Decoding the GBP/ZAR Alternate Price: A Complete Chart Evaluation

Associated Articles: Decoding the GBP/ZAR Alternate Price: A Complete Chart Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the GBP/ZAR Alternate Price: A Complete Chart Evaluation. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the GBP/ZAR Alternate Price: A Complete Chart Evaluation

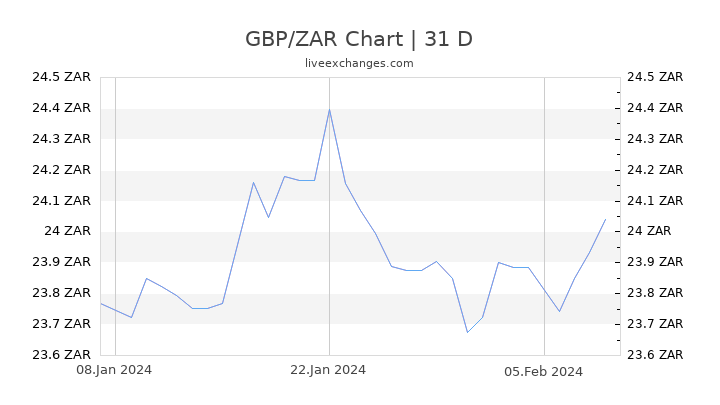

The British Pound (GBP) to South African Rand (ZAR) change charge is a dynamic indicator reflecting the complicated interaction of financial elements affecting each the UK and South Africa. Understanding the historic developments and present fluctuations depicted in a GBP/ZAR chart is essential for anybody concerned in worldwide commerce, funding, or just planning journey between these two nations. This text will delve into the intricacies of this change charge, analyzing its historic efficiency, key influencing elements, and offering insights into potential future actions.

Historic Perspective: A Journey By the GBP/ZAR Chart

A look at a long-term GBP/ZAR chart reveals a narrative of great volatility. Over the previous 20 years, the change charge has fluctuated dramatically, starting from lows of roughly 10 ZAR per GBP to highs exceeding 25 ZAR per GBP. This volatility stems from a mess of things, a lot of that are intertwined and troublesome to isolate. Nonetheless, by inspecting key durations, we are able to achieve worthwhile insights:

-

Early 2000s: The early 2000s witnessed a comparatively steady interval, with the GBP typically buying and selling at the next worth in opposition to the ZAR. This era coincided with comparatively sturdy financial development within the UK and a interval of commodity value stability, benefiting South Africa’s export-oriented economic system.

-

World Monetary Disaster (2008-2009): The worldwide monetary disaster considerably impacted the GBP/ZAR change charge. The disaster led to a pointy decline within the worth of the GBP in opposition to main currencies, together with the ZAR. This was partly as a result of UK’s publicity to the worldwide banking system and a subsequent contraction within the British economic system. The ZAR additionally skilled important weak spot resulting from its reliance on commodity exports, which noticed a pointy value decline through the disaster.

-

Commodity Worth Cycles: South Africa’s economic system is closely reliant on the export of commodities equivalent to gold, platinum, and diamonds. Fluctuations in world commodity costs immediately affect the demand for the ZAR, influencing its worth in opposition to the GBP. Durations of excessive commodity costs are likely to strengthen the ZAR, whereas durations of low costs weaken it. This relationship is clearly seen within the GBP/ZAR chart, exhibiting durations of ZAR appreciation coinciding with commodity value booms and durations of depreciation throughout commodity value slumps.

-

Political and Financial Instability in South Africa: Political uncertainty and financial challenges inside South Africa have additionally considerably influenced the GBP/ZAR change charge. Durations of political instability, coverage uncertainty, and issues about governance typically result in a weakening of the ZAR in opposition to the GBP. Equally, durations of financial stagnation or decline in South Africa are likely to negatively affect the ZAR’s worth.

-

Brexit and its Aftermath: The 2016 Brexit referendum and its subsequent fallout had a profound affect on the GBP’s worth in opposition to many currencies, together with the ZAR. The uncertainty surrounding the UK’s future relationship with the European Union led to a pointy depreciation of the GBP, making it cheaper for South Africans to purchase British items and providers, but additionally making it costlier for UK companies working in South Africa. The long-term results of Brexit proceed to form the GBP/ZAR change charge.

-

Curiosity Price Differentials: The distinction in rates of interest between the UK and South Africa additionally performs a major function. Increased rates of interest in a single nation relative to a different can appeal to international funding, rising the demand for that nation’s foreign money and strengthening its worth. Due to this fact, variations in financial coverage between the Financial institution of England and the South African Reserve Financial institution affect the GBP/ZAR change charge.

Key Components Influencing the GBP/ZAR Alternate Price:

Analyzing the GBP/ZAR chart requires understanding the quite a few elements at play. These will be broadly categorized as:

-

Macroeconomic Components: GDP development charges, inflation charges, unemployment ranges, and authorities debt ranges in each the UK and South Africa considerably affect the change charge. Stronger financial fundamentals in both nation are likely to help the respective foreign money.

-

Political Components: Political stability and coverage certainty are essential. Political dangers, equivalent to modifications in authorities, coverage shifts, or social unrest, can result in foreign money volatility.

-

World Financial Circumstances: World financial development, geopolitical occasions, and shifts in investor sentiment all have a bearing on the GBP/ZAR change charge. World danger aversion typically results in a flight to security, benefiting currencies of steady economies just like the GBP, whereas world danger urge for food can increase rising market currencies just like the ZAR relying on the precise circumstances.

-

Commodity Costs: As beforehand talked about, commodity costs are a significant driver of the ZAR’s worth. Adjustments in gold, platinum, and different commodity costs immediately affect South Africa’s export earnings and its present account steadiness, influencing the ZAR’s change charge.

-

Financial Coverage: The rate of interest insurance policies of the Financial institution of England and the South African Reserve Financial institution play a vital function. Differentials in rates of interest can appeal to or repel international funding, impacting the provision and demand for every foreign money.

Decoding the GBP/ZAR Chart: Technical Evaluation

Technical evaluation of the GBP/ZAR chart entails finding out value patterns and indicators to foretell future value actions. Merchants use numerous instruments, together with:

-

Shifting Averages: These easy out value fluctuations and assist establish developments.

-

Assist and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by way of, offering potential entry and exit factors for merchants.

-

Technical Indicators: Comparable to RSI (Relative Power Index) and MACD (Shifting Common Convergence Divergence) present indicators about overbought or oversold situations and potential pattern reversals.

Predicting Future Actions: Challenges and Concerns

Predicting future actions within the GBP/ZAR change charge is inherently difficult as a result of complicated interaction of things. Whereas technical evaluation can present insights, it is essential to think about elementary elements as properly. Analyzing financial indicators, political developments, and world occasions is important for a extra complete outlook. Nonetheless, even with thorough evaluation, unexpected occasions can considerably affect the change charge, highlighting the inherent danger concerned in forecasting foreign money actions.

Conclusion:

The GBP/ZAR change charge is a posh and dynamic entity, influenced by a mess of things. Analyzing a GBP/ZAR chart requires a complete understanding of each the UK and South African economies, in addition to world financial situations. Whereas historic developments can present worthwhile insights, predicting future actions stays a difficult activity. A mixture of technical and elementary evaluation, coupled with consciousness of potential geopolitical and financial dangers, is essential for navigating the volatility of this vital change charge. Staying knowledgeable about financial information, coverage modifications, and market sentiment is important for anybody searching for to know and probably revenue from the GBP/ZAR change charge. Steady monitoring of the chart and a nuanced understanding of the underlying financial forces are key to creating knowledgeable selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the GBP/ZAR Alternate Price: A Complete Chart Evaluation. We admire your consideration to our article. See you in our subsequent article!