Chart of Accounts for Data Know-how: Navigating the Digital Panorama

Associated Articles: Chart of Accounts for Data Know-how: Navigating the Digital Panorama

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Chart of Accounts for Data Know-how: Navigating the Digital Panorama. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Chart of Accounts for Data Know-how: Navigating the Digital Panorama

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

The center of any profitable group, no matter {industry}, lies in its monetary administration. For Data Know-how (IT) corporations, that is significantly essential, given the complicated nature of their companies and the fast tempo of technological change. A well-structured Chart of Accounts (COA) is the cornerstone of this administration, offering a standardized framework for recording, classifying, and summarizing monetary transactions. This text delves into the intricacies of making and sustaining a sturdy COA particularly tailor-made for the IT sector, encompassing numerous income streams, expense classes, and asset classifications.

Understanding the Basis: What’s a Chart of Accounts?

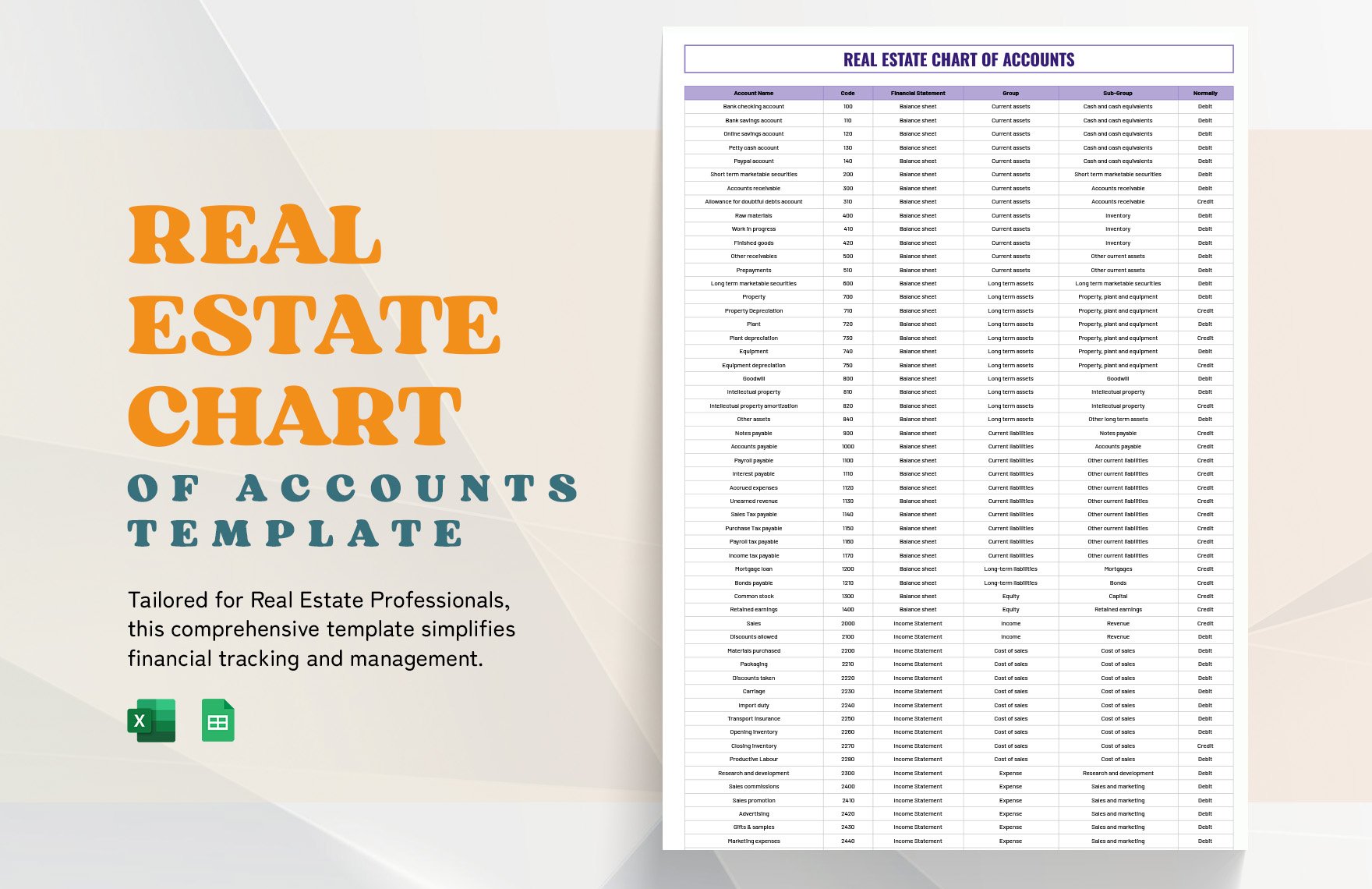

A Chart of Accounts is a structured record of all accounts utilized by a company to file its monetary transactions. These accounts are categorized utilizing a standardized numbering system, permitting for straightforward monitoring and reporting. Every account represents a selected component of the enterprise’s monetary exercise, similar to belongings, liabilities, fairness, income, and bills. The COA’s construction ensures consistency and accuracy in monetary reporting, simplifying duties similar to budgeting, forecasting, and monetary assertion preparation.

The Distinctive Challenges of an IT COA:

The IT {industry} presents distinctive challenges in growing a complete COA. In contrast to conventional companies, IT corporations usually grapple with:

- Numerous Income Streams: IT companies can generate income by way of numerous channels, together with software program gross sales, {hardware} gross sales, consulting companies, managed companies, cloud companies, coaching, and help contracts. Every income stream wants its personal account to precisely observe profitability.

- Intangible Belongings: A good portion of an IT firm’s belongings are intangible, similar to software program licenses, mental property, and buyer databases. These require particular accounting therapy and devoted accounts throughout the COA.

- Speedy Technological Change: The IT panorama is continually evolving. New applied sciences, companies, and enterprise fashions emerge commonly, requiring the COA to be adaptable and versatile to accommodate these modifications.

- Mission-Primarily based Accounting: Many IT tasks are undertaken on a project-by-project foundation, necessitating a system to trace prices, income, and profitability for every particular person venture. This usually entails the usage of job costing or activity-based costing methodologies.

- Subscription-Primarily based Fashions: The growing prevalence of subscription-based companies necessitates accounting for recurring income and associated prices, requiring particular accounts to trace subscriptions, renewals, and churn.

Structuring the IT Chart of Accounts:

A well-designed IT COA usually follows a hierarchical construction, using a constant numbering system for straightforward navigation and reporting. Whereas the precise numbering system can differ, a typical method makes use of a mix of numerical and alphabetical codes to categorize accounts. A pattern construction may appear like this:

I. Belongings:

-

1000 Present Belongings:

- 1100 Money and Money Equivalents

- 1200 Accounts Receivable (Software program Gross sales, Providers, and so on.)

- 1300 Stock ({Hardware}, Software program, and so on.)

- 1400 Pay as you go Bills

-

2000 Non-Present Belongings:

- 2100 Property, Plant, and Gear (PPE)

- 2200 Intangible Belongings (Software program Licenses, Patents, Copyrights)

- 2300 Investments

-

3000 Different Belongings:

- 3100 Deferred Income

II. Liabilities:

-

4000 Present Liabilities:

- 4100 Accounts Payable

- 4200 Salaries Payable

- 4300 Unearned Income (Subscriptions, Providers)

-

5000 Non-Present Liabilities:

- 5100 Lengthy-Time period Debt

III. Fairness:

-

6000 Proprietor’s Fairness:

- 6100 Capital Inventory

- 6200 Retained Earnings

IV. Income:

-

7000 Income:

- 7100 Software program Gross sales

- 7200 {Hardware} Gross sales

- 7300 Consulting Providers

- 7400 Managed Providers

- 7500 Cloud Providers

- 7600 Coaching and Training

- 7700 Help and Upkeep Contracts

- 7800 Subscription Income

V. Bills:

-

8000 Price of Items Bought (COGS):

- 8100 Direct Supplies ({Hardware}, Software program)

- 8200 Direct Labor

- 8300 Manufacturing Overhead

-

9000 Working Bills:

- 9100 Salaries and Wages

- 9200 Lease

- 9300 Utilities

- 9400 Advertising and Promoting

- 9500 Analysis and Growth (R&D)

- 9600 Skilled Charges (Authorized, Accounting)

- 9700 Journey Bills

- 9800 Workplace Provides

- 9900 Depreciation and Amortization (Intangibles)

- 10000 Mission Particular Bills: (Separate accounts for every venture)

Particular Concerns for IT COA:

- Software program Growth Prices: Correct capitalization and amortization of software program improvement prices are essential. Particular accounts ought to observe improvement bills, together with salaries, supplies, and exterior prices.

- Cloud Computing Prices: Detailed accounts are needed to trace bills associated to cloud companies, together with infrastructure prices, storage, and bandwidth.

- Cybersecurity Bills: Allocate separate accounts for bills associated to cybersecurity measures, similar to software program, {hardware}, {and professional} companies.

- Buyer Relationship Administration (CRM): Monitor bills associated to CRM software program and implementation.

- Mission Administration Software program: Account for prices related to venture administration software program and associated companies.

Sustaining and Updating the COA:

The COA shouldn’t be a static doc. It wants common overview and updates to replicate modifications within the enterprise’s operations and the evolving IT panorama. Common opinions ought to assess the accuracy and relevance of present accounts and determine the necessity for brand new accounts to accommodate new companies, merchandise, or bills. This ongoing upkeep ensures the COA stays a dependable instrument for monetary administration.

Software program Options for COA Administration:

Accounting software program packages play an important position in managing the COA. These packages automate many points of accounting, together with transaction recording, account reconciliation, and monetary reporting. Selecting a software program answer that’s scalable and adaptable to the precise wants of an IT enterprise is essential for environment friendly monetary administration. Many accounting software program options provide industry-specific templates and options that simplify the method of organising and sustaining a COA.

Conclusion:

A well-designed and meticulously maintained Chart of Accounts is indispensable for the monetary success of any IT firm. By rigorously contemplating the distinctive points of the IT {industry}, together with numerous income streams, intangible belongings, and fast technological change, organizations can create a COA that gives correct, dependable, and insightful monetary data. This, in flip, empowers knowledgeable decision-making, enhances operational effectivity, and contributes to the general progress and profitability of the enterprise. Common overview and adaptation are key to making sure the COA stays a beneficial asset, reflecting the dynamic nature of the IT sector.

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts for Data Know-how: Navigating the Digital Panorama. We thanks for taking the time to learn this text. See you in our subsequent article!