Chart of Accounts: The Spine of Your Accounting System

Associated Articles: Chart of Accounts: The Spine of Your Accounting System

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Accounts: The Spine of Your Accounting System. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chart of Accounts: The Spine of Your Accounting System

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

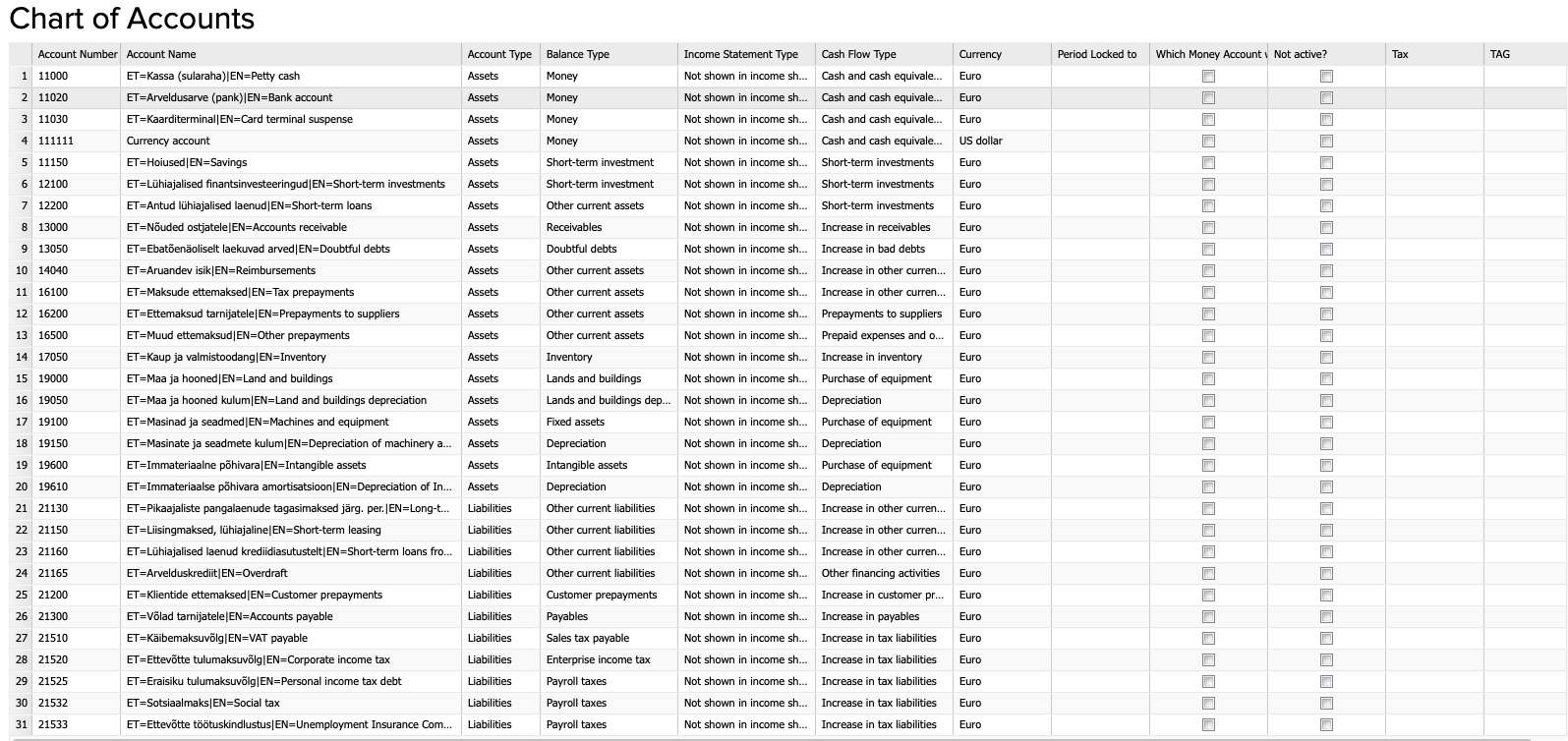

The chart of accounts (COA) is the bedrock of any profitable accounting system. It is a structured record of all of the accounts a enterprise makes use of to document its monetary transactions. Consider it as an in depth organizational map of your organization’s funds, offering a transparent and constant framework for monitoring revenue, bills, belongings, liabilities, and fairness. And not using a well-designed and meticulously maintained COA, monetary reporting turns into chaotic, inaccurate, and finally unhelpful for decision-making. This text will delve into the intricacies of the chart of accounts, exploring its construction, implementation, and significance for companies of all sizes.

Understanding the Construction of a Chart of Accounts

A chart of accounts usually follows a hierarchical construction, categorizing accounts based mostly on their nature. This construction facilitates environment friendly knowledge group and retrieval. Whereas the precise construction can range relying on the {industry}, firm measurement, and accounting software program used, most COAs adhere to a common framework based mostly on the accounting equation:

Belongings = Liabilities + Fairness

This elementary equation guides the group of accounts into these three main classes:

-

Belongings: These signify what an organization owns, together with assets that present future financial advantages. Examples embody:

- Present Belongings: Money, accounts receivable, stock, pay as you go bills (anticipated to be transformed into money or used inside one 12 months).

- Non-Present Belongings: Property, plant, and tools (PP&E), intangible belongings (patents, copyrights), long-term investments.

-

Liabilities: These signify what an organization owes to others, signifying its monetary obligations. Examples embody:

- Present Liabilities: Accounts payable, salaries payable, short-term loans, taxes payable (due inside one 12 months).

- Non-Present Liabilities: Lengthy-term loans, bonds payable, deferred income (income obtained however not but earned).

-

Fairness: This represents the house owners’ stake within the firm, reflecting the residual curiosity after deducting liabilities from belongings. For sole proprietorships and partnerships, that is typically merely the proprietor’s capital account. For firms, it contains:

- Frequent Inventory: Represents the possession shares issued to buyers.

- Retained Earnings: Collected earnings that haven’t been distributed as dividends.

Inside every of those main classes, accounts are additional subdivided into extra particular sub-accounts. As an illustration, "Accounts Receivable" is likely to be damaged down into "Accounts Receivable – Buyer A," "Accounts Receivable – Buyer B," and so forth. This stage of element is essential for monitoring particular person buyer balances and figuring out potential points with collections. Equally, "Bills" might be categorized into sub-accounts like "Hire Expense," "Salaries Expense," "Utilities Expense," and plenty of extra, offering a granular view of operational prices.

Numbering Programs and Account Codes

To keep up consistency and facilitate knowledge processing, accounts are usually assigned distinctive numerical codes. These codes typically replicate the hierarchical construction of the COA. A standard method makes use of a decimal system, the place the primary digit represents the main class (e.g., 1 for Belongings, 2 for Liabilities, 3 for Fairness), adopted by subsequent digits indicating more and more particular sub-accounts. For instance:

- 1100: Money

- 1200: Accounts Receivable

- 1210: Accounts Receivable – Buyer A

- 1220: Accounts Receivable – Buyer B

- 2100: Accounts Payable

- 3100: Retained Earnings

This technique ensures that every account has a definite identifier, stopping confusion and simplifying knowledge entry and retrieval. The precise numbering system used will rely upon the corporate’s wants and the accounting software program employed.

Implementing and Sustaining a Chart of Accounts

Creating and implementing a COA is a crucial step in organising a brand new enterprise or revising an present accounting system. It requires cautious planning and consideration of the corporate’s particular operations and reporting necessities. Listed below are some key steps:

-

Business Finest Practices: Analysis industry-specific chart of accounts templates to achieve a foundational understanding of related accounts.

-

Enterprise Wants Evaluation: Determine all of the accounts obligatory to trace the corporate’s monetary actions precisely. This entails contemplating all sources of income, bills, belongings, and liabilities.

-

Account Choice and Naming: Select descriptive and constant account names that clearly replicate their goal. Keep away from ambiguity and make sure that account names are simply understood by all stakeholders.

-

Numbering System Design: Implement a logical numbering system that displays the hierarchical construction of the COA. This simplifies knowledge group and retrieval.

-

Software program Integration: Choose accounting software program that may accommodate the chosen COA construction and numbering system. Most accounting software program packages permit for personalisation of the COA.

-

Common Overview and Updates: The COA just isn’t a static doc. It wants common evaluate and updates to replicate modifications within the enterprise’s operations, accounting requirements, and regulatory necessities. Including new accounts or modifying present ones could also be obligatory because the enterprise grows and evolves.

The Significance of a Nicely-Outlined Chart of Accounts

A well-designed and maintained COA affords quite a few advantages:

-

Correct Monetary Reporting: A structured COA ensures that each one transactions are recorded persistently and precisely, resulting in dependable monetary statements.

-

Improved Monetary Evaluation: An in depth COA facilitates in-depth monetary evaluation, permitting companies to establish traits, assess efficiency, and make knowledgeable choices.

-

Enhanced Inside Management: A well-defined COA strengthens inner controls by offering a framework for segregation of duties and authorization of transactions.

-

Streamlined Auditing: A well-organized COA simplifies the auditing course of, decreasing the effort and time required to confirm the accuracy of monetary information.

-

Compliance with Laws: A correctly structured COA helps companies adjust to related accounting requirements and regulatory necessities.

-

Facilitates Budgeting and Forecasting: An in depth COA is crucial for correct budgeting and forecasting, offering a framework for projecting future monetary efficiency.

Conclusion

The chart of accounts is way over only a record of accounts; it is the spine of an organization’s monetary reporting system. A well-designed COA is essential for correct monetary reporting, efficient monetary evaluation, and sound enterprise decision-making. By fastidiously planning and sustaining its COA, a enterprise can make sure that its monetary data is dependable, constant, and readily accessible, paving the way in which for sustainable progress and success. Ignoring the significance of a well-structured COA can result in important monetary and operational challenges down the road. Subsequently, investing effort and time in growing and sustaining a strong COA is an funding within the long-term monetary well being of any group.

Closure

Thus, we hope this text has supplied priceless insights into Chart of Accounts: The Spine of Your Accounting System. We hope you discover this text informative and useful. See you in our subsequent article!