Chart Patterns: A Deep Dive into Technical Evaluation (Marathi Contextualized)

Associated Articles: Chart Patterns: A Deep Dive into Technical Evaluation (Marathi Contextualized)

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Chart Patterns: A Deep Dive into Technical Evaluation (Marathi Contextualized). Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart Patterns: A Deep Dive into Technical Evaluation (Marathi Contextualized)

Whereas there is not a available, complete ebook on chart patterns particularly written in Marathi, the ideas of technical evaluation, and the popularity and interpretation of chart patterns, are universally relevant. This text goals to discover the world of chart patterns, contextualizing them for a Marathi-speaking viewers within the Indian inventory market, and highlighting their relevance to the distinctive traits of the market.

Introduction: The Language of Charts

For these conversant in the colourful world of the Indian inventory market (भारतीय शेअर बाजार), understanding worth actions is paramount. Whereas elementary evaluation focuses on an organization’s intrinsic worth, technical evaluation makes use of previous worth and quantity knowledge to foretell future worth developments. Chart patterns are a vital aspect of technical evaluation, offering visible representations of market sentiment and potential future worth actions. These patterns, whether or not showing on candlestick charts (काँडलस्टिक चार्ट) or bar charts (बार चार्ट), provide merchants and buyers useful insights. Consider them as a visible language, talking volumes about market psychology and momentum.

Frequent Chart Patterns: A Visible Dictionary

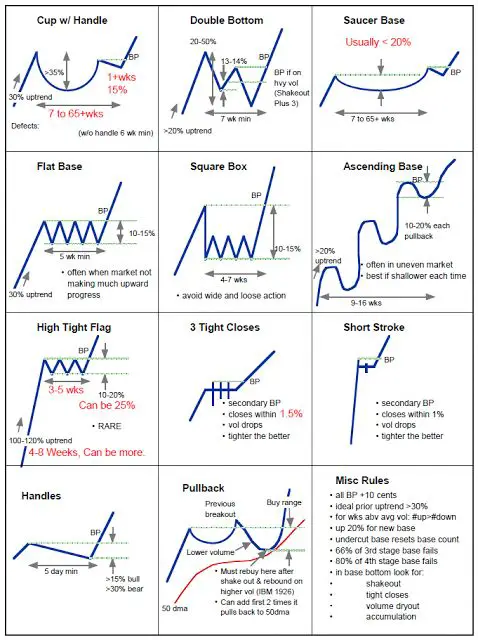

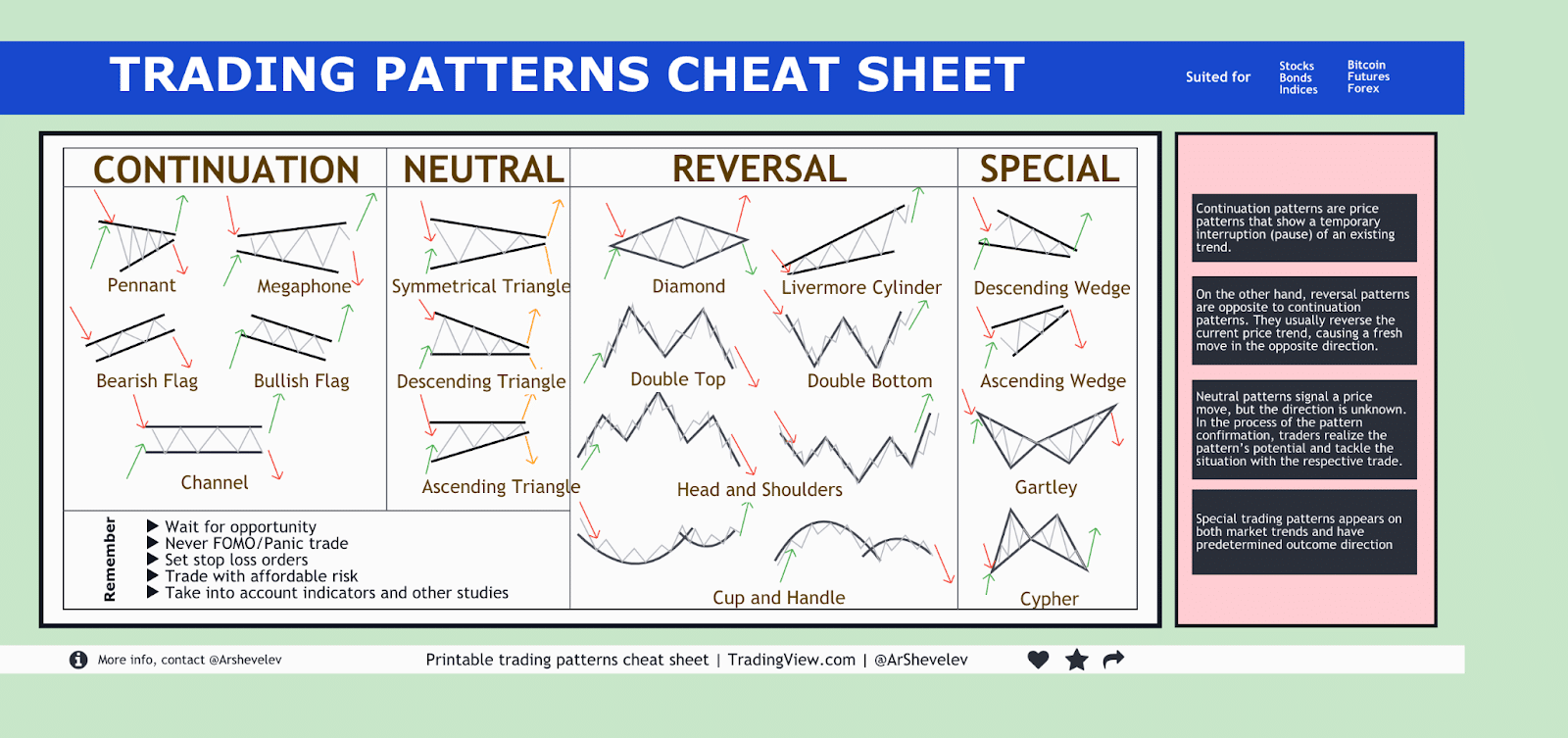

Many chart patterns exist, every carrying its personal implications. We’ll discover a number of the most prevalent, emphasizing their interpretation and potential buying and selling methods.

-

Head and Shoulders (हेड अँड शोल्डर्स): This bearish reversal sample resembles a head with two smaller shoulders on both facet. The "head" represents a major worth peak, adopted by decrease peaks ("shoulders"). A break beneath the neckline (a assist line connecting the lows of the shoulders) indicators a possible downward pattern. Within the context of the Indian market, this sample may point out a shift in sentiment away from a specific inventory or sector, doubtlessly triggered by macroeconomic elements like coverage adjustments (सरकारी धोरणांमधील बदल) or world occasions.

-

Inverse Head and Shoulders (उलटे हेड अँड शोल्डर्स): The bullish counterpart of the pinnacle and shoulders sample. A break above the neckline suggests a possible upward pattern. This might be notably related for buyers anticipating development in sectors like expertise (तंत्रज्ञान) or renewable vitality (नूतनीकरणीय ऊर्जा), which regularly exhibit sturdy upward momentum.

-

Triangles (त्रिकोण): Triangles are consolidation patterns, characterised by converging trendlines. They are often ascending, descending, or symmetrical. These patterns counsel a interval of indecision earlier than a possible breakout. Within the Indian market, this might replicate a interval of uncertainty earlier than a major occasion, like an earnings announcement (निधी जाहीर), impacting the value motion.

-

Double Tops and Double Bottoms (डबल टॉप आणि डबल बॉटम): These patterns point out potential reversals. Double tops counsel a bearish reversal after two comparable worth peaks, whereas double bottoms counsel a bullish reversal after two comparable worth troughs. The importance of those patterns within the Indian market might be linked to seasonal developments (ऋतूमय प्रवाह) or particular occasions affecting investor sentiment.

-

Flags and Pennants (ध्वज आणि पेनंट्स): These patterns typically seem throughout sturdy developments and symbolize short-term pauses. Flags are rectangular, whereas pennants are triangular. Breakouts from these patterns typically proceed the present pattern. These might be noticed in fast-growing sectors experiencing intervals of consolidation earlier than resuming their upward trajectory.

-

Cup and Deal with (कप आणि हँडल): This bullish continuation sample resembles a cup with a deal with. The "cup" represents a interval of worth decline adopted by a restoration, and the "deal with" is a brief interval of consolidation. A breakout above the deal with suggests a continuation of the upward pattern. This sample might be seen in corporations exhibiting constant development and attracting investor confidence.

Decoding Patterns within the Indian Context:

Whereas these patterns are universally relevant, their interpretation throughout the Indian market requires cautious consideration of a number of elements:

-

Macroeconomic Elements (महत्त्वपूर्ण आर्थिक घटक): Authorities insurance policies, inflation (दरवाढ), rates of interest (व्याजदर), and world occasions considerably affect the Indian inventory market. These elements can impression the formation and interpretation of chart patterns.

-

Sector-Particular Dynamics (क्षेत्र-विशिष्ट गतिशीलता): Completely different sectors exhibit distinctive traits. Understanding the particular dynamics of a sector is essential for precisely deciphering chart patterns inside that sector. For instance, patterns within the agricultural sector (कृषी क्षेत्र) is likely to be influenced by monsoon patterns (पावसाचे ढाचे), whereas these within the IT sector (माहिती तंत्रज्ञान क्षेत्र) is likely to be affected by world expertise developments.

-

Liquidity (द्रवता): Liquidity performs a vital position within the Indian market. Excessive liquidity permits for smoother worth actions, making chart patterns simpler to determine and interpret. Conversely, low liquidity can distort patterns.

-

Investor Sentiment (गुंतवणूकदारांची भावना): The psychology of Indian buyers is a major issue. Occasions like festivals (सण) or main information bulletins can affect investor sentiment and have an effect on chart patterns.

Past the Patterns: Threat Administration and Technique

Even with correct sample recognition, threat administration is essential. No sample ensures success. Think about:

-

Cease-Loss Orders (स्टॉप-लॉस ऑर्डर): At all times use stop-loss orders to restrict potential losses. That is particularly vital in a risky market just like the Indian inventory market.

-

Place Sizing (पोजिशन साईजिंग): Do not make investments greater than you possibly can afford to lose. Diversify your portfolio throughout completely different shares and sectors.

-

Affirmation from Different Indicators (इतर सूचकांक पासून पुष्टीकरण): Do not rely solely on chart patterns. Use different technical indicators (जसे की RSI, MACD) and elementary evaluation to substantiate your buying and selling choices.

-

Backtesting (बॅकटेस्टिंग): Earlier than implementing any buying and selling technique primarily based on chart patterns, backtest it on historic knowledge to evaluate its effectiveness.

Conclusion: A Highly effective Software within the Dealer’s Arsenal

Chart patterns are a robust instrument for technical evaluation, providing useful insights into market sentiment and potential worth actions. Whereas this text gives a basis, steady studying and observe are important for mastering their interpretation. By understanding the nuances of chart patterns and contextualizing them throughout the particular dynamics of the Indian inventory market, merchants and buyers can considerably improve their decision-making course of and enhance their probabilities of success. Keep in mind that it is a complicated area and requires thorough analysis and understanding earlier than making any funding choices. Consulting with a monetary advisor is all the time advisable earlier than making any funding decisions. The data offered right here is for academic functions solely and doesn’t represent monetary recommendation.

Closure

Thus, we hope this text has offered useful insights into Chart Patterns: A Deep Dive into Technical Evaluation (Marathi Contextualized). We thanks for taking the time to learn this text. See you in our subsequent article!