Decoding the 15-Yr Mortgage Fee Chart: A Complete Information for Homebuyers

Associated Articles: Decoding the 15-Yr Mortgage Fee Chart: A Complete Information for Homebuyers

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the 15-Yr Mortgage Fee Chart: A Complete Information for Homebuyers. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the 15-Yr Mortgage Fee Chart: A Complete Information for Homebuyers

The dream of homeownership usually hinges on securing a positive mortgage. Among the many numerous mortgage phrases accessible, the 15-year mortgage stands out for its potential to considerably cut back curiosity funds and speed up fairness constructing. Understanding the dynamics of 15-year mortgage charges, nevertheless, requires navigating a fancy panorama of financial components and market developments. This text delves into the intricacies of a 15-year mortgage fee chart, explaining its elements, influencing components, and the right way to interpret it to make knowledgeable selections.

Understanding the 15-Yr Mortgage Fee Chart:

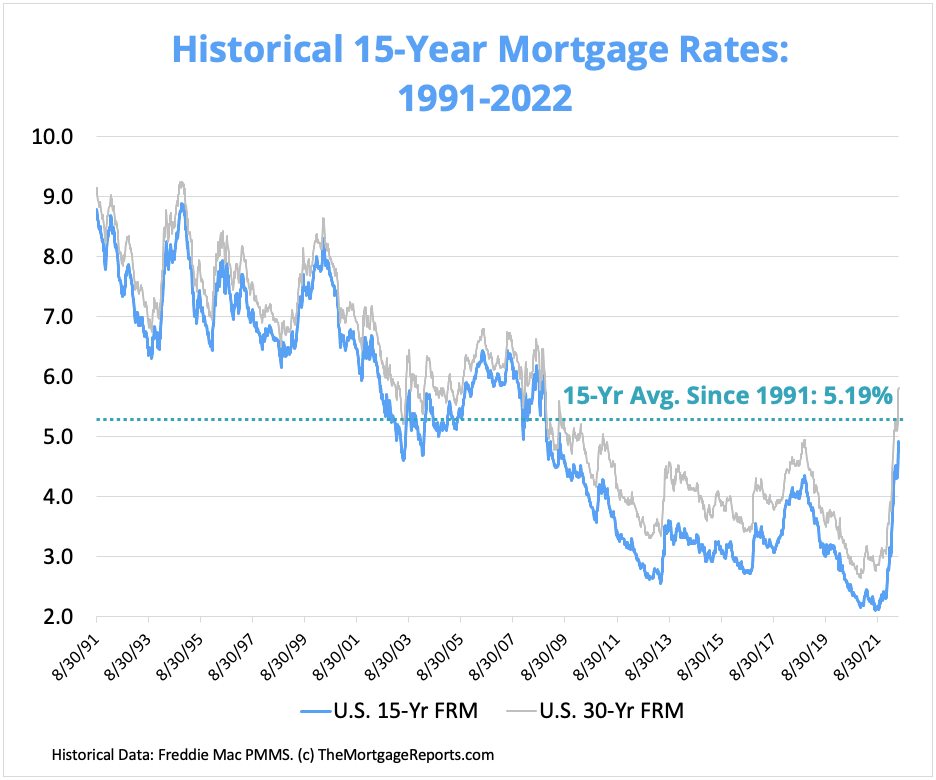

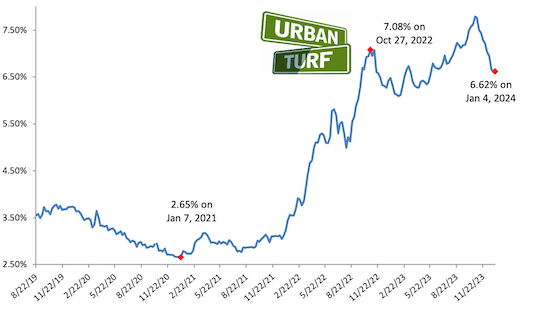

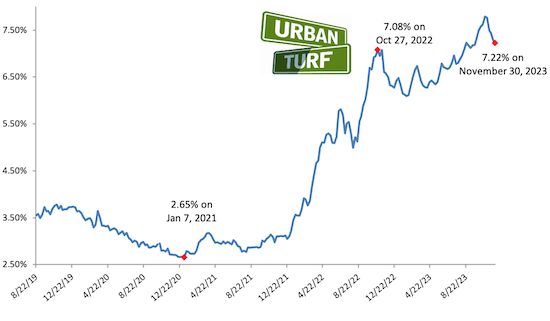

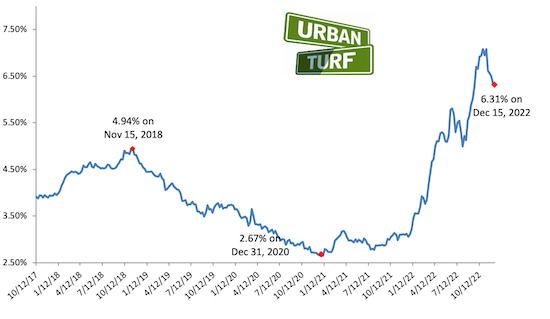

A 15-year mortgage fee chart sometimes shows the historic and present rates of interest for 15-year fixed-rate mortgages. These charts are often introduced graphically, usually as a line graph exhibiting the speed fluctuation over time, sometimes starting from months to years. The chart’s x-axis represents the time interval (e.g., months or years), whereas the y-axis represents the rate of interest, often expressed as a proportion.

The knowledge introduced on a 15-year mortgage fee chart is essential for potential homebuyers. It gives a visible illustration of:

- Historic Tendencies: The chart illustrates how charges have modified over time, permitting debtors to see the cyclical nature of rates of interest and probably establish durations of excessive and low charges. This historic perspective helps set up context for present charges.

- Present Fee: The latest information level on the chart signifies the prevailing rate of interest for a 15-year mortgage on the time of viewing.

- Fee Volatility: The chart showcases the diploma of fluctuation in charges. A steep, jagged line suggests excessive volatility, whereas a smoother line signifies extra secure charges.

- Predictive Potential (Restricted): Whereas not a crystal ball, the chart can present a normal sense of potential future fee actions primarily based on previous developments. Nonetheless, it is essential to do not forget that future charges are influenced by quite a few unpredictable components.

Components Influencing 15-Yr Mortgage Charges:

A number of intertwined financial and market components decide the rates of interest supplied on 15-year mortgages. Understanding these components is essential to decoding the speed chart successfully:

- The Federal Reserve (The Fed): The Fed’s financial coverage performs a dominant position. When the Fed raises rates of interest (sometimes by the federal funds fee), borrowing turns into costlier throughout the board, together with mortgages. Conversely, decrease federal funds charges usually result in decrease mortgage charges.

- Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to lift rates of interest to fight it. This, in flip, impacts mortgage charges. Low inflation, conversely, can contribute to decrease mortgage charges.

- Financial Development: Robust financial progress usually results in elevated demand for loans, probably pushing charges increased. Conversely, slower financial progress can suppress demand and end in decrease charges.

- Authorities Rules: Authorities laws impacting the mortgage business can have an effect on charges. Adjustments in lending requirements or government-backed mortgage packages can affect the general value of borrowing.

- Investor Sentiment and Market Situations: Investor confidence and broader market situations considerably affect rates of interest. Uncertainty within the monetary markets can result in increased charges as lenders search to mitigate threat.

- Provide and Demand of Mortgage-Backed Securities (MBS): MBS are bundles of mortgages bought to buyers. The availability and demand for these securities instantly affect mortgage charges. Excessive demand can push charges down, whereas low demand can push them up.

- Creditworthiness of Debtors: Whereas circuitously mirrored on the speed chart itself, the creditworthiness of debtors performs a major position in figuring out the rate of interest they obtain. Debtors with robust credit score scores sometimes qualify for decrease charges.

Decoding the 15-Yr Mortgage Fee Chart:

Studying a 15-year mortgage fee chart successfully includes extra than simply observing the present fee. Think about the next:

- Lengthy-Time period Tendencies: Look past the speedy fluctuations and establish any long-term upward or downward developments. This may present a broader context for the present fee.

- Fee Volatility: A extremely unstable chart suggests a extra unpredictable market, making it difficult to foretell future charges. Secure charges supply extra certainty.

- Comparability to Historic Charges: Evaluate the present fee to historic averages and highs/lows. This helps decide whether or not the present fee is comparatively excessive or low in comparison with the previous.

- Financial Context: Think about the broader financial local weather when decoding the chart. Are inflation charges excessive? Is the financial system rising strongly or slowing down? These components present priceless context for understanding fee actions.

- Do not Rely Solely on the Chart: Whereas the chart is a great tool, it should not be the only foundation in your mortgage choice. Seek the advice of with a mortgage skilled for personalised recommendation and up-to-date info.

Benefits and Disadvantages of a 15-Yr Mortgage:

The 15-year mortgage provides distinct benefits and downsides in comparison with its 30-year counterpart:

Benefits:

- Decrease Curiosity Funds: The shorter mortgage time period results in considerably decrease complete curiosity paid over the lifetime of the mortgage.

- Quicker Fairness Constructing: You construct fairness in your house a lot quicker, rising your internet price extra rapidly.

- Potential for Decrease Month-to-month Funds (in some instances): Whereas month-to-month funds are increased than a 30-year mortgage, the decrease rate of interest might offset this, leading to decrease general funds in some situations.

- Sooner Paid-Off Mortgage: The peace of thoughts of proudly owning your own home outright sooner is a major benefit.

Disadvantages:

- Increased Month-to-month Funds: The shorter reimbursement interval necessitates bigger month-to-month funds.

- Much less Flexibility: The upper funds can cut back monetary flexibility, probably limiting your potential to make different vital purchases or investments.

- Increased Qualification Necessities: Lenders might have stricter qualification necessities for 15-year mortgages as a result of increased month-to-month funds.

Conclusion:

The 15-year mortgage fee chart serves as a priceless device for understanding the historic and present developments in rates of interest. Nonetheless, decoding the chart successfully requires understanding the underlying financial components that affect charges. By combining the knowledge gleaned from the chart with knowledgeable recommendation from a mortgage skilled, homebuyers could make knowledgeable selections about whether or not a 15-year mortgage aligns with their monetary objectives and threat tolerance. Do not forget that whereas a chart gives priceless information, it is essential to think about your particular person monetary scenario and long-term goals earlier than committing to a mortgage. An intensive understanding of the chart and the broader financial panorama empowers you to navigate the home-buying course of with better confidence and make one of the best choice in your future.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the 15-Yr Mortgage Fee Chart: A Complete Information for Homebuyers. We thanks for taking the time to learn this text. See you in our subsequent article!