Deciphering the Tata Energy Chart: A Deep Dive into India’s Power Large

Associated Articles: Deciphering the Tata Energy Chart: A Deep Dive into India’s Power Large

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Deciphering the Tata Energy Chart: A Deep Dive into India’s Power Large. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Deciphering the Tata Energy Chart: A Deep Dive into India’s Power Large

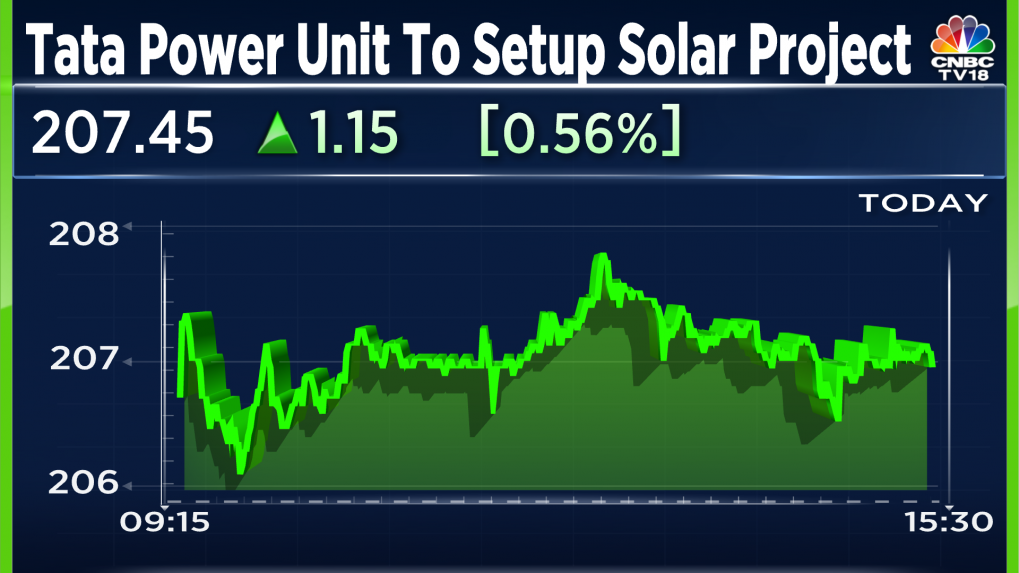

Tata Energy, a reputation synonymous with India’s vitality panorama, has witnessed a rollercoaster experience in its inventory efficiency through the years. Understanding its chart requires a multi-faceted method, contemplating its enterprise mannequin, the broader macroeconomic surroundings, and the evolving vitality sector dynamics. This in-depth evaluation will discover the important thing components influencing Tata Energy’s inventory worth, providing insights for traders in search of to navigate this complicated funding alternative.

Understanding the Enterprise Mannequin:

Tata Energy’s enterprise is multifaceted, spanning throughout numerous segments:

-

Standard Energy Era: This stays a big a part of their operations, encompassing coal-based, hydro, and gas-based energy crops. The profitability of this section is closely influenced by coal costs, regulatory adjustments, and the demand-supply dynamics of the ability sector. Fluctuations in these components instantly influence the corporate’s total efficiency and consequently, its inventory worth.

-

Renewable Power: Tata Energy is aggressively increasing its renewable vitality portfolio, together with photo voltaic and wind energy. This section is essential for long-term progress and aligns with the worldwide shift in the direction of cleaner vitality sources. Authorities insurance policies selling renewable vitality, technological developments, and worldwide collaborations considerably affect this section’s efficiency and investor sentiment.

-

Distribution: Tata Energy operates energy distribution networks in numerous cities throughout India. This section’s profitability is affected by components reminiscent of electrical energy tariffs, regulatory approvals, and the effectivity of its distribution community. Any disruptions or inefficiencies can negatively influence the corporate’s earnings and inventory worth.

-

Transmission: The transmission section entails the motion of electrical energy throughout lengthy distances. This section advantages from the expansion in energy consumption and infrastructure growth. Nevertheless, it is usually topic to regulatory frameworks and the general well being of the ability grid.

Analyzing the Chart: Key Components and Traits:

Analyzing Tata Energy’s chart requires contemplating a number of essential features:

-

Lengthy-Time period Progress Potential: The corporate’s strategic shift in the direction of renewable vitality presents vital long-term progress potential. As India continues its push in the direction of cleaner vitality, Tata Energy’s renewable vitality belongings are prone to grow to be more and more helpful. This constructive outlook typically interprets into investor confidence and upward strain on the inventory worth.

-

Regulatory Panorama: The facility sector is closely regulated, and adjustments in authorities insurance policies, tariffs, and environmental rules can considerably influence Tata Energy’s profitability. A supportive regulatory surroundings can enhance investor sentiment, whereas opposed adjustments can result in downward strain on the inventory worth.

-

Gasoline Prices: The price of coal, fuel, and different fuels considerably influences the profitability of Tata Energy’s typical energy technology section. Fluctuations in international commodity costs can instantly have an effect on the corporate’s earnings and consequently, its inventory worth. Hedging methods and diversification into renewable vitality can mitigate this danger.

-

Debt Ranges: Tata Energy has a big debt burden, which may influence its monetary flexibility and profitability. Excessive debt ranges could make traders cautious, probably resulting in a decrease inventory valuation. The corporate’s skill to handle its debt successfully is essential for sustaining investor confidence.

-

Competitors: The facility sector is aggressive, with each private and non-private gamers vying for market share. Tata Energy’s aggressive positioning, technological developments, and operational effectivity play an important function in its market share and profitability. Elevated competitors can put downward strain on costs and margins, impacting the inventory worth.

-

Macroeconomic Components: Broader macroeconomic components reminiscent of financial progress, inflation, and rates of interest additionally affect Tata Energy’s inventory worth. A powerful economic system typically results in greater electrical energy demand, benefiting the corporate’s efficiency. Conversely, financial downturns can scale back demand, affecting the inventory worth negatively.

-

Technical Evaluation: Technical evaluation of the chart, together with figuring out assist and resistance ranges, trendlines, and buying and selling volumes, can present helpful insights into potential worth actions. This evaluation, nonetheless, must be used together with basic evaluation for a complete understanding.

Deciphering Chart Patterns:

Observing historic chart patterns can provide helpful insights. For instance, figuring out intervals of excessive volatility, consolidation phases, and breakout patterns can assist traders anticipate potential worth actions. Nevertheless, it is essential to do not forget that previous efficiency shouldn’t be indicative of future outcomes.

Elementary Evaluation: A Deeper Dive:

Elementary evaluation entails analyzing the corporate’s monetary statements, administration high quality, aggressive panorama, and future progress prospects. Key metrics to think about embody:

- Earnings per share (EPS): Displays the corporate’s profitability on a per-share foundation.

- Worth-to-earnings ratio (P/E): Compares the inventory worth to its earnings, indicating its valuation relative to its friends.

- Debt-to-equity ratio: Measures the corporate’s leverage and monetary danger.

- Return on fairness (ROE): Signifies the corporate’s effectivity in producing income from its shareholders’ fairness.

Investor Sentiment and Information Circulation:

Investor sentiment, pushed by information occasions, analyst rankings, and market traits, considerably impacts Tata Energy’s inventory worth. Optimistic information, reminiscent of securing new tasks, technological breakthroughs, or favorable regulatory adjustments, can enhance investor confidence and drive the inventory worth greater. Conversely, destructive information can result in a decline within the inventory worth.

Conclusion:

Analyzing the Tata Energy chart is a posh endeavor requiring a holistic method. Contemplating the corporate’s enterprise mannequin, the broader macroeconomic surroundings, the evolving vitality sector dynamics, and each technical and basic evaluation is essential for knowledgeable funding selections. Whereas the shift in the direction of renewable vitality presents vital long-term progress potential, traders should additionally fastidiously assess the dangers related to regulatory adjustments, gas prices, debt ranges, and competitors. A well-diversified funding technique and a radical understanding of the components influencing Tata Energy’s efficiency are important for navigating the complexities of this funding alternative. Common monitoring of the chart, coupled with steady basic evaluation, will permit traders to make knowledgeable selections and probably capitalize on the alternatives offered by this dynamic vitality large. Bear in mind to at all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied helpful insights into Deciphering the Tata Energy Chart: A Deep Dive into India’s Power Large. We hope you discover this text informative and useful. See you in our subsequent article!