Decoding the Rising Markets Index Chart: A Journey By means of Progress, Volatility, and Alternative

Associated Articles: Decoding the Rising Markets Index Chart: A Journey By means of Progress, Volatility, and Alternative

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Rising Markets Index Chart: A Journey By means of Progress, Volatility, and Alternative. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Rising Markets Index Chart: A Journey By means of Progress, Volatility, and Alternative

Rising markets, a vibrant tapestry of growing economies throughout the globe, provide a singular mix of excessive development potential and inherent volatility. Understanding their efficiency requires a deep dive into the indices that monitor them, charting a course by fluctuating financial landscapes, geopolitical shifts, and evolving investor sentiment. This text will discover the complexities of rising market index charts, analyzing their historic efficiency, figuring out key drivers of their motion, and assessing the alternatives and dangers they current to traders.

Understanding the Panorama: Main Rising Market Indices

A number of indices function benchmarks for rising market efficiency, every with its personal methodology and constituent elements. Essentially the most outstanding embody:

-

MSCI Rising Markets Index (MSCI EM): That is arguably probably the most extensively adopted rising market index, encompassing a broad vary of huge and mid-cap firms throughout numerous sectors and nations. Its methodology focuses on market capitalization weighting, that means bigger firms have a higher affect on the index’s total efficiency. The MSCI EM is often used as a benchmark for actively managed rising market funds and ETFs.

-

FTSE Rising Markets Index: One other important index, the FTSE Rising Markets Index, presents a barely totally different perspective, using its personal proprietary methodology for choosing and weighting constituents. Variations in methodology can result in variations in efficiency in comparison with the MSCI EM.

-

S&P Rising Markets BMI: The S&P Rising Markets BMI (Broad Market Index) differs from the MSCI and FTSE indices by together with a wider vary of firms, together with smaller-cap shares. This broader illustration can provide a extra complete view of rising market efficiency, however it could additionally introduce higher volatility.

-

Regional Indices: Past world indices, traders can even monitor regional rising market indices, such because the MSCI Latin America Index, MSCI Asia ex-Japan Index, or MSCI Africa Index. These indices present extra granular insights into particular geographic areas, permitting for focused funding methods.

Decoding the Chart: Key Components Influencing Efficiency

The trajectory of an rising market index chart isn’t linear. Its fluctuations mirror a fancy interaction of macroeconomic components, geopolitical occasions, and investor sentiment. Analyzing the chart requires understanding these key drivers:

-

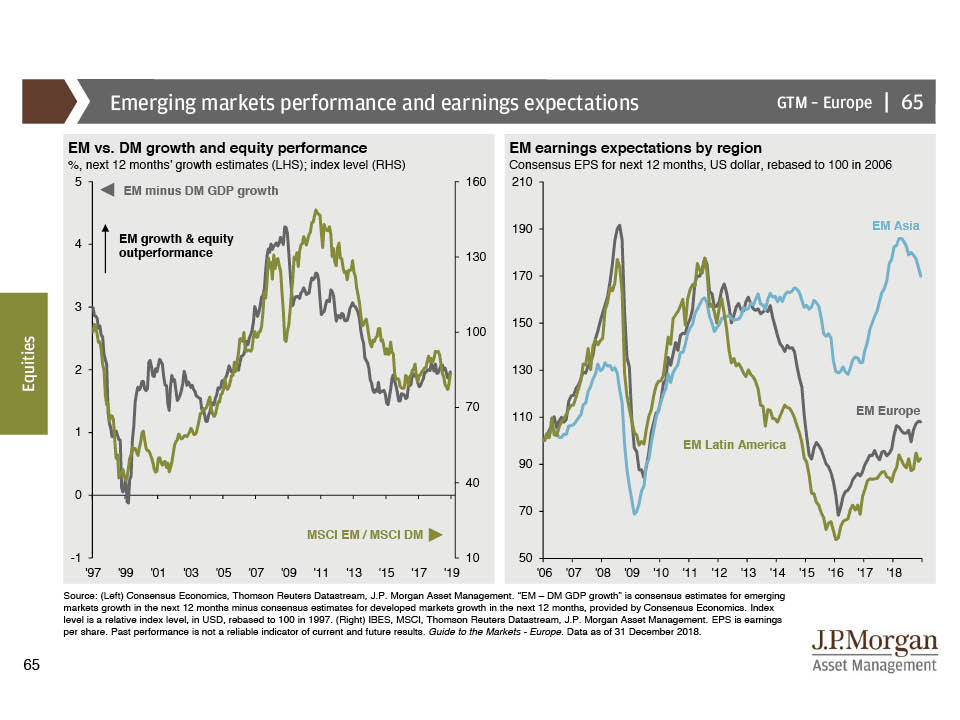

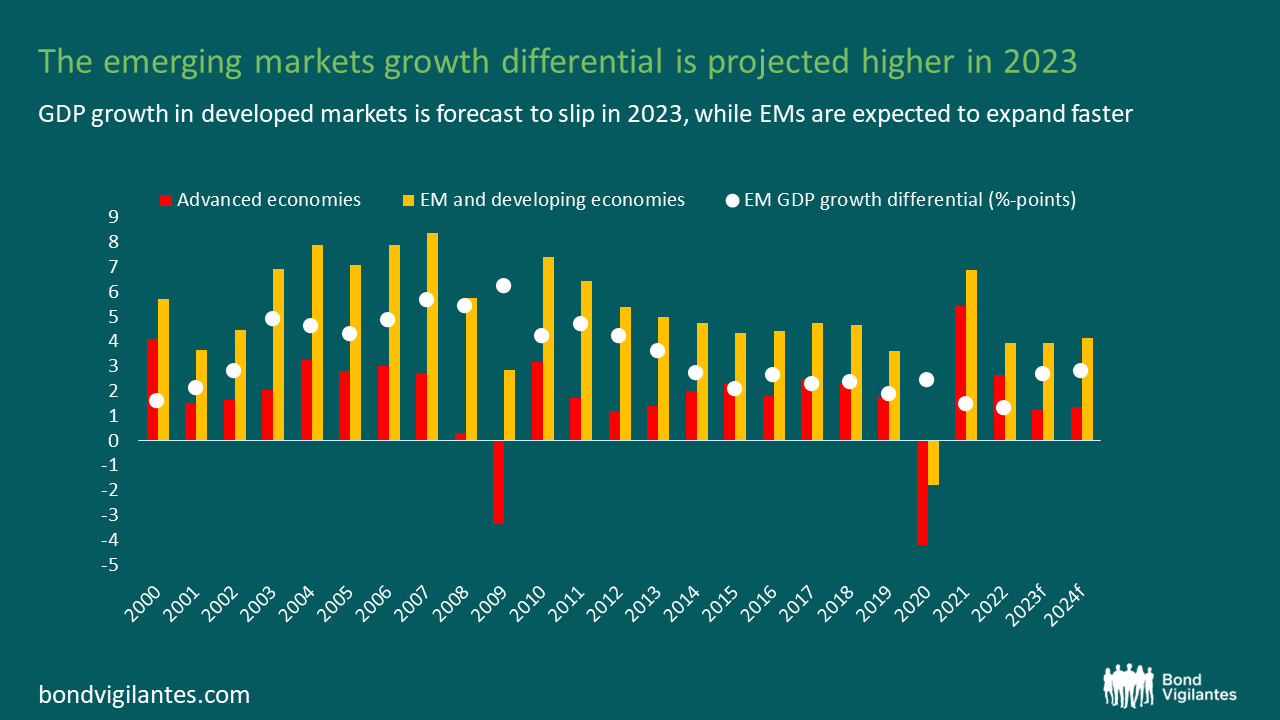

Financial Progress: The first driver of rising market efficiency is the speed of financial development throughout the constituent nations. Greater GDP development typically interprets to stronger company earnings, resulting in greater index values. Nonetheless, uneven development throughout totally different nations throughout the index can complicate the general image.

-

Commodity Costs: Many rising market economies are closely reliant on commodity exports (e.g., oil, metals, agricultural merchandise). Fluctuations in commodity costs considerably influence their financial efficiency and, consequently, the efficiency of their respective indices. A surge in commodity costs can enhance financial development and index values, whereas a decline can set off a downturn.

-

Curiosity Charges and Financial Coverage: Rate of interest modifications by central banks in each rising and developed markets affect capital flows into and out of rising markets. Greater rates of interest in developed markets can appeal to funding away from rising markets, resulting in a decline in index values. Conversely, decrease rates of interest can stimulate funding in rising markets.

-

Political Stability and Threat: Political instability, corruption, and geopolitical dangers are important components affecting investor confidence and capital flows. Political uncertainty can result in capital flight and a decline in index values. Conversely, secure political environments have a tendency to draw international funding and enhance index efficiency.

-

Foreign money Fluctuations: Modifications in change charges between the currencies of rising market nations and main currencies just like the US greenback considerably influence the efficiency of indices denominated in US {dollars}. A weakening of an rising market forex in opposition to the greenback can scale back the greenback worth of returns, even when the underlying financial efficiency is robust.

-

International Market Sentiment: The general temper in world monetary markets performs an important position. Durations of worldwide threat aversion usually result in capital flight from rising markets, leading to a decline in index values. Conversely, durations of optimism and elevated threat urge for food can drive funding into rising markets, boosting index efficiency.

Analyzing Historic Developments: Classes from the Previous

Analyzing historic rising market index charts reveals recurring patterns and cycles. Durations of speedy development have usually been adopted by corrections, reflecting the inherent volatility of those markets. Finding out these historic developments can present precious insights into potential future eventualities:

-

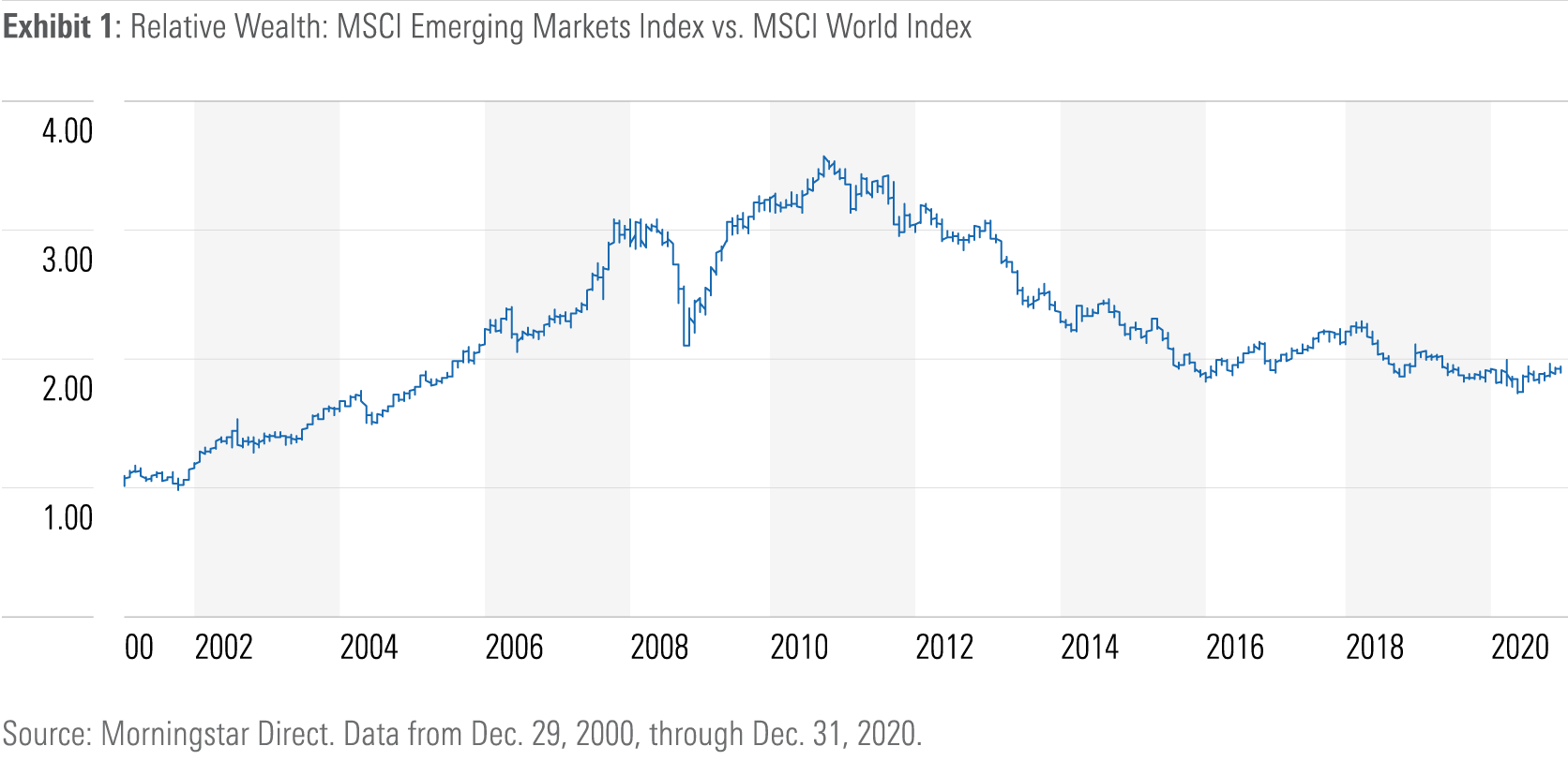

Rising Market Crises: Previous crises, such because the Asian Monetary Disaster of 1997-98 and the International Monetary Disaster of 2008-09, highlighted the vulnerability of rising markets to world shocks. These occasions usually resulted in sharp declines in index values, underscoring the significance of threat administration.

-

Cycles of Progress and Correction: Rising market indices are likely to exhibit durations of robust development adopted by durations of correction or consolidation. Understanding these cycles is essential for traders in search of to navigate the inherent volatility.

-

Lengthy-Time period Progress Potential: Regardless of the volatility, rising markets have traditionally demonstrated robust long-term development potential, pushed by components corresponding to inhabitants development, rising incomes, and industrialization. This long-term perspective is essential for long-term traders.

Alternatives and Dangers: Navigating the Rising Market Panorama

Investing in rising markets presents each important alternatives and appreciable dangers.

Alternatives:

-

Excessive Progress Potential: Rising markets provide the potential for greater returns in comparison with developed markets, pushed by quicker financial development and increasing shopper bases.

-

Diversification Advantages: Investing in rising markets can improve portfolio diversification, lowering total threat by lowering correlation with developed market belongings.

-

Entry to Untapped Potential: Rising markets provide entry to firms and sectors that might not be available in developed markets, offering distinctive funding alternatives.

Dangers:

-

Volatility: Rising markets are inherently extra risky than developed markets, topic to higher fluctuations because of financial, political, and geopolitical components.

-

Liquidity Threat: Liquidity generally is a concern in some rising markets, making it difficult to purchase or promote belongings rapidly at favorable costs.

-

Foreign money Threat: Fluctuations in change charges can considerably influence returns for traders whose residence forex differs from the forex of the funding.

-

Political and Geopolitical Threat: Political instability, corruption, and geopolitical occasions can negatively influence funding returns.

Conclusion: A Strategic Method to Rising Market Investing

Rising market index charts present a precious instrument for understanding the efficiency and potential of those dynamic economies. Nonetheless, decoding these charts requires a nuanced understanding of the advanced interaction of things that drive their actions. Buyers ought to undertake a long-term perspective, rigorously assess their threat tolerance, and diversify their investments throughout totally different rising markets and asset courses. Skilled monetary recommendation is really useful for these in search of to navigate the complexities of rising market investing. By rigorously contemplating the alternatives and dangers, traders can doubtlessly harness the numerous development potential whereas mitigating the inherent volatility of this thrilling and dynamic asset class. Steady monitoring of the index charts, coupled with elementary and macroeconomic evaluation, is important for knowledgeable decision-making on this ever-evolving funding panorama.

Closure

Thus, we hope this text has offered precious insights into Decoding the Rising Markets Index Chart: A Journey By means of Progress, Volatility, and Alternative. We recognize your consideration to our article. See you in our subsequent article!