chart of accounts vs trial stability

Associated Articles: chart of accounts vs trial stability

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to chart of accounts vs trial stability. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart of Accounts vs. Trial Stability: The Cornerstones of Monetary File-Maintaining

Monetary record-keeping is the spine of any profitable enterprise, no matter dimension or business. Two basic parts underpin this course of: the Chart of Accounts and the Trial Stability. Whereas typically utilized in conjunction, these instruments serve distinct but interconnected functions, offering a framework for organizing monetary knowledge and verifying its accuracy. Understanding their variations and the essential relationship between them is crucial for anybody concerned in accounting or monetary administration.

The Chart of Accounts: The Blueprint of Monetary Group

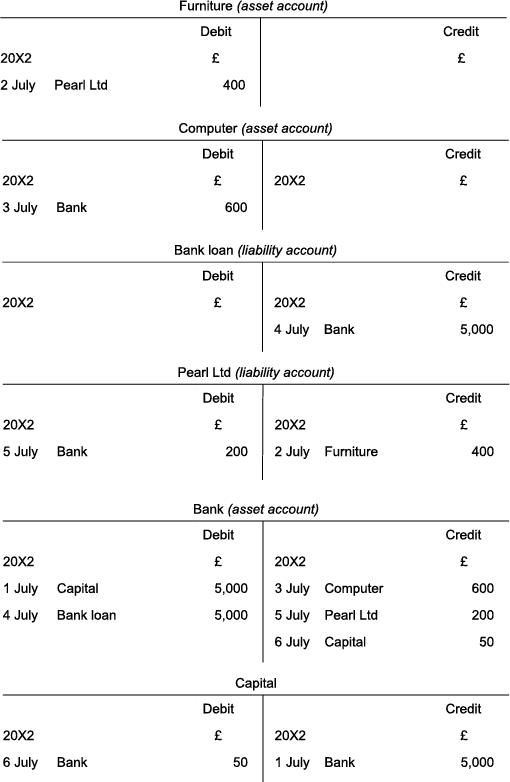

The Chart of Accounts (COA) is basically a structured record of all of the accounts utilized by a enterprise to report its monetary transactions. Consider it because the blueprint for the corporate’s monetary reporting system. It supplies a standardized framework for classifying and categorizing each monetary occasion, making certain consistency and comparability over time. Every account throughout the COA represents a selected facet of the enterprise’s monetary actions, comparable to property, liabilities, fairness, revenues, and bills.

The COA is often organized utilizing a hierarchical construction, typically using a numbering system to facilitate environment friendly categorization and retrieval of knowledge. This construction usually follows a standardized format, although particular classifications can fluctuate based mostly on business, firm dimension, and accounting requirements adopted (e.g., GAAP, IFRS). A typical COA would possibly embrace the next main account classes:

-

Property: These characterize what the corporate owns, together with present property (money, accounts receivable, stock) and non-current property (property, plant, and gear, intangible property). Every asset kind would have its personal sub-accounts for higher element. For instance, "Money" may be additional damaged down into "Checking Account," "Financial savings Account," and "Petty Money."

-

Liabilities: These characterize what the corporate owes to others, together with present liabilities (accounts payable, salaries payable, short-term loans) and non-current liabilities (long-term loans, bonds payable). Just like property, liabilities are additionally categorized into sub-accounts for higher group.

-

Fairness: This represents the homeowners’ stake within the enterprise. For sole proprietorships and partnerships, this would possibly merely be the proprietor’s capital account. For companies, it will embrace widespread inventory, retained earnings, and different fairness accounts.

-

Revenues: These characterize the earnings generated from the corporate’s main operations, comparable to gross sales income, service income, and curiosity income. Completely different income streams are sometimes categorized individually.

-

Bills: These characterize the prices incurred in producing income, together with price of products bought, salaries expense, hire expense, utilities expense, and advertising and marketing expense. Bills are additionally damaged down into numerous sub-accounts for higher evaluation.

The design and implementation of a well-structured COA are crucial for a number of causes:

-

Improved Monetary Reporting: A well-organized COA ensures that monetary info is precisely categorized and available for producing monetary statements just like the earnings assertion, stability sheet, and assertion of money flows.

-

Enhanced Accuracy: By standardizing the accounting course of, the COA minimizes the danger of errors and inconsistencies in recording transactions.

-

Facilitated Evaluation: The detailed categorization throughout the COA allows efficient monetary evaluation, permitting companies to determine developments, assess efficiency, and make knowledgeable selections.

-

Streamlined Auditing: A well-structured COA simplifies the auditing course of by offering a transparent and arranged report of monetary transactions.

-

Compliance: The COA helps companies adjust to related accounting requirements and laws.

The Trial Stability: A Snapshot of Monetary Equilibrium

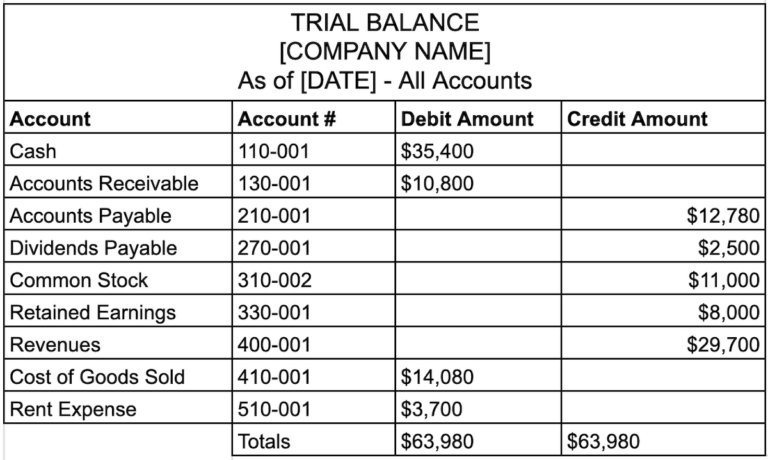

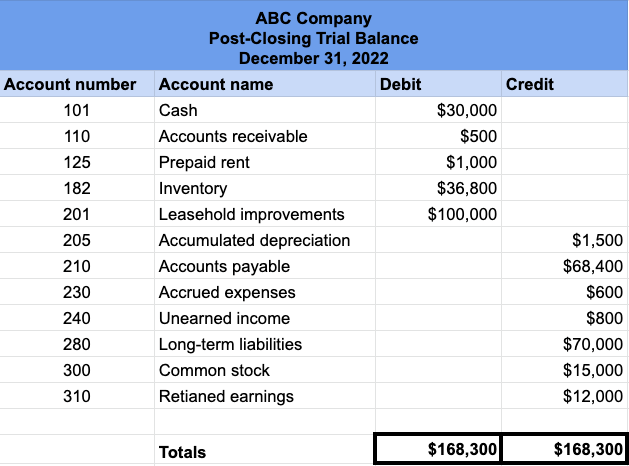

The Trial Stability is a abstract report that lists the debit and credit score balances of all accounts within the Chart of Accounts at a selected time limit. In contrast to the COA, which is a static record of accounts, the Trial Stability is a dynamic report that displays the present state of the corporate’s monetary data. It is basically a snapshot of the overall ledger at a given second.

The Trial Stability is generated by extracting the ending balances from every account within the normal ledger. Debits are listed in a single column, and credit are listed within the different. If the full debits equal the full credit, it signifies that the accounting equation (Property = Liabilities + Fairness) is in stability, suggesting that the accounting data are probably correct. This equality is a vital indicator of the integrity of the monetary knowledge.

Nonetheless, it is necessary to notice {that a} balanced Trial Stability would not assure the entire accuracy of the monetary data. Errors comparable to compensating errors (the place two errors offset one another) can nonetheless exist even when the Trial Stability balances. Due to this fact, whereas a balanced Trial Stability is a mandatory situation for correct monetary statements, it’s not a enough situation.

The Trial Stability serves a number of crucial functions:

-

Error Detection: The first goal is to detect errors within the recording of transactions. A Trial Stability that does not stability signifies the presence of an error someplace within the accounting course of. This prompts additional investigation to determine and proper the error.

-

Preparation of Monetary Statements: The Trial Stability serves as the muse for making ready the monetary statements. The account balances from the Trial Stability are used to compile the earnings assertion, stability sheet, and assertion of money flows.

-

Inside Management: The common preparation of a Trial Stability contributes to a powerful inside management system by offering a mechanism for verifying the accuracy of the accounting data.

-

Auditing: The Trial Stability is a vital doc for auditors, offering a abstract of the corporate’s monetary place at a selected time limit, facilitating the auditing course of.

The Interaction Between Chart of Accounts and Trial Stability

The Chart of Accounts and the Trial Stability are inextricably linked. The COA supplies the framework for organizing and classifying transactions, whereas the Trial Stability summarizes the outcomes of these transactions. The COA defines the accounts that can seem on the Trial Stability, and the Trial Stability displays the balances in these accounts. The connection may be visualized as follows:

-

Transaction Recording: All monetary transactions are recorded within the normal ledger utilizing the accounts outlined within the COA.

-

Account Balancing: After every transaction is recorded, the debit and credit score sides of every account are balanced.

-

Trial Stability Era: At common intervals (e.g., month-to-month, quarterly, yearly), the ending balances of all accounts within the normal ledger are extracted to create the Trial Stability.

-

Error Detection and Correction: If the Trial Stability would not stability, it signifies an error, prompting a overview of the transactions recorded within the normal ledger to determine and proper the error.

-

Monetary Assertion Preparation: As soon as the Trial Stability is balanced, the account balances are used to arrange the monetary statements.

Conclusion:

The Chart of Accounts and the Trial Stability are basic instruments in monetary record-keeping. The COA supplies the organizational construction for classifying and categorizing monetary transactions, whereas the Trial Stability supplies a abstract of the monetary place at a selected time limit. Collectively, they kind the idea for correct and dependable monetary reporting, enabling knowledgeable decision-making and making certain compliance with accounting requirements. A well-designed COA and a recurrently ready and balanced Trial Stability are important for the monetary well being and stability of any enterprise. Understanding their particular person roles and their symbiotic relationship is essential for anybody concerned in managing or analyzing monetary info.

Closure

Thus, we hope this text has offered priceless insights into chart of accounts vs trial stability. We hope you discover this text informative and useful. See you in our subsequent article!