Decoding the Dance: Gold Worth and Inventory Market Correlation – A 2000-Phrase Exploration

Associated Articles: Decoding the Dance: Gold Worth and Inventory Market Correlation – A 2000-Phrase Exploration

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Dance: Gold Worth and Inventory Market Correlation – A 2000-Phrase Exploration. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Dance: Gold Worth and Inventory Market Correlation – A 2000-Phrase Exploration

Gold, a timeless image of wealth and stability, and the inventory market, a barometer of financial dynamism, usually exhibit a fancy and fluctuating relationship. Whereas typically shifting in tandem, they often diverge, creating alternatives and challenges for traders searching for to diversify their portfolios and navigate market uncertainty. Understanding the correlation between gold costs and inventory market efficiency is essential for making knowledgeable funding choices. This text delves deep into this relationship, exploring historic tendencies, influencing elements, and the implications for traders.

Historic Perspective: A Shifting Correlation

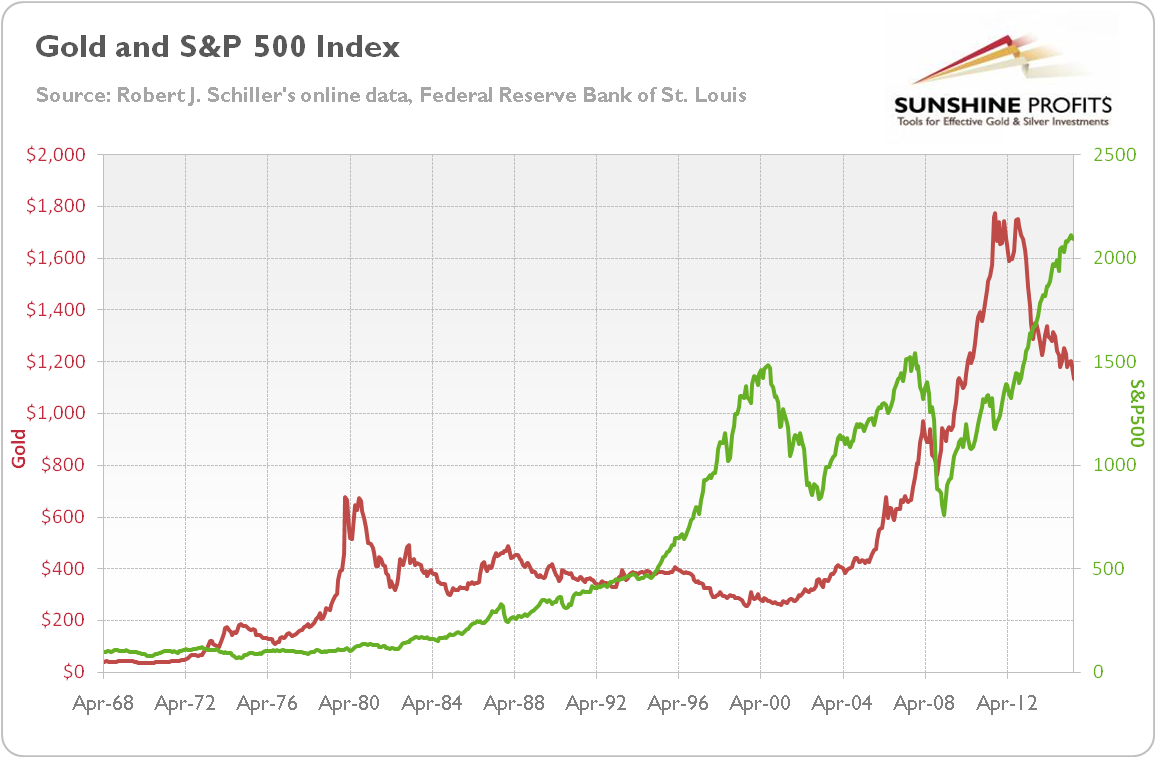

The correlation between gold costs and inventory market indices, such because the S&P 500 or the Dow Jones Industrial Common, will not be static. It varies considerably over time, influenced by a mess of financial and geopolitical elements. Analyzing historic knowledge reveals intervals of constructive correlation (each belongings shifting in the identical route), damaging correlation (shifting in reverse instructions), and intervals of near-zero correlation (no discernible relationship).

As an illustration, in periods of financial enlargement and powerful company earnings, the inventory market usually outperforms gold. Buyers are extra keen to tackle danger, pouring cash into equities anticipating larger returns. Gold, perceived as a safe-haven asset, may even see comparatively muted value will increase and even slight declines throughout such bullish intervals. This results in a damaging correlation.

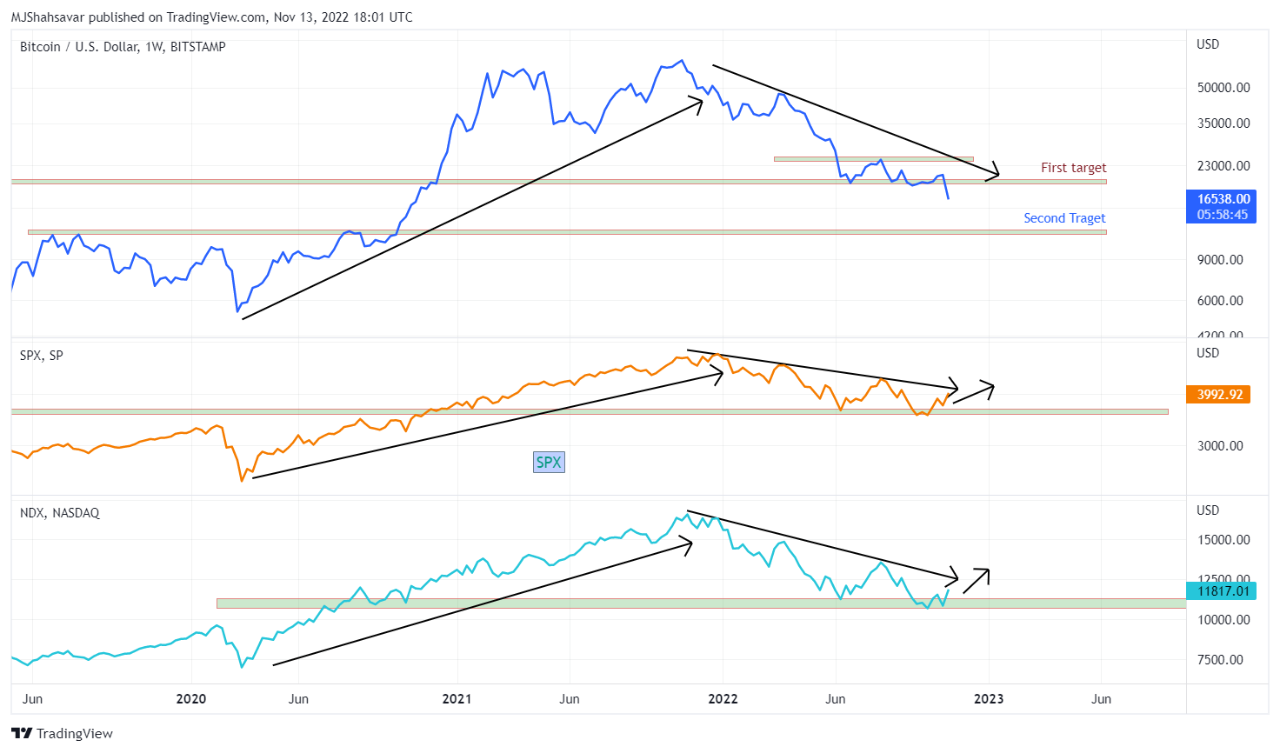

Conversely, throughout financial downturns, recessions, or intervals of excessive market volatility, the correlation usually turns constructive. As traders flee from the perceived danger of equities, they search the security and stability supplied by gold, driving up its value. This "flight to security" phenomenon is clearly evident throughout main monetary crises just like the 2008 international monetary disaster and the COVID-19 pandemic-induced market crash in 2020. In these cases, gold acted as a hedge in opposition to losses within the inventory market.

Components Influencing the Correlation:

The correlation between gold and the inventory market will not be merely a matter of probability. A number of key elements contribute to the dynamic interaction between these two asset lessons:

-

Inflation: Inflation is a major driver of gold costs. When inflation rises, the buying energy of fiat currencies decreases, making gold, a tangible asset with inherent worth, a extra enticing funding. Excessive inflation usually coincides with a weakening inventory market as rising rates of interest and elevated uncertainty dampen company income and investor sentiment. This contributes to a constructive correlation.

-

Curiosity Charges: Rates of interest and gold costs typically have an inverse relationship. Greater rates of interest improve the chance price of holding non-interest-bearing belongings like gold, as traders can earn larger returns from interest-bearing devices. This will result in a decline in gold costs, whereas concurrently impacting inventory market efficiency. Rising charges can curb financial progress, probably negatively impacting company earnings and inventory costs, thus fostering a constructive correlation between gold and inventory market declines.

-

US Greenback Energy: The US greenback’s energy has a major impression on gold costs, as gold is often priced in US {dollars}. A stronger greenback makes gold dearer for traders holding different currencies, probably suppressing demand and resulting in decrease gold costs. Conversely, a weakening greenback usually boosts gold costs. The impression on the inventory market is much less direct, however a powerful greenback can typically harm multinational companies’ earnings, probably resulting in a damaging correlation between gold and inventory costs in such situations.

-

Geopolitical Uncertainty: Geopolitical occasions, resembling wars, political instability, or terrorist assaults, usually set off a "flight to security" phenomenon, driving traders in direction of safe-haven belongings like gold. This will result in a constructive correlation between gold costs and inventory market declines, as uncertainty and danger aversion dominate market sentiment.

-

Provide and Demand: The availability and demand dynamics of gold additionally play a vital position. Components resembling gold mining manufacturing, central financial institution purchases, and jewellery demand affect the general provide and value of gold. These elements can impression the correlation with the inventory market, notably if important provide shocks or modifications in demand happen concurrently with main inventory market occasions.

-

Investor Sentiment: Investor psychology performs a major position. Worry, uncertainty, and doubt (FUD) can drive traders in direction of gold, making a constructive correlation with market declines. Conversely, intervals of optimism and danger urge for food can result in a damaging correlation as traders shift their focus in direction of higher-growth belongings.

Implications for Buyers:

Understanding the dynamic correlation between gold and the inventory market is significant for traders searching for to optimize their portfolio allocation and danger administration methods. The shortage of a constant correlation highlights the significance of diversification.

-

Diversification: Holding a portfolio that features each gold and shares can assist cut back general portfolio volatility. During times of inventory market decline, gold can act as a buffer, limiting potential losses. Nevertheless, it is essential to keep in mind that gold’s returns are typically decrease than equities over the long run.

-

Hedging in opposition to Inflation: Gold can function a hedge in opposition to inflation, notably in periods of rising costs. This makes it a priceless addition to a portfolio for traders involved about inflation eroding the buying energy of their investments.

-

Danger Administration: Gold’s position as a safe-haven asset makes it a useful gizmo for danger administration. Buyers can allocate a portion of their portfolio to gold to scale back publicity to market volatility and defend in opposition to potential losses in periods of financial uncertainty.

-

Strategic Allocation: The optimum allocation to gold will depend on particular person danger tolerance, funding objectives, and market outlook. Buyers with a better danger tolerance would possibly allocate a smaller share to gold, whereas these searching for larger safety in opposition to market downturns could select a bigger allocation.

Chart Evaluation: Unveiling the Developments

Analyzing historic charts exhibiting gold costs and a serious inventory market index (e.g., S&P 500) side-by-side can reveal the fluctuating correlation. Intervals of constructive correlation will present each belongings shifting in related instructions, whereas damaging correlation will present them shifting in reverse instructions. particular occasions – financial crises, geopolitical upheavals, or modifications in financial coverage – can present insights into how these occasions influenced the correlation at particular deadlines. Moreover, calculating the correlation coefficient (a statistical measure starting from -1 to +1) over totally different time intervals can quantify the energy and route of the connection. A coefficient near +1 signifies robust constructive correlation, -1 signifies robust damaging correlation, and 0 signifies no correlation. Nevertheless, it is essential to keep in mind that previous correlation will not be essentially indicative of future efficiency.

Conclusion:

The connection between gold costs and the inventory market is intricate and ever-changing. Whereas there isn’t any assured correlation, understanding the elements influencing this dynamic is vital for traders. Diversification, strategic allocation, and a radical understanding of market situations are key to successfully using gold inside a well-rounded funding portfolio. By fastidiously monitoring financial indicators, geopolitical occasions, and investor sentiment, traders could make extra knowledgeable choices about their gold holdings and navigate the complexities of the market panorama. Do not forget that skilled monetary recommendation ought to at all times be sought earlier than making any important funding choices. The knowledge offered on this article is for instructional functions solely and shouldn’t be thought-about as monetary recommendation.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Dance: Gold Worth and Inventory Market Correlation – A 2000-Phrase Exploration. We recognize your consideration to our article. See you in our subsequent article!