Charting Foreign exchange in Actual Time: A Complete Information

Associated Articles: Charting Foreign exchange in Actual Time: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Charting Foreign exchange in Actual Time: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Charting Foreign exchange in Actual Time: A Complete Information

The overseas alternate (foreign exchange) market, often known as FX or forex market, is the most important and most liquid monetary market globally. Buying and selling operates 24/5, making it a dynamic and difficult atmosphere. Actual-time charting performs a vital function in navigating this complexity, offering merchants with up-to-the-second worth motion, permitting for knowledgeable decision-making and doubtlessly maximizing earnings. This text explores the intricacies of real-time foreign exchange charting, overlaying important points from selecting the best platform to decoding chart patterns and indicators.

Understanding the Significance of Actual-Time Charts

Within the fast-paced world of foreign currency trading, delays will be expensive. Actual-time charts provide a vital benefit by displaying reside worth information, eliminating the lag typically present in delayed charts. This immediacy permits merchants to:

- React Rapidly to Market Occasions: Information bulletins, financial information releases, and geopolitical occasions can drastically influence forex pairs. Actual-time charts allow merchants to immediately observe these impacts and alter their positions accordingly.

- Determine Rising Tendencies: By observing reside worth motion, merchants can spot growing traits sooner than these utilizing delayed information. This early identification can result in higher entry and exit factors, enhancing buying and selling efficiency.

- Handle Danger Successfully: Actual-time charts permit for fixed monitoring of open positions, enabling merchants to react promptly to opposed worth actions and decrease potential losses by way of well timed stop-loss orders or changes.

- Execute Trades Exactly: The power to see reside worth fluctuations permits for extra exact order execution, doubtlessly main to raised fills and diminished slippage.

- Backtest Methods Successfully: Whereas in a roundabout way a real-time operate, the power to overlay historic information on real-time charts permits for dynamic backtesting and technique refinement, making certain the technique’s viability within the present market circumstances.

Selecting the Proper Charting Platform

The effectiveness of real-time foreign exchange charting closely is dependent upon the platform used. A very good platform ought to provide:

- Low Latency: Minimal delay between worth modifications and their show on the chart is essential. Excessive latency can result in missed alternatives and inaccurate buying and selling choices.

- A number of Chart Sorts: Entry to numerous chart varieties like candlestick, bar, line, and Renko charts is important for versatile evaluation. Every chart kind provides distinctive views on worth motion.

- Huge Vary of Indicators: A sturdy platform ought to present a complete library of technical indicators, together with transferring averages, oscillators, quantity indicators, and others, to boost evaluation.

- Customizable Settings: Merchants ought to be capable of personalize their charts by adjusting colours, timeframes, and indicator settings to go well with their particular person preferences and buying and selling types.

- Drawing Instruments: Instruments akin to trendlines, Fibonacci retracements, help/resistance ranges, and channels are essential for figuring out patterns and potential buying and selling alternatives.

- Automated Buying and selling Capabilities (Non-compulsory): Some platforms provide automated buying and selling functionalities, permitting merchants to execute pre-programmed methods based mostly on real-time chart information. This requires cautious consideration and testing.

- Integration with Brokers: Seamless integration with foreign exchange brokers is important for easy order execution instantly from the charting platform.

Fashionable platforms providing real-time foreign exchange charting embody MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, cTrader, and lots of broker-specific platforms. Selecting the best platform typically is dependent upon particular person wants and preferences.

Decoding Chart Patterns and Indicators

Actual-time charts are solely as helpful because the dealer’s potential to interpret the info they show. Understanding chart patterns and technical indicators is essential for making knowledgeable buying and selling choices.

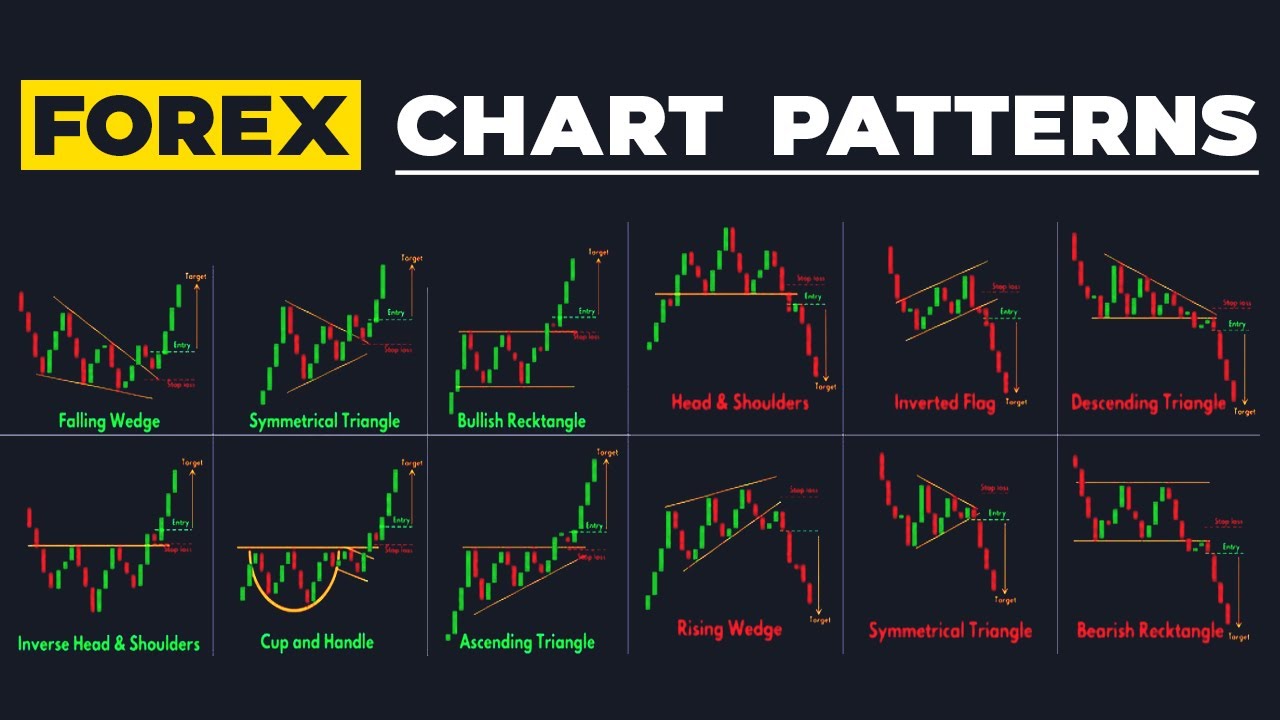

Widespread Chart Patterns:

- Head and Shoulders: A reversal sample indicating a possible development change.

- Double Tops/Bottoms: Reversal patterns just like head and shoulders however less complicated.

- Triangles: Consolidation patterns that may precede a breakout in both course.

- Flags and Pennants: Continuation patterns suggesting a continuation of the prevailing development.

- Wedges: Patterns that may be both bullish or bearish relying on their slope.

Fashionable Technical Indicators:

- Transferring Averages (MA): Easy out worth fluctuations, figuring out traits and potential help/resistance ranges. Widespread varieties embody Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA).

- Relative Energy Index (RSI): An oscillator indicating overbought and oversold circumstances, doubtlessly figuring out potential development reversals.

- Transferring Common Convergence Divergence (MACD): One other oscillator that identifies momentum modifications and potential development reversals.

- Stochastic Oscillator: Measures the momentum of worth modifications, just like RSI.

- Bollinger Bands: Present worth volatility and potential help/resistance ranges.

- Common True Vary (ATR): Measures market volatility.

Combining Chart Patterns and Indicators:

Efficient foreign currency trading typically includes combining chart patterns and technical indicators. As an example, a dealer would possibly determine a head and shoulders sample on a candlestick chart and make sure the potential reversal utilizing the RSI or MACD oscillator. This mix gives a extra sturdy buying and selling sign.

Danger Administration in Actual-Time Buying and selling

Actual-time buying and selling, whereas providing thrilling alternatives, additionally carries heightened danger. Efficient danger administration is essential:

- Cease-Loss Orders: Important for limiting potential losses by routinely closing a place when the worth reaches a predetermined stage.

- Take-Revenue Orders: Safe earnings by routinely closing a place when the worth reaches a specified goal.

- Place Sizing: Figuring out the suitable quantity to put money into every commerce, limiting general danger publicity.

- Diversification: Spreading investments throughout a number of forex pairs to scale back the influence of losses in a single pair.

- Emotional Self-discipline: Avoiding impulsive choices based mostly on short-term worth fluctuations. Sticking to a well-defined buying and selling plan is essential.

Superior Charting Strategies

Past primary chart interpretation, superior strategies can additional improve buying and selling efficiency:

- Quantity Evaluation: Finding out buying and selling quantity alongside worth motion can present insights into the power of worth actions.

- Order Circulate Evaluation: Analyzing the order e-book to grasp the underlying market dynamics.

- Market Profile: A way of visualizing worth distribution and figuring out potential help and resistance ranges.

- Algorithmic Buying and selling: Creating and utilizing automated buying and selling techniques based mostly on real-time chart information.

Conclusion:

Actual-time foreign exchange charting is an indispensable device for profitable foreign currency trading. By understanding the significance of real-time information, selecting the best charting platform, decoding chart patterns and indicators successfully, and implementing sturdy danger administration methods, merchants can considerably enhance their buying and selling efficiency. Nevertheless, it is essential to keep in mind that foreign currency trading includes inherent danger, and no technique ensures revenue. Steady studying, observe, and adaptation are important for long-term success on this dynamic market. At all times observe accountable buying and selling and take into account searching for recommendation from monetary professionals earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Charting Foreign exchange in Actual Time: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!