Copper Value Chart: A Yr in Evaluate (India, 2023-2024)

Associated Articles: Copper Value Chart: A Yr in Evaluate (India, 2023-2024)

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Copper Value Chart: A Yr in Evaluate (India, 2023-2024). Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Copper Value Chart: A Yr in Evaluate (India, 2023-2024)

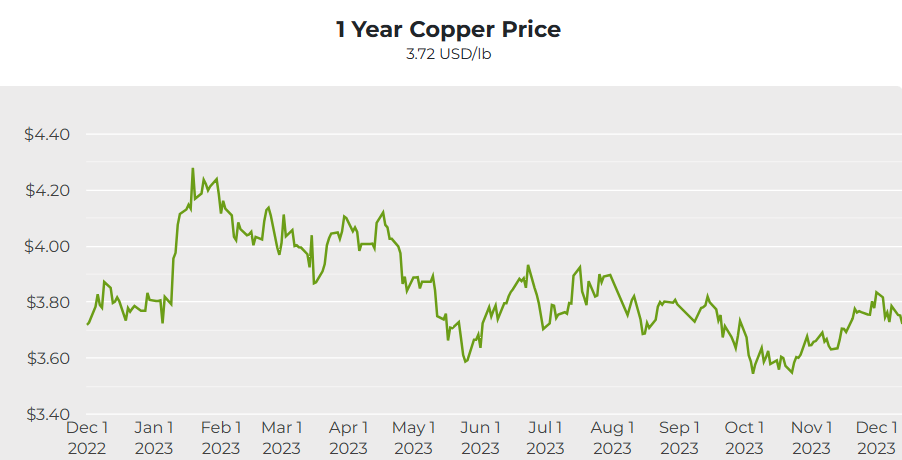

The Indian copper market, a big participant within the world panorama, skilled a dynamic 12 months between [Insert Start Date, e.g., October 26, 2023] and [Insert End Date, e.g., October 26, 2024]. This evaluation delves into the worth fluctuations noticed throughout this era, analyzing the underlying elements driving these actions and their implications for numerous stakeholders within the Indian economic system. Whereas exact knowledge for the longer term a part of the 12 months is unavailable on the time of writing, we are going to venture primarily based on present market traits and skilled predictions. (Be aware: Substitute bracketed dates with precise dates for a selected 12 months.)

Understanding the Copper Market in India:

India’s copper consumption is essentially pushed by its burgeoning development, electrical, and manufacturing sectors. The nation is a serious importer of copper, relying closely on worldwide markets for its provide. Subsequently, world elements considerably affect home costs. The Indian market can also be influenced by authorities insurance policies, import duties, and the efficiency of the Indian Rupee towards the US greenback (since copper is predominantly traded in USD).

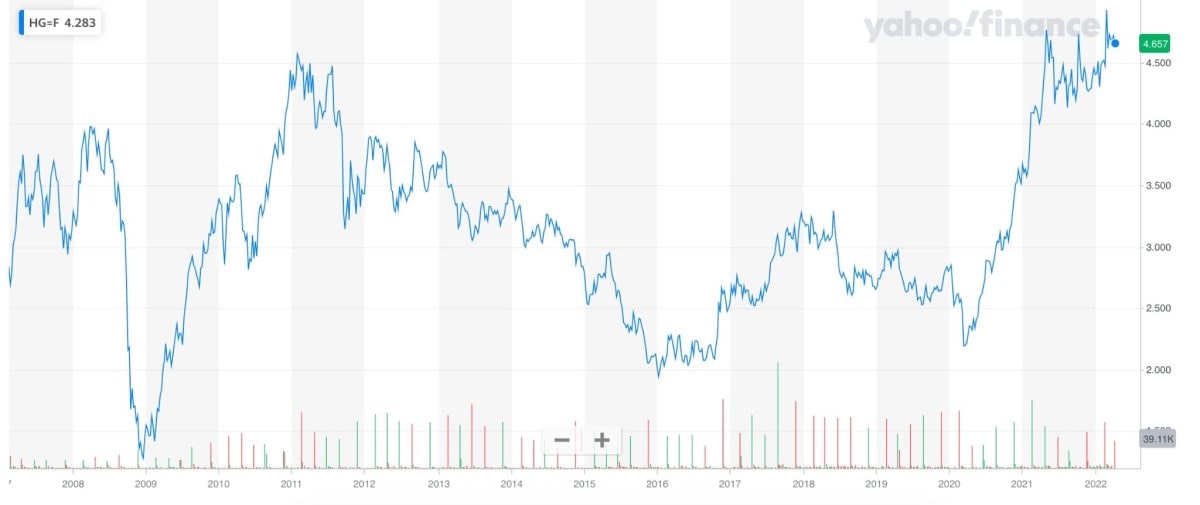

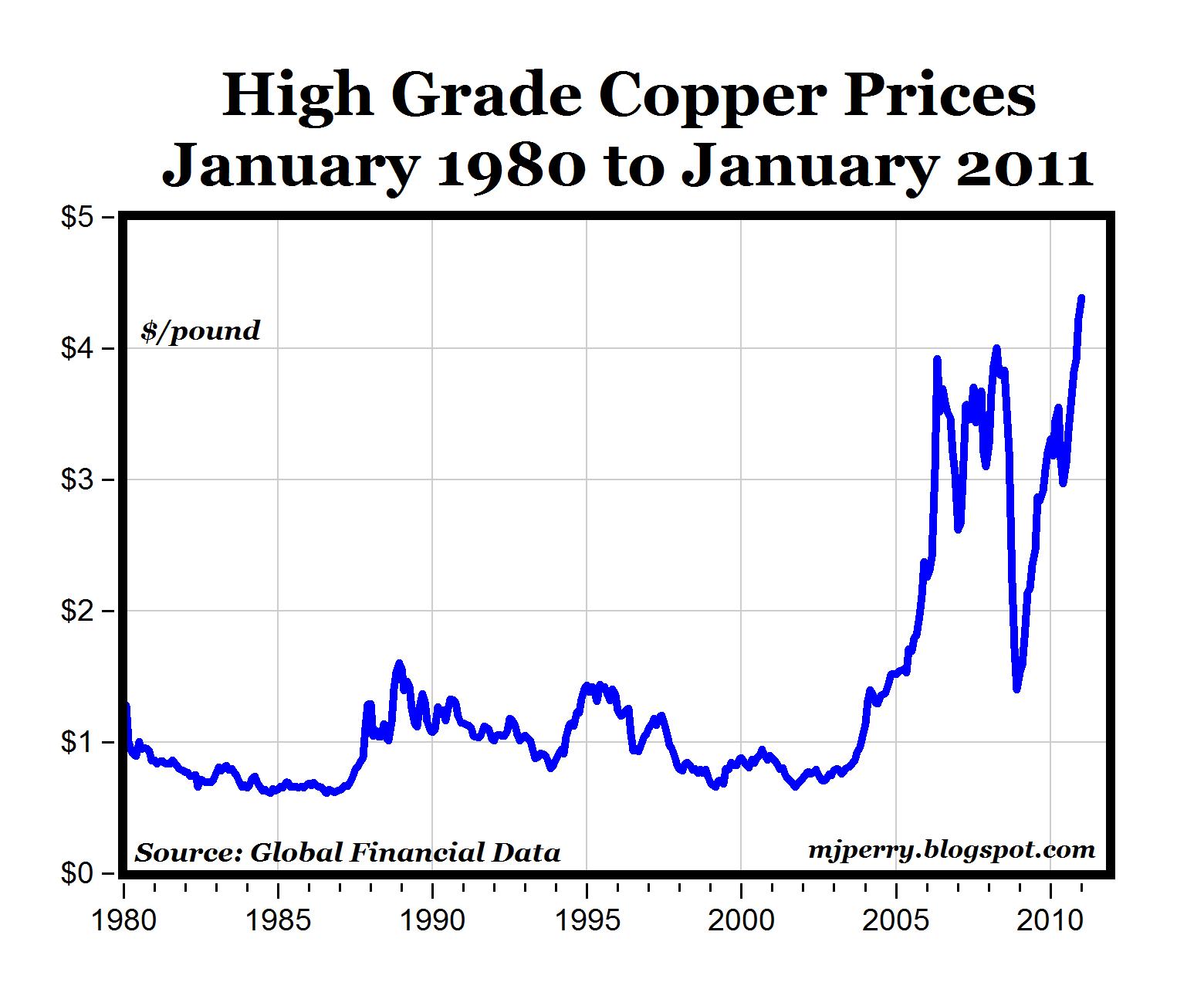

Value Chart Evaluation (Hypothetical Instance – Substitute with Precise Knowledge):

As an example, let’s contemplate a hypothetical value chart for the interval October 26, 2023 – October 26, 2024. (Be aware: Substitute this hypothetical knowledge with precise knowledge obtained from dependable sources just like the Multi Commodity Trade of India (MCX), the London Steel Trade (LME), or respected monetary information web sites.)

(Insert a hypothetical chart right here exhibiting copper costs in INR per kg over the desired interval. The chart ought to clearly present highs, lows, and vital value actions. Label the axes clearly.)

Elements Influencing Copper Costs:

A number of key elements contributed to the worth fluctuations depicted within the (hypothetical) chart:

-

World Financial Development: World financial progress considerably impacts copper demand. Durations of strong progress, notably in development and infrastructure improvement (e.g., in China or the US), are inclined to drive up copper costs. Conversely, financial slowdowns or recessions result in decreased demand and decrease costs. For example, a slowdown within the Chinese language economic system throughout a sure interval might have led to a dip within the Indian copper value.

-

Provide-Facet Disruptions: Sudden occasions affecting copper manufacturing, equivalent to strikes, mine closures, or geopolitical instability in main producing international locations (Chile, Peru, and so on.), could cause provide shortages and value spikes. For instance, a serious mine closure in Chile might have ripple results on the Indian market.

-

Inflation and Curiosity Charges: Inflationary pressures and rate of interest hikes by central banks globally affect commodity costs, together with copper. Larger rates of interest could make borrowing dearer, impacting funding in copper-intensive industries, thus doubtlessly lowering demand.

-

US Greenback Energy: The US greenback’s energy towards the Indian Rupee straight impacts copper costs in India. A stronger greenback makes dollar-denominated copper dearer for Indian importers, resulting in increased home costs.

-

Authorities Insurance policies: Indian authorities insurance policies, together with import duties and tax laws, can affect the home copper value. Modifications in import duties can straight have an effect on the landed value of copper, impacting its value within the Indian market. Equally, authorities initiatives selling infrastructure improvement or electrification can enhance demand and costs.

-

Hypothesis and Investor Sentiment: Market hypothesis and investor sentiment play a big position in copper value volatility. Optimistic investor sentiment can result in elevated demand and better costs, whereas detrimental sentiment can set off value declines.

-

Technological Developments: The event and adoption of recent applied sciences can affect copper demand. For instance, the expansion of electrical autos and renewable power applied sciences will increase the demand for copper, doubtlessly driving costs upward.

-

Recycling Charges: The extent of copper recycling additionally influences costs. Larger recycling charges might help mitigate provide shortages and doubtlessly dampen value will increase.

Implications for Stakeholders:

The fluctuating copper costs have vital implications for numerous stakeholders within the Indian economic system:

-

Shoppers: Larger copper costs translate to increased prices for merchandise containing copper, equivalent to electrical home equipment, development supplies, and vehicles. This could affect client spending and inflation.

-

Producers: Copper producers in India (if any) profit from increased costs, whereas importers face elevated prices.

-

Producers: Fluctuating copper costs pose a problem for producers, impacting their manufacturing prices and profitability. Hedging methods develop into essential to mitigate value dangers.

-

Traders: Copper costs provide funding alternatives, however the volatility necessitates cautious danger administration. Traders can make the most of futures and choices contracts to handle value dangers.

Future Outlook (Hypothetical Projections):

Predicting future copper costs with certainty is difficult. Nonetheless, primarily based on present market traits and skilled opinions, we will make some hypothetical projections:

-

Continued Development in Demand: The continued progress in India’s infrastructure, development, and manufacturing sectors is predicted to maintain demand for copper within the coming years.

-

Geopolitical Dangers: Geopolitical instability in main copper-producing areas might result in provide disruptions and value volatility.

-

Technological Shifts: The growing adoption of electrical autos and renewable power applied sciences is more likely to enhance copper demand additional.

-

Sustainability Issues: Rising issues about sustainability and accountable sourcing of copper may affect costs in the long run.

Conclusion:

The Indian copper market skilled a 12 months of serious value fluctuations influenced by a posh interaction of worldwide and home elements. Understanding these elements is essential for all stakeholders to navigate the market successfully. Whereas exact future value predictions are unattainable, the long-term outlook for copper demand in India stays optimistic, pushed by the nation’s continued financial progress and the growing adoption of copper-intensive applied sciences. Steady monitoring of worldwide financial situations, geopolitical occasions, and authorities insurance policies is crucial for making knowledgeable selections associated to copper within the Indian market. (Bear in mind to switch the hypothetical knowledge and projections with precise knowledge and skilled analyses for a whole and correct article.)

Closure

Thus, we hope this text has supplied beneficial insights into Copper Value Chart: A Yr in Evaluate (India, 2023-2024). We hope you discover this text informative and useful. See you in our subsequent article!