Chart Patterns: A Dealer’s Information to Recognizing and Exploiting Predictable Value Actions

Associated Articles: Chart Patterns: A Dealer’s Information to Recognizing and Exploiting Predictable Value Actions

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns: A Dealer’s Information to Recognizing and Exploiting Predictable Value Actions. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chart Patterns: A Dealer’s Information to Recognizing and Exploiting Predictable Value Actions

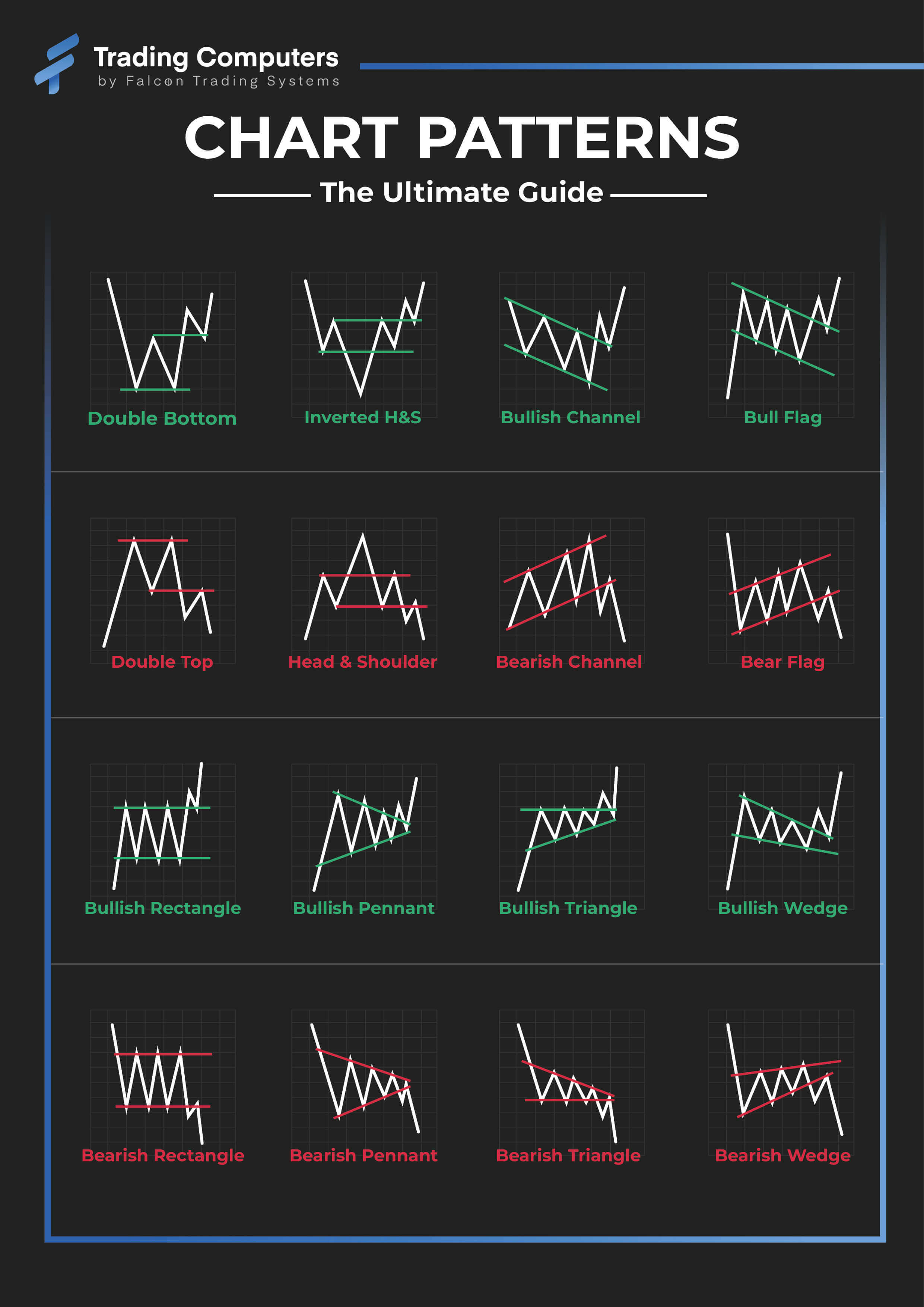

Chart patterns are visible representations of worth motion on a chart, revealing potential shifts in market sentiment and momentum. Skilled merchants make the most of these patterns to anticipate future worth actions, enhancing their decision-making course of and bettering commerce accuracy. Whereas no chart sample ensures success, recognizing and understanding them offers a major edge within the dynamic world of buying and selling. This text explores numerous frequent chart patterns, their traits, and the way to use them in your buying and selling technique.

I. Understanding Chart Sample Fundamentals:

Chart patterns are fashioned by the interaction of provide and demand. Bullish patterns counsel a shift in direction of shopping for strain, indicating a possible worth improve. Bearish patterns, conversely, sign rising promoting strain, hinting at a worth decline. The reliability of a sample depends upon numerous components, together with:

- Quantity: Affirmation of a sample’s energy comes from observing quantity modifications. Greater quantity throughout breakout confirms the sample’s validity. Low quantity breakouts are sometimes weak and unreliable.

- Timeframe: Patterns fashioned on greater timeframes (e.g., every day, weekly) usually maintain extra weight than these on decrease timeframes (e.g., hourly, 15-minute).

- Context: The general market pattern is essential. A bullish sample in a bearish market would possibly fail, whereas a bearish sample in a bullish pattern may very well be a short lived correction.

- Sample Readability: Properly-defined patterns with clear help and resistance ranges are extra dependable than ambiguous or poorly fashioned ones.

II. Main Bullish Chart Patterns:

-

Head and Shoulders Backside: This basic bullish reversal sample resembles a head and two shoulders. The "head" represents a decrease low, flanked by two "shoulders" forming greater lows. A neckline connects the troughs of the shoulders. A breakout above the neckline confirms the sample and indicators a possible upward pattern.

-

Double Backside: This sample options two consecutive lows at roughly the identical worth degree, adopted by a rebound. The neckline connects the 2 lows. A breakout above the neckline signifies a possible bullish reversal.

-

Triple Backside: Much like a double backside, however with three consecutive lows at roughly the identical worth degree. It strengthens the bullish sign, implying stronger help.

-

Inverse Head and Shoulders: It is a mirror picture of the top and shoulders backside, representing a bullish continuation sample. It varieties throughout an uptrend and suggests additional upward motion.

-

Cup and Deal with: This sample resembles a cup with a small deal with. The cup represents a interval of consolidation, adopted by a breakout from the deal with. It is a bullish continuation sample indicating additional worth appreciation.

-

Ascending Triangle: This sample exhibits a rising resistance line and a horizontal help line. As the value consolidates, the triangle narrows. A breakout above the resistance line is a bullish sign.

-

Bullish Flag: This sample exhibits a pointy worth improve adopted by a interval of consolidation inside parallel trendlines. The consolidation resembles a flag. A breakout above the higher trendline confirms the sample and suggests additional upward motion.

III. Main Bearish Chart Patterns:

-

Head and Shoulders Prime: The inverse of the top and shoulders backside, this can be a bearish reversal sample indicating a possible downtrend. A breakout beneath the neckline confirms the sample.

-

Double Prime: This sample exhibits two consecutive highs at roughly the identical worth degree, adopted by a worth decline. A breakdown beneath the neckline (connecting the 2 highs) confirms the bearish sign.

-

Triple Prime: Much like a double prime, however with three consecutive highs at roughly the identical worth degree, reinforcing the bearish sign.

-

Descending Triangle: This sample incorporates a declining help line and a horizontal resistance line. As the value consolidates, the triangle narrows. A breakdown beneath the help line is a bearish sign.

-

Bearish Flag: Much like the bullish flag, however in a downtrend. A pointy worth lower is adopted by consolidation inside parallel trendlines. A breakdown beneath the decrease trendline confirms the sample.

-

Rounding Prime: This sample exhibits a gradual worth improve adopted by a gradual decline, forming a rounded prime. It indicators a bearish reversal.

IV. Different Necessary Chart Patterns:

-

Rectangles: These patterns present a interval of consolidation between horizontal help and resistance ranges. Breakouts above or beneath these ranges point out the route of the longer term pattern.

-

Wedges: These patterns are characterised by converging trendlines. Ascending wedges are usually bearish, whereas descending wedges are usually bullish.

-

Pennants: Much like flags, however the consolidation interval is shorter and extra symmetrical.

-

Triangles (Symmetrical): These patterns have converging trendlines, however not like wedges, the slope of the strains are roughly equal. The breakout route might be both bullish or bearish.

V. Utilizing Chart Patterns in Your Buying and selling Technique:

-

Determine the Sample: Rigorously analyze the value chart to establish potential chart patterns. Use technical evaluation instruments and indicators to substantiate the sample’s formation.

-

Verify the Breakout: Anticipate a transparent breakout above (bullish) or beneath (bearish) the neckline or trendline. Verify the breakout with elevated quantity.

-

Set Cease-Loss Orders: Place stop-loss orders to restrict potential losses if the breakout fails. That is essential threat administration.

-

Decide Take-Revenue Ranges: Based mostly on the sample’s traits and your threat tolerance, decide acceptable take-profit ranges. Think about using Fibonacci retracements or different technical indicators to establish potential revenue targets.

-

Handle Your Positions: Monitor your trades intently and alter your stop-loss and take-profit ranges as wanted. Be ready to exit a commerce if the market situations change.

-

Apply and Persistence: Mastering chart sample recognition requires observe and endurance. Begin by analyzing historic charts and progressively apply your data to reside buying and selling. Do not forget that no sample ensures success, and losses are a part of buying and selling.

VI. Conclusion:

Chart patterns present helpful insights into potential worth actions, however they don’t seem to be a crystal ball. They need to be used together with different technical indicators and elementary evaluation to make knowledgeable buying and selling selections. By understanding the traits of assorted chart patterns and incorporating them right into a well-defined buying and selling technique, merchants can enhance their odds of success and navigate the complexities of the monetary markets extra successfully. Keep in mind to all the time observe correct threat administration and by no means make investments greater than you’ll be able to afford to lose. Steady studying and adaptation are essential for long-term success in buying and selling.

Closure

Thus, we hope this text has offered helpful insights into Chart Patterns: A Dealer’s Information to Recognizing and Exploiting Predictable Value Actions. We thanks for taking the time to learn this text. See you in our subsequent article!