Decoding the Candlestick Chart: A Complete Information to Technical Evaluation

Associated Articles: Decoding the Candlestick Chart: A Complete Information to Technical Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Candlestick Chart: A Complete Information to Technical Evaluation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Candlestick Chart: A Complete Information to Technical Evaluation

Candlestick charts, a cornerstone of technical evaluation, present a visually compelling and informative solution to interpret value actions in monetary markets. In contrast to bar charts which solely present the excessive, low, open, and shut costs, candlestick charts symbolize this information in a extra intuitive and readily digestible format. This text delves deep into the world of candlestick patterns, exploring their formation, interpretation, and sensible functions in buying and selling and funding methods.

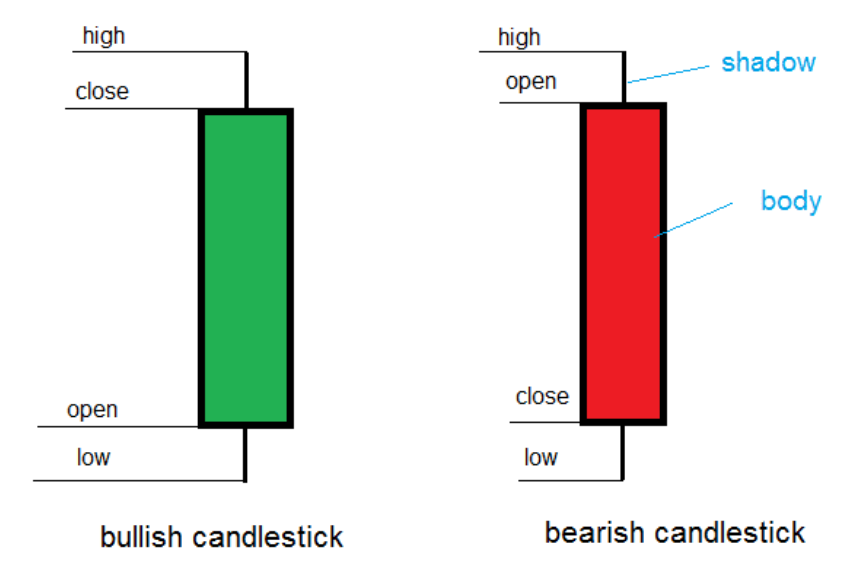

Understanding the Anatomy of a Candlestick:

Every candlestick represents the value motion of a selected interval, usually a day, hour, or perhaps a minute. The "physique" of the candlestick represents the vary between the opening and shutting costs. A "bullish" (or inexperienced) candlestick signifies that the closing value was greater than the opening value, whereas a "bearish" (or crimson) candlestick exhibits that the closing value was decrease than the opening value. Extending from the physique are the "wicks" or "shadows," which symbolize the excessive and low costs of the interval. An extended wick suggests vital value motion past the open and shut, whereas a brief wick implies a comparatively contained value vary.

Key Parts of Candlestick Interpretation:

The facility of candlestick evaluation lies in its potential to disclose the interaction of provide and demand. By analyzing the scale and form of the candlesticks, and their relationship to surrounding candles, merchants can determine potential development reversals, continuation patterns, and areas of help and resistance. A number of key components affect the interpretation:

-

Physique Measurement: An extended physique signifies robust conviction within the path of the value motion. A brief physique suggests indecision or an absence of momentum.

-

Wick Size: Lengthy higher wicks typically point out promoting stress at greater costs, whereas lengthy decrease wicks counsel shopping for stress at decrease costs. Quick wicks counsel restricted value volatility.

-

Shade: The colour of the candlestick (usually inexperienced for bullish and crimson for bearish) signifies the path of the value motion throughout the interval.

-

Sample Formation: The true energy of candlestick evaluation emerges when particular person candlesticks mix to kind particular patterns. These patterns, typically comprising two or extra candles, present insights into potential future value actions.

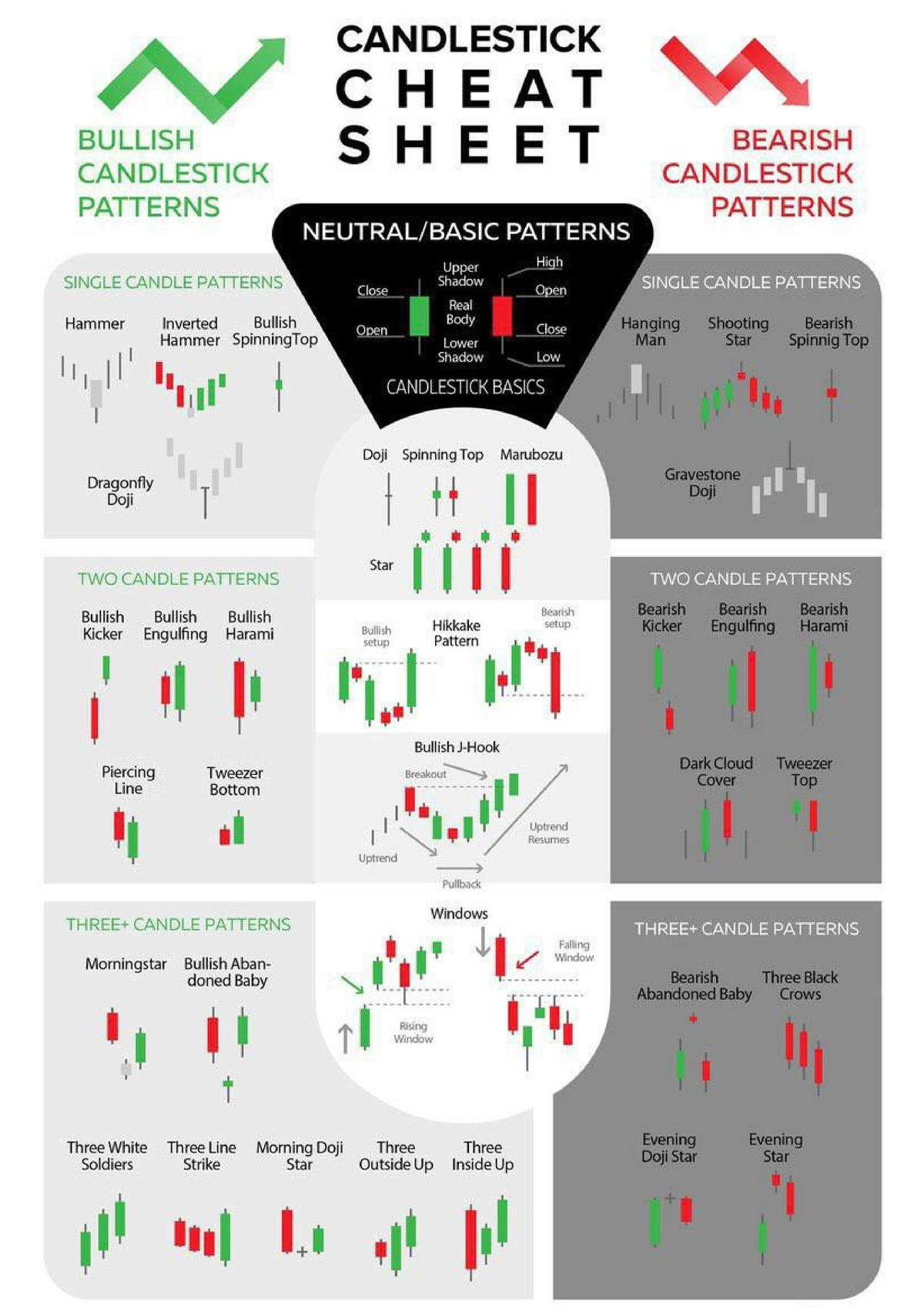

Frequent Candlestick Patterns: Bullish Reversals

Bullish reversal patterns counsel a possible shift from a downtrend to an uptrend. Some outstanding examples embrace:

-

Hammer: A small physique with an extended decrease wick, indicating shopping for stress at decrease costs. The hammer means that patrons stepped in to help the value, doubtlessly signaling a bullish reversal. A confirmed hammer typically seems after a downtrend and is adopted by a bullish candlestick.

-

Inverted Hammer: Much like a hammer, however with an extended higher wick and a small physique. It means that sellers pushed the value greater, however patrons finally took management, hinting at a possible bullish reversal. Affirmation is essential, usually requiring a subsequent bullish candlestick.

-

Morning Star: A 3-candle sample consisting of a bearish candle, a small physique (typically a doji), and a bullish candle. The small physique signifies indecision, whereas the following bullish candle suggests a shift in momentum in the direction of the bulls.

-

Piercing Line: A two-candle sample the place a bearish candle is adopted by a bullish candle that opens decrease than the earlier candle’s shut however closes above its midpoint. This exhibits patrons overcoming the promoting stress, suggesting a possible bullish reversal.

Frequent Candlestick Patterns: Bearish Reversals

Bearish reversal patterns point out a possible shift from an uptrend to a downtrend. Key examples embrace:

-

Hanging Man: A small physique with an extended decrease wick, showing on the prime of an uptrend. It means that patrons are dropping management, doubtlessly signaling a bearish reversal. Affirmation is required, normally by a subsequent bearish candlestick.

-

Capturing Star: Much like an inverted hammer, however showing on the prime of an uptrend. It exhibits promoting stress at greater costs, hinting at a bearish reversal. Affirmation is essential, usually requiring a following bearish candlestick.

-

Night Star: A 3-candle sample, the reverse of the morning star. It consists of a bullish candle, a small physique (typically a doji), and a bearish candle. This sample suggests a shift in momentum from patrons to sellers.

-

Engulfing Sample (Bearish): A two-candle sample the place a bullish candle is totally engulfed by a subsequent bigger bearish candle. This signifies a big shift in momentum in the direction of the bears.

Frequent Candlestick Patterns: Continuation Patterns

Continuation patterns counsel that the prevailing development is prone to proceed. These patterns do not sign a reversal however reasonably a short lived pause or consolidation earlier than the development resumes.

-

Doji: A candlestick with equal opening and shutting costs, forming a cross. It signifies indecision out there, a pause within the development. Dojis are usually not reversal patterns on their very own however might be vital elements of bigger patterns.

-

Spinning High: A small physique with comparatively lengthy higher and decrease wicks, suggesting indecision. Much like a doji, it signifies a pause within the development reasonably than a reversal.

-

Bullish/Bearish Engulfing Sample (Continuation): Whereas engulfing patterns might be reversal alerts, they may also be continuation patterns. A bullish engulfing sample throughout an uptrend confirms the bullish momentum, whereas a bearish engulfing sample throughout a downtrend confirms the bearish momentum.

Combining Candlestick Patterns with Different Technical Indicators:

Candlestick patterns are best when used along with different technical evaluation instruments. Combining them with indicators like transferring averages, relative energy index (RSI), MACD, and quantity evaluation can considerably improve the accuracy and reliability of buying and selling alerts. As an example, a bullish reversal sample confirmed by a optimistic divergence within the RSI or a bullish crossover within the transferring averages strengthens the sign considerably.

Limitations of Candlestick Evaluation:

Whereas candlestick patterns supply invaluable insights, it is essential to acknowledge their limitations:

-

Subjectivity: Deciphering candlestick patterns might be subjective, significantly when patterns are unclear or ambiguous.

-

Affirmation Bias: Merchants could also be susceptible to seeing patterns the place none exist, resulting in false alerts.

-

False Indicators: Candlestick patterns can generally generate false alerts, particularly in risky markets. Subsequently, relying solely on candlestick patterns for buying and selling choices is dangerous.

-

Context is Key: The interpretation of candlestick patterns ought to at all times be thought of inside the broader context of the market development and general financial surroundings.

Sensible Purposes in Buying and selling and Funding Methods:

Candlestick patterns might be built-in into varied buying and selling methods:

-

Swing Buying and selling: Figuring out potential reversal patterns may help swing merchants time their entries and exits successfully.

-

Day Buying and selling: Quick-term merchants can make the most of candlestick patterns to determine intraday alternatives.

-

Place Buying and selling: Lengthy-term traders can use candlestick patterns to substantiate main development adjustments.

-

Danger Administration: Understanding candlestick patterns may help in setting stop-loss orders and managing threat successfully.

Conclusion:

Candlestick chart evaluation is a strong software for understanding market dynamics and making knowledgeable buying and selling choices. Whereas not a foolproof technique, mastering the artwork of candlestick interpretation can considerably improve a dealer’s potential to determine potential alternatives and handle threat. Nonetheless, it is essential to mix candlestick evaluation with different technical indicators and basic evaluation to make well-rounded and knowledgeable funding selections. Steady studying and apply are important to develop proficiency on this invaluable facet of technical evaluation. Keep in mind, self-discipline, threat administration, and a complete method are key to success in any market.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Candlestick Chart: A Complete Information to Technical Evaluation. We recognize your consideration to our article. See you in our subsequent article!