Chart Patterns: A Dealer’s Roadmap to Knowledgeable Choices

Associated Articles: Chart Patterns: A Dealer’s Roadmap to Knowledgeable Choices

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns: A Dealer’s Roadmap to Knowledgeable Choices. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Chart Patterns: A Dealer’s Roadmap to Knowledgeable Choices

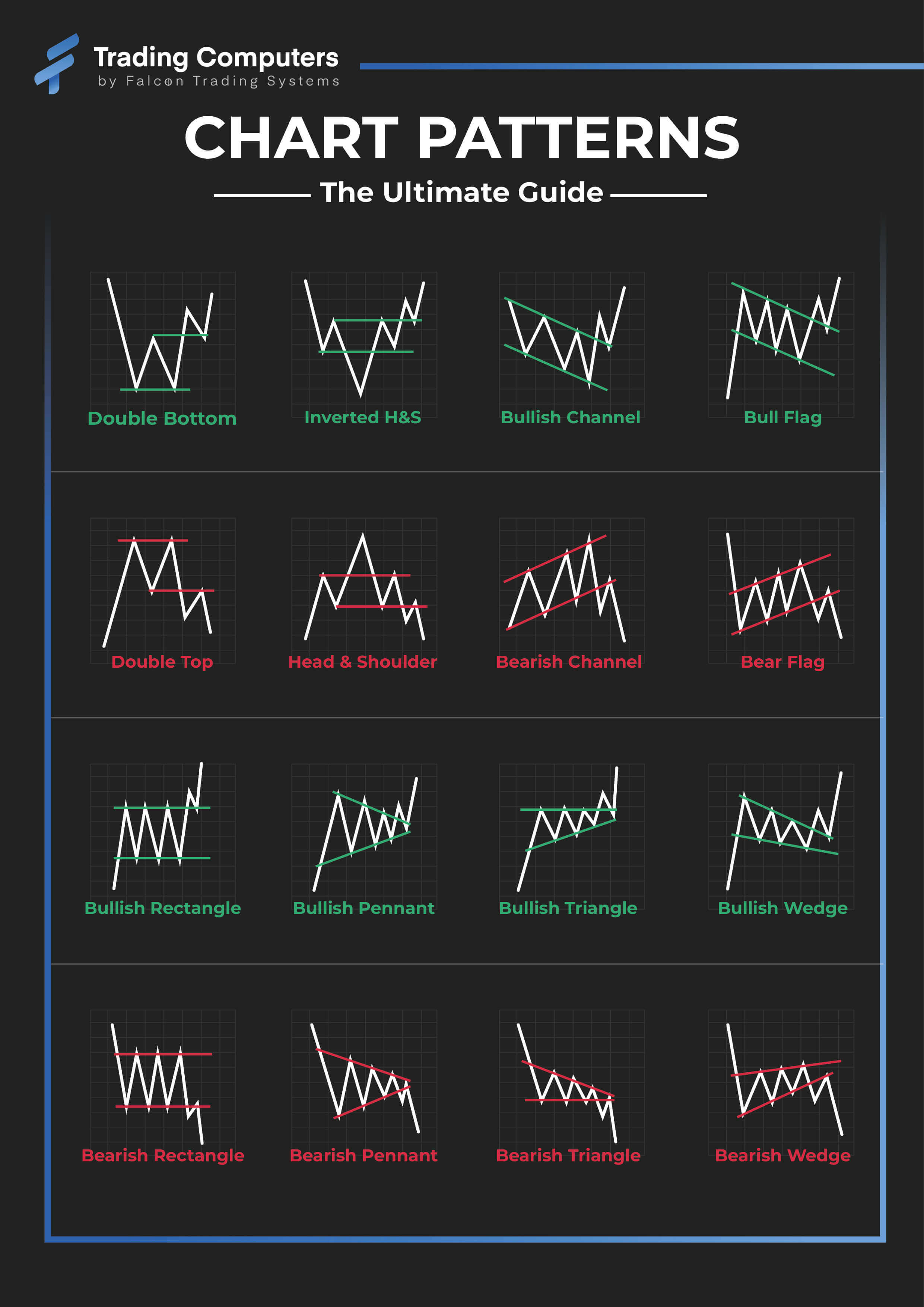

Chart patterns, the visible representations of value motion over time, are invaluable instruments for merchants throughout all market sorts. They provide a structured strategy to analyzing market sentiment, figuring out potential reversals or continuations, and finally, enhancing buying and selling choices. Whereas not foolproof predictors of future value actions, understanding and making use of chart patterns considerably enhances a dealer’s potential to anticipate market tendencies and handle danger. This text delves deep into the world of chart patterns, exploring their significance, differing types, and efficient methods for incorporating them into a strong buying and selling plan.

The Basis: Understanding Value Motion

Earlier than diving into particular patterns, it is essential to know the underlying precept: value motion displays the collective habits of patrons and sellers. A sustained uptrend signifies constant shopping for strain exceeding promoting strain, whereas a downtrend signifies the other. Chart patterns emerge as value fluctuates inside these tendencies, creating recognizable shapes that usually correlate with future value actions. These shapes aren’t arbitrary; they replicate the psychological dynamics of the market, revealing shifts in investor sentiment and potential turning factors.

Categorizing Chart Patterns: Reversal vs. Continuation

Chart patterns are broadly categorized into two foremost teams: reversal and continuation patterns.

1. Reversal Patterns: These patterns sign a possible change within the prevailing pattern. After an prolonged uptrend, a reversal sample suggests a shift in the direction of a downtrend, and vice-versa. Figuring out these patterns could be essential for merchants seeking to exit lengthy positions (in case of a high reversal) or enter brief positions (in case of a backside reversal). Some distinguished reversal patterns embrace:

-

Head and Shoulders: This traditional sample consists of three peaks, with the center peak (the "head") being the very best. The 2 outer peaks are the "shoulders." A neckline connects the troughs between the peaks. A break under the neckline sometimes indicators a bearish reversal.

-

Inverse Head and Shoulders: The mirror picture of the top and shoulders, this sample signifies a possible bullish reversal after a downtrend. A break above the neckline suggests a probable upward transfer.

-

Double High/Backside: A double high varieties after an uptrend, displaying two related value peaks. A break under the help stage connecting these peaks indicators a possible bearish reversal. A double backside, conversely, signifies a possible bullish reversal after a downtrend, with a break above the help stage suggesting an upward transfer.

-

Triple High/Backside: Much like double tops/bottoms, however with three peaks (tops) or troughs (bottoms), indicating stronger affirmation of a possible reversal.

2. Continuation Patterns: These patterns counsel that the prevailing pattern is more likely to proceed. They symbolize non permanent pauses or consolidations inside a bigger pattern, providing merchants alternatives to enter or add to present positions within the course of the pattern. Widespread continuation patterns embrace:

-

Triangles: These patterns are characterised by converging trendlines, forming a triangle form. There are a number of varieties of triangles, together with symmetrical, ascending, and descending triangles, every with barely completely different implications for future value motion. A breakout from the triangle sometimes confirms the continuation of the prevailing pattern.

-

Flags and Pennants: These patterns resemble small flags or pennants connected to a pole (the previous pattern). They symbolize short-term consolidations inside a powerful pattern. A breakout from the flag or pennant often confirms the continuation of the pattern.

-

Rectangles: These patterns present a interval of sideways consolidation, bounded by horizontal help and resistance ranges. A breakout above the resistance stage suggests a continuation of the uptrend, whereas a break under the help stage signifies a continuation of the downtrend.

-

Wedges: Much like triangles, wedges are characterised by converging trendlines, however they slope both upwards (bullish wedge) or downwards (bearish wedge). Bullish wedges usually precede a bearish breakout, whereas bearish wedges sometimes precede a bullish breakout.

Past the Fundamentals: Sample Recognition and Affirmation

Whereas recognizing the visible shapes of chart patterns is vital, profitable buying and selling requires extra than simply sample identification. A number of components improve the reliability of pattern-based buying and selling choices:

-

Quantity Evaluation: Confirming a sample breakout with elevated quantity provides vital weight to the sign. A powerful breakout ought to ideally be accompanied by a surge in buying and selling quantity, indicating sturdy conviction behind the worth motion.

-

Technical Indicators: Combining chart patterns with technical indicators, reminiscent of transferring averages, RSI, MACD, and so on., can present further affirmation and filter out false indicators.

-

Help and Resistance Ranges: Figuring out key help and resistance ranges together with chart patterns helps to outline potential value targets and stop-loss ranges.

-

Market Context: Think about the broader market atmosphere and information occasions which may impression the worth of the asset. A chart sample may be much less dependable if main financial information or geopolitical occasions are more likely to considerably affect the market.

-

Sample Measurement: Many patterns have particular measurements related to them, reminiscent of the peak of the flagpole in a flag sample or the width of a triangle. Understanding and making use of these measurements will help refine value targets and danger administration methods.

Danger Administration and Place Sizing:

Even with cautious sample evaluation, buying and selling entails inherent danger. Efficient danger administration is essential for long-term success. This contains:

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses if the commerce strikes towards you. Place stop-loss orders strategically, contemplating help ranges or sample breakouts.

-

Place Sizing: By no means danger extra capital than you’ll be able to afford to lose on any single commerce. Correct place sizing helps to handle danger and shield your buying and selling capital.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling throughout completely different property and methods to mitigate danger.

Conclusion: Chart Patterns as a Element of a Holistic Buying and selling Technique

Chart patterns are highly effective instruments, however they don’t seem to be a magic bullet. They need to be thought of as one element of a holistic buying and selling technique that includes basic evaluation, danger administration, and emotional self-discipline. By understanding the assorted chart patterns, combining them with different analytical strategies, and implementing a strong danger administration plan, merchants can considerably enhance their decision-making course of and improve their probabilities of success within the dynamic world of monetary markets. Constant apply, steady studying, and disciplined execution are key to mastering the artwork of chart sample evaluation and reaping its advantages. Do not forget that constant profitability requires a mix of technical ability, market understanding, and emotional management. Chart patterns present a priceless framework, however finally, profitable buying and selling hinges on a holistic and adaptable strategy.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has supplied priceless insights into Chart Patterns: A Dealer’s Roadmap to Knowledgeable Choices. We thanks for taking the time to learn this text. See you in our subsequent article!