Decoding the BSE Choice Chain Chart: A Complete Information for Merchants

Associated Articles: Decoding the BSE Choice Chain Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the BSE Choice Chain Chart: A Complete Information for Merchants. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the BSE Choice Chain Chart: A Complete Information for Merchants

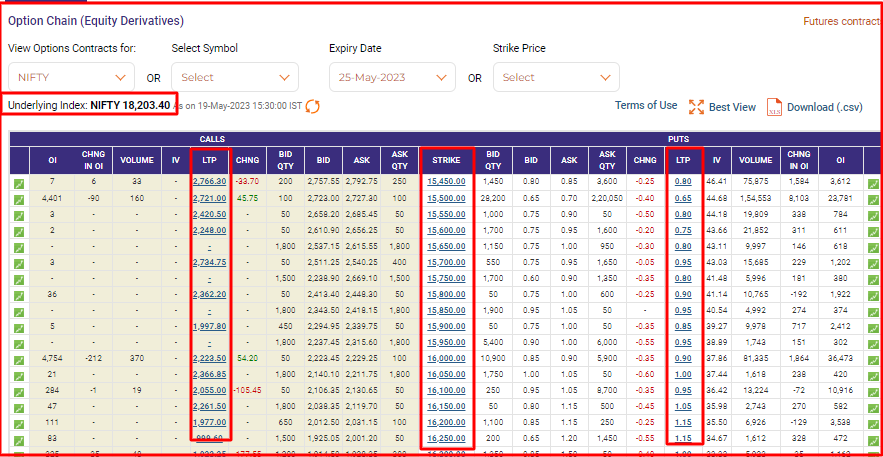

The Bombay Inventory Change (BSE) choice chain chart is a strong device for choices merchants, offering a snapshot of the market’s sentiment and expectations for a selected underlying asset. Understanding find out how to learn and interpret this chart is essential for making knowledgeable buying and selling selections. This text will delve deep into the intricacies of the BSE choice chain chart, explaining its elements, deciphering the info, and highlighting its strategic purposes.

Understanding the Fundamentals: What’s an Choice Chain?

An choice chain is a complete desk displaying all out there name and put choices contracts for a selected underlying asset (e.g., a inventory, index) at varied strike costs and expiry dates. Every entry within the chain gives essential details about the choice contract, together with:

- Underlying Asset: The inventory or index on which the choice is predicated.

- Expiry Date: The date on which the choice contract expires.

- Strike Worth: The value at which the choice holder should buy (name) or promote (put) the underlying asset.

- Name Choice: A contract giving the customer the correct, however not the duty, to purchase the underlying asset on the strike worth on or earlier than the expiry date.

- Put Choice: A contract giving the customer the correct, however not the duty, to promote the underlying asset on the strike worth on or earlier than the expiry date.

- Choice Worth (Premium): The value paid to buy the choice contract. This displays the market’s evaluation of the chance of the choice expiring in-the-money.

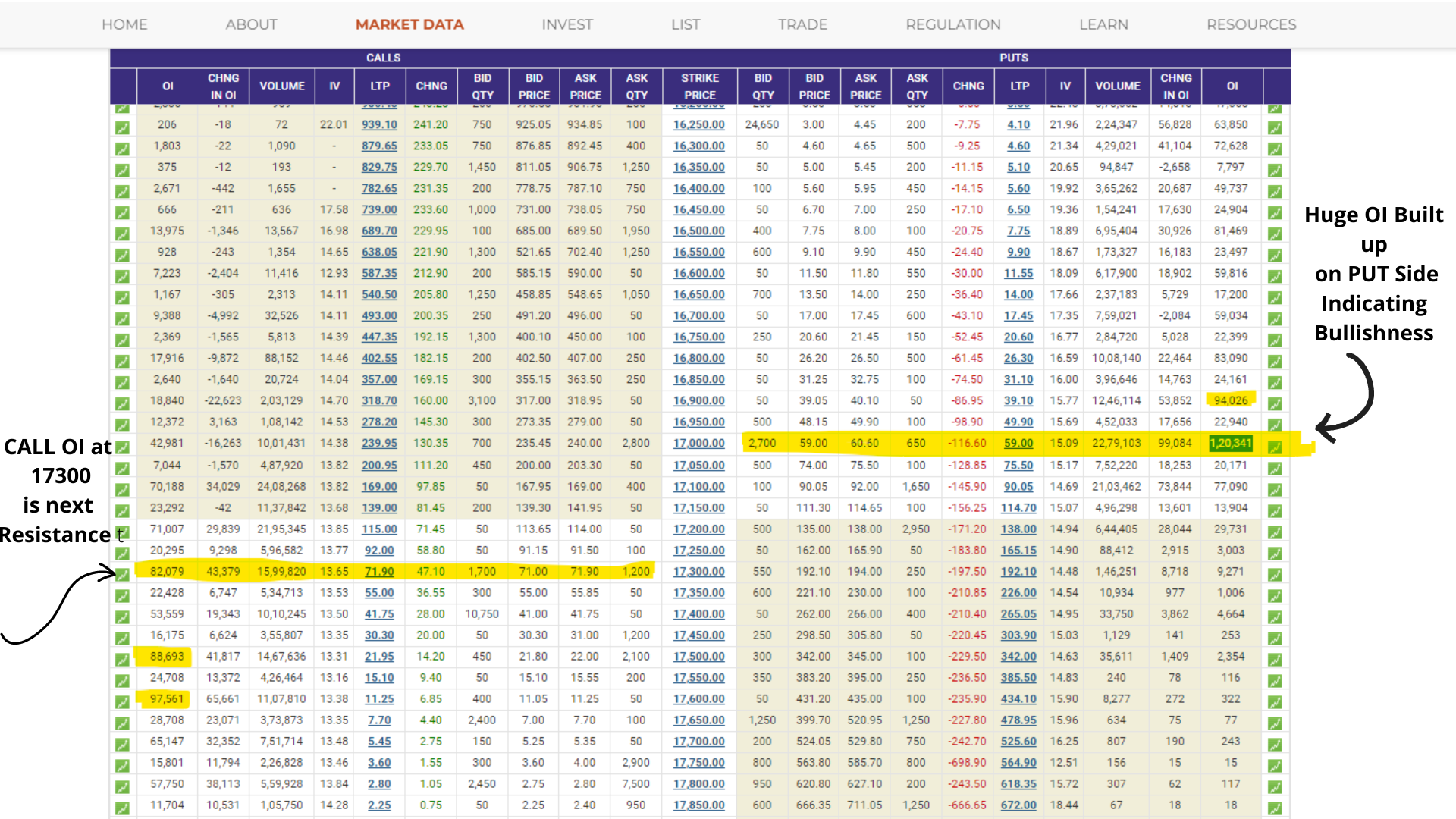

- Open Curiosity (OI): The overall variety of excellent choice contracts that have not been exercised or expired. Excessive OI signifies important market curiosity in a selected strike worth.

- Change in Open Curiosity (Chng in OI): Exhibits the web change in open curiosity from the earlier buying and selling day. A constructive worth signifies a rise in OI, suggesting elevated market participation.

- Quantity: The variety of contracts traded in the course of the day. Excessive quantity signifies important buying and selling exercise at a selected strike worth.

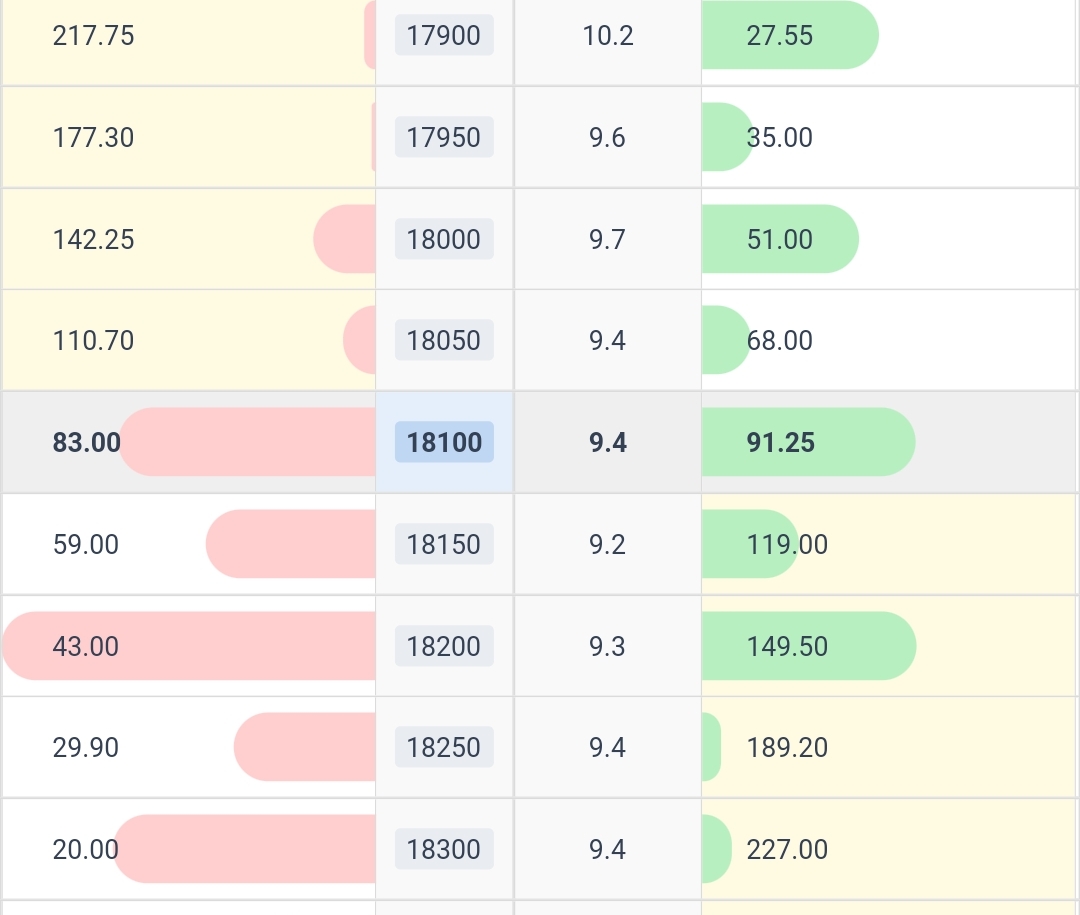

- Bid Worth: The best worth a purchaser is prepared to pay for the choice.

- Ask Worth: The bottom worth a vendor is prepared to simply accept for the choice.

- Final Traded Worth (LTP): The value at which the final choice contract was traded.

- Implied Volatility (IV): A measure of the market’s expectation of future worth volatility of the underlying asset. Increased IV typically means greater choice premiums.

Deciphering the BSE Choice Chain Chart:

The BSE choice chain chart presents this knowledge in a structured format, sometimes organized by expiry date after which by strike worth. Merchants use this knowledge to glean insights into market sentiment and potential worth actions. Here is find out how to interpret key features:

-

Open Curiosity (OI) Evaluation: Excessive OI at a selected strike worth suggests a major variety of merchants imagine the underlying asset’s worth will attain or exceed that degree. A sudden improve in OI can sign a powerful directional transfer. Analyzing the change in OI helps determine accumulating positions (constructive Chng in OI) and liquidating positions (detrimental Chng in OI).

-

Quantity Evaluation: Excessive quantity at a selected strike worth, coupled with important OI, reinforces the significance of that worth degree. It signifies sturdy conviction behind the value motion. Uncommon quantity spikes can sign potential breakouts or reversals.

-

Put-Name Ratio (PCR): This ratio (calculated as Put OI / Name OI) affords insights into market sentiment. A excessive PCR suggests bearish sentiment, whereas a low PCR signifies bullish sentiment. Nevertheless, PCR ought to be interpreted cautiously and along side different indicators.

-

Implied Volatility (IV) Evaluation: Excessive IV suggests elevated uncertainty and threat available in the market, resulting in greater choice premiums. Merchants usually use IV to determine probably overpriced or underpriced choices. Modifications in IV generally is a main indicator of upcoming worth actions.

-

Figuring out Help and Resistance Ranges: Analyzing OI and quantity throughout totally different strike costs might help determine potential assist and resistance ranges. Excessive OI at particular strike costs usually coincides with important assist or resistance ranges.

-

Analyzing the Form of the Choice Chain: The general distribution of OI throughout totally different strike costs can reveal market expectations. A skewed distribution, with excessive OI concentrated at one aspect of the chain, suggests a powerful directional bias.

Strategic Functions of the BSE Choice Chain Chart:

The BSE choice chain chart is a flexible device with quite a few strategic purposes:

-

Figuring out Potential Buying and selling Alternatives: By analyzing OI, quantity, and IV, merchants can determine probably worthwhile choices buying and selling methods, corresponding to shopping for or promoting calls or places at particular strike costs and expiry dates.

-

Hedging Methods: The choice chain permits merchants to implement hedging methods to mitigate potential losses from opposed worth actions within the underlying asset.

-

Market Sentiment Evaluation: The choice chain gives priceless insights into market sentiment, serving to merchants to anticipate potential worth developments and regulate their buying and selling methods accordingly.

-

Threat Administration: Understanding the choice chain permits merchants to higher assess and handle their threat publicity. They’ll select choices methods that align with their threat tolerance and buying and selling objectives.

-

Figuring out Potential Breakouts and Reversals: Analyzing quantity and OI modifications might help determine potential breakouts from established buying and selling ranges or potential reversals in worth developments.

Limitations and Cautions:

Whereas the BSE choice chain chart is a strong device, it is important to concentrate on its limitations:

-

Data Lag: The information introduced within the choice chain displays previous buying and selling exercise and will not completely predict future worth actions.

-

Market Manipulation: Massive institutional merchants can manipulate choice costs and OI to affect market sentiment.

-

Complexity: Understanding and deciphering the choice chain requires important data and expertise. Novices ought to strategy it cautiously and search steerage from skilled merchants or monetary advisors.

-

Over-reliance: The choice chain shouldn’t be the only foundation for buying and selling selections. It ought to be used along side different technical and elementary evaluation instruments.

Conclusion:

The BSE choice chain chart is an indispensable device for choices merchants, offering a complete view of market sentiment, worth expectations, and potential buying and selling alternatives. By rigorously analyzing the info introduced within the chart, merchants can develop knowledgeable methods, handle threat successfully, and probably improve their buying and selling efficiency. Nevertheless, it is essential to do not forget that the choice chain is only one piece of the puzzle. Profitable choices buying and selling requires a holistic strategy, combining chart evaluation, elementary evaluation, threat administration, and a deep understanding of market dynamics. Steady studying and observe are key to mastering the artwork of deciphering the BSE choice chain chart and utilizing it to realize constant buying and selling success.

Closure

Thus, we hope this text has offered priceless insights into Decoding the BSE Choice Chain Chart: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!