Decoding the 30-Yr Mortgage Fee Chart: A Deep Dive into Right now’s US Market (October 26, 2023)

Associated Articles: Decoding the 30-Yr Mortgage Fee Chart: A Deep Dive into Right now’s US Market (October 26, 2023)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the 30-Yr Mortgage Fee Chart: A Deep Dive into Right now’s US Market (October 26, 2023). Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the 30-Yr Mortgage Fee Chart: A Deep Dive into Right now’s US Market (October 26, 2023)

The 30-year fixed-rate mortgage is the cornerstone of the American dream of homeownership. For many years, it has been the benchmark in opposition to which potential consumers gauge affordability and plan their monetary futures. Understanding at present’s charges, nevertheless, requires navigating a fancy panorama of financial indicators, market sentiment, and particular person lender practices. This text will dissect the present 30-year mortgage fee chart for the USA (as of October 26, 2023 – observe that charges are dynamic and alter day by day), inspecting its historic context, influential elements, and what it means for potential homebuyers and the broader financial system.

Present Market Snapshot (October 26, 2023): A Preliminary Look

It is essential to preface any dialogue of present charges with a disclaimer: charges are fluid. The knowledge offered right here displays a snapshot in time and shouldn’t be thought-about monetary recommendation. All the time seek the advice of with a certified mortgage skilled for personalised fee quotes.

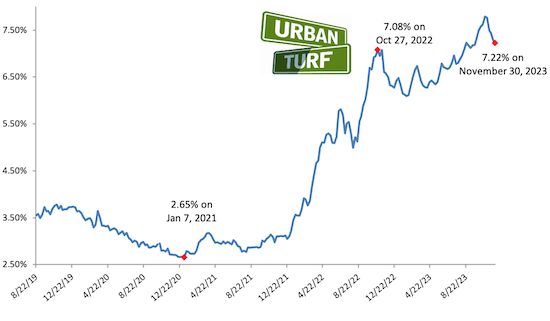

As of at present, October twenty sixth, 2023, the common 30-year fixed-rate mortgage is hovering round [Insert Current Average Rate Here – obtain this from a reputable source like Freddie Mac or Bankrate.com]%. This determine represents the common fee provided by lenders throughout the nation, however particular person charges can range considerably primarily based on a number of elements mentioned under. A chart visualizing this fee, alongside current historic knowledge, would supply a clearer image. (Ideally, a chart can be included right here, displaying charges for the previous yr, ideally with annotations highlighting key financial occasions.)

Historic Context: A Lengthy-Time period Perspective

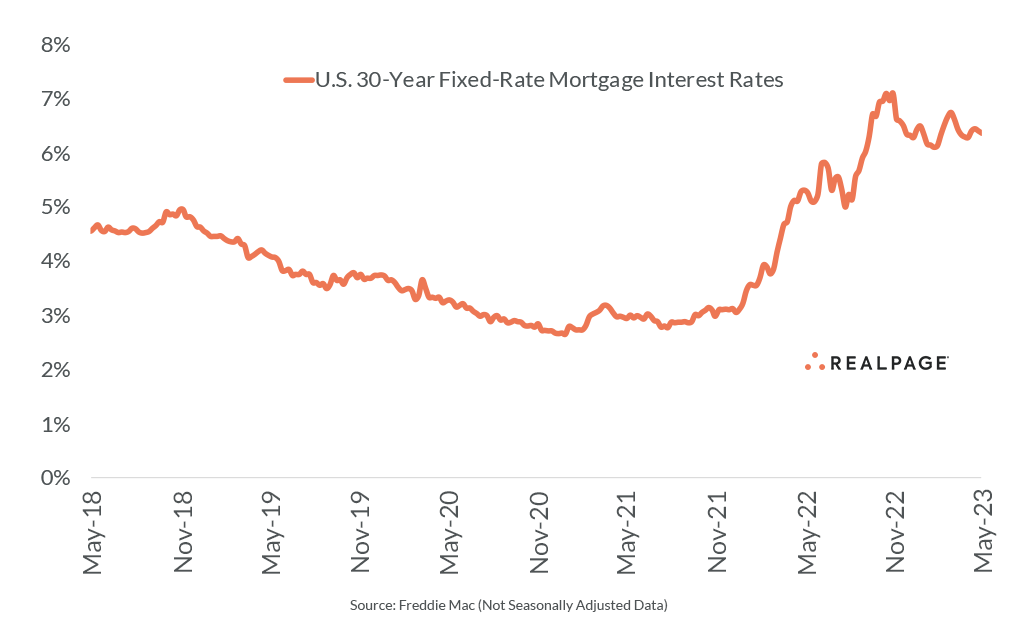

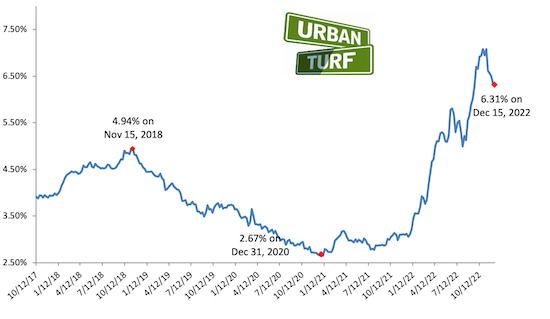

To actually perceive at present’s charges, it is important to look at their historic trajectory. The 30-year mortgage fee has fluctuated dramatically over the previous few a long time, influenced by numerous financial forces. For example, the early 2000s noticed comparatively low charges, contributing to a housing growth. The following housing disaster of 2008 led to a pointy improve, making homeownership much less accessible for a lot of. The interval following the disaster witnessed a protracted interval of traditionally low charges, fueled by the Federal Reserve’s quantitative easing insurance policies. This period of low charges stimulated the housing market, but additionally contributed to issues about asset bubbles.

(The hypothetical chart talked about above would ideally present this historic context, highlighting intervals of excessive and low charges and correlating them with main financial occasions like recessions, inflation spikes, and adjustments in Federal Reserve coverage.)

Elements Influencing 30-Yr Mortgage Charges:

A number of interconnected elements drive fluctuations in 30-year mortgage charges:

-

The Federal Reserve (The Fed): The Fed’s financial coverage is arguably essentially the most vital affect. By adjusting the federal funds fee (the goal fee for in a single day lending between banks), the Fed influences the general price of borrowing. Greater federal funds charges typically result in greater mortgage charges, as lenders move on elevated borrowing prices to shoppers. Conversely, decrease federal funds charges sometimes lead to decrease mortgage charges.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the financial system. This, in flip, results in greater mortgage charges. Conversely, low inflation permits for decrease rates of interest. The present inflationary setting is a key driver of the present mortgage fee panorama.

-

Financial Development: A strong financial system typically results in elevated demand for mortgages, probably pushing charges greater. Conversely, a weak financial system can suppress demand, probably resulting in decrease charges. The present state of the financial system, whether or not it is experiencing development or contraction, considerably impacts mortgage charges.

-

Authorities Laws: Authorities rules and insurance policies associated to the housing market may also have an effect on mortgage charges. Modifications in lending requirements, for instance, can affect the chance profile of mortgages, affecting the charges lenders provide.

-

Investor Sentiment and Market Volatility: Uncertainty within the broader monetary markets can affect investor confidence and affect mortgage charges. Intervals of excessive market volatility can result in elevated threat premiums, leading to greater charges.

-

Provide and Demand of Mortgages: The interaction between the provision of accessible mortgages and the demand from homebuyers additionally impacts charges. Excessive demand with restricted provide can push charges upward, whereas the other can result in decrease charges.

-

Credit score Scores and Mortgage-to-Worth Ratios (LTV): Particular person debtors’ creditworthiness performs an important position in figuring out their mortgage fee. Greater credit score scores typically qualify for decrease charges, reflecting decrease threat for lenders. Equally, a decrease LTV (the ratio of the mortgage quantity to the property worth) additionally interprets to decrease charges.

What the Present Chart Means for Homebuyers:

The present 30-year mortgage fee chart (as of October 26, 2023) paints an image of a market that’s [Insert Description based on the current rate – e.g., "moderately higher than recent lows, reflecting the ongoing impact of inflation and tighter monetary policy," or "relatively stable after recent volatility," etc.]. Which means potential homebuyers ought to:

-

Fastidiously assess their affordability: Greater charges improve the month-to-month mortgage funds, impacting affordability. Patrons have to realistically consider their finances and monetary capability earlier than making a purchase order resolution.

-

Store round for one of the best charges: Charges range between lenders, so evaluating affords from a number of lenders is essential to securing essentially the most favorable phrases.

-

Think about various mortgage merchandise: Relying on their monetary state of affairs, consumers may discover various mortgage merchandise, comparable to adjustable-rate mortgages (ARMs) or government-backed loans (FHA, VA), which can provide decrease charges or extra versatile phrases.

-

Enhance their credit score rating: The next credit score rating can considerably scale back the rate of interest, probably saving 1000’s of {dollars} over the lifetime of the mortgage.

Wanting Forward: Forecasting Future Charges

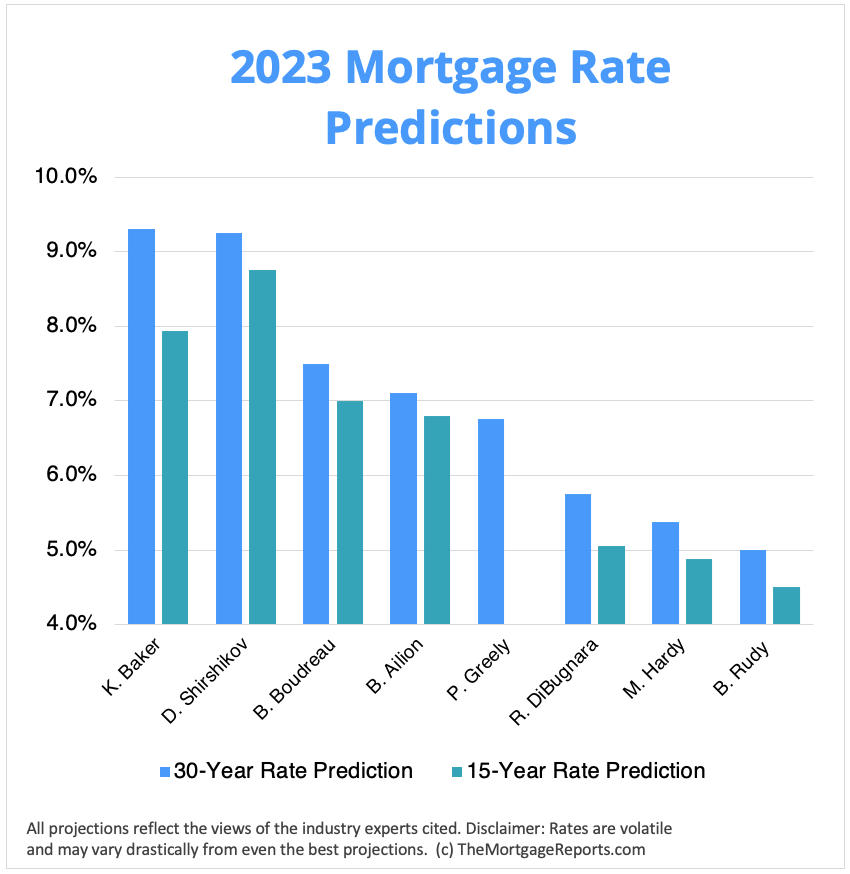

Predicting future mortgage charges is inherently difficult, because it is dependent upon the interaction of quite a few financial elements. Nevertheless, analysts typically base their forecasts on anticipated adjustments within the Federal Reserve’s financial coverage, inflation tendencies, and total financial development. Present predictions (as of October 26, 2023) recommend [Insert predictions from reputable sources, including caveats about uncertainty]. It is essential to keep in mind that these are simply predictions, and precise charges might differ considerably.

Conclusion:

The 30-year mortgage fee chart is a crucial software for understanding the dynamics of the US housing market. By understanding the historic context, influential elements, and present market circumstances, potential homebuyers could make knowledgeable choices about their monetary future. Whereas present charges could current challenges for some, the market stays dynamic, and cautious planning and diligent analysis might help navigate the complexities of homeownership. Bear in mind to seek the advice of with a monetary advisor and mortgage skilled for personalised steerage. The knowledge offered on this article is for instructional functions solely and shouldn’t be thought-about monetary recommendation.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Closure

Thus, we hope this text has offered helpful insights into Decoding the 30-Yr Mortgage Fee Chart: A Deep Dive into Right now’s US Market (October 26, 2023). We admire your consideration to our article. See you in our subsequent article!