Decoding the GBP/EUR Trade Charge Chart: A Complete Information

Associated Articles: Decoding the GBP/EUR Trade Charge Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the GBP/EUR Trade Charge Chart: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the GBP/EUR Trade Charge Chart: A Complete Information

The pound sterling (GBP) and the euro (EUR) are two of the world’s most traded currencies, making their trade fee a crucial issue for companies, vacationers, and buyers alike. Understanding the fluctuations within the GBP/EUR trade fee requires extra than simply glancing at a chart; it calls for an understanding of the underlying financial forces driving its actions. This text delves deep into the GBP/EUR trade fee chart, explaining its historic traits, key influencing elements, and the way to interpret its indicators for knowledgeable decision-making.

A Historic Perspective: Tracing the GBP/EUR Trajectory

The introduction of the euro in 1999 considerably altered the panorama of European foreign money trade. Previous to this, the GBP traded towards a mess of nationwide currencies. The preliminary GBP/EUR trade fee mirrored the relative energy of the British and European economies on the time. Nevertheless, the connection hasn’t been static. Over the previous twenty years, the chart has showcased durations of great appreciation and depreciation for each currencies, influenced by a fancy interaction of things.

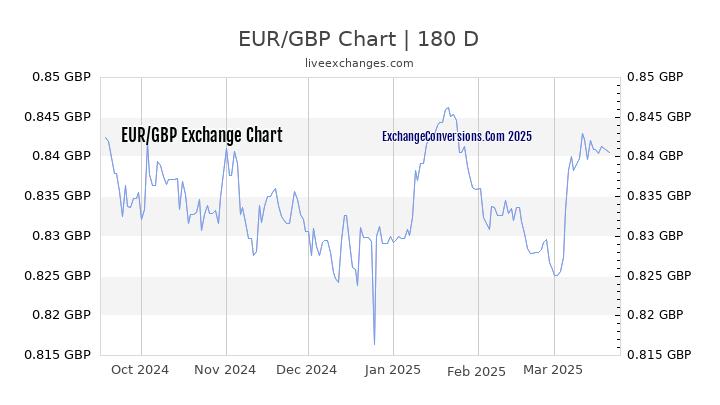

The early 2000s noticed a interval of relative stability, with the trade fee fluctuating inside a comparatively slender band. Nevertheless, the worldwide monetary disaster of 2008-2009 triggered a major downturn for the GBP, leading to a pointy decline towards the EUR. The Brexit referendum in 2016 marked one other watershed second, inflicting a dramatic and instant fall within the pound’s worth. This highlighted the numerous influence of political occasions on foreign money markets. Since then, the trade fee has skilled durations of each restoration and additional decline, reflecting the continued uncertainties surrounding Brexit and the broader world financial local weather. Inspecting a long-term chart reveals these key turning factors and the general development, providing helpful insights into the historic relationship between the 2 currencies.

Key Components Influencing the GBP/EUR Trade Charge

The GBP/EUR trade fee isn’t decided by a single issue however somewhat a fancy interaction of financial, political, and geopolitical forces. Understanding these influences is essential for decoding the chart’s actions and making knowledgeable predictions.

1. Financial Efficiency: The relative energy of the UK and Eurozone economies performs an important position. Increased financial development, decrease inflation, and robust employment figures within the UK are inclined to assist a stronger pound towards the euro. Conversely, optimistic financial information from the Eurozone can strengthen the euro towards the pound. Key financial indicators to look at embody GDP development, inflation charges (CPI and PPI), unemployment charges, and manufacturing output. Analyzing these indicators for each economies supplies a helpful context for understanding trade fee fluctuations.

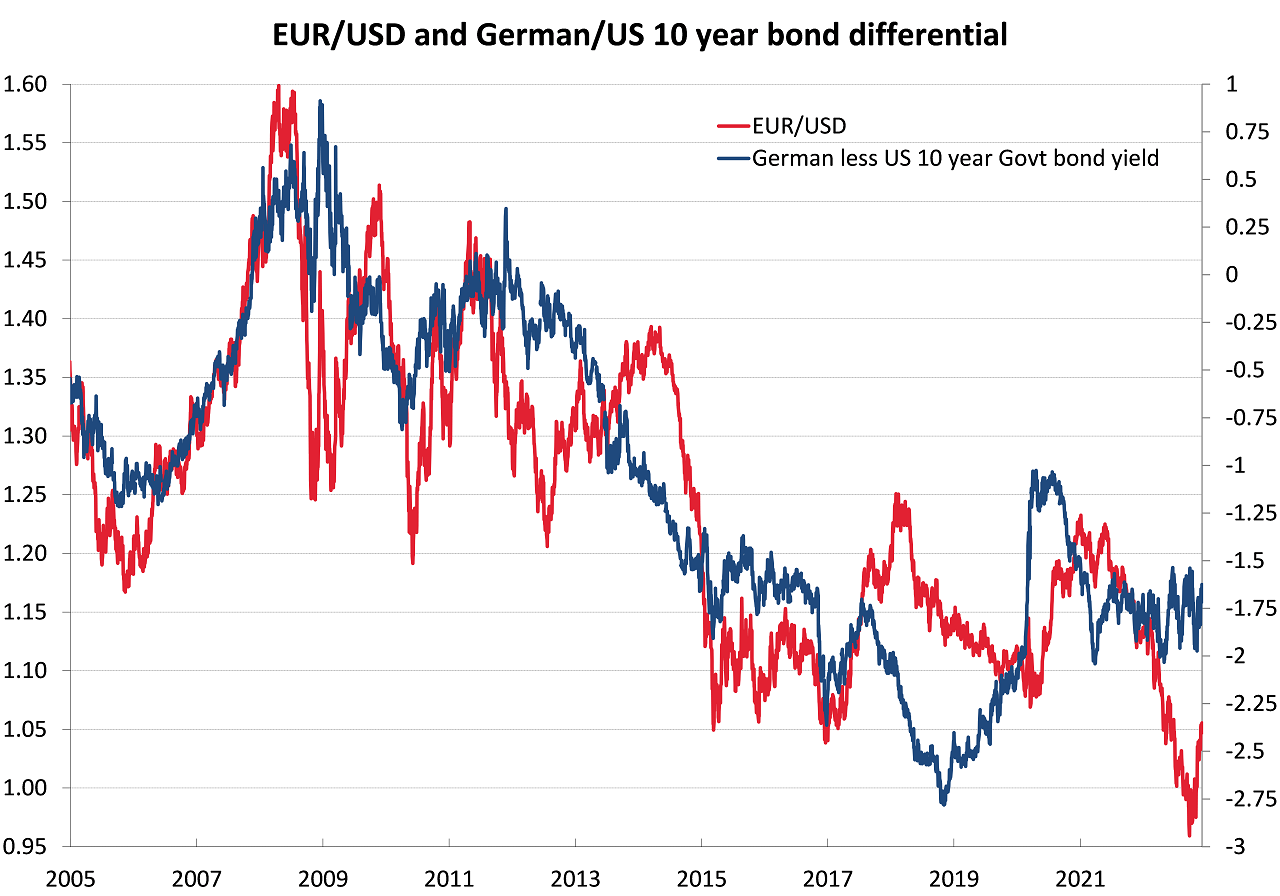

2. Curiosity Charges: Financial coverage selections by the Financial institution of England (BoE) and the European Central Financial institution (ECB) considerably influence the trade fee. Increased rates of interest within the UK relative to the Eurozone have a tendency to draw international funding, rising demand for the pound and strengthening it towards the euro. Conversely, larger rates of interest within the Eurozone would have the other impact. Market members intently monitor rate of interest bulletins and forecasts to gauge the long run route of the trade fee.

3. Political and Geopolitical Components: Political stability and uncertainty considerably affect foreign money markets. The Brexit course of, as an illustration, had a profound influence on the GBP/EUR trade fee, with durations of uncertainty resulting in vital volatility. Different geopolitical occasions, reminiscent of world conflicts or commerce disputes, also can have an effect on investor sentiment and, consequently, the trade fee. Information associated to political stability in each the UK and the Eurozone must be rigorously monitored.

4. Market Sentiment and Hypothesis: Investor sentiment and speculative buying and selling play a considerable position in driving short-term fluctuations. Optimistic information concerning the UK economic system or unfavourable information concerning the Eurozone can result in elevated demand for the pound, pushing the trade fee larger. Conversely, unfavourable information concerning the UK or optimistic information concerning the Eurozone can result in a decline within the pound’s worth. Analyzing market sentiment by way of information reviews, analyst forecasts, and buying and selling quantity can present insights into short-term value actions.

5. Authorities Debt and Finances Deficits: Excessive ranges of presidency debt and protracted finances deficits can weaken a foreign money. If the UK’s debt ranges are perceived as unsustainable, it might result in a decline within the pound towards the euro. Equally, considerations concerning the fiscal well being of Eurozone international locations can influence the euro’s worth. Monitoring authorities debt ranges and finances deficits for each areas is essential for understanding long-term trade fee traits.

6. Commerce Balances: The stability of commerce between the UK and the Eurozone additionally influences the trade fee. A big commerce surplus (exporting greater than importing) can strengthen a foreign money, whereas a commerce deficit can weaken it. Analyzing the commerce stability information for each areas supplies helpful insights into the underlying financial forces affecting the trade fee.

Deciphering the GBP/EUR Trade Charge Chart: Methods and Instruments

Understanding the historic context and influencing elements is simply half the battle. Successfully decoding the GBP/EUR trade fee chart requires using numerous technical and basic evaluation strategies.

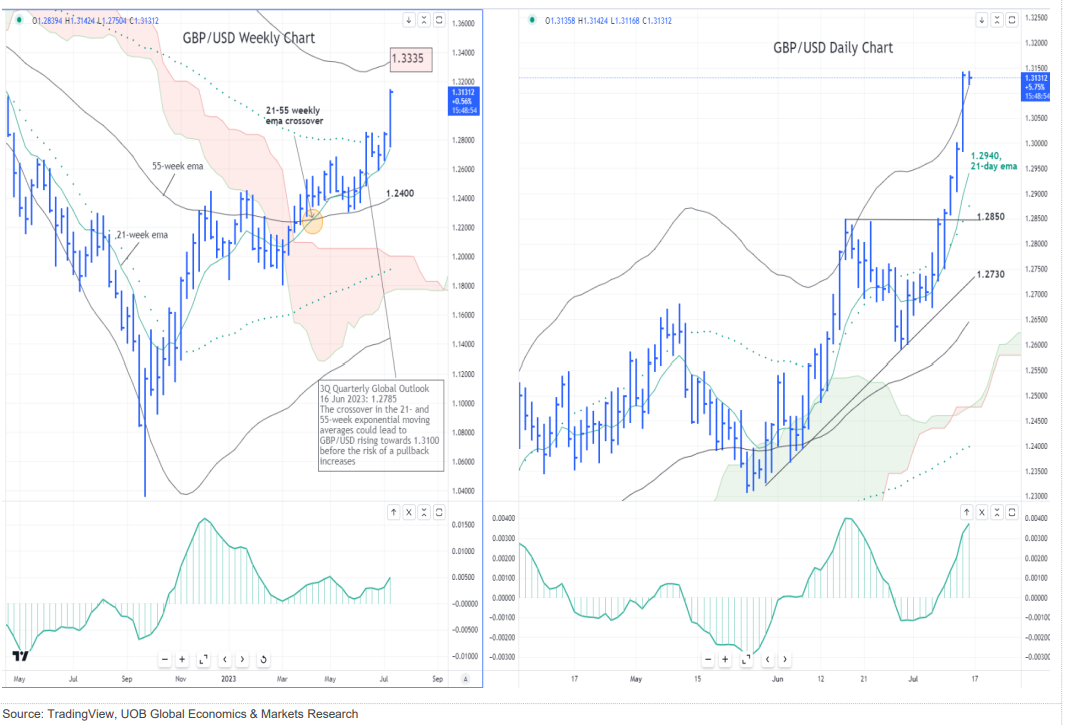

1. Technical Evaluation: This entails finding out value charts to establish patterns and traits. Instruments like shifting averages, assist and resistance ranges, and numerous technical indicators will help predict future value actions. Nevertheless, it is essential to do not forget that technical evaluation isn’t foolproof and must be used along with basic evaluation.

2. Elementary Evaluation: This entails assessing the underlying financial and political elements influencing the trade fee. Analyzing financial indicators, rates of interest, and political occasions supplies a extra holistic understanding of the forces driving the trade fee. Combining basic and technical evaluation presents a extra complete strategy to forecasting.

3. Chart Patterns: Figuring out chart patterns like head and shoulders, double tops/bottoms, and triangles can present helpful insights into potential future value actions. These patterns are sometimes related to particular market sentiments and can be utilized to foretell reversals or continuations of traits.

4. Indicators: Technical indicators like Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), and Stochastic Oscillator will help establish overbought or oversold situations, potential development reversals, and momentum adjustments. Nevertheless, these indicators must be used cautiously and along with different evaluation strategies.

5. Help and Resistance Ranges: These are value ranges the place the trade fee has traditionally struggled to interrupt by way of. Help ranges characterize value flooring, whereas resistance ranges characterize value ceilings. Figuring out these ranges will help predict potential value reversals or breakouts.

Conclusion: Navigating the GBP/EUR Trade Charge Panorama

The GBP/EUR trade fee chart is a dynamic reflection of the advanced interaction between the UK and Eurozone economies, political landscapes, and world market forces. Understanding the historic traits, key influencing elements, and numerous analytical strategies is essential for navigating this advanced panorama. Whereas predicting future actions with certainty is not possible, a radical understanding of those elements, mixed with cautious evaluation of the chart, can considerably improve decision-making for companies, vacationers, and buyers alike. Steady monitoring of financial indicators, political developments, and market sentiment is crucial for staying knowledgeable and adapting to the ever-changing dynamics of the GBP/EUR trade fee. Keep in mind to seek the advice of with monetary professionals for personalised recommendation tailor-made to your particular circumstances.

Closure

Thus, we hope this text has offered helpful insights into Decoding the GBP/EUR Trade Charge Chart: A Complete Information. We admire your consideration to our article. See you in our subsequent article!