Decoding Silver’s Worth Chart: A Deep Dive into Shifting Averages

Associated Articles: Decoding Silver’s Worth Chart: A Deep Dive into Shifting Averages

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding Silver’s Worth Chart: A Deep Dive into Shifting Averages. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding Silver’s Worth Chart: A Deep Dive into Shifting Averages

Silver, a lustrous metallic with a wealthy historical past spanning millennia, has all the time held a charming attract for buyers. Its twin nature – as an industrial metallic and a treasured metallic – makes it a compelling asset class, inclined to cost fluctuations pushed by various financial and geopolitical components. Understanding its worth actions is essential for anybody contemplating investing in silver, and a strong instrument on this pursuit is the evaluation of shifting averages on its worth chart. This text delves deep into the world of silver worth charts, specializing in the insights gleaned from numerous shifting averages and the way they can be utilized to tell buying and selling and funding choices.

Understanding Silver Worth Charts:

A silver worth chart visually represents the historic worth of silver over a selected interval, often plotted towards time. These charts could be introduced in numerous kinds, together with line charts, candlestick charts, and bar charts. Every chart sort gives a novel perspective on worth motion, however all serve the identical elementary objective: for example the worth fluctuations of silver over time. The X-axis usually represents time (e.g., day by day, weekly, month-to-month), whereas the Y-axis represents the worth of silver (typically expressed in USD per troy ounce).

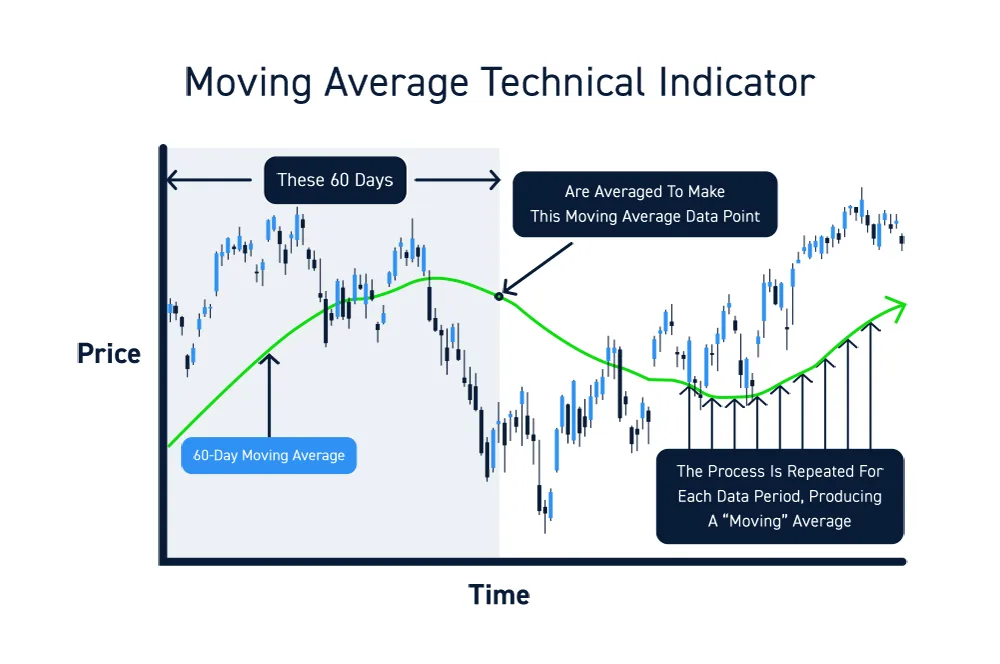

Analyzing a uncooked silver worth chart could be overwhelming because of the inherent volatility and noise. That is the place shifting averages come into play. Shifting averages clean out the worth knowledge, making it simpler to establish traits and potential assist and resistance ranges.

Shifting Averages: Smoothing the Volatility:

Shifting averages are calculated by averaging the closing costs of silver over a particular interval. The most typical varieties embrace:

-

Easy Shifting Common (SMA): That is the best kind, calculated by summing the closing costs over an outlined interval and dividing by the variety of intervals. For instance, a 50-day SMA averages the closing costs of the final 50 days. SMAs are simple however react shortly to current worth adjustments, making them doubtlessly extra risky than different varieties.

-

Exponential Shifting Common (EMA): EMAs assign higher weight to more moderen costs, making them extra conscious of current worth actions than SMAs. This responsiveness could be advantageous in figuring out shorter-term traits however may result in extra whipsaws (false alerts). The weighting think about an EMA determines the responsiveness; the next weighting issue offers extra weight to current costs.

-

Weighted Shifting Common (WMA): WMAs assign completely different weights to every worth inside the interval, usually giving extra weight to the newest costs. The particular weights are decided by a selected weighting scheme. WMAs supply a steadiness between the responsiveness of EMAs and the smoothness of SMAs.

Decoding Shifting Averages on a Silver Worth Chart:

The interaction between completely different shifting averages gives invaluable insights:

-

Pattern Identification: When a shorter-term shifting common (e.g., 20-day EMA) crosses above a longer-term shifting common (e.g., 200-day SMA), it is typically interpreted as a bullish sign, suggesting an upward pattern is growing. Conversely, a crossover under signifies a possible bearish pattern. That is sometimes called a "golden cross" (bullish) or a "dying cross" (bearish).

-

Assist and Resistance Ranges: Shifting averages can act as dynamic assist and resistance ranges. When the worth approaches a shifting common, it could bounce off it, offering a possible entry or exit level for merchants. The power of the assist or resistance is determined by the shifting common’s interval and the general market context.

-

Pattern Power: The gap between shifting averages can point out the power of a pattern. A big hole between a short-term and long-term shifting common suggests a powerful pattern, whereas a slender hole suggests a weaker pattern or potential pattern reversal.

-

Affirmation of Indicators: Shifting averages shouldn’t be utilized in isolation. They need to be mixed with different technical indicators (e.g., RSI, MACD) and elementary evaluation to substantiate buying and selling alerts and cut back the chance of false alerts.

Widespread Shifting Common Combos for Silver:

A number of mixtures of shifting averages are continuously utilized in silver worth chart evaluation:

-

20-day EMA and 50-day SMA: This mix is helpful for figuring out shorter-term traits and potential entry/exit factors.

-

50-day SMA and 200-day SMA: This mix is a well-liked long-term pattern indicator. A golden cross (20-day above 50-day) suggests a bullish pattern, whereas a dying cross (50-day under 200-day) suggests a bearish pattern.

-

10-day EMA, 20-day EMA, 50-day EMA: This mix gives a extra granular view of short-term worth motion and pattern adjustments.

Components Affecting Silver Costs Past Shifting Averages:

Whereas shifting averages present invaluable technical insights, it is essential to keep in mind that they do not seize the total image. Different components considerably affect silver costs:

-

Industrial Demand: Silver’s industrial purposes (electronics, photo voltaic panels, and so forth.) are a significant driver of demand. Adjustments in world industrial manufacturing and technological developments can influence silver costs.

-

Funding Demand: Silver is taken into account a safe-haven asset, and funding demand can fluctuate based mostly on financial uncertainty, inflation, and geopolitical occasions. Alternate-traded funds (ETFs) monitoring silver costs considerably influence its market dynamics.

-

Foreign money Fluctuations: The US greenback is the dominant foreign money in treasured metals buying and selling. A weakening greenback typically results in larger silver costs (because it turns into cheaper for holders of different currencies to purchase), whereas a strengthening greenback can put downward strain on silver costs.

-

Authorities Insurance policies: Laws, taxes, and different authorities insurance policies can have an effect on silver mining, manufacturing, and buying and selling.

-

Geopolitical Occasions: Political instability, wars, and different geopolitical occasions can create uncertainty available in the market, resulting in elevated demand for safe-haven property like silver.

Conclusion:

Shifting averages are a robust instrument for analyzing silver worth charts, serving to buyers and merchants establish traits, assist and resistance ranges, and potential entry and exit factors. Nevertheless, they shouldn’t be utilized in isolation. A complete evaluation requires contemplating different technical indicators, elementary components, and macroeconomic situations. By combining technical evaluation with a radical understanding of the components driving silver costs, buyers could make extra knowledgeable choices and navigate the dynamic world of silver buying and selling with higher confidence. Keep in mind, previous efficiency is just not indicative of future outcomes, and threat administration is paramount in any funding technique. At all times seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Decoding Silver’s Worth Chart: A Deep Dive into Shifting Averages. We hope you discover this text informative and useful. See you in our subsequent article!