Decoding the Foreign exchange Market: A Complete Information to Charts and Their Software

Associated Articles: Decoding the Foreign exchange Market: A Complete Information to Charts and Their Software

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the Foreign exchange Market: A Complete Information to Charts and Their Software. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Foreign exchange Market: A Complete Information to Charts and Their Software

The international trade (foreign exchange) market, a worldwide decentralized market for buying and selling currencies, operates 24/5 and boasts unparalleled liquidity. Navigating this dynamic atmosphere requires subtle instruments, and among the many most important are charts. Charts present a visible illustration of worth actions over time, permitting merchants to establish developments, patterns, and potential buying and selling alternatives. Understanding learn how to learn and interpret foreign exchange charts is prime to profitable buying and selling. This text delves into the assorted kinds of charts, their functions, and the important thing indicators used at the side of them to make knowledgeable buying and selling selections.

Forms of Foreign exchange Charts:

A number of chart sorts cater to completely different buying and selling types and analytical preferences. The most typical embrace:

-

Candlestick Charts: These are arguably the preferred chart sort in foreign currency trading. Every candlestick represents a selected time interval (e.g., 1 minute, 5 minutes, 1 hour, 1 day). The candlestick physique signifies the worth vary between the open and shut, whereas the wicks (shadows) present the excessive and low costs for that interval. The colour of the candlestick usually signifies whether or not the worth closed larger (inexperienced or white) or decrease (pink or black) than it opened. Candlestick patterns, equivalent to hammers, dojis, and engulfing patterns, present invaluable insights into potential worth reversals or continuations.

-

Bar Charts: Much like candlestick charts, bar charts show the open, excessive, low, and shut (OHLC) costs for a given interval. Nevertheless, as a substitute of a candlestick physique, they use a vertical bar. The left tick represents the open worth, the precise tick the shut worth, and the highest and backside of the bar characterize the excessive and low, respectively. Whereas much less visually interesting than candlestick charts, bar charts supply the identical elementary data.

-

Line Charts: These charts join the closing costs of every interval with a steady line. They’re easier than candlestick or bar charts and are finest suited to figuring out long-term developments. Whereas they do not present the intra-period excessive and low, they supply a transparent image of the general worth route.

Timeframes and Their Significance:

The timeframe chosen considerably impacts the knowledge offered on the chart. Completely different timeframes reveal completely different features of market habits:

-

Quick-term Timeframes (e.g., 1-minute, 5-minute, 15-minute): These are perfect for scalping and day buying and selling, specializing in short-term worth fluctuations and fast revenue alternatives. Noise (random worth actions) is extra outstanding on these timeframes.

-

Medium-term Timeframes (e.g., 30-minute, 1-hour, 4-hour): These permit merchants to establish intermediate-term developments and patterns, appropriate for swing buying and selling methods. The noise is much less important than on short-term charts.

-

Lengthy-term Timeframes (e.g., each day, weekly, month-to-month): These deal with long-term developments and are most popular by place merchants who maintain positions for prolonged durations. Noise is minimal, and the general market route is clearer.

Selecting the suitable timeframe is essential. A dealer specializing in long-term investments would doubtless ignore short-term fluctuations depicted on a 1-minute chart. Conversely, a scalper would not have an interest within the delicate long-term developments seen on a month-to-month chart.

Technical Indicators and Their Integration with Charts:

Charts alone do not present the entire image. Technical indicators, mathematical calculations primarily based on worth and quantity information, improve chart evaluation by figuring out potential help and resistance ranges, momentum shifts, and overbought/oversold circumstances. Some generally used indicators embrace:

-

Shifting Averages (MA): These easy out worth fluctuations and spotlight the underlying development. Frequent sorts embrace easy transferring averages (SMA), exponential transferring averages (EMA), and weighted transferring averages (WMA). Crossovers of various transferring averages (e.g., a 50-day SMA crossing above a 200-day SMA) are sometimes interpreted as purchase or promote indicators.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of current worth adjustments to guage overbought and oversold circumstances. RSI values above 70 usually recommend an overbought market, whereas values beneath 30 point out an oversold market. Divergences between worth and RSI will also be important buying and selling indicators.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, route, momentum, and length of a development. It consists of two transferring averages and a sign line, with crossovers signaling potential purchase or promote alternatives.

-

Bollinger Bands: These encompass three strains: a easy transferring common and two normal deviation bands above and beneath it. They assist establish worth volatility and potential reversals. Worth bounces off the bands could be interpreted as potential buying and selling indicators.

-

Stochastic Oscillator: This momentum indicator compares a safety’s closing worth to its worth vary over a given interval. It helps establish overbought and oversold circumstances, much like the RSI.

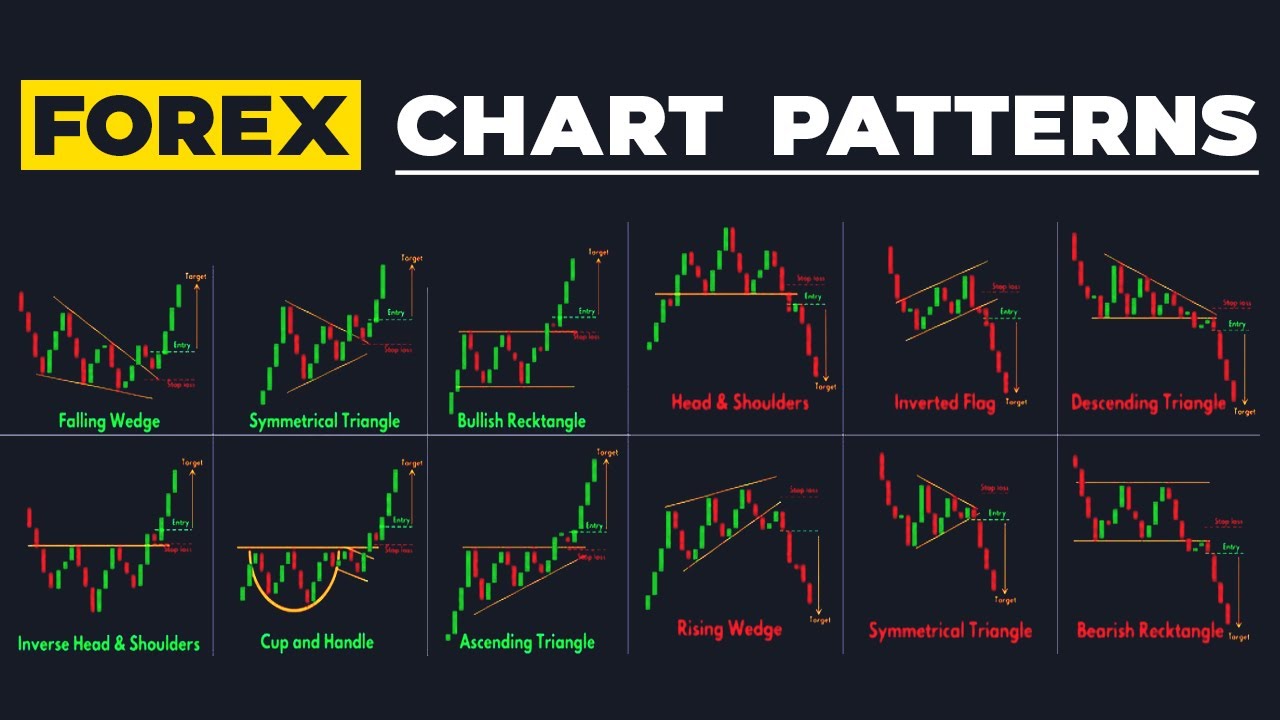

Chart Sample Recognition:

Recognizing chart patterns is a vital ability for foreign exchange merchants. These patterns, fashioned by recurring worth actions, can predict future worth motion. Some frequent patterns embrace:

-

Head and Shoulders: A reversal sample indicating a possible development change.

-

Double Tops and Double Bottoms: Reversal patterns suggesting a possible worth reversal.

-

Triangles: Continuation patterns that recommend a breakout within the route of the previous development.

-

Flags and Pennants: Continuation patterns indicating a brief pause in a robust development.

-

Channels: Patterns indicating an outlined worth vary inside which the worth tends to maneuver.

Threat Administration and Chart Evaluation:

Efficient chart evaluation is inseparable from sturdy threat administration. Even probably the most correct chart evaluation can lead to losses if correct threat administration strategies aren’t carried out. This contains:

-

Setting Cease-Loss Orders: These orders robotically shut a place when the worth reaches a predetermined degree, limiting potential losses.

-

Figuring out Take-Revenue Orders: These orders robotically shut a place when the worth reaches a predetermined revenue goal, securing earnings.

-

Place Sizing: This includes figuring out the suitable quantity of capital to allocate to every commerce, minimizing the impression of potential losses.

Conclusion:

Foreign exchange charts are indispensable instruments for merchants of all ranges. Mastering chart evaluation, together with understanding completely different chart sorts, timeframes, technical indicators, and chart patterns, is essential for making knowledgeable buying and selling selections. Nevertheless, it is vital to do not forget that chart evaluation is just not a foolproof system. Combining chart evaluation with elementary evaluation, threat administration methods, and steady studying is important for navigating the complexities of the foreign exchange market and reaching constant profitability. The journey to changing into a proficient foreign exchange dealer includes steady follow, studying, and adaptation to the ever-evolving market dynamics. Keep in mind to at all times follow accountable buying and selling and search skilled recommendation if wanted.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Foreign exchange Market: A Complete Information to Charts and Their Software. We hope you discover this text informative and helpful. See you in our subsequent article!