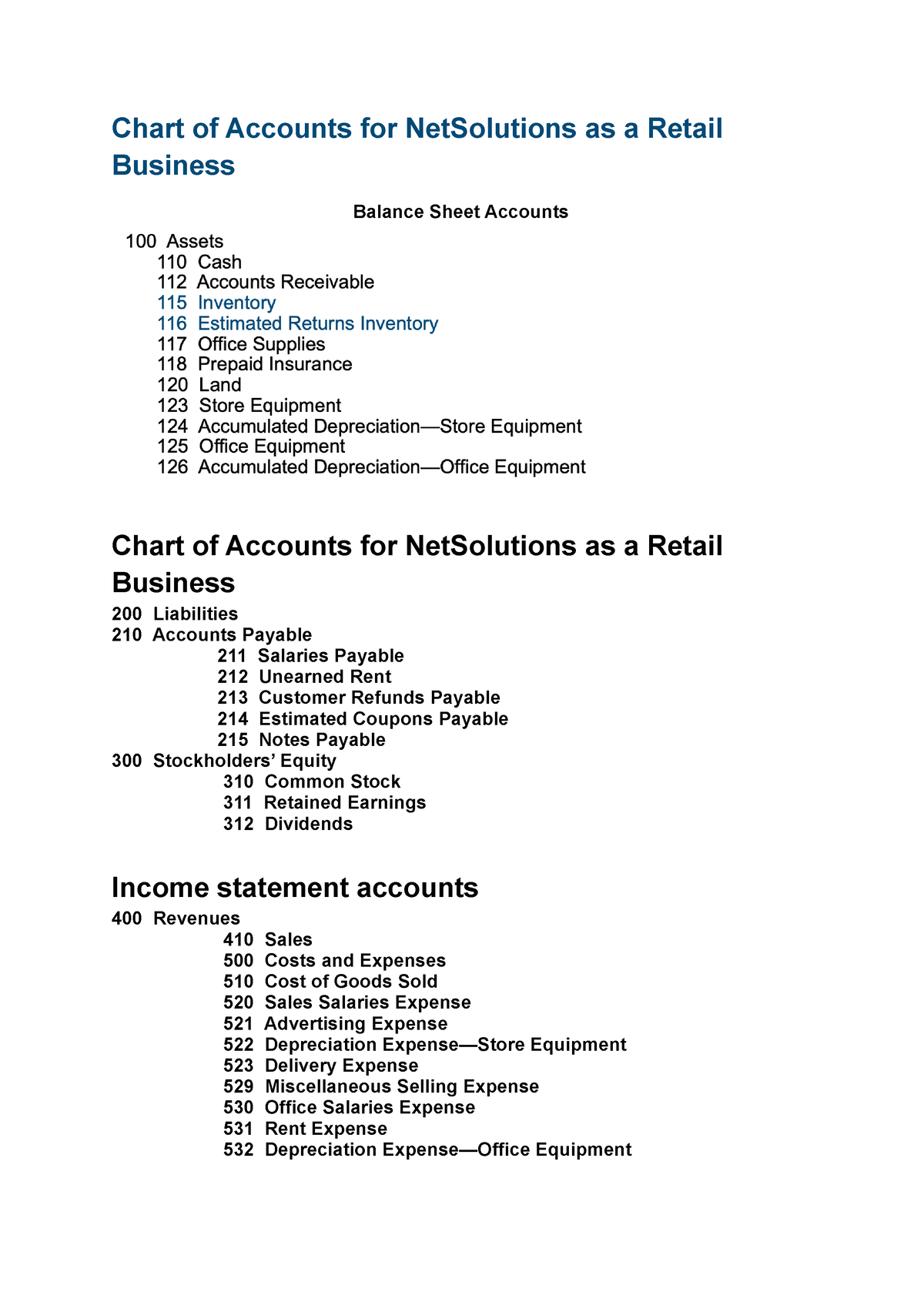

A chart of accounts sometimes follows a hierarchical construction, using a constant numbering system to categorize accounts. This method permits for simple identification and retrieval of economic knowledge. The construction usually employs a multi-digit numbering system, with every digit representing a particular class or sub-category. For instance, a five-digit system would possibly use the primary digit to signify the key account class (e.g., 1 for belongings, 2 for liabilities, and many others.), the subsequent two digits for sub-categories, and the final two for particular accounts inside these sub-categories.

The construction of a retail chart of accounts would possibly look one thing like this:

-

Belongings (1000-1999): These signify what the enterprise owns.

-

Present Belongings (1000-1499): Belongings anticipated to be transformed to money inside one 12 months.

- Money (1000-1099): Money available, checking accounts, petty money.

- Accounts Receivable (1100-1199): Cash owed to the enterprise by prospects.

- Stock (1200-1299): Items accessible on the market. This is likely to be additional damaged down by product class or location.

- Pay as you go Bills (1300-1399): Bills paid prematurely, similar to hire or insurance coverage.

-

Non-Present Belongings (1500-1999): Belongings not anticipated to be transformed to money inside one 12 months.

- Property, Plant, and Tools (PP&E) (1500-1599): Buildings, fixtures, gear.

- Gathered Depreciation (1600-1699): Discount within the worth of PP&E over time.

-

Present Belongings (1000-1499): Belongings anticipated to be transformed to money inside one 12 months.

-

Liabilities (2000-2999): These signify what the enterprise owes to others.

-

Present Liabilities (2000-2499): Obligations due inside one 12 months.

- Accounts Payable (2000-2099): Cash owed to suppliers.

- Salaries Payable (2100-2199): Wages owed to staff.

- Gross sales Tax Payable (2200-2299): Gross sales taxes collected however not but remitted.

-

Non-Present Liabilities (2500-2999): Obligations due in multiple 12 months.

- Lengthy-Time period Loans (2500-2599): Loans with reimbursement phrases exceeding one 12 months.

-

Present Liabilities (2000-2499): Obligations due inside one 12 months.

-

Fairness (3000-3999): The proprietor’s funding within the enterprise.

- Proprietor’s Fairness (3000-3099): Capital contributions, retained earnings.

-

Income (4000-4999): Earnings generated from the enterprise’s operations.

- Gross sales Income (4000-4099): Income from the sale of products. This is likely to be additional damaged down by product class, gross sales channel (on-line, in-store), or cost methodology.

- Different Income (4100-4199): Income from sources apart from gross sales, similar to rental revenue.

-

Bills (5000-5999): Prices incurred in producing income.

- Price of Items Bought (COGS) (5000-5099): Direct prices related to producing or buying items offered.

- Working Bills (5100-5999): Bills associated to the day-to-day operations of the enterprise.

- Salaries and Wages (5100-5199): Worker compensation.

- Lease Expense (5200-5299): Price of renting enterprise premises.

- Utilities Expense (5300-5399): Electrical energy, water, gasoline.

- Advertising and marketing and Promoting (5400-5499): Prices related to selling merchandise.

- Insurance coverage Expense (5500-5599): Premiums paid for varied insurance coverage insurance policies.

- Depreciation Expense (5600-5699): Allocation of the price of belongings over their helpful life.

- Repairs and Upkeep (5700-5799): Prices of sustaining gear and services.

- Provides Expense (5800-5899): Prices of workplace and retail provides.

- Dangerous Debt Expense (5900-5999): Losses from uncollectible accounts receivable.

Particular Concerns for Retail Companies:

Retail companies require particular account classes to precisely mirror their distinctive operations. Listed below are some examples:

- Stock Valuation: Retailers want to trace stock utilizing strategies like FIFO (First-In, First-Out) or LIFO (Final-In, First-Out) and mirror this of their COGS calculation. The chart of accounts ought to accommodate this.

- Gross sales Returns and Allowances: Accounts to trace returns and worth changes are essential.

- Reductions and Promotions: Monitoring the price of reductions and promotional actions is important for correct revenue evaluation.

- Delivery and Dealing with: Separate accounts for delivery prices incurred by the enterprise and charged to prospects are crucial.

- Level of Sale (POS) System Integration: The chart of accounts ought to be designed to seamlessly combine with the POS system for automated knowledge entry.

- E-commerce Particular Accounts: If the enterprise operates on-line, accounts for internet advertising, cost processing charges, and web site upkeep ought to be included.

- Shrinkage: An account to trace stock losses because of theft, injury, or obsolescence.

Greatest Practices for Implementation and Upkeep:

- Consistency: Preserve constant use of account codes and descriptions all through the accounting course of.

- Common Evaluate: Periodically evaluation and replace the chart of accounts to mirror adjustments within the enterprise’s operations and accounting requirements.

- Documentation: Preserve thorough documentation of the chart of accounts, together with descriptions of every account and its function.

- Coaching: Guarantee all personnel concerned in monetary record-keeping are correctly skilled on the use and upkeep of the chart of accounts.

- Software program Integration: Make the most of accounting software program that may seamlessly combine with the chart of accounts for environment friendly knowledge entry and reporting.

Conclusion:

A well-designed and meticulously maintained chart of accounts is paramount for the success of any retail enterprise. It gives the inspiration for correct monetary reporting, facilitates knowledgeable decision-making, and ensures compliance with tax laws. By fastidiously contemplating the particular wants of the retail operation and following finest practices for implementation and upkeep, companies can leverage their chart of accounts as a strong instrument for development and profitability. Keep in mind to seek the advice of with a certified accountant to make sure your chart of accounts aligns together with your particular enterprise wants and business finest practices. The detailed construction offered above gives a powerful place to begin, however customization is vital to reaching optimum performance and monetary readability. Common evaluation and adaptation will guarantee your chart of accounts stays a invaluable asset for years to come back.

![Ecommerce Accounting & Bookkeeping Guide To Best Practices [2024]](https://www.ecommerceceo.com/wp-content/uploads/2020/12/image-1024x598.png)

Closure

Thus, we hope this text has supplied invaluable insights into Chart of Accounts for a Thriving Retail Enterprise: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!