Deciphering the GBP/USD Foreign exchange Chart: A Complete Information

Associated Articles: Deciphering the GBP/USD Foreign exchange Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deciphering the GBP/USD Foreign exchange Chart: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Deciphering the GBP/USD Foreign exchange Chart: A Complete Information

The GBP/USD, or "cable" because it’s affectionately recognized within the foreign exchange market, is without doubt one of the most actively traded forex pairs globally. Its volatility and sensitivity to financial occasions make it a compelling instrument for each seasoned merchants and newcomers. Understanding the GBP/USD foreign exchange chart requires extra than simply glancing on the value; it necessitates a deep dive into the components influencing its actions and the instruments used to investigate its trajectory. This text will discover the GBP/USD chart, its historic efficiency, key influencing components, technical evaluation strategies, and threat administration methods.

Historic Efficiency and Key Traits:

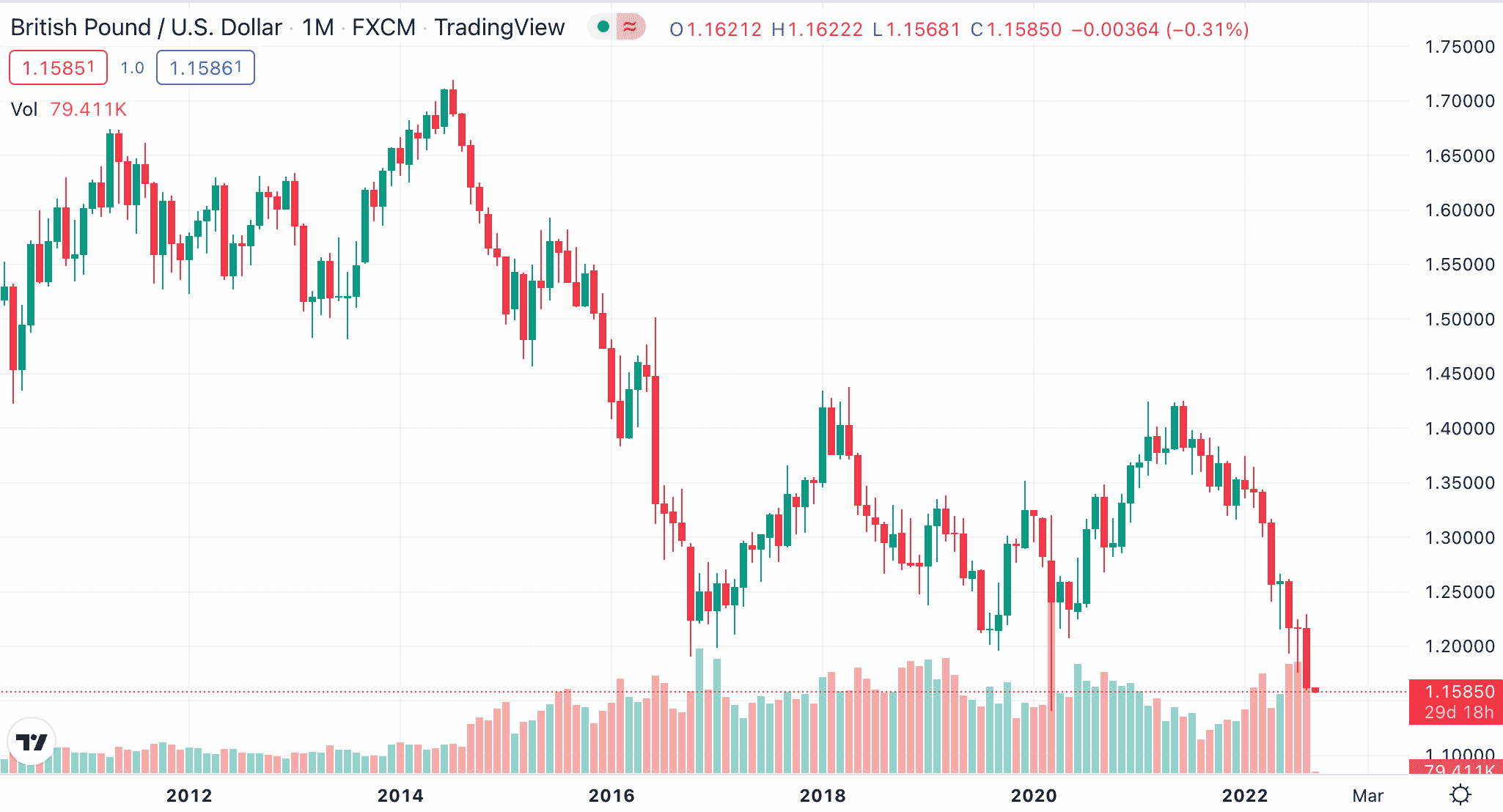

The GBP/USD’s historical past is a tapestry woven with intervals of energy and weak spot, reflecting the relative financial well being of the UK and the US. Over the long run, the pair has exhibited vital fluctuations. As an example, the interval following the 2008 monetary disaster noticed a pointy decline within the GBP’s worth in opposition to the USD, largely because of the UK’s publicity to the worldwide financial downturn. Conversely, intervals of sturdy UK financial progress and comparatively weak US financial efficiency have seen the GBP recognize in opposition to the USD.

Analyzing historic charts reveals recurring patterns and tendencies. Help and resistance ranges, recognized as areas the place the value has traditionally struggled to interrupt by way of, are essential for figuring out potential buying and selling alternatives. For instance, the 1.20 degree has traditionally acted as a big help degree for the GBP/USD, whereas the 1.40 degree has usually served as resistance. Understanding these historic patterns can support in predicting future value actions, though it is essential to do not forget that previous efficiency just isn’t indicative of future outcomes.

Elements Influencing GBP/USD Actions:

The GBP/USD’s value is a dynamic reflection of varied interconnected financial, political, and geopolitical components. Understanding these influences is essential for efficient buying and selling.

-

Financial institution of England (BoE) Financial Coverage: The BoE’s rate of interest choices considerably impression the GBP. Elevating rates of interest usually strengthens the GBP, making it extra enticing to overseas traders searching for increased returns. Conversely, decreasing rates of interest can weaken the GBP. Bulletins relating to quantitative easing (QE) applications even have a considerable affect on the forex pair.

-

US Federal Reserve (Fed) Financial Coverage: Just like the BoE, the Fed’s financial coverage choices profoundly have an effect on the USD. Fed charge hikes are inclined to strengthen the USD, whereas charge cuts weaken it. The Fed’s communication relating to future coverage intentions additionally performs a significant function in influencing the GBP/USD.

-

Financial Knowledge Releases: Key financial indicators from each the UK and the US considerably impression the GBP/USD. Knowledge releases akin to GDP progress, inflation figures (CPI and RPI), unemployment charges, manufacturing and industrial manufacturing, and commerce balances may cause substantial value volatility. Unexpectedly sturdy knowledge for one nation relative to the opposite can set off vital value actions.

-

Political Occasions: Political stability and uncertainty in both the UK or the US can considerably impression the GBP/USD. Political occasions akin to elections, Brexit-related developments, and modifications in authorities can result in substantial market volatility. Uncertainty usually results in a weakening of the affected forex.

-

World Market Sentiment: World occasions, akin to geopolitical tensions, commerce wars, and world financial crises, can affect market sentiment and consequently the GBP/USD. Durations of threat aversion usually see traders flock to the security of the USD, resulting in a strengthening of the USD in opposition to the GBP.

-

Technical Elements: Whereas elementary components present the underlying context, technical components, akin to chart patterns, indicators, and help/resistance ranges, play a vital function in short-term value actions. Merchants use these components to determine potential entry and exit factors.

Technical Evaluation of the GBP/USD Chart:

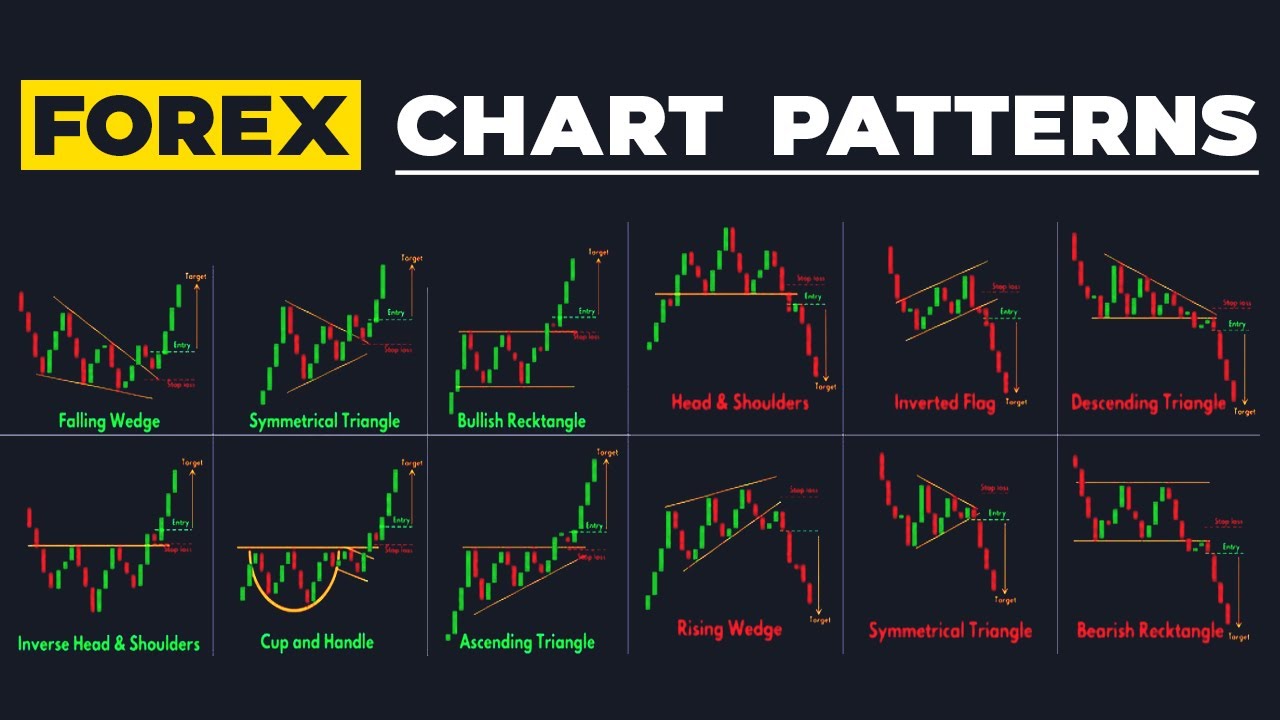

Technical evaluation entails finding out previous value actions and chart patterns to foretell future value tendencies. A number of instruments and strategies are used to investigate the GBP/USD chart:

-

Transferring Averages: Transferring averages, such because the 50-day and 200-day shifting averages, easy out value fluctuations and assist determine tendencies. Crossovers between shifting averages can sign potential purchase or promote indicators.

-

Relative Power Index (RSI): The RSI is a momentum indicator that measures the velocity and alter of value actions. RSI readings above 70 usually recommend overbought situations, whereas readings under 30 point out oversold situations. These ranges can sign potential reversals.

-

MACD (Transferring Common Convergence Divergence): The MACD is a trend-following momentum indicator that identifies modifications within the energy, path, momentum, and period of a development. Crossovers of the MACD traces can point out potential purchase or promote indicators.

-

Help and Resistance Ranges: These ranges symbolize value areas the place the value has traditionally struggled to interrupt by way of. Figuring out these ranges will help merchants decide potential entry and exit factors.

-

Chart Patterns: Recognizing chart patterns, akin to head and shoulders, double tops/bottoms, and triangles, can present insights into potential value actions.

Danger Administration Methods:

Buying and selling the GBP/USD, like every foreign exchange pair, entails inherent threat. Efficient threat administration is essential to guard capital and forestall vital losses. Key threat administration methods embrace:

-

Place Sizing: Figuring out the suitable dimension of trades primarily based on account fairness and threat tolerance is important. By no means threat greater than a small share of your buying and selling capital on any single commerce.

-

Cease-Loss Orders: Putting stop-loss orders to routinely exit a commerce at a predetermined loss degree helps restrict potential losses.

-

Take-Revenue Orders: Setting take-profit orders to routinely exit a commerce at a predetermined revenue degree helps safe income and defend positive factors.

-

Diversification: Diversifying your buying and selling portfolio throughout totally different forex pairs and asset lessons helps scale back total threat.

-

Backtesting: Earlier than implementing any buying and selling technique, it is essential to backtest it utilizing historic knowledge to evaluate its efficiency and determine potential weaknesses.

Conclusion:

The GBP/USD foreign exchange chart is a fancy and dynamic panorama influenced by a large number of things. Profitable buying and selling requires a complete understanding of those components, coupled with the applying of acceptable technical evaluation strategies and sturdy threat administration methods. Whereas historic patterns can supply insights, it is essential to do not forget that the foreign exchange market is inherently unpredictable, and no buying and selling technique ensures income. Steady studying, adaptation, and disciplined threat administration are important for navigating the complexities of the GBP/USD market and reaching long-term success. Moreover, searching for steering from skilled professionals and staying knowledgeable about world financial and political developments are essential elements of accountable and worthwhile buying and selling. The journey to mastering the GBP/USD chart is ongoing, requiring dedication, persistence, and a dedication to steady enchancment.

Closure

Thus, we hope this text has supplied worthwhile insights into Deciphering the GBP/USD Foreign exchange Chart: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!