Decoding the Cup and Deal with Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the Cup and Deal with Chart Sample: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Cup and Deal with Chart Sample: A Complete Information for Merchants. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Cup and Deal with Chart Sample: A Complete Information for Merchants

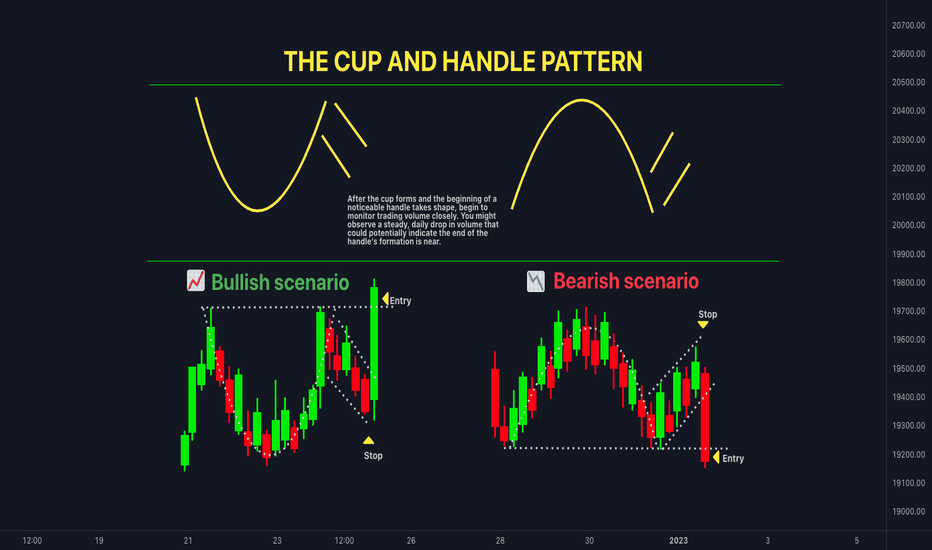

The cup and deal with chart sample is a well-liked technical evaluation device utilized by merchants to determine potential bullish reversals within the worth of an asset. Acknowledged for its distinct visible illustration, this sample suggests a interval of consolidation adopted by a breakout, hinting at a future worth improve. Whereas not a foolproof predictor, mastering the identification and interpretation of the cup and deal with can considerably improve a dealer’s capability to capitalize on market alternatives. This text will delve deep into the intricacies of this sample, exploring its formation, identification standards, variations, limitations, and sensible functions.

Understanding the Anatomy of the Cup and Deal with

The cup and deal with sample resembles, as its identify suggests, a cup with a deal with. Let’s dissect the person parts:

-

The Cup: That is the rounded, U-shaped formation representing a interval of worth consolidation or sideways buying and selling. Ideally, the cup needs to be comparatively symmetrical, with a easy curve reasonably than sharp angles. The depth of the cup is essential; a deeper cup typically implies a extra vital correction earlier than the bullish reversal. Sometimes, the depth of the cup needs to be between one-third and one-half of the previous uptrend’s peak.

-

The Deal with: This can be a brief, downward sloping consolidation interval following the cup. The deal with is usually lower than half the depth of the cup and lasts for a number of days or even weeks. It is characterised by decrease quantity than the cup’s formation, suggesting much less aggressive promoting stress. The deal with acts as a interval of accumulation, the place traders purchase at barely decrease costs earlier than the anticipated breakout.

-

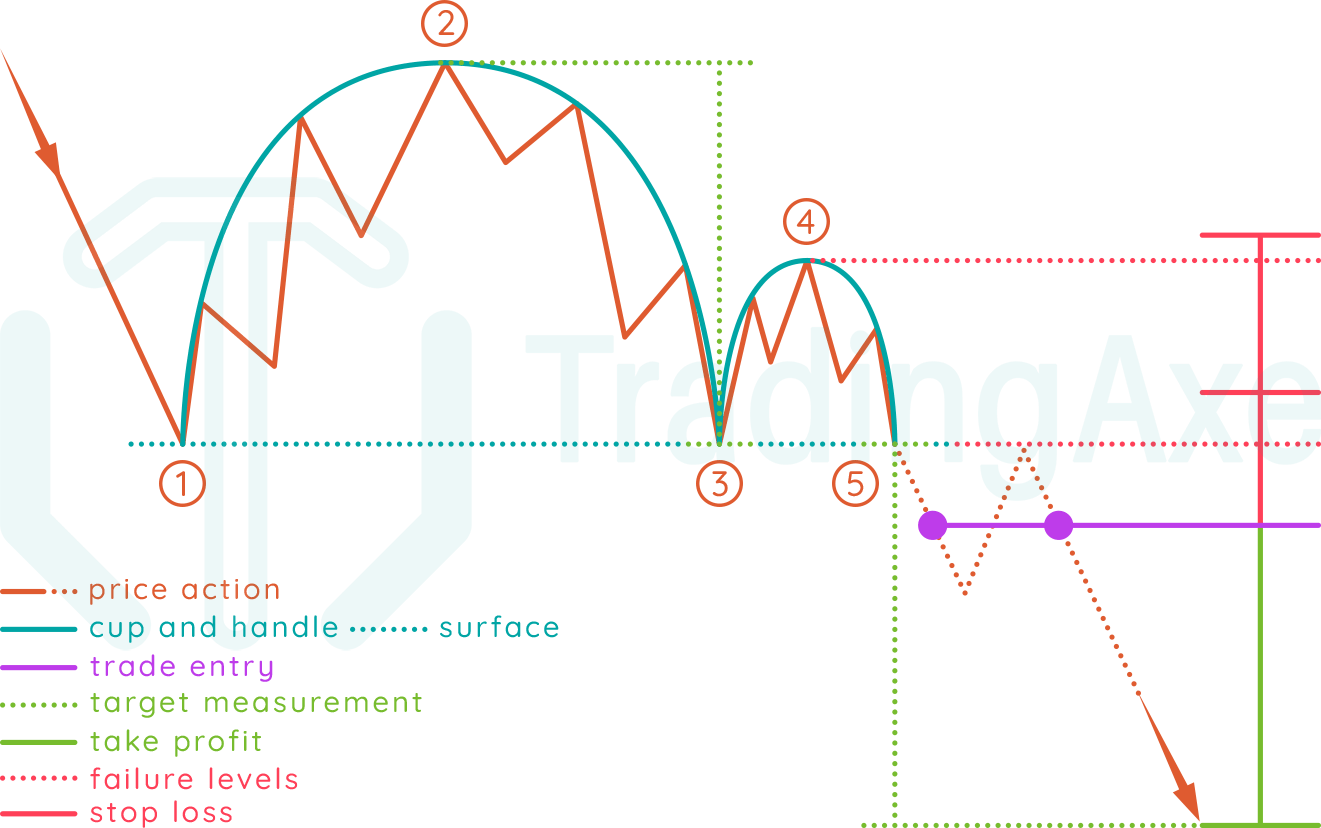

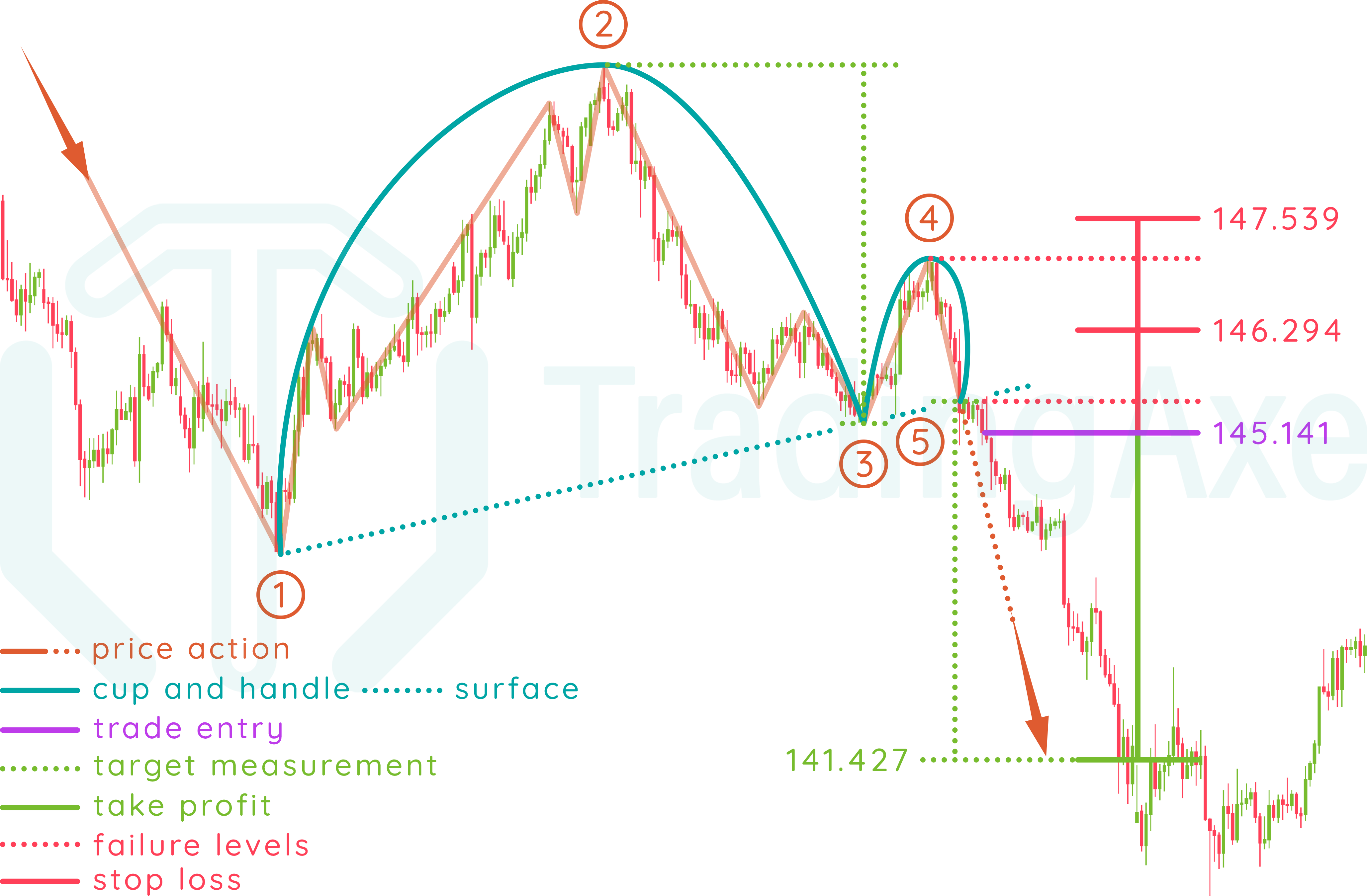

The Breakout: The bullish sign is triggered when the value breaks above the resistance line shaped by the deal with’s excessive level. This breakout often accompanies a major improve in buying and selling quantity, confirming the power of the shopping for stress. The goal worth after the breakout is usually projected utilizing the depth of the cup as a measure. That is decided by measuring the vertical distance from the underside of the cup to the breakout level and including that distance to the breakout worth.

Key Traits for Figuring out a Legitimate Cup and Deal with Sample:

Whereas the visible illustration is essential, a number of key traits should be current to verify a sound cup and deal with sample:

- U-Formed Cup: The cup ought to have a comparatively symmetrical, U-shaped formation, avoiding sharp angles or V-shaped bottoms.

- Constant Quantity: Whereas quantity would possibly fluctuate inside the cup, a common lower in quantity in the course of the deal with formation is fascinating. A major surge in quantity in the course of the breakout confirms the sample’s validity.

- Clear Resistance Line: The deal with ought to kind a transparent resistance line, performing because the essential breakout level.

- Deal with Period: The deal with’s period is usually shorter than the cup’s formation, often lasting a number of days or even weeks.

- Deal with Depth: The deal with needs to be shallower than the cup, ideally lower than half its depth.

- Upward Pattern Previous the Cup: A previous established uptrend is important. The cup and deal with characterize a short lived pause or consolidation inside a bigger bullish development.

Variations of the Cup and Deal with Sample:

Whereas the traditional cup and deal with sample is well recognizable, variations exist:

- Inverse Cup and Deal with: This can be a bearish counterpart of the sample, indicating a possible worth decline. It is characterised by an inverted U-shaped cup and a deal with pointing upwards.

- Asymmetrical Cup: Not all cups are completely symmetrical. Slight asymmetries are acceptable so long as the general form resembles a U and the opposite standards are met.

- Double Cup and Deal with: Generally, a inventory would possibly kind two consecutive cup and deal with patterns, indicating robust bullish momentum.

- Shallow Cup and Deal with: These patterns have shallower cups, signifying much less vital corrections earlier than the breakout.

Limitations and Issues:

It is essential to keep in mind that the cup and deal with sample is just not a assured predictor of future worth actions. A number of limitations want consideration:

- Subjectivity: Figuring out the sample could be subjective, significantly in figuring out the cup’s depth and the deal with’s period. Totally different merchants could interpret the identical chart in a different way.

- False Breakouts: The worth would possibly break above the deal with’s resistance line solely to shortly revert again, resulting in a false sign. That is why confirming the breakout with elevated quantity is essential.

- Time Body Dependency: The sample’s effectiveness varies throughout totally different timeframes. What would possibly seem as a cup and deal with on a every day chart may not be evident on a weekly or month-to-month chart.

- Market Context: The sample needs to be analyzed inside the broader market context. Bearish market situations would possibly negate the bullish sign of a cup and deal with.

Sensible Purposes and Buying and selling Methods:

The cup and deal with sample is usually used together with different technical indicators to verify the buying and selling sign. Listed below are some sensible functions:

- Entry Level: The best entry level is after the value breaks above the deal with’s resistance line with elevated quantity.

- Cease-Loss Order: A stop-loss order needs to be positioned under the deal with’s low level to restrict potential losses if the breakout fails.

- Goal Value: The goal worth is usually projected by including the depth of the cup to the breakout worth.

- Affirmation with Indicators: Utilizing indicators just like the Relative Power Index (RSI) or Transferring Common Convergence Divergence (MACD) might help affirm the bullish sign.

Conclusion:

The cup and deal with chart sample is a helpful device for figuring out potential bullish reversals in asset costs. Whereas not infallible, understanding its traits, variations, and limitations is essential for profitable implementation. By combining the sample’s visible illustration with different technical indicators and sound danger administration practices, merchants can considerably enhance their possibilities of capitalizing on worthwhile buying and selling alternatives. Keep in mind that thorough evaluation, coupled with a complete understanding of market dynamics, is important for making knowledgeable buying and selling choices. All the time follow accountable buying and selling and think about consulting with a monetary advisor earlier than making any funding choices. The knowledge supplied on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation.

![]()

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Cup and Deal with Chart Sample: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!