Decoding Medicare Half G: A Complete Information to Protection and Prices

Associated Articles: Decoding Medicare Half G: A Complete Information to Protection and Prices

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Medicare Half G: A Complete Information to Protection and Prices. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding Medicare Half G: A Complete Information to Protection and Prices

Medicare Half G would not exist. There isn’t any Medicare Half G. The query possible stems from confusion with different Medicare elements and supplemental plans. This text will as an alternative comprehensively discover Medicare protection, clarifying the totally different elements and the way supplemental plans (like Medigap plans, usually mistakenly referred to with letter designations) can fill gaps in protection. We’ll then create a hypothetical "Half G" primarily based on a typical Medigap plan construction for instance how supplemental protection works.

Understanding the Core Medicare Components:

Earlier than diving into supplemental plans, it is essential to know the 4 foremost elements of Authentic Medicare:

-

Half A (Hospital Insurance coverage): Covers inpatient hospital care, expert nursing facility care, hospice, and a few residence healthcare. Most individuals do not pay a premium for Half A as a result of they or their partner paid Medicare taxes whereas working. Nonetheless, there are deductibles and coinsurance quantities you may be accountable for.

-

Half B (Medical Insurance coverage): Covers physician visits, outpatient care, medical provides, and a few preventive providers. Most individuals pay a month-to-month premium for Half B, and there are deductibles and coinsurance quantities.

-

Half C (Medicare Benefit): Provided by personal firms accredited by Medicare, Half C combines Half A, Half B, and sometimes Half D (prescription drug protection) right into a single plan. Half C plans have their very own networks of docs and hospitals, and should require referrals to specialists. Premiums and cost-sharing range extensively relying on the plan.

-

Half D (Prescription Drug Insurance coverage): Helps cowl the price of prescription medicines. It is a separate a part of Medicare that you could enroll in if you’d like prescription drug protection. Premiums, deductibles, and cost-sharing range enormously relying on the plan.

The Position of Medigap (Supplemental) Insurance coverage:

Authentic Medicare (Components A and B) leaves gaps in protection. Medigap plans, offered by personal insurance coverage firms, assist fill these gaps. These plans are also called Medicare Complement Insurance coverage. They’re not the identical as Medicare Benefit (Half C) plans. They complement Authentic Medicare. There are standardized Medigap plans (A by means of N), every providing a special stage of protection. The plan letters and their protection range by state.

Why the Confusion About "Half G"?

The confusion round a "Half G" possible stems from the earlier existence of varied Medigap plans with totally different letter designations. These letters represented totally different ranges of protection. Over time, some plans have been discontinued, and the naming conventions have modified barely over time. Due to this fact, any reference to a "Half G" isn’t an official Medicare half however somewhat a misunderstanding or misremembering of a Medigap plan.

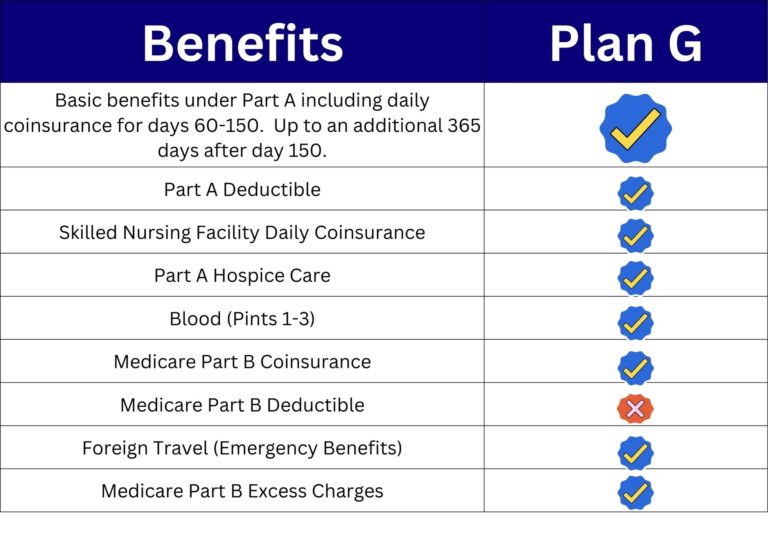

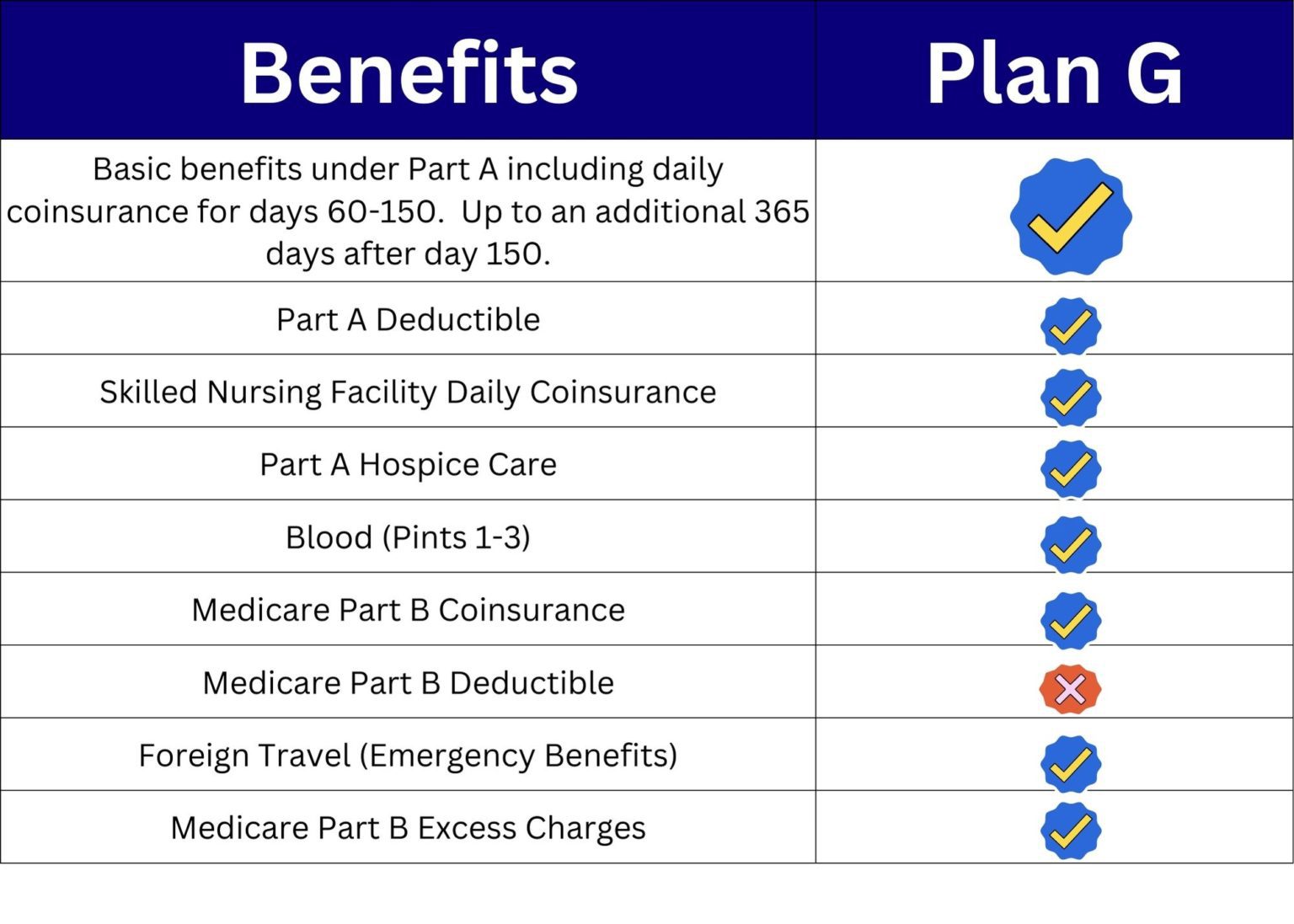

Hypothetical "Half G" Protection Chart (Based mostly on a Medigap Plan):

For example how a supplemental plan works, let’s create a hypothetical "Half G" primarily based on a typical Medigap plan that gives substantial supplemental protection. This chart is for illustrative functions solely and doesn’t signify any actual Medigap plan. At all times test together with your insurance coverage supplier for correct particulars.

| Service | Authentic Medicare Protection (Instance) | Hypothetical "Half G" Protection (Instance) | Out-of-Pocket Prices (Instance) |

|---|---|---|---|

| Hospital Inpatient Keep (Day 1-60) | $1,600 deductible, then coinsurance | Full protection of deductible and coinsurance | $0 |

| Hospital Inpatient Keep (Day 61-90) | Coinsurance | Full protection of coinsurance | $0 |

| Hospital Inpatient Keep (Past Day 90) | Coinsurance and vital out-of-pocket prices | Partial protection of coinsurance and out-of-pocket prices | Lowered out-of-pocket prices |

| Expert Nursing Facility (as much as 100 days) | Coinsurance after 20 days | Full protection of coinsurance | $0 |

| Physician Visits | 80% coated after deductible | Full protection of 20% coinsurance | $0 |

| Outpatient Providers | 80% coated after deductible | Full protection of 20% coinsurance | $0 |

| Blood Transfusions | First 3 pints coated | Full protection of all pints | $0 |

| Overseas Journey Emergency Care | Restricted protection | Partial protection | Lowered out-of-pocket prices |

Necessary Issues:

- Premiums: Medigap plans have month-to-month premiums, which range relying on the plan and your location.

- Open Enrollment: There is a particular interval when you possibly can enroll in a Medigap plan with out medical underwriting (which means your well being standing will not have an effect on your eligibility).

- Pre-existing Circumstances: Medigap plans can not exclude protection for pre-existing circumstances should you enroll throughout your Medigap Open Enrollment Interval.

- State Laws: Medigap plan choices and rules range by state.

- Plan Comparisons: It is important to match totally different Medigap plans to search out the one which most closely fits your wants and funds.

Discovering the Proper Protection:

Navigating Medicare will be advanced. To keep away from confusion and guarantee you may have the suitable protection, take into account these steps:

- Seek the advice of Medicare.gov: The official Medicare web site is a precious useful resource for info.

- Converse with a Medicare Counselor: Unbiased Medicare counselors can present unbiased recommendation and assist you to perceive your choices.

- Contact Your State Well being Insurance coverage Help Program (SHIP): SHIP counselors provide free, unbiased counseling that can assist you select the very best Medicare plan.

- Evaluate Medigap Plans: Use on-line comparability instruments or seek the advice of with insurance coverage brokers to match the prices and advantages of various Medigap plans.

Conclusion:

Whereas there isn’t a Medicare Half G, the query highlights the significance of understanding the nuances of Medicare protection. Medigap plans, usually mistakenly referred to utilizing letter designations, play an important position in supplementing Authentic Medicare and filling gaps in protection. By fastidiously researching and evaluating your choices, you will discover the very best Medicare protection to suit your particular person wants and funds. Keep in mind to seek the advice of dependable assets and search skilled recommendation to make knowledgeable choices about your Medicare protection. The knowledge offered right here is for instructional functions solely and shouldn’t be thought-about medical or monetary recommendation. At all times seek the advice of with certified professionals for customized steerage.

Closure

Thus, we hope this text has offered precious insights into Decoding Medicare Half G: A Complete Information to Protection and Prices. We recognize your consideration to our article. See you in our subsequent article!