Charting the Course: A Deep Dive into USD to CAD Alternate Charges

Associated Articles: Charting the Course: A Deep Dive into USD to CAD Alternate Charges

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Charting the Course: A Deep Dive into USD to CAD Alternate Charges. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Charting the Course: A Deep Dive into USD to CAD Alternate Charges

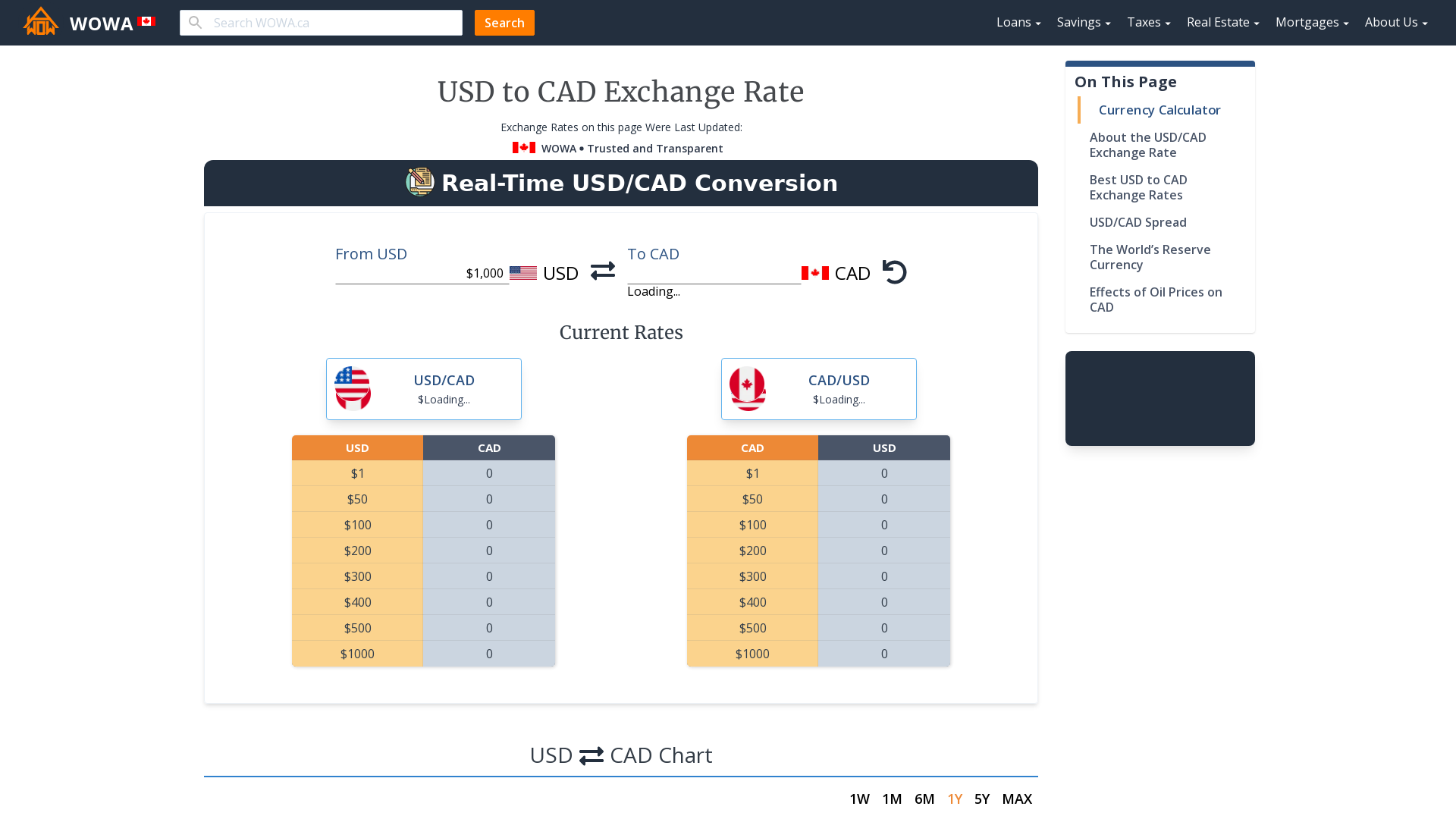

The USD/CAD change price, also known as the "Loonie" (as a result of Canadian one-dollar coin that includes a loon), is a dynamic and influential metric within the North American and world economies. Understanding its fluctuations requires analyzing a large number of things, from rate of interest differentials and commodity costs to geopolitical occasions and investor sentiment. This text will delve into the intricacies of the USD/CAD chart, exploring its historic tendencies, key drivers, and implications for companies, buyers, and people.

Historic Context: A Rollercoaster Trip

The USD/CAD change price has skilled important volatility all through its historical past. Whereas the particular price fluctuates continually, a assessment of long-term tendencies reveals a number of key intervals:

-

Early Years (Pre-Nineteen Seventies): Previous to the collapse of the Bretton Woods system, change charges had been largely mounted. The USD/CAD price was comparatively secure, reflecting a detailed financial relationship between the 2 nations.

-

Submit-Bretton Woods Period (Nineteen Seventies-Current): The shift to floating change charges launched better volatility. The speed has been influenced by varied financial shocks, together with oil worth fluctuations, rate of interest modifications, and recessions. Intervals of great power for the Canadian greenback (CAD appreciating in opposition to the USD) typically coincided with excessive commodity costs, significantly oil, given Canada’s function as a significant exporter. Conversely, intervals of weak spot had been continuously related to decrease commodity costs or financial downturns in Canada or the US.

-

Current Developments (2010s-Current): The previous decade has witnessed intervals of each appreciation and depreciation for the CAD in opposition to the USD. The shale oil increase within the US initially put downward stress on oil costs, impacting the Canadian greenback. Nevertheless, subsequent geopolitical occasions and world financial shifts have led to fluctuations, with intervals of great CAD power adopted by intervals of weak spot. The COVID-19 pandemic, for instance, initially noticed a pointy depreciation of the CAD, reflecting world uncertainty and decreased demand for Canadian commodities. Subsequent financial restoration and rate of interest changes have influenced the speed’s trajectory.

Key Drivers of USD/CAD Fluctuations:

The USD/CAD change price is influenced by a posh interaction of things. A number of the most important embrace:

-

Curiosity Price Differentials: A key determinant is the distinction between rates of interest within the US and Canada. Greater rates of interest in Canada sometimes appeal to international funding, growing demand for the CAD and resulting in appreciation. Conversely, increased US rates of interest can strengthen the USD in opposition to the CAD. Central financial institution insurance policies play an important function right here, with bulletins from the Federal Reserve (Fed) and the Financial institution of Canada (BoC) typically inflicting rapid market reactions.

-

Commodity Costs: Canada is a significant exporter of commodities, significantly oil, pure fuel, and lumber. Fluctuations in world commodity costs considerably affect the CAD. Greater commodity costs usually increase the CAD, as elevated demand for Canadian exports will increase demand for the foreign money. Conversely, decrease commodity costs weaken the CAD. The correlation between oil costs and the USD/CAD price is especially robust.

-

Financial Development Differentials: Relative financial efficiency between the US and Canada additionally influences the change price. Stronger financial progress in Canada in comparison with the US tends to assist the CAD, whereas stronger US progress can strengthen the USD. Elements like employment charges, GDP progress, and client confidence contribute to this dynamic.

-

Geopolitical Occasions: International political instability, commerce wars, and different geopolitical occasions can considerably affect the USD/CAD price. Uncertainty within the world market typically results in buyers looking for secure havens, doubtlessly boosting the USD (a worldwide reserve foreign money) and placing downward stress on the CAD.

-

Investor Sentiment: Market sentiment in direction of each the US and Canadian economies performs a major function. Optimistic sentiment in direction of Canada’s financial prospects tends to extend demand for the CAD, whereas detrimental sentiment can result in depreciation. This sentiment is usually mirrored in market indices and investor flows.

-

US Greenback Energy: The USD’s power relative to different main currencies (e.g., EUR, JPY) can not directly have an effect on the USD/CAD price. A powerful USD tends to place downward stress on most currencies, together with the CAD.

Analyzing the USD/CAD Chart:

Analyzing the USD/CAD chart requires understanding a number of technical and elementary points:

-

Technical Evaluation: This includes finding out previous worth actions, quantity, and different indicators to foretell future worth tendencies. Technical analysts use instruments like shifting averages, assist and resistance ranges, and chart patterns to establish potential buying and selling alternatives.

-

Elementary Evaluation: This includes analyzing the underlying financial components driving the change price, equivalent to rate of interest differentials, commodity costs, and financial progress. Elementary evaluation helps to find out the honest worth of the USD/CAD price and establish potential mispricings.

-

Chart Patterns: Recognizing frequent chart patterns, equivalent to head and shoulders, double tops/bottoms, and triangles, can present insights into potential worth reversals or continuations.

-

Indicators: Technical indicators like RSI (Relative Energy Index), MACD (Shifting Common Convergence Divergence), and Bollinger Bands may also help establish overbought or oversold situations and potential development modifications.

Implications for Companies, Buyers, and People:

The USD/CAD change price has important implications for varied stakeholders:

-

Companies: Companies engaged in cross-border commerce between the US and Canada are significantly uncovered to change price fluctuations. Adjustments within the price can affect profitability, pricing methods, and competitiveness. Hedging methods are sometimes employed to mitigate change price danger.

-

Buyers: Buyers holding belongings denominated in both USD or CAD are affected by change price actions. The speed can affect the worth of their investments and affect funding selections. Diversification throughout currencies may also help mitigate danger.

-

People: People concerned in cross-border transactions, equivalent to tourism or remittances, are straight impacted by change price fluctuations. The speed impacts the price of items and providers and the worth of cash transfers.

Conclusion:

The USD/CAD change price is a posh and dynamic metric influenced by a variety of things. Understanding these components, analyzing historic tendencies, and using applicable analytical instruments are essential for navigating the volatility of this vital foreign money pair. Whether or not you’re a enterprise, investor, or particular person, staying knowledgeable in regards to the USD/CAD change price and its drivers is important for making sound monetary selections. Repeatedly monitoring the chart, alongside related financial information and evaluation, is vital to successfully managing publicity to this ever-changing market. The knowledge offered on this article serves as a place to begin for a extra in-depth understanding; additional analysis and session with monetary professionals are beneficial for knowledgeable decision-making.

Closure

Thus, we hope this text has offered beneficial insights into Charting the Course: A Deep Dive into USD to CAD Alternate Charges. We respect your consideration to our article. See you in our subsequent article!