Charters in Economics: Governance, Property Rights, and Market Dynamics

Associated Articles: Charters in Economics: Governance, Property Rights, and Market Dynamics

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Charters in Economics: Governance, Property Rights, and Market Dynamics. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Charters in Economics: Governance, Property Rights, and Market Dynamics

The time period "constitution" carries a wealthy historic and authorized weight, extending far past its colloquial understanding as a doc granting permission. In economics, the idea of a constitution takes on multifaceted meanings, profoundly influencing market constructions, useful resource allocation, and the very definition of property rights. This text will discover the varied financial interpretations of charters, analyzing their roles in shaping governance constructions, influencing agency habits, and impacting total financial effectivity.

Historic Context: Charters and the Rise of Capitalism

Traditionally, charters have been granted by monarchs or sovereign entities to people or teams, bestowing unique rights and privileges. These privileges usually concerned buying and selling monopolies, the fitting to ascertain settlements, or the management of particular assets. The East India Firm, for example, operated underneath a royal constitution, granting it immense energy and affect in its commerce actions. This historic context highlights a key facet of charters in economics: the creation of synthetic shortage and the potential for rent-seeking habits. By granting unique rights, charters might restrict competitors and generate financial rents for the charter-holder, even when these rents weren’t essentially earned by means of innovation or effectivity.

This early type of constitution highlights the interaction between political energy and financial exercise. The granting of a constitution wasn’t a purely financial resolution; it was a political one, reflecting the ability dynamics of the time and the sovereign’s strategic aims. This connection between political affect and financial outcomes continues to resonate in trendy interpretations of charters.

Trendy Interpretations: Charters and Institutional Frameworks

In modern economics, the idea of a "constitution" manifests in a number of methods, usually associated to institutional frameworks and organizational constructions:

-

Charters of Firms: Trendy firms function underneath charters granted by the state, outlining their authorized construction, rights, and tasks. These charters outline the boundaries of company energy, specify shareholder rights, and set up mechanisms for accountability. The main points of those charters can considerably affect company habits, together with funding choices, risk-taking, and social accountability. For example, a constitution that emphasizes shareholder worth maximization might incentivize short-term income over long-term sustainability. Conversely, a constitution that comes with social and environmental issues may result in totally different company methods.

-

Charters of Organizations: Non-profit organizations, universities, and different entities additionally function underneath charters that outline their mission, governance construction, and permissible actions. These charters set up the principles of the sport for these organizations, influencing their useful resource allocation, stakeholder engagement, and total affect. The design of those charters may be essential in making certain the group’s effectiveness and accountability. For instance, a clearly outlined constitution for a non-profit may appeal to extra donors and improve its credibility.

-

Charters of Markets and Establishments: The idea of a constitution will also be utilized to the design of markets and establishments themselves. For example, the principles governing a inventory change or a commodity market may very well be seen as a kind of constitution, defining the buying and selling mechanisms, laws, and dispute decision processes. These institutional charters form market effectivity, liquidity, and investor confidence. A well-designed constitution can foster a strong and clear market, whereas a poorly designed one can result in market failures and instability.

-

Charters and Property Rights: The elemental idea of property rights is intrinsically linked to charters. A property proper, in its essence, is a constitution granted by the state (or different governing authority) that defines the proprietor’s rights and tasks relating to a specific asset. These charters can differ considerably of their scope and specificity, influencing the incentives for funding, innovation, and useful resource administration. Safe and well-defined property rights, usually enshrined in authorized charters, are thought of essential for financial growth. Conversely, weak or ambiguous property rights can result in underinvestment, useful resource depletion, and battle.

Constitution Design and Financial Outcomes

The design of charters has profound implications for financial outcomes. A number of key components affect the effectiveness of charters:

-

Readability and Enforceability: A well-designed constitution is evident, unambiguous, and simply enforceable. Obscure or contradictory clauses can result in uncertainty and disputes, undermining the constitution’s supposed objective. Efficient enforcement mechanisms are additionally vital to make sure compliance and deter opportunistic habits.

-

Flexibility and Adaptability: Whereas readability is important, a constitution must also be versatile sufficient to adapt to altering circumstances. A inflexible constitution that fails to accommodate technological developments or evolving social norms might turn out to be out of date and ineffective.

-

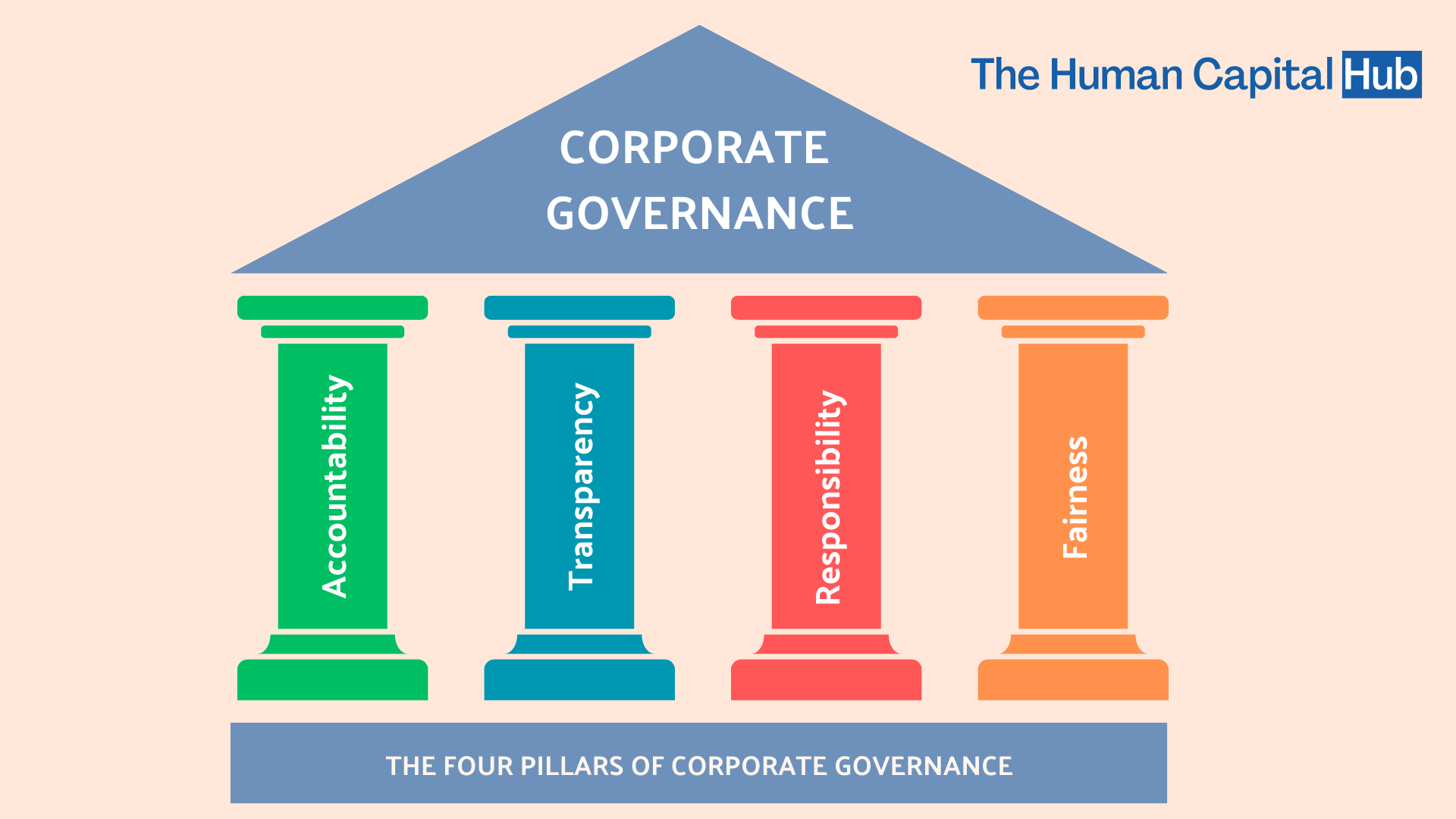

Accountability and Transparency: Mechanisms for accountability are essential to make sure that constitution holders act in the very best pursuits of stakeholders. Transparency in decision-making and monetary reporting can improve accountability and construct belief.

-

Incentive Alignment: A well-designed constitution aligns the incentives of constitution holders with the general targets of the group or market. This requires cautious consideration of the potential for rent-seeking habits and the necessity to incentivize innovation and effectivity.

Challenges and Criticisms of Charters

Regardless of their potential advantages, charters additionally face a number of challenges and criticisms:

-

Hire-In search of: As talked about earlier, charters can create alternatives for rent-seeking habits, the place people or organizations search to extract financial rents with out contributing to productive exercise. This will result in inefficiency and inequity.

-

Seize: Charters may be topic to "seize" by particular pursuits, the place the principles are manipulated to profit a specific group on the expense of others. This will undermine the equity and effectiveness of the constitution.

-

Lack of Competitors: Unique rights granted by charters can stifle competitors, resulting in larger costs and decrease high quality for shoppers.

-

Enforcement Challenges: Imposing charters may be troublesome, significantly in environments with weak governance or restricted authorized capability.

Conclusion: Charters in a Dynamic Financial Panorama

The idea of a constitution in economics encompasses a broad vary of institutional preparations and governance constructions. From historic buying and selling monopolies to trendy company charters and institutional frameworks, the design and implementation of charters considerably affect financial outcomes. Whereas charters can present priceless mechanisms for establishing property rights, fostering cooperation, and selling financial growth, cautious consideration have to be given to potential pitfalls resembling rent-seeking, seize, and the stifling of competitors. Efficient constitution design requires a nuanced understanding of the interaction between political energy, financial incentives, and institutional capability. Ongoing analysis and adaptation are essential to make sure that charters stay related and efficient in a dynamic and ever-evolving financial panorama. The way forward for charters lies to find a stability between granting obligatory rights and privileges whereas minimizing the dangers of market distortion and inequitable outcomes. This requires ongoing analysis, sturdy regulatory frameworks, and a dedication to transparency and accountability.

Closure

Thus, we hope this text has supplied priceless insights into Charters in Economics: Governance, Property Rights, and Market Dynamics. We recognize your consideration to our article. See you in our subsequent article!