Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Chart Patterns: A Complete Information (PDF Downloadable)

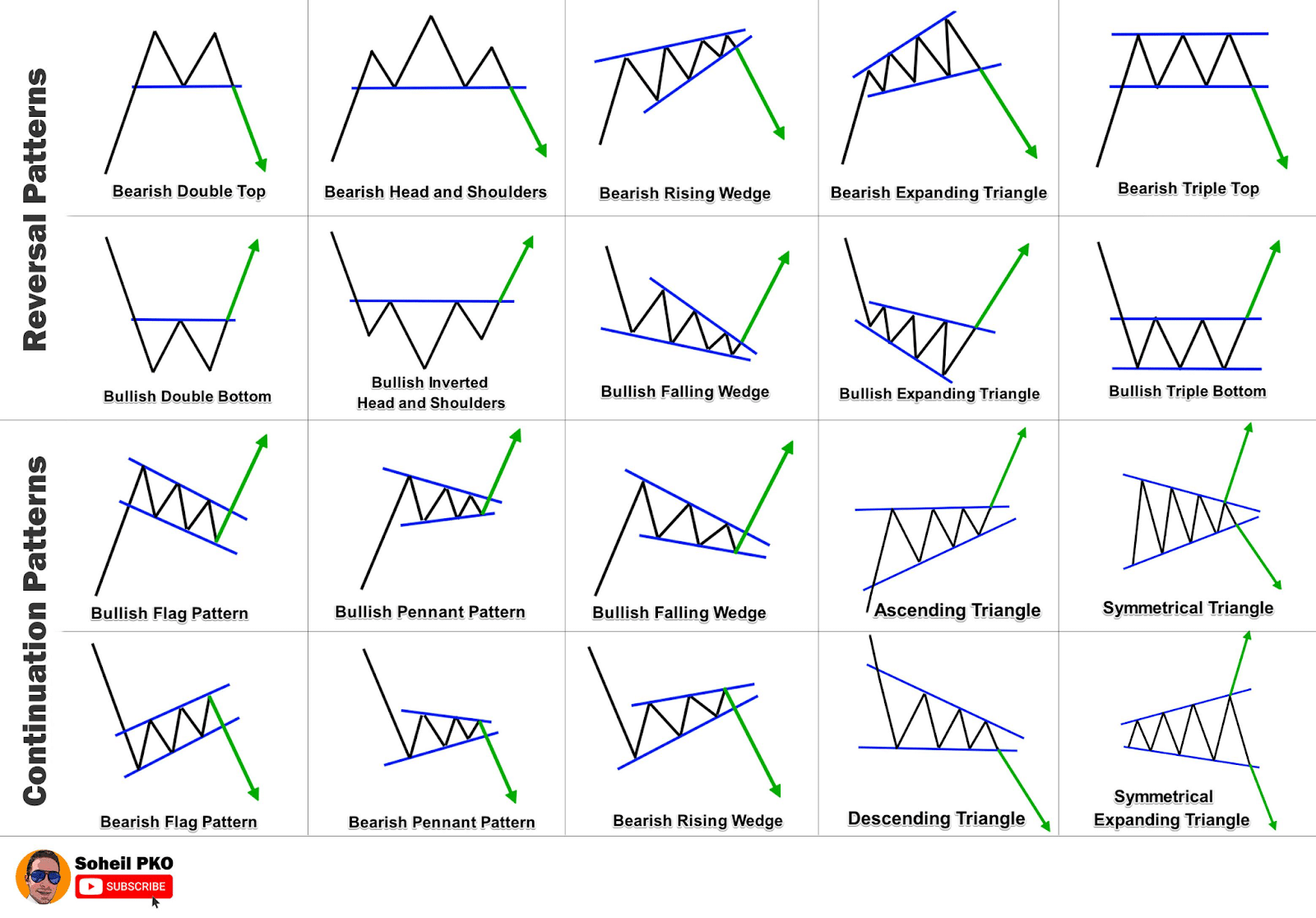

Technical evaluation, a cornerstone of buying and selling and investing, closely depends on chart patterns to foretell future value actions. These patterns, visually recognized on value charts, symbolize the collective habits of market members and provide invaluable insights into potential help and resistance ranges, pattern reversals, and continuation strikes. This text supplies a complete overview of widespread chart patterns, categorized for readability, together with their traits, identification methods, and buying and selling methods. A downloadable PDF model of this information is offered at [Insert Link Here].

I. Introduction to Chart Patterns:

Chart patterns are recurring formations on value charts that, primarily based on historic information, recommend a possible future value motion. They aren’t foolproof predictors, however reasonably probabilistic instruments that enhance the percentages of profitable trades. The effectiveness of a chart sample is determined by a number of elements, together with the timeframe used, the amount accompanying the sample, and the general market context. Ignoring these elements can result in inaccurate interpretations and losses.

Understanding chart patterns requires observe and expertise. Novices ought to concentrate on mastering just a few key patterns earlier than increasing their information base. Bear in mind, affirmation from different technical indicators or elementary evaluation can considerably improve the reliability of a chart sample sign.

II. Continuation Patterns:

Continuation patterns recommend that the present pattern will probably proceed after a short lived pause or consolidation. These patterns sometimes kind in periods of sideways value motion inside a longtime pattern.

-

Triangles: Triangles are characterised by converging trendlines, making a triangular form on the chart. There are three fundamental varieties:

- Symmetrical Triangles: Equal upward and downward slopes, indicating indecision between consumers and sellers. A breakout above the higher trendline confirms the continuation of the uptrend, whereas a break beneath the decrease trendline confirms the continuation of the downtrend.

- Ascending Triangles: A flat decrease trendline and an upward sloping higher trendline, suggesting consumers are steadily gaining management. A breakout above the higher trendline confirms the uptrend continuation.

- Descending Triangles: A flat higher trendline and a downward sloping decrease trendline, suggesting sellers are steadily gaining management. A break beneath the decrease trendline confirms the downtrend continuation.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the previous pattern). They’re characterised by a quick interval of consolidation adopted by a continuation of the unique pattern. Flags are characterised by parallel trendlines, whereas pennants have converging trendlines, much like triangles. Breakouts above the higher trendline for uptrends and beneath the decrease trendline for downtrends sign continuation.

-

Rectangles: Rectangles are characterised by two parallel horizontal trendlines, representing a interval of consolidation. A breakout above the higher trendline confirms the uptrend continuation, whereas a break beneath the decrease trendline confirms the downtrend continuation.

III. Reversal Patterns:

Reversal patterns recommend a possible change within the path of the prevailing pattern. These patterns normally kind on the finish of a pattern and point out a shift in market sentiment.

-

Head and Shoulders: A basic reversal sample consisting of three peaks. The center peak (the pinnacle) is increased than the 2 outer peaks (the shoulders). A neckline connects the lows of the 2 shoulders. A break beneath the neckline confirms a possible downtrend reversal. The inverse head and shoulders sample alerts a possible uptrend reversal.

-

Double Tops and Double Bottoms: These patterns include two comparable peaks (double high) or troughs (double backside). A break beneath the neckline in a double high confirms a possible downtrend reversal, whereas a break above the neckline in a double backside confirms a possible uptrend reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. They’re typically thought of stronger reversal alerts as a result of elevated affirmation.

-

Rounding Tops and Bottoms: These patterns are characterised by a gradual, curving value motion forming a rounded form. Rounding tops recommend a downtrend reversal, whereas rounding bottoms recommend an uptrend reversal. These patterns sometimes take longer to kind than different reversal patterns.

IV. Different Notable Patterns:

-

Wedges: Wedges are characterised by converging trendlines, much like triangles, however with each trendlines sloping in the identical path (both upward or downward). Rising wedges are bearish, suggesting a possible downtrend, whereas falling wedges are bullish, suggesting a possible uptrend.

-

Gaps: Gaps are value discontinuities the place there isn’t a buying and selling exercise between consecutive value bars. Gaps could be vital indicators of market momentum or potential reversals, however their interpretation requires cautious consideration of the context.

-

Island Reversals: These patterns include a niche adopted by a interval of consolidation after which one other hole in the other way. Island reversals are thought of robust reversal alerts.

V. Buying and selling Methods Utilizing Chart Patterns:

Profitable buying and selling utilizing chart patterns requires a well-defined technique that comes with threat administration. Listed below are some key issues:

-

Affirmation: By no means rely solely on chart patterns. Verify the sample utilizing different technical indicators (e.g., transferring averages, RSI, MACD) or elementary evaluation.

-

Quantity: Elevated quantity throughout breakouts confirms the validity of the sample. Low quantity breakouts are sometimes weak and vulnerable to reversals.

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. Place your stop-loss order beneath the neckline for bearish patterns and above the neckline for bullish patterns.

-

Goal Costs: Decide your goal value primarily based on the sample’s projected transfer. This may be calculated utilizing Fibonacci retracements or different technical instruments.

-

Threat-Reward Ratio: Handle your threat by making certain a good risk-reward ratio. For instance, purpose for a risk-reward ratio of 1:2 or higher, that means your potential revenue is twice your potential loss.

-

Timeframe: The timeframe you select influences the sample’s reliability. Longer-term patterns (e.g., weekly or month-to-month charts) are typically thought of extra dependable than short-term patterns (e.g., intraday charts).

VI. Limitations of Chart Patterns:

Whereas chart patterns provide invaluable insights, they don’t seem to be infallible. A number of limitations have to be thought of:

-

Subjectivity: Figuring out chart patterns could be subjective, resulting in differing interpretations amongst merchants.

-

False Indicators: Chart patterns can generate false alerts, leading to losses if not fastidiously managed.

-

Market Situations: The effectiveness of chart patterns can differ relying on market circumstances. In periods of excessive volatility or vital information occasions, chart patterns could also be much less dependable.

-

Lack of Elementary Help: Relying solely on chart patterns with out contemplating elementary evaluation could be dangerous. Elementary elements can override technical alerts.

VII. Conclusion:

Chart patterns are a robust instrument for technical analysts, providing insights into potential value actions. Nevertheless, they need to be used together with different technical indicators and elementary evaluation to enhance accuracy and handle threat. Mastering chart patterns requires observe, persistence, and a disciplined method to buying and selling. This information supplies a basis for understanding these patterns, however steady studying and expertise are essential for profitable software. Bear in mind to at all times observe accountable threat administration and adapt your methods to altering market circumstances. Obtain the PDF model of this information for straightforward reference and future examine. [Insert Link Here]

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has supplied invaluable insights into Chart Patterns: A Complete Information (PDF Downloadable). We thanks for taking the time to learn this text. See you in our subsequent article!