Decoding the Dow Jones Chart: A Complete Information

Associated Articles: Decoding the Dow Jones Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Dow Jones Chart: A Complete Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Dow Jones Chart: A Complete Information

The Dow Jones Industrial Common (DJIA), typically merely known as the "Dow," is a inventory market index that tracks the efficiency of 30 giant, publicly-owned firms based mostly in america. It is arguably essentially the most extensively adopted barometer of the U.S. economic system and international market sentiment. Understanding learn how to interpret a Dow Jones chart is essential for buyers, analysts, and anybody fascinated with monitoring the well being of the American economic system. This text will delve into the intricacies of the Dow Jones chart, exploring its historical past, elements, calculation, interpretation, and its position in broader market evaluation.

A Temporary Historical past and Composition:

The Dow Jones Industrial Common was first calculated in 1896 by Charles Dow, co-founder of Dow Jones & Firm, and initially comprised 12 firms. Over time, the composition has been adjusted to replicate modifications within the American economic system. Corporations are added or eliminated based mostly on elements like market capitalization, sector illustration, and general financial significance. This course of, whereas rare, ensures the index stays a related reflection of the U.S. enterprise panorama. Presently, the index features a numerous vary of sectors, together with expertise (Apple, Microsoft), finance (Goldman Sachs, JPMorgan Chase), industrials (Boeing, Caterpillar), client items (Coca-Cola, Nike), and healthcare (Johnson & Johnson, UnitedHealth Group). The choice course of is rigorously scrutinized, aiming for a stability that represents the broader market whereas sustaining a manageable variety of elements.

Understanding the Chart’s Elements:

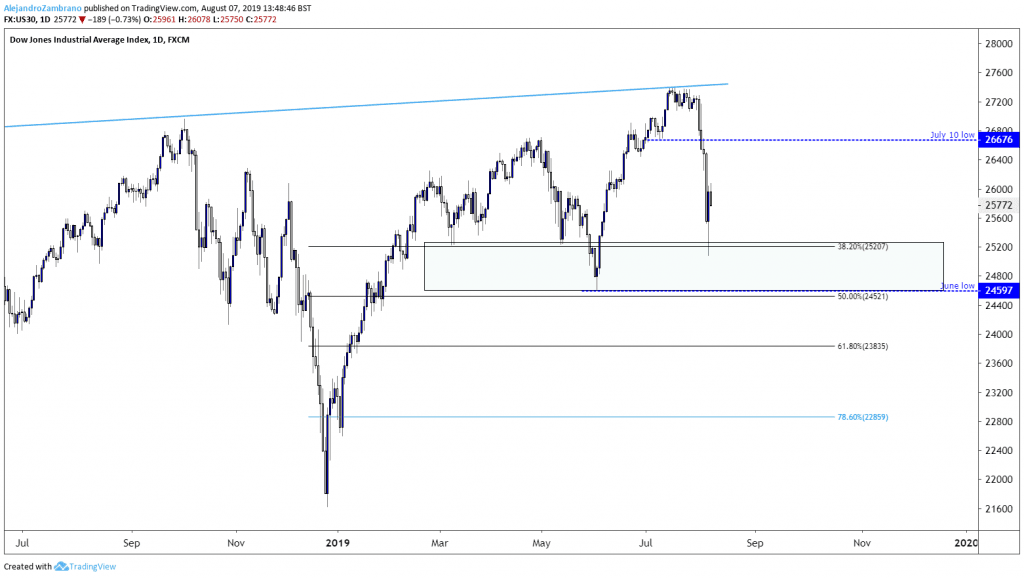

A typical Dow Jones chart shows the index’s worth over time, normally plotted towards a date or time axis. The chart itself is a visible illustration of the index’s value actions, offering insights into tendencies, volatility, and potential turning factors. Key elements of a Dow Jones chart embrace:

- Worth Axis (Y-axis): This vertical axis represents the worth of the Dow Jones Industrial Common at any given cut-off date. The size is often adjusted to suit the vary of values being displayed.

- Time Axis (X-axis): This horizontal axis represents the time interval lined by the chart, which might vary from a number of days to a number of a long time. The size is normally adjusted to offer readability and readability.

- Worth Candlesticks or Line Graph: Most Dow Jones charts make the most of both candlestick charts or line graphs to signify the value actions. Candlesticks show the opening, closing, excessive, and low costs for a particular interval (e.g., a day, week, or month). Line graphs join the closing costs of consecutive durations, offering a smoother illustration of the general development.

- Transferring Averages: Usually overlaid on the chart are shifting averages, which easy out value fluctuations and assist establish tendencies. Frequent shifting averages embrace the 50-day and 200-day shifting averages. Crossovers between these shifting averages can sign potential purchase or promote indicators, though they need to be used at the side of different technical indicators.

- Technical Indicators: Many charts incorporate further technical indicators, resembling Relative Energy Index (RSI), MACD (Transferring Common Convergence Divergence), and Bollinger Bands. These indicators present insights into momentum, overbought/oversold situations, and volatility, serving to merchants and buyers make knowledgeable selections.

- Quantity: Whereas not all the time displayed immediately on the value chart, buying and selling quantity is an important factor. Excessive quantity throughout value will increase suggests robust shopping for strain, whereas excessive quantity throughout value decreases suggests robust promoting strain. Quantity information can be utilized to substantiate tendencies and establish potential reversals.

Calculating the Dow Jones Common:

Not like different market indices that use market capitalization-weighted strategies, the Dow Jones Industrial Common employs a price-weighted methodology. Which means the index’s worth is calculated by summing the costs of all 30 element shares and dividing by a divisor. The divisor is a consistently adjusted issue that accounts for inventory splits, dividends, and different company actions. This ensures the index’s worth stays constant regardless of modifications within the underlying firms’ share constructions. The worth-weighted methodology offers larger weight to higher-priced shares, which might typically result in distortions in representing the general market efficiency in comparison with market capitalization-weighted indices just like the S&P 500.

Deciphering the Dow Jones Chart:

Deciphering a Dow Jones chart entails analyzing its numerous elements to establish tendencies, patterns, and potential buying and selling alternatives. Key elements to think about embrace:

- Development Identification: Figuring out the general development (uptrend, downtrend, or sideways development) is essential. This may be completed by visually inspecting the chart, utilizing shifting averages, or making use of trendline evaluation.

- Assist and Resistance Ranges: These are value ranges the place the Dow has traditionally struggled to interrupt via. Assist ranges signify value flooring the place shopping for strain tends to beat promoting strain, whereas resistance ranges signify value ceilings the place promoting strain tends to beat shopping for strain.

- Chart Patterns: Numerous chart patterns, resembling head and shoulders, double tops/bottoms, and triangles, can present insights into potential future value actions. Recognizing these patterns requires expertise and follow.

- Quantity Evaluation: Excessive quantity accompanying value will increase confirms the energy of the uptrend, whereas excessive quantity accompanying value decreases confirms the energy of the downtrend. Low quantity throughout value actions suggests weaker tendencies and potential reversals.

- Correlation with Different Markets: The Dow Jones Industrial Common is usually correlated with different international markets. Analyzing the efficiency of different indices, such because the S&P 500, Nasdaq Composite, and worldwide indices, can present a broader perspective on market sentiment.

The Dow Jones Chart’s Function in Broader Market Evaluation:

The Dow Jones chart serves as a key indicator for understanding broader market sentiment and financial well being. Its actions are sometimes intently adopted by buyers, analysts, and policymakers. A rising Dow is mostly interpreted as an indication of financial optimism and investor confidence, whereas a falling Dow can sign issues concerning the economic system and potential market corrections. Nonetheless, it is essential to keep in mind that the Dow is only one indicator, and it is vital to think about different elements, resembling macroeconomic information, geopolitical occasions, and industry-specific information, when making funding selections.

Limitations of the Dow Jones Chart:

Whereas the Dow Jones chart offers useful insights, it is vital to acknowledge its limitations:

- Worth-Weighted Methodology: The worth-weighted methodology can disproportionately affect the index’s worth based mostly on the value of particular person shares, not their general market capitalization.

- Restricted Illustration: The index solely contains 30 firms, representing a comparatively small phase of the general U.S. inventory market. The S&P 500, with its 500 elements, offers a broader illustration.

- Susceptibility to Manipulation: Whereas manipulation is much less possible with a big index just like the Dow, particular person inventory value actions can nonetheless affect the general index.

- Lagging Indicator: The Dow, like many market indices, is usually thought of a lagging indicator, which means it displays previous efficiency slightly than predicting future actions.

Conclusion:

The Dow Jones chart is a robust instrument for understanding the U.S. inventory market and broader financial tendencies. By understanding its historical past, composition, calculation, and interpretation strategies, buyers can achieve useful insights into market sentiment and potential funding alternatives. Nonetheless, it is essential to make use of the Dow Jones chart at the side of different indicators and analyses, recognizing its limitations and avoiding overreliance on any single metric. A complete strategy, incorporating elementary and technical evaluation, is important for making knowledgeable funding selections. Steady studying and adaptation are key to navigating the complexities of the monetary markets and successfully deciphering the precious info offered by the Dow Jones chart.

Closure

Thus, we hope this text has offered useful insights into Decoding the Dow Jones Chart: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!