Decoding the Candlestick Chart: A Complete Information to Candle Sorts

Associated Articles: Decoding the Candlestick Chart: A Complete Information to Candle Sorts

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Candlestick Chart: A Complete Information to Candle Sorts. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Candlestick Chart: A Complete Information to Candle Sorts

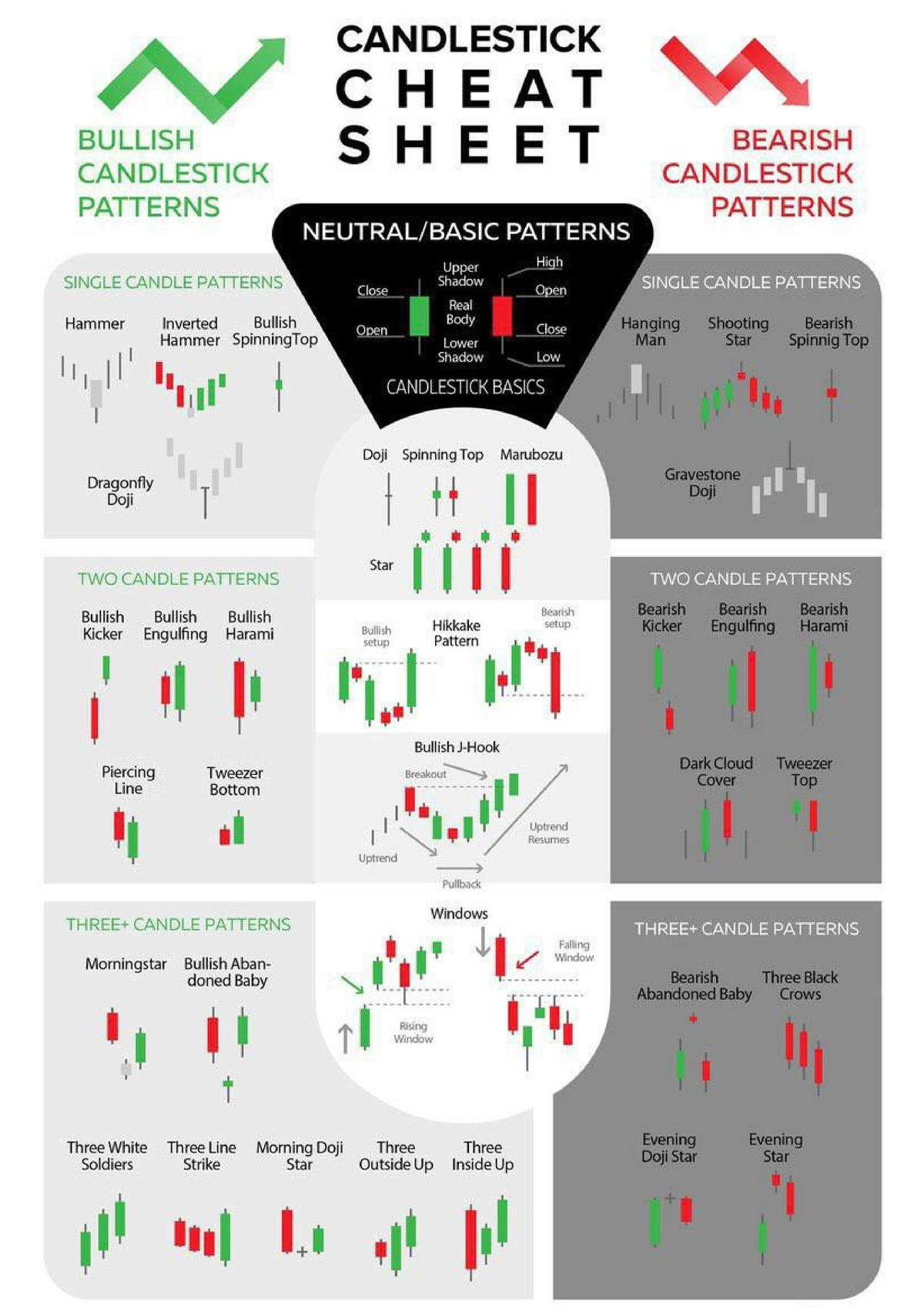

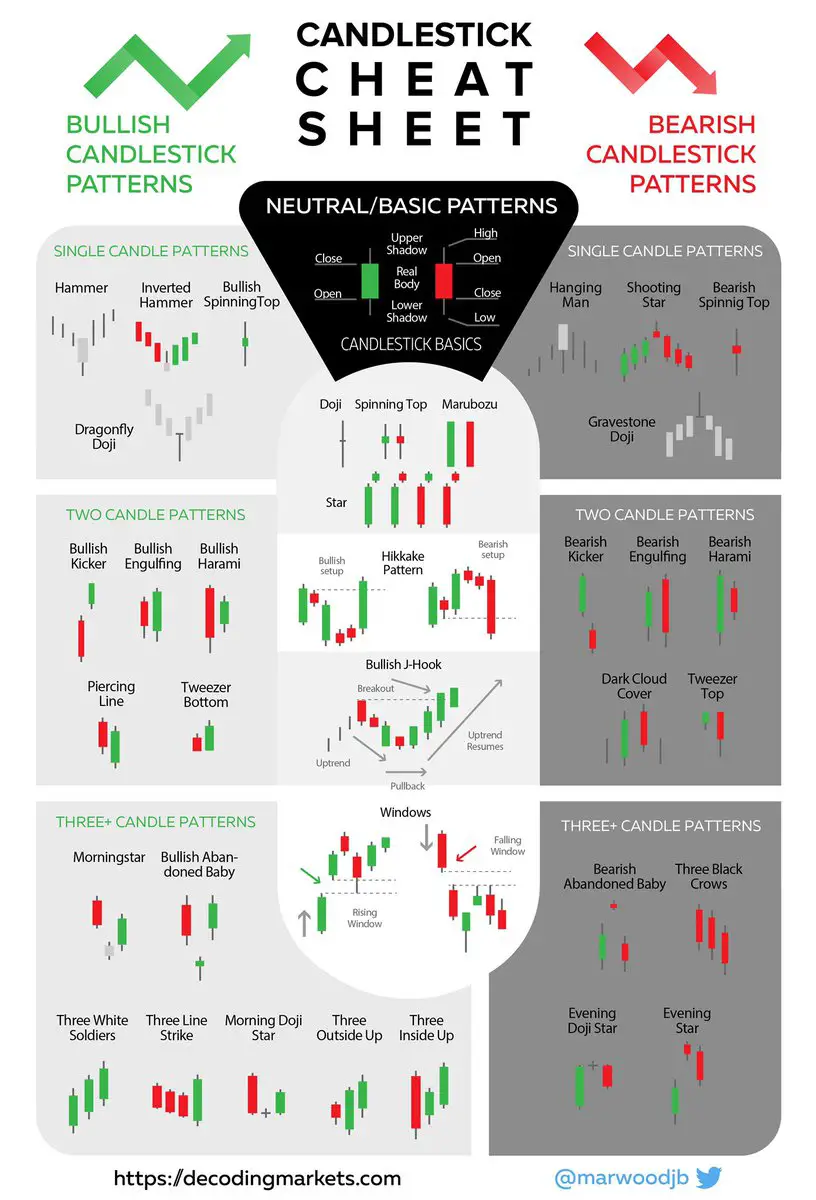

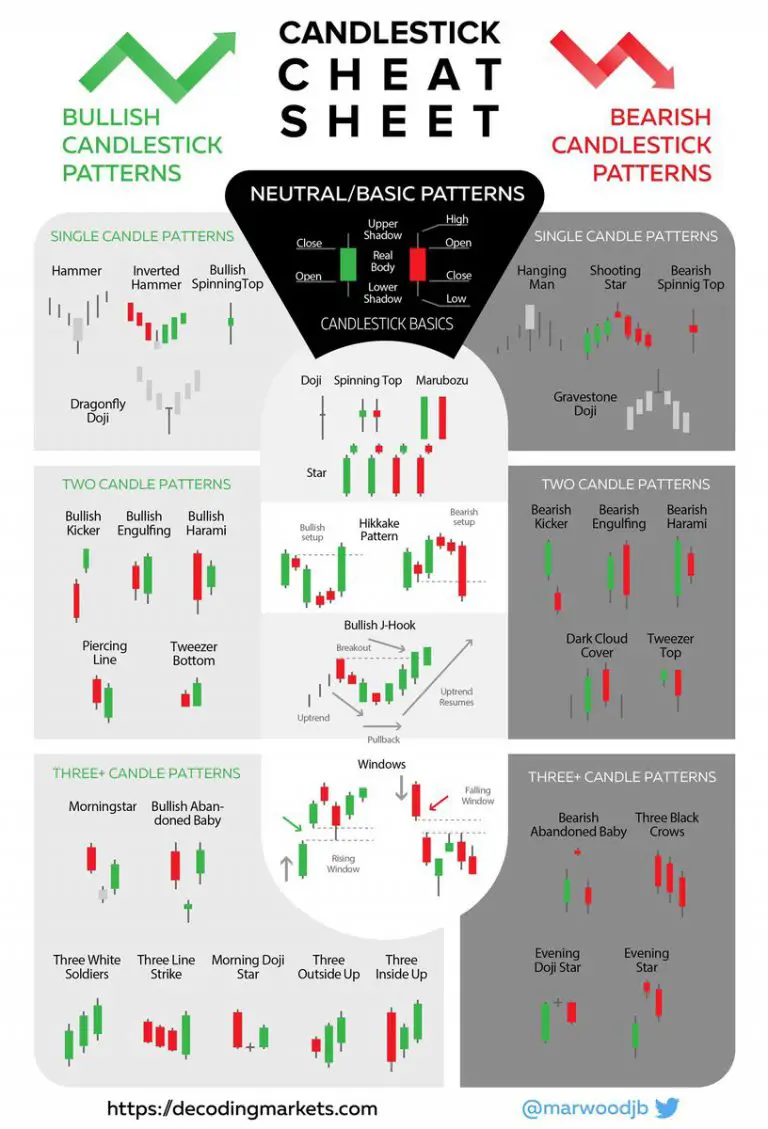

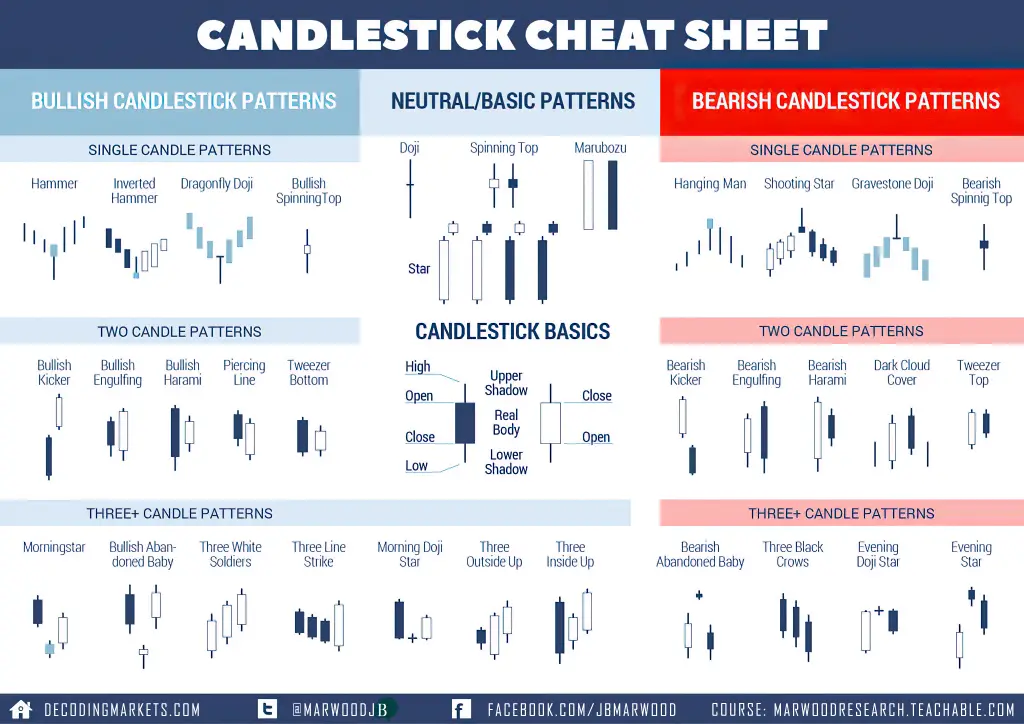

Candlestick charts are a strong visible instrument for technical evaluation, offering a concise abstract of value motion over a selected interval. In contrast to bar charts, which merely present the excessive, low, open, and shut costs, candlestick charts characterize this knowledge in a visually intuitive manner, permitting merchants to shortly establish tendencies, reversals, and potential buying and selling alternatives. Understanding the several types of candlesticks is essential for efficient technical evaluation. This text will delve into the assorted candle patterns, explaining their formation, significance, and implications for buying and selling methods.

The Anatomy of a Candlestick:

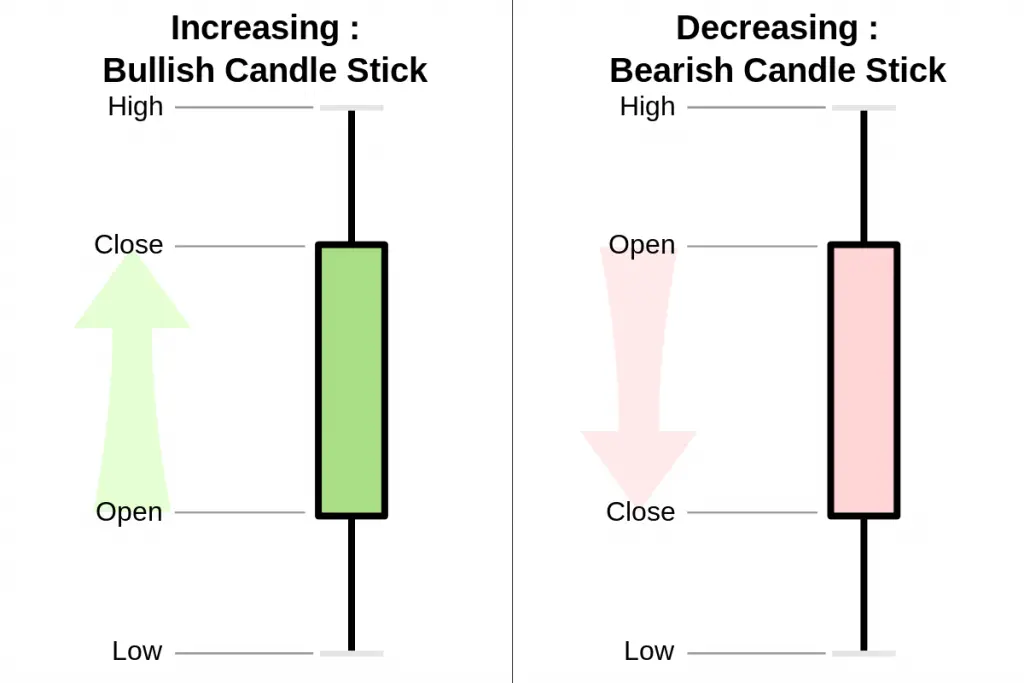

Earlier than exploring particular candle sorts, let’s evaluation the fundamental elements of a single candlestick:

-

Physique: The oblong portion of the candlestick represents the value vary between the open and shut. A "bullish" or "inexperienced" candle signifies that the closing value was greater than the opening value, whereas a "bearish" or "pink" candle signifies a closing value decrease than the opening value. The size of the physique displays the magnitude of the value distinction between the open and shut.

-

Wicks (Shadows or Tails): The traces extending above and under the physique are referred to as wicks or shadows. The higher wick reveals the best value reached in the course of the interval, whereas the decrease wick signifies the bottom value. Lengthy wicks usually recommend robust shopping for or promoting strain that was finally overcome.

Frequent Candlestick Patterns:

The next sections will element varied candlestick patterns, categorized for readability. Do not forget that the importance of a candlestick sample is usually enhanced when it seems along with different patterns or inside a broader market context.

I. Single Candlestick Patterns:

These patterns include a single candlestick and supply insights into the speedy market sentiment.

-

Doji: A Doji is characterised by a gap value and shutting value which are just about similar, leading to a small or nonexistent physique. The wicks might be lengthy or brief. Dojis usually sign indecision available in the market, a possible turning level, or a pause earlier than a big value transfer. Several types of Dojis exist, together with long-legged Doji, dragonfly Doji, headstone Doji, and others, every with barely nuanced interpretations.

-

Marubozu: A Marubozu is a candlestick with no higher or decrease wicks, indicating a powerful directional transfer. A bullish Marubozu has an extended inexperienced physique, signifying robust shopping for strain all through the interval. A bearish Marubozu shows an extended pink physique, signifying robust promoting strain. These candles show a decisive market transfer with minimal hesitation.

-

Spinning Prime: Much like a Doji, a spinning prime has a small physique, however in contrast to a Doji, it has important higher and decrease wicks. This implies indecision and a possible battle between patrons and sellers. The size of the wicks relative to the physique is essential for interpretation.

-

Hammer and Hanging Man: Each are characterised by a small physique on the prime or backside of an extended decrease wick. A Hammer seems on the backside of a downtrend and suggests a possible reversal to the upside, as patrons stepped in to stop additional declines. A Hanging Man seems on the prime of an uptrend and indicators a possible reversal to the draw back, as sellers overwhelmed patrons. The distinction lies primarily of their context inside the prevailing pattern.

-

Engulfing Sample: This sample consists of two candlesticks. The second candle utterly "engulfs" the physique of the primary candle. A bullish engulfing sample (pink candle adopted by a bigger inexperienced candle) suggests a possible bullish reversal, whereas a bearish engulfing sample (inexperienced candle adopted by a bigger pink candle) suggests a possible bearish reversal. The scale distinction between the candles is essential for affirmation.

II. Two-Candlestick Patterns:

These patterns mix two candlesticks to offer a extra complete image of market dynamics.

-

Piercing Sample: This bullish reversal sample happens after a downtrend. It consists of an extended pink candle adopted by a inexperienced candle that opens decrease than the earlier candle’s shut however closes greater than its midpoint. This implies that patrons are beginning to achieve management.

-

Darkish Cloud Cowl: This bearish reversal sample happens after an uptrend. It consists of an extended inexperienced candle adopted by a pink candle that opens greater than the earlier candle’s shut however closes under its midpoint. This implies that sellers are beginning to achieve management.

-

Morning Star and Night Star: These three-candlestick patterns are variations of the two-candlestick patterns. A Morning Star is a bullish reversal sample, whereas an Night Star is a bearish reversal sample. They include three candles: an extended bearish candle, a small indecisive candle (usually a Doji or spinning prime), and an extended bullish (Morning Star) or bearish (Night Star) candle.

III. Three-Candlestick Patterns:

These patterns supply much more strong indicators, requiring affirmation from a number of candles.

-

Morning Star and Night Star (detailed): As talked about above, these are essential three-candle reversal patterns. The center candle’s small physique is vital, indicating a pause within the pattern earlier than a possible reversal. The scale and shade of the ultimate candle strongly affirm the reversal sign.

-

Three White Troopers: This bullish sample consists of three consecutive inexperienced candles, every with a better open and shut than the earlier one. It suggests robust shopping for strain and a possible uptrend.

-

Three Black Crows: This bearish sample is the other of Three White Troopers. It consists of three consecutive pink candles, every with a decrease open and shut than the earlier one. It suggests robust promoting strain and a possible downtrend.

IV. Different Essential Concerns:

-

Affirmation: Whereas candlestick patterns present helpful insights, it is essential to substantiate them with different technical indicators or basic evaluation earlier than making buying and selling selections. Quantity evaluation, shifting averages, and assist/resistance ranges can all assist to strengthen a candlestick sample’s sign.

-

Context is Key: The interpretation of candlestick patterns relies upon closely on the broader market context. A sample which may sign a reversal in a sideways market might be insignificant inside a powerful trending market.

-

Timeframes: Candlestick patterns might be recognized throughout varied timeframes (e.g., 1-minute, 5-minute, every day, weekly). The timeframe chosen influences the interpretation and significance of the patterns. A sample that may be important on a every day chart may be much less related on a 1-minute chart.

-

False Alerts: Like every technical indicator, candlestick patterns can generate false indicators. It is vital to handle threat and keep away from over-reliance on any single indicator.

-

Sample Combos: Skilled merchants usually search for combos of candlestick patterns to extend the accuracy of their predictions. For instance, a bullish engulfing sample adopted by a hammer can present a stronger bullish sign.

Conclusion:

Candlestick charts are a useful instrument for technical evaluation, providing a wealthy visible illustration of market sentiment and value motion. Understanding the assorted candlestick patterns, their formation, and their implications is essential for making knowledgeable buying and selling selections. Nonetheless, it is important to keep in mind that candlestick patterns needs to be used along with different technical indicators and basic evaluation to attenuate threat and improve the chance of profitable trades. Steady studying and apply are key to mastering the artwork of candlestick chart interpretation. By combining information of those patterns with self-discipline and threat administration, merchants can considerably improve their means to establish potential buying and selling alternatives and navigate the complexities of the monetary markets.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Candlestick Chart: A Complete Information to Candle Sorts. We admire your consideration to our article. See you in our subsequent article!