Decoding the 10-12 months Treasury Price Chart: A Decade of Volatility and Perception

Associated Articles: Decoding the 10-12 months Treasury Price Chart: A Decade of Volatility and Perception

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the 10-12 months Treasury Price Chart: A Decade of Volatility and Perception. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the 10-12 months Treasury Price Chart: A Decade of Volatility and Perception

The ten-year Treasury be aware yield, a benchmark for world borrowing prices, is a vital indicator of financial well being and investor sentiment. Its chart, a seemingly easy line graph depicting the yield over time, tells a fancy story of financial booms and busts, inflation anxieties, and shifts in financial coverage. Understanding this chart is paramount for traders, policymakers, and anybody searching for to know the heart beat of the worldwide financial system. This text delves deep into the intricacies of the 10-year Treasury fee chart, analyzing its historic tendencies, key influencing components, and implications for varied market contributors.

A Historic Perspective: From Dot-Com Bust to Pandemic Panic

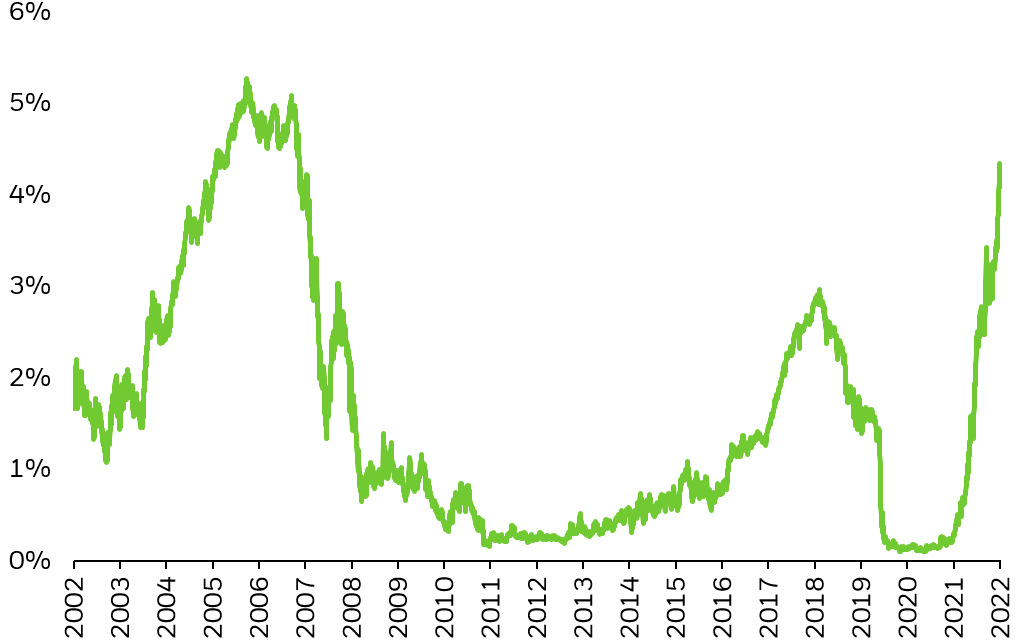

Analyzing the 10-year Treasury fee chart from the yr 2000 onwards reveals an interesting narrative. The early 2000s noticed yields comparatively excessive, reflecting the aftermath of the dot-com bubble burst and subsequent financial slowdown. The Federal Reserve, in response, carried out a collection of rate of interest cuts, driving down the 10-year yield to traditionally low ranges. This era of low charges fueled a housing increase, finally culminating within the 2008 monetary disaster.

The disaster triggered a dramatic spike within the 10-year Treasury yield as traders sought the protection of presidency bonds amidst widespread market uncertainty. Nevertheless, this spike was short-lived, because the Fed responded with aggressive quantitative easing (QE) applications, injecting liquidity into the market and pushing yields again down. This era of near-zero rates of interest continued for a number of years, prompting considerations about potential inflation and the effectiveness of financial coverage.

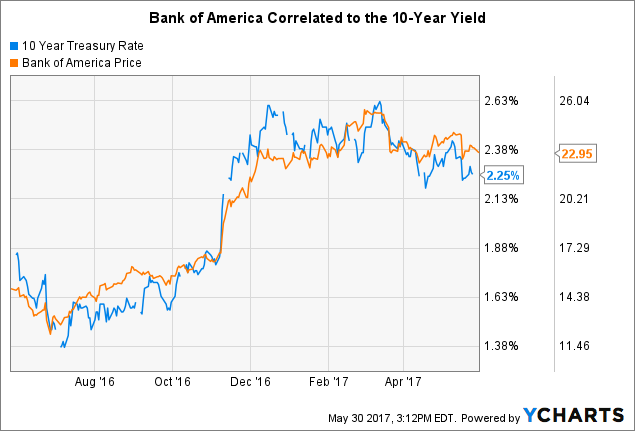

The restoration years following the 2008 disaster witnessed a gradual enhance within the 10-year yield, reflecting enhancing financial circumstances and rising investor confidence. Nevertheless, this upward development was punctuated by intervals of volatility, usually pushed by geopolitical occasions, sudden financial knowledge releases, or shifts in Fed coverage expectations.

The COVID-19 pandemic in 2020 triggered an unprecedented plunge within the 10-year Treasury yield, as traders flocked to the protection of presidency bonds amid widespread uncertainty and financial lockdowns. The Fed’s aggressive response, together with additional rounds of QE and near-zero rates of interest, exacerbated this decline. The following financial restoration, fueled by authorities stimulus and pent-up demand, led to a major surge in inflation, which in flip triggered a pointy enhance within the 10-year yield all through 2021 and 2022. This rise mirrored investor expectations of future Fed fee hikes geared toward combating inflation.

Key Elements Influencing the 10-12 months Treasury Price

A number of interconnected components affect the 10-year Treasury fee, creating the dynamic fluctuations noticed in its chart:

-

Federal Reserve Coverage: The Fed’s financial coverage choices, significantly its goal federal funds fee, are a main driver of Treasury yields. When the Fed raises rates of interest, it usually results in greater Treasury yields, as traders demand greater returns on bonds to compensate for the elevated alternative price of holding them. Conversely, rate of interest cuts are likely to decrease Treasury yields. The Fed’s communication relating to its future coverage intentions additionally considerably impacts market expectations and yield actions.

-

Inflation Expectations: Inflation is a vital determinant of Treasury yields. Larger inflation erodes the buying energy of future bond funds, main traders to demand greater yields to compensate for this threat. Market contributors carefully monitor inflation indicators just like the Client Value Index (CPI) and Producer Value Index (PPI) to gauge inflation expectations and their impression on Treasury yields.

-

Financial Progress: Sturdy financial progress usually results in greater Treasury yields, as traders anticipate elevated demand for credit score and better inflation. Conversely, weak financial progress or recessionary fears can push yields decrease as traders search the protection of presidency bonds. Financial knowledge releases, similar to GDP progress figures and employment reviews, considerably affect yield actions.

-

International Financial Circumstances: Worldwide financial occasions and geopolitical dangers may also have an effect on the 10-year Treasury yield. International uncertainties usually drive traders in the direction of the protection of US Treasuries, pushing yields decrease. Conversely, constructive world financial information can result in greater yields as traders search greater returns elsewhere.

-

Provide and Demand: The provision of Treasury bonds and the demand from traders play an important position in figuring out yields. Elevated authorities borrowing to finance price range deficits can enhance the availability of bonds, probably pushing yields greater. Conversely, sturdy demand from traders, significantly overseas traders, can decrease yields.

-

Market Sentiment: Investor sentiment and threat urge for food considerably affect Treasury yields. Intervals of heightened threat aversion usually result in elevated demand for safe-haven property like Treasuries, driving yields decrease. Conversely, intervals of optimism and elevated risk-taking can push yields greater.

Deciphering the Chart: Implications for Totally different Market Members

The ten-year Treasury fee chart holds totally different implications for varied market contributors:

-

Traders: The chart helps traders assess the risk-reward trade-off of investing in bonds versus different asset courses. Low yields counsel decrease returns but in addition decrease threat, whereas excessive yields provide the potential for greater returns but in addition carry larger threat. Traders use the chart to make knowledgeable choices about their bond portfolio allocations and general funding methods.

-

Debtors: The chart supplies insights into the price of borrowing for companies and governments. Larger yields point out greater borrowing prices, which might impression funding choices and financial exercise. Corporations and governments monitor the chart to plan their borrowing methods and handle their debt ranges.

-

Central Banks: Central banks use the chart to gauge the effectiveness of their financial insurance policies and assess the general well being of the financial system. Yield actions can sign inflationary pressures, financial progress, or market sentiment, offering precious data for policymakers.

-

Companies: Companies use the chart to evaluate the price of capital and make funding choices. Decrease yields can incentivize companies to speculate, whereas greater yields can discourage borrowing and funding.

Conclusion: A Steady Narrative

The ten-year Treasury fee chart isn’t just a static illustration of historic knowledge; it is a dynamic and evolving narrative reflecting the complexities of the worldwide financial system. Understanding the historic tendencies, key influencing components, and implications for various market contributors is essential for navigating the monetary markets successfully. By fastidiously analyzing the chart and contemplating the broader financial context, traders, policymakers, and companies can achieve precious insights and make knowledgeable choices in a always altering world. The chart will proceed to inform its story, offering an important window into the long run path of rates of interest, inflation, and the general well being of the worldwide financial system. Steady monitoring and evaluation of this significant indicator are important for anybody searching for to grasp and take part within the monetary markets.

Closure

Thus, we hope this text has offered precious insights into Decoding the 10-12 months Treasury Price Chart: A Decade of Volatility and Perception. We hope you discover this text informative and helpful. See you in our subsequent article!