Decoding the Ascending Triangle: A Complete Information to a Highly effective Chart Sample

Associated Articles: Decoding the Ascending Triangle: A Complete Information to a Highly effective Chart Sample

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Ascending Triangle: A Complete Information to a Highly effective Chart Sample. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Ascending Triangle: A Complete Information to a Highly effective Chart Sample

The world of technical evaluation is full of a myriad of chart patterns, every whispering potential insights into future worth actions. Amongst these, the ascending triangle stands out as a comparatively dependable sample, typically signaling a bullish breakout. Whereas not foolproof, understanding its formation, interpretation, and limitations can considerably improve a dealer’s means to establish high-probability buying and selling setups. This text offers a complete exploration of the ascending triangle, delving into its traits, affirmation methods, danger administration, and sensible purposes.

Understanding the Ascending Triangle’s Formation

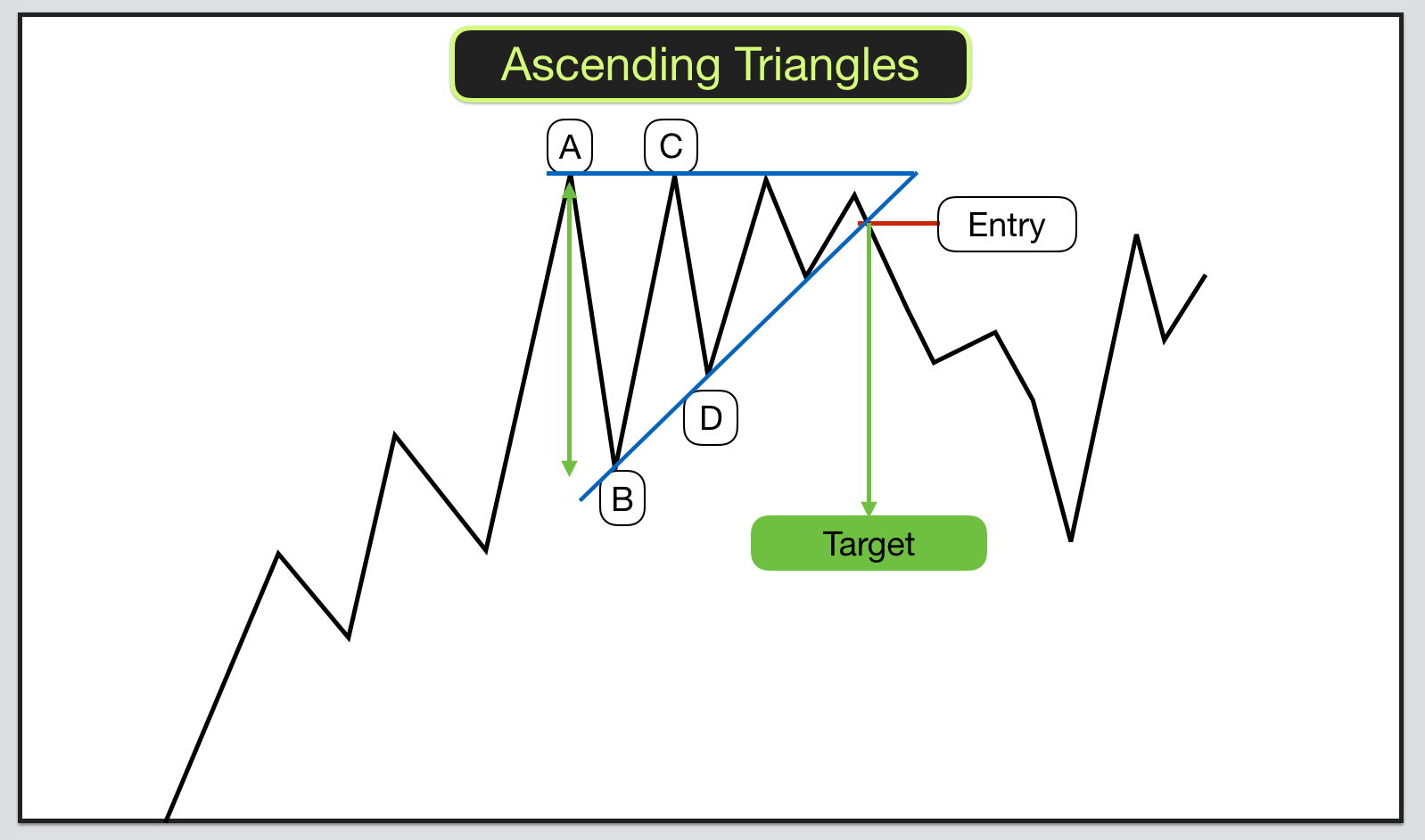

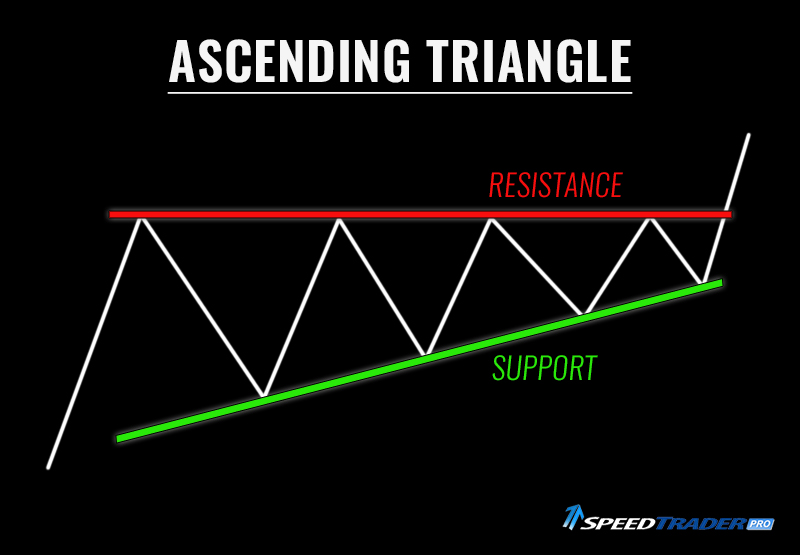

The ascending triangle is a continuation sample, which means it sometimes happens throughout a longtime uptrend. Its formation is characterised by two key components:

-

A horizontal resistance line: This represents a worth stage the place promoting stress persistently prevents the worth from breaking via. It is fashioned by connecting a sequence of swing highs, all roughly on the identical worth level. This line signifies a zone of great resistance, probably as a result of psychological components, earlier highs, or technical indicators.

-

An ascending trendline: This line connects a sequence of progressively greater lows. It displays rising shopping for stress, as consumers persistently step in to help the worth at decrease ranges. The slope of this trendline is essential; a steeper slope signifies stronger shopping for stress and doubtlessly a extra important breakout.

The interplay between these two strains creates the triangular form. The horizontal resistance and the upward-sloping help line converge, making a narrowing worth vary. This convergence signifies a interval of consolidation, the place consumers and sellers are locked in a battle for dominance. The longer this consolidation lasts, the extra highly effective the eventual breakout is commonly perceived to be. Nonetheless, it’s essential to keep in mind that time alone doesn’t assure a breakout.

Figuring out a Legitimate Ascending Triangle

Not each triangle-like formation on a chart represents a legitimate ascending triangle. A number of components should be thought-about to make sure correct identification:

-

Clear Horizontal Resistance: The resistance line must be well-defined, with a minimum of two clear swing highs touching or very close to the road. The extra touches, the stronger the resistance. A single contact may be inadequate to substantiate a major resistance stage.

-

Properly-Outlined Ascending Trendline: Equally, the ascending trendline must be clearly outlined, connecting a minimum of two, ideally extra, progressively greater lows. The trendline ought to have a comparatively constant upward slope. A flat or downward-sloping trendline negates the sample’s bullish interpretation.

-

Quantity Affirmation: Whereas not at all times a definitive indicator, quantity can present priceless affirmation. Sometimes, quantity tends to lower as the worth consolidates inside the triangle, reflecting the indecision between consumers and sellers. Nonetheless, a surge in quantity accompanying the breakout can present robust affirmation of the sample’s validity.

-

Time Body Consideration: Ascending triangles can kind on varied timeframes, from short-term (intraday) to long-term (month-to-month or yearly) charts. The timeframe chosen ought to align with the dealer’s funding horizon and buying and selling fashion. A sample recognized on a each day chart will sometimes have a longer-term implication than one on a 5-minute chart.

-

Contextual Evaluation: It is essential to research the ascending triangle inside the broader context of the market. Take into account the general development, the sector’s efficiency, and any related elementary information or occasions. A bullish ascending triangle in a bearish market may be much less dependable than one in a bullish development.

Deciphering the Breakout and Goal Worth

Essentially the most important occasion in an ascending triangle is the breakout. A bullish breakout happens when the worth decisively breaks above the horizontal resistance line, sometimes accompanied by elevated quantity. This breakout indicators that purchasing stress has lastly overwhelmed promoting stress.

Figuring out the Goal Worth: As soon as a breakout is confirmed, merchants typically use the next strategies to mission a possible worth goal:

-

Measuring the Triangle’s Peak: The commonest methodology entails measuring the vertical distance between the best level of the ascending trendline and the horizontal resistance line. This distance is then projected upwards from the breakout level. This projection offers a possible worth goal for the breakout transfer.

-

Fibonacci Extensions: Fibonacci retracement ranges can be used to mission potential worth targets. By figuring out key Fibonacci extension ranges above the breakout level, merchants can set extra refined worth targets.

-

Assist and Resistance Ranges: Present help and resistance ranges above the breakout level may also function potential worth targets.

Affirmation Methods and Danger Administration

Whereas the breakout above the resistance line is the important thing sign, merchants ought to make use of affirmation methods to mitigate danger:

-

Quantity Affirmation: A big improve in buying and selling quantity accompanying the breakout considerably strengthens the sign. Low quantity breakouts are sometimes false breakouts.

-

Worth Affirmation: The value ought to ideally shut above the resistance line to substantiate the breakout. A easy break above the road adopted by a fast reversal is commonly a false sign.

-

Indicator Affirmation: Technical indicators just like the Relative Power Index (RSI) or Shifting Common Convergence Divergence (MACD) can present extra affirmation. A bullish divergence in these indicators previous to the breakout can improve the sign’s reliability.

Danger Administration: As with every buying and selling technique, danger administration is paramount. Merchants ought to at all times use stop-loss orders to restrict potential losses. An acceptable stop-loss order might be positioned slightly below the horizontal resistance line or barely under the breakout level, relying on the dealer’s danger tolerance.

False Breakouts and Limitations

It is essential to acknowledge that ascending triangles, like all chart patterns, will not be foolproof. False breakouts can happen, the place the worth briefly breaks above the resistance line earlier than reversing downwards. This may be irritating for merchants who entered lengthy positions based mostly on the preliminary breakout. To attenuate the influence of false breakouts, merchants ought to:

-

Await Affirmation: Keep away from coming into an extended place instantly upon a breakout. Await affirmation via elevated quantity and a decisive worth closure above the resistance line.

-

Use Tight Cease-Losses: Make use of tight stop-loss orders to restrict potential losses in case of a false breakout.

-

Handle Place Measurement: By no means danger extra capital than you may afford to lose on a single commerce.

Sensible Functions and Examples

Ascending triangles have been noticed in quite a few markets, throughout varied asset courses. From particular person shares to indices and commodities, the sample’s prevalence highlights its versatility. Analyzing historic charts of profitable breakouts demonstrates the potential for important worth appreciation following a confirmed breakout. Nonetheless, it is necessary to keep in mind that previous efficiency shouldn’t be indicative of future outcomes.

Conclusion

The ascending triangle is a robust chart sample that may considerably improve a dealer’s means to establish high-probability buying and selling setups. Whereas not a assured win, understanding its formation, interpretation, and limitations, coupled with sturdy danger administration methods, can considerably enhance buying and selling outcomes. By combining technical evaluation with elementary evaluation and cautious consideration of market context, merchants can leverage the ascending triangle sample to establish doubtlessly worthwhile buying and selling alternatives. Keep in mind that constant studying, disciplined buying and selling, and adapting to market dynamics are essential for long-term success in any buying and selling method.

![Chart Patterns – The Advanced Guide [Bonus Cheat Sheet] - ForexSpringBoard](https://forexspringboard.com/wp-content/uploads/2018/11/descending_triangle-768x471.png)

Closure

Thus, we hope this text has offered priceless insights into Decoding the Ascending Triangle: A Complete Information to a Highly effective Chart Sample. We thanks for taking the time to learn this text. See you in our subsequent article!