Chart of Depreciation in SAP FICO: A Complete Information

Associated Articles: Chart of Depreciation in SAP FICO: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart of Depreciation in SAP FICO: A Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart of Depreciation in SAP FICO: A Complete Information

Depreciation, the systematic allocation of an asset’s value over its helpful life, is a vital facet of economic accounting. In SAP FICO (Monetary Accounting and Controlling), the "Chart of Depreciation" performs a pivotal position in managing this course of. This text offers a complete overview of the Chart of Depreciation, its configuration, performance, and significance inside the SAP system.

Understanding the Idea:

Earlier than diving into the SAP specifics, it is essential to know the basic idea of depreciation. Completely different strategies exist, every with its personal implications:

- Straight-Line Methodology: The asset’s value is evenly distributed over its helpful life. That is the best methodology.

- Declining Steadiness Methodology: A hard and fast proportion of the asset’s remaining guide worth is depreciated every year, leading to increased depreciation expense within the early years and decrease expense in later years.

- Sum-of-the-Years’ Digits Methodology: A extra accelerated methodology than straight-line, however much less aggressive than declining stability. It makes use of a fraction primarily based on the sum of the years of the asset’s helpful life.

- Items of Manufacturing Methodology: Depreciation is calculated primarily based on the precise utilization of the asset. That is appropriate for belongings whose worth is straight tied to their output.

The selection of depreciation methodology considerably impacts the monetary statements, affecting profitability and tax liabilities. SAP FICO permits for flexibility in choosing and making use of varied strategies.

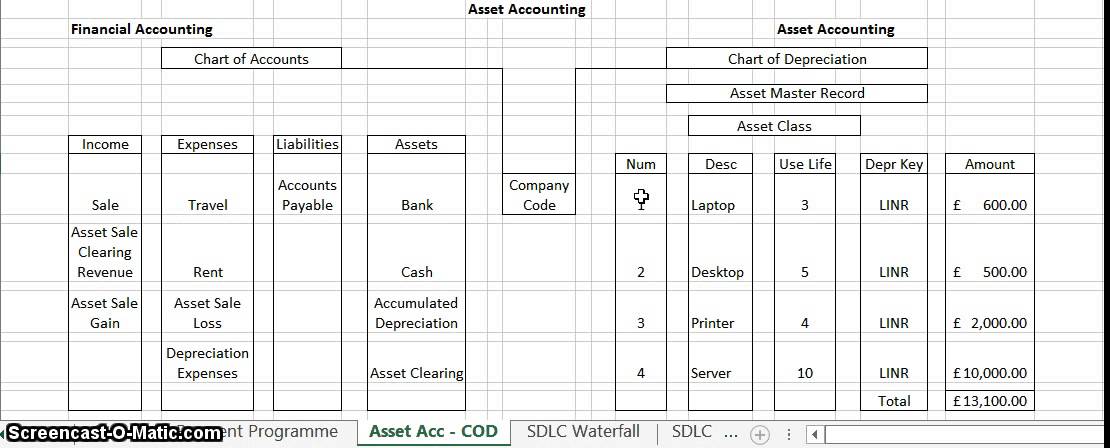

The Function of the Chart of Depreciation in SAP FICO:

The Chart of Depreciation (often known as the depreciation key) in SAP FICO is a vital configuration factor that defines the depreciation methodology, calculation guidelines, and different parameters for an asset. It acts as a blueprint for a way the system will calculate depreciation for belongings assigned to it. A single chart of depreciation can be utilized for a number of belongings, offered they share the identical depreciation traits.

Key Parts of a Chart of Depreciation:

A Chart of Depreciation in SAP FICO contains a number of key parts:

- Depreciation Methodology: This specifies the tactic used to calculate depreciation (e.g., straight-line, declining stability, and many others.).

- Helpful Life: The estimated interval (in years or durations) over which the asset will probably be depreciated.

- Salvage Worth: The estimated worth of the asset on the finish of its helpful life. This worth just isn’t depreciated.

- Depreciation Calculation Guidelines: These outline particular parameters for the chosen depreciation methodology, similar to the share fee for declining stability or the variety of durations for straight-line.

- Fiscal Yr Variant: This defines the fiscal yr construction used for depreciation calculations.

- Interval Management: This specifies how typically depreciation is calculated (e.g., month-to-month, quarterly, yearly).

- Transaction Keys: These are used for posting depreciation entries within the common ledger.

Creating and Sustaining Charts of Depreciation:

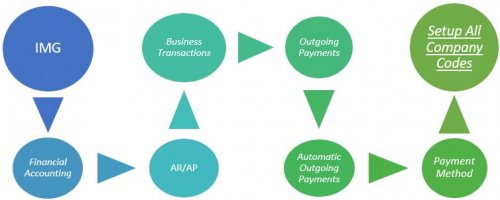

The creation and upkeep of charts of depreciation are sometimes dealt with by approved SAP customers with applicable entry rights. This includes utilizing transaction code AO90. The method contains:

- Defining a New Chart of Depreciation: This includes specifying a singular code and assigning the related parameters talked about above.

- Assigning Depreciation Strategies: Choosing the suitable depreciation methodology and specifying the calculation parameters.

- Specifying Interval Management: Defining the frequency of depreciation calculations.

- Assigning Transaction Keys: Linking the chart of depreciation to the related G/L accounts for depreciation posting.

- Testing and Validation: Completely testing the chart of depreciation to make sure accuracy earlier than assigning it to belongings.

Integration with Different SAP Modules:

The Chart of Depreciation is seamlessly built-in with different SAP modules, primarily:

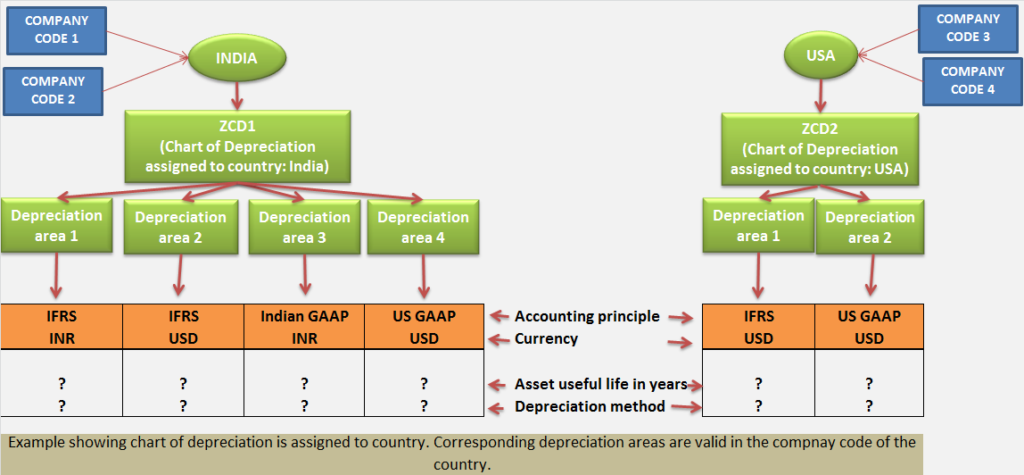

- Asset Accounting (FI-AA): That is the first module the place belongings are managed. The chart of depreciation is assigned to an asset grasp document, dictating how its depreciation is calculated.

- Common Ledger (FI-GL): The depreciation calculated utilizing the chart of depreciation is mechanically posted to the final ledger accounts specified within the chart’s configuration.

- Controlling (CO): Depreciation will also be posted to controlling accounts for inside administration reporting and evaluation.

Significance of Correct Chart of Depreciation Configuration:

Correct configuration of the Chart of Depreciation is essential for a number of causes:

- Compliance: Correct depreciation calculations guarantee compliance with accounting requirements and tax laws.

- Monetary Reporting: Correct depreciation figures are important for producing dependable monetary statements.

- Asset Administration: Correct depreciation permits for efficient monitoring of asset worth and helpful life.

- Resolution-Making: Dependable depreciation knowledge informs funding choices and strategic planning.

Troubleshooting Frequent Points:

A number of widespread points can come up through the configuration and utilization of charts of depreciation:

- Incorrect Depreciation Methodology: Selecting an inappropriate methodology can result in inaccurate depreciation calculations.

- Incorrect Parameters: Errors in specifying parameters like helpful life or salvage worth can have an effect on the outcomes.

- Lacking Transaction Keys: With out correct transaction keys, depreciation postings can’t be made.

- Knowledge Inconsistencies: Inconsistent knowledge between the chart of depreciation, asset grasp knowledge, and different related modules can result in errors.

Troubleshooting these points typically requires cautious overview of the chart of depreciation configuration, asset grasp knowledge, and related transaction logs.

Superior Options and Concerns:

SAP FICO gives a number of superior options associated to charts of depreciation:

- A number of Depreciation Areas: Permits for calculating depreciation utilizing totally different strategies for various functions (e.g., tax reporting vs. monetary reporting).

- Particular Depreciation Guidelines: Permits for customizing depreciation calculations for particular conditions, similar to partial-year depreciation or adjustments in asset helpful life.

- Integration with Exterior Methods: Permits for integration with exterior methods for knowledge trade and reporting.

Conclusion:

The Chart of Depreciation in SAP FICO is a vital part for managing asset depreciation successfully. Its correct configuration and upkeep are important for correct monetary reporting, compliance with laws, and knowledgeable decision-making. Understanding the varied depreciation strategies, configuring the chart appropriately, and troubleshooting potential points are essential abilities for any SAP FICO person concerned in asset administration. By mastering the intricacies of the Chart of Depreciation, organizations can make sure the correct and dependable monitoring of their belongings’ worth over time. The flexibleness and superior options provided by SAP FICO allow organizations to tailor their depreciation processes to satisfy their particular wants and necessities, resulting in improved monetary administration and reporting.

Closure

Thus, we hope this text has offered worthwhile insights into Chart of Depreciation in SAP FICO: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!