Chart Patterns: A Free E book Information to Mastering Technical Evaluation

Associated Articles: Chart Patterns: A Free E book Information to Mastering Technical Evaluation

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Chart Patterns: A Free E book Information to Mastering Technical Evaluation. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Patterns: A Free E book Information to Mastering Technical Evaluation

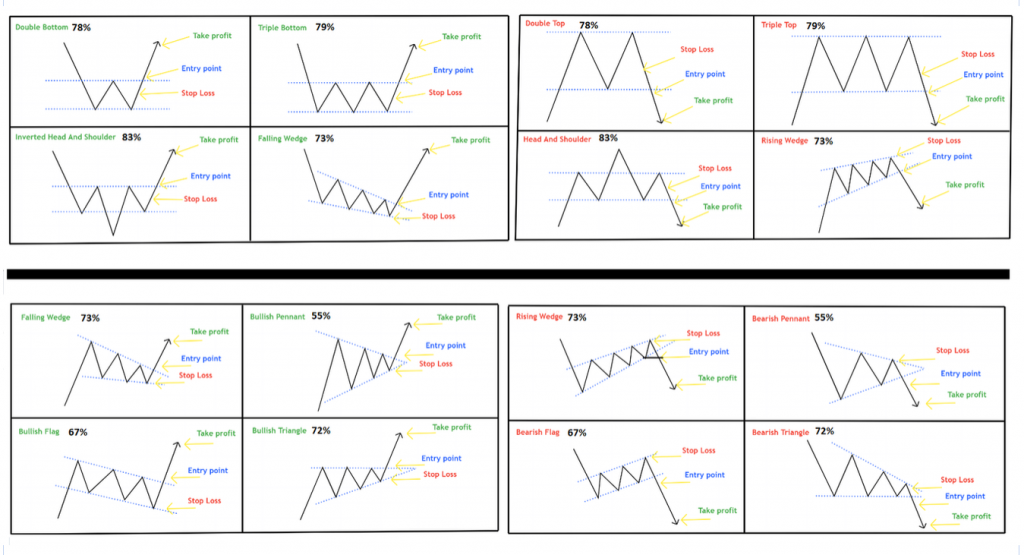

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

The monetary markets are a posh tapestry woven with threads of financial indicators, investor sentiment, and numerous different elements. Navigating this labyrinth can appear daunting, however technical evaluation affords a robust toolset for understanding worth motion and predicting future actions. Central to technical evaluation are chart patterns – recurring formations on worth charts that reveal potential shifts in market momentum and supply invaluable buying and selling alerts. Whereas many sources on chart patterns require vital monetary funding, this text serves as a free book information, exploring the elemental rules and offering a complete overview of a few of the most typical and efficient chart patterns.

Chapter 1: Introduction to Chart Patterns and Technical Evaluation

Technical evaluation is the research of previous market knowledge – primarily worth and quantity – to foretell future worth actions. It is based mostly on the premise that historical past tends to repeat itself, and identifiable patterns can present clues about upcoming traits. Chart patterns are visible representations of those recurring worth actions, providing merchants invaluable insights into potential assist and resistance ranges, breakout factors, and the general energy or weak spot of a development.

In contrast to basic evaluation, which focuses on an organization’s monetary well being and financial situations, technical evaluation is fully price-driven. This does not imply basic evaluation is irrelevant; in actual fact, a holistic strategy combining each methodologies typically yields the most effective outcomes. Nevertheless, for the needs of this book, we’ll focus solely on the applying of chart patterns inside a technical evaluation framework.

Chapter 2: Key Ideas and Terminology

Earlier than diving into particular chart patterns, understanding some basic ideas is essential:

- Assist: A worth degree the place shopping for stress is robust sufficient to stop an extra worth decline. It is typically marked by a horizontal line on the chart.

- Resistance: A worth degree the place promoting stress is robust sufficient to stop an extra worth improve. It is also typically marked by a horizontal line on the chart.

- Trendline: A line connecting a collection of upper lows (uptrend) or decrease highs (downtrend). Breaks of trendlines typically sign vital shifts in momentum.

- Breakout: A worth motion past a assist or resistance degree, typically indicating a continuation or reversal of the prevailing development.

- Pullback: A short lived worth reversal towards the dominant development. Pullbacks can supply wonderful shopping for alternatives in an uptrend or promoting alternatives in a downtrend.

- Quantity: The variety of shares or contracts traded throughout a selected interval. Quantity affirmation is essential; a robust breakout ought to ideally be accompanied by elevated buying and selling quantity.

Chapter 3: Frequent Chart Patterns: Reversal Patterns

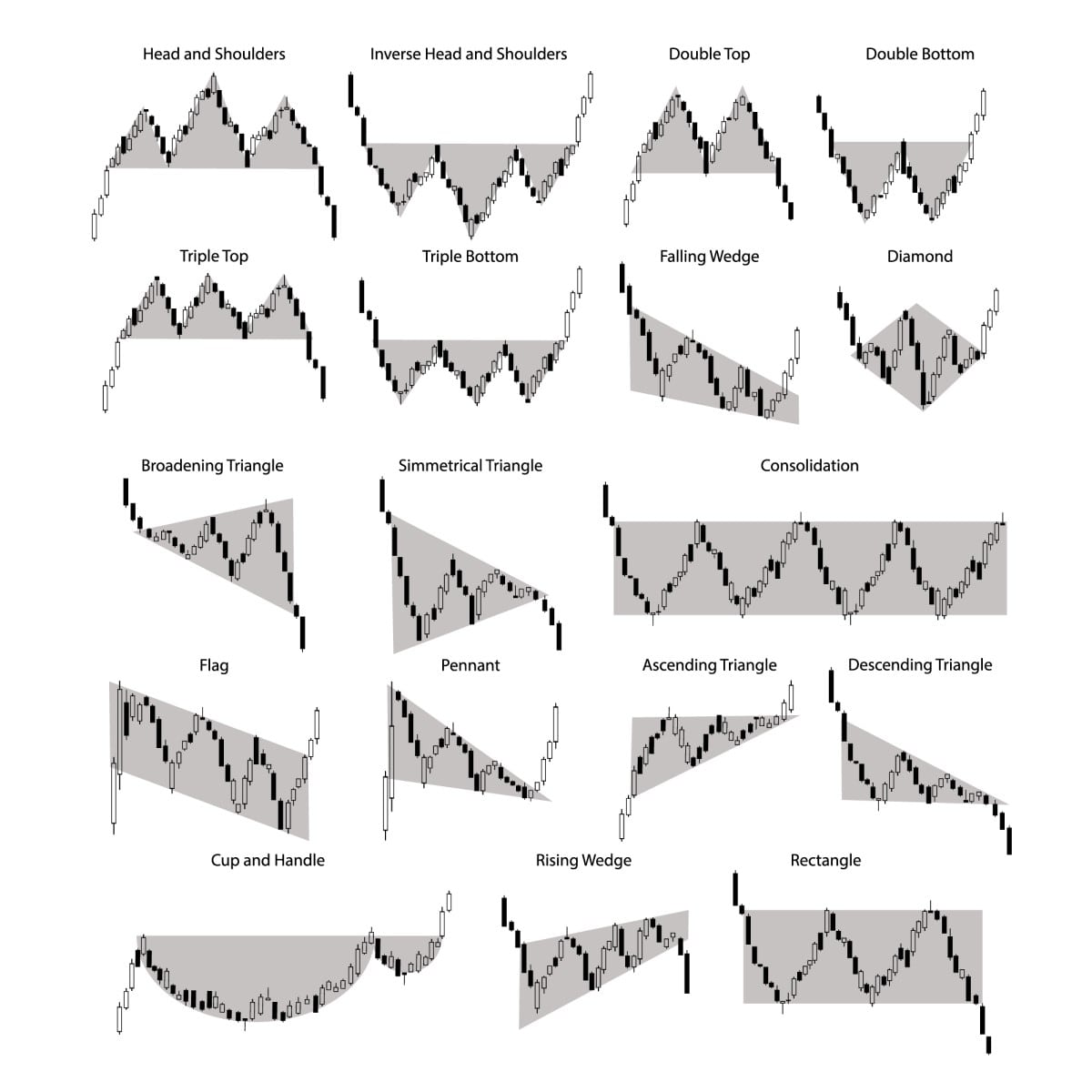

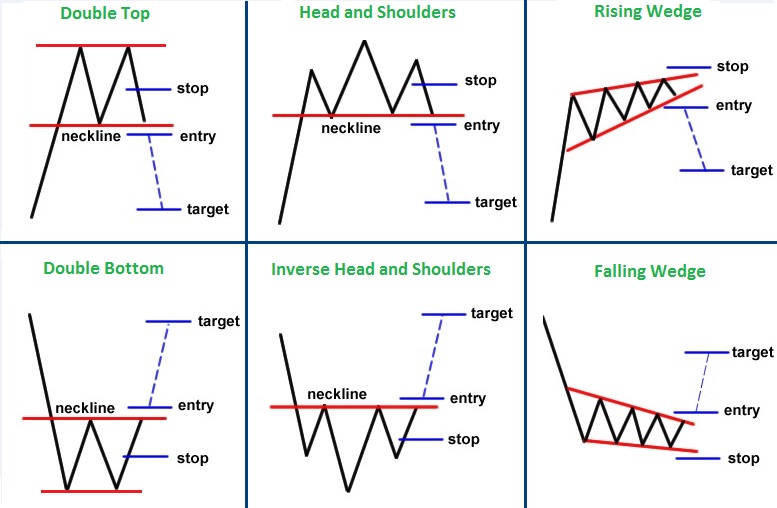

Reversal patterns recommend a possible change within the course of the prevailing development. A few of the most well known reversal patterns embody:

- Head and Shoulders: This sample consists of three peaks, with the center peak (the "head") being the best. A neckline connects the troughs between the peaks. A break beneath the neckline confirms the bearish reversal.

- Inverse Head and Shoulders: The mirror picture of the pinnacle and shoulders sample, indicating a bullish reversal. A break above the neckline confirms the bullish reversal.

- Double Prime/Backside: Two consecutive peaks (double prime) or troughs (double backside) at roughly the identical worth degree. A break beneath the double prime or above the double backside alerts a possible reversal.

- Triple Prime/Backside: Much like double tops/bottoms, however with three peaks or troughs. These patterns typically present stronger reversal alerts because of their elevated affirmation.

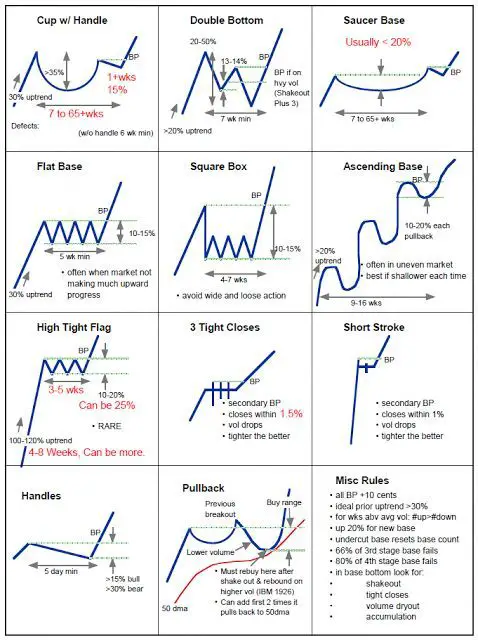

Chapter 4: Frequent Chart Patterns: Continuation Patterns

Continuation patterns recommend that the prevailing development will doubtless proceed after a brief pause or consolidation. Some distinguished continuation patterns embody:

- Triangles: These patterns are characterised by converging trendlines, forming a triangle form. There are a number of varieties of triangles, together with symmetrical, ascending, and descending triangles, every with barely totally different implications. Breakouts from triangles typically sign a continuation of the prevailing development.

- Flags and Pennants: These are short-term consolidation patterns that resemble flags or pennants on a pole. They sometimes seem inside a robust development and are adopted by a breakout within the course of the unique development.

- Rectangles: These patterns are characterised by horizontal assist and resistance ranges. Breakouts above the resistance or beneath the assist typically sign a continuation of the development.

- Wedges: These patterns are characterised by converging trendlines, just like triangles, however with sloping trendlines that point out a weakening of the development. Breakouts can verify both a continuation or reversal, relying on the kind of wedge.

Chapter 5: Deciphering Chart Patterns: Quantity and Affirmation

Whereas chart patterns present invaluable insights, relying solely on them is dangerous. Affirmation from different technical indicators or basic evaluation is essential. One of the vital vital confirmations comes from buying and selling quantity. A powerful breakout ought to ideally be accompanied by considerably elevated quantity, indicating sturdy shopping for or promoting stress. Conversely, low quantity breakouts is perhaps false alerts.

Different affirmation strategies embody:

- Transferring Averages: Evaluating the sample’s breakout with the habits of shifting averages (e.g., 50-day, 200-day) can present further assist for the sign.

- Relative Power Index (RSI): This momentum oscillator can assist verify overbought or oversold situations, lending credence to potential reversals.

- MACD (Transferring Common Convergence Divergence): This momentum indicator can spotlight modifications in development momentum, offering additional affirmation of chart sample alerts.

Chapter 6: Danger Administration and Buying and selling Methods

Profitable buying and selling entails efficient threat administration. By no means threat extra capital than you possibly can afford to lose. When buying and selling based mostly on chart patterns, take into account these methods:

- Cease-Loss Orders: At all times place stop-loss orders to restrict potential losses if the commerce goes towards you.

- Take-Revenue Orders: Set take-profit orders to safe income as soon as your goal worth is reached.

- Place Sizing: Decide the suitable place dimension based mostly in your threat tolerance and account dimension.

- Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different belongings and buying and selling methods.

Chapter 7: Additional Studying and Assets

This book supplies a foundational understanding of chart patterns. To deepen your information, take into account exploring further sources akin to:

- On-line Programs: Quite a few on-line programs supply in-depth coaching on technical evaluation and chart patterns.

- Buying and selling Books: Many wonderful books cowl technical evaluation intimately.

- Buying and selling Communities: Participating with skilled merchants in on-line boards and communities can present invaluable insights and assist.

- Observe: Constant apply is essential to mastering chart sample recognition and buying and selling methods. Use demo accounts to hone your abilities earlier than risking actual capital.

Conclusion:

Chart patterns are a invaluable device in a technical analyst’s arsenal. By understanding the elemental rules and recognizing frequent patterns, merchants can enhance their capability to establish potential buying and selling alternatives and handle threat. Do not forget that no buying and selling technique is foolproof, and constant studying, apply, and threat administration are important for long-term success within the monetary markets. This free book serves as a place to begin; steady studying and adaptation are essential for navigating the ever-evolving world of buying and selling. Bear in mind to all the time conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Chart Patterns: A Free E book Information to Mastering Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!