Decoding the EUR/USD OTC Dwell Chart: A Deep Dive into the Over-the-Counter Market

Associated Articles: Decoding the EUR/USD OTC Dwell Chart: A Deep Dive into the Over-the-Counter Market

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the EUR/USD OTC Dwell Chart: A Deep Dive into the Over-the-Counter Market. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the EUR/USD OTC Dwell Chart: A Deep Dive into the Over-the-Counter Market

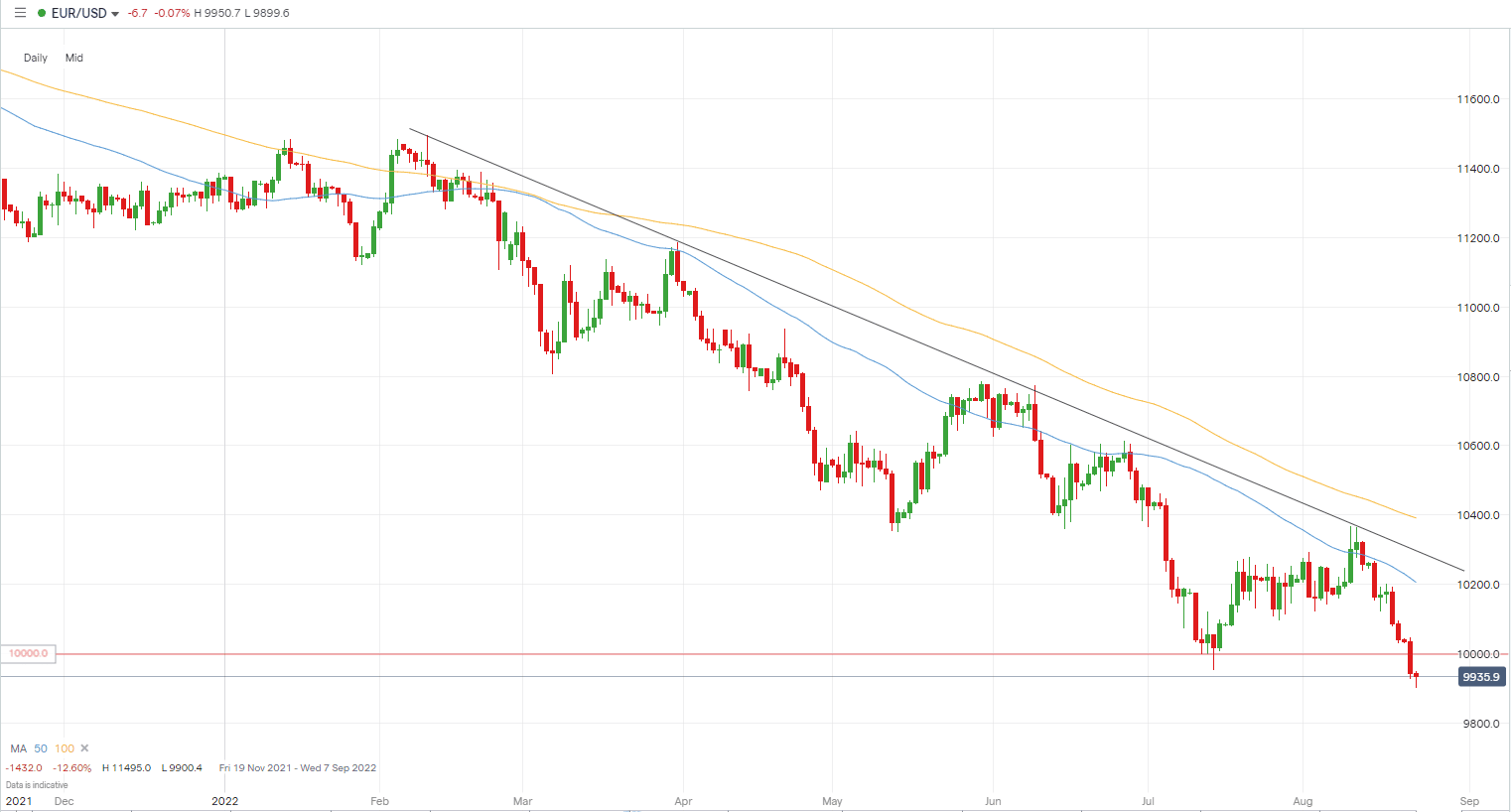

The EUR/USD foreign money pair, representing the Euro in opposition to the US Greenback, is arguably probably the most actively traded pair within the international trade (foreign exchange) market. Whereas a lot of the buying and selling quantity happens on exchanges, a major, and infrequently underestimated, portion takes place within the Over-the-Counter (OTC) market. Understanding the dynamics of the EUR/USD OTC dwell chart requires delving into the intricacies of this decentralized market and the elements influencing its worth actions.

Understanding the OTC Market:

Not like exchanges, the OTC market does not have a centralized location or buying and selling board. As an alternative, transactions happen instantly between two events – usually giant monetary establishments, companies, or high-net-worth people – by way of a community of brokers and sellers. This decentralized nature provides a number of benefits:

- Flexibility and Customization: OTC buying and selling permits for better flexibility when it comes to commerce dimension, execution timing, and contract specs. That is notably enticing for big transactions the place liquidity on exchanges is likely to be inadequate.

- Anonymity: The shortage of a public order e book offers a level of anonymity, which is interesting to those that want to maintain their buying and selling actions non-public.

- Entry to Unique Choices: OTC markets provide entry to a wider vary of economic devices, together with custom-made derivatives and choices not out there on exchanges.

- 24/5 Availability: Not like exchanges with outlined buying and selling hours, the OTC market operates just about 24 hours a day, 5 days every week, catering to international buying and selling wants.

Nonetheless, the OTC market additionally presents sure drawbacks:

- Lack of Transparency: The absence of a centralized order e book makes it troublesome to gauge total market sentiment and liquidity. Worth discovery depends closely on the person quotes supplied by market makers.

- Counterparty Danger: Since transactions happen instantly between two events, there is a greater danger of counterparty default. Creditworthiness of the counterparty turns into an important consideration.

- Regulatory Oversight: Whereas laws are in place, oversight within the OTC market might be much less stringent than on regulated exchanges, probably resulting in greater dangers.

- Liquidity Variations: Whereas usually extremely liquid, liquidity can fluctuate relying on market situations and the provision of counterparties.

Deciphering the EUR/USD OTC Dwell Chart:

A typical EUR/USD OTC dwell chart shows the value of the Euro when it comes to US {Dollars} over time. The chart often incorporates varied technical indicators, permitting merchants to research worth tendencies and potential future actions. Key components to think about when analyzing the chart embrace:

- Worth Motion: Probably the most elementary facet is the value itself. Analyzing worth actions, together with highs, lows, and candlestick patterns, helps determine tendencies (uptrends, downtrends, sideways actions) and potential reversal factors.

- Shifting Averages: Shifting averages, such because the 50-day and 200-day shifting averages, clean out worth fluctuations and spotlight the general pattern. Crossovers between shifting averages can sign potential purchase or promote indicators.

- Relative Power Index (RSI): The RSI is a momentum indicator that helps determine overbought and oversold situations. RSI values above 70 usually counsel an overbought market, whereas values beneath 30 point out an oversold market.

- MACD (Shifting Common Convergence Divergence): The MACD is a trend-following momentum indicator that identifies adjustments within the energy, course, momentum, and period of a pattern. Crossovers of the MACD strains can sign potential purchase or promote alternatives.

- Bollinger Bands: Bollinger Bands measure volatility and present worth deviations from a shifting common. Worth actions outdoors the bands can point out potential breakouts or reversals.

- Quantity: Whereas not all the time available on OTC dwell charts, quantity information offers worthwhile insights into the energy of worth actions. Excessive quantity accompanying worth adjustments confirms the energy of the pattern.

Elements Influencing the EUR/USD OTC Dwell Chart:

Quite a few elements affect the value fluctuations on the EUR/USD OTC dwell chart. These might be broadly categorized as:

- Financial Knowledge: Macroeconomic indicators from each the Eurozone and the US considerably affect the pair. Knowledge releases reminiscent of GDP development, inflation charges, unemployment figures, and manufacturing PMI considerably affect investor sentiment and, consequently, the trade price. Unexpectedly sturdy information from the Eurozone tends to strengthen the Euro, whereas optimistic US information usually strengthens the Greenback.

- Curiosity Fee Differentials: The distinction in rates of interest between the European Central Financial institution (ECB) and the Federal Reserve (Fed) performs an important function. Increased rates of interest in a single area appeal to capital, growing demand for its foreign money and strengthening it relative to the opposite.

- Political Occasions: Geopolitical occasions and political instability inside the Eurozone or the US can considerably affect the EUR/USD trade price. Political uncertainty usually results in elevated volatility and unpredictable worth actions.

- Market Sentiment: General market sentiment, whether or not risk-on or risk-off, influences the pair. During times of danger aversion, traders are likely to flock in the direction of the protection of the US Greenback, resulting in a strengthening of the USD in opposition to the EUR.

- Technical Evaluation: Technical indicators and chart patterns, as mentioned earlier, present insights into potential worth actions and buying and selling alternatives. Technical evaluation is a worthwhile device for merchants navigating the OTC market.

- Intervention by Central Banks: In excessive circumstances, central banks may intervene within the foreign exchange market to affect the trade price. Such interventions can considerably affect the EUR/USD pair.

Challenges and Alternatives in OTC EUR/USD Buying and selling:

Buying and selling EUR/USD within the OTC market presents each challenges and alternatives. The shortage of transparency and the potential for counterparty danger require cautious danger administration methods. Nonetheless, the pliability, customization, and 24/5 availability provide vital benefits for classy merchants.

Conclusion:

The EUR/USD OTC dwell chart offers a dynamic view of one of many world’s most necessary foreign money pairs. Understanding the intricacies of the OTC market, deciphering the chart’s varied indicators, and maintaining abreast of the macroeconomic and geopolitical elements influencing the pair are essential for profitable buying and selling. Whereas the OTC market presents distinctive challenges, its flexibility and entry to personalized devices make it a lovely possibility for knowledgeable merchants keen to navigate its complexities. Profitable buying and selling requires a mix of elementary evaluation, technical evaluation, strong danger administration, and a deep understanding of the market dynamics. It is essential to do not forget that foreign currency trading carries inherent dangers, and losses can exceed preliminary investments. Thorough analysis and probably looking for recommendation from monetary professionals are extremely advisable earlier than participating in any foreign currency trading actions.

:max_bytes(150000):strip_icc()/over-the-countermarket-FINAL-b6f12f01cc464b3b8eff91ad07765fc1.jpg)

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the EUR/USD OTC Dwell Chart: A Deep Dive into the Over-the-Counter Market. We thanks for taking the time to learn this text. See you in our subsequent article!