Decoding the Gold Market Cap Chart: A Deep Dive into the King’s Efficiency

Associated Articles: Decoding the Gold Market Cap Chart: A Deep Dive into the King’s Efficiency

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Gold Market Cap Chart: A Deep Dive into the King’s Efficiency. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Gold Market Cap Chart: A Deep Dive into the King’s Efficiency

Gold, a timeless image of wealth and stability, has captivated buyers for millennia. Whereas its value fluctuates, its inherent worth and perceived safe-haven standing proceed to drive demand. Understanding the gold market capitalization chart, due to this fact, is essential for anybody in search of to navigate this advanced and dynamic market. This text will delve into the intricacies of gold market cap charts, exploring their significance, decoding their developments, and analyzing the components that affect their actions.

What’s Gold Market Capitalization?

In contrast to shares or cryptocurrencies, gold does not have a single, available market capitalization determine like an organization’s market cap. It is because gold’s whole provide is not confined to a particular entity. As a substitute, gold’s market cap is calculated by multiplying the present value of gold per ounce by the estimated whole quantity of gold ever mined and at present above floor. This calculation supplies an approximate valuation of all of the gold on the earth, representing its collective value.

The problem lies in precisely estimating the entire quantity of gold ever mined. Whereas varied organizations, together with the World Gold Council (WGC), try to trace this determine, it stays an approximation because of historic information inconsistencies and the potential for unreported mining actions. Due to this fact, the gold market cap needs to be seen as a dynamic estimate reasonably than a exact determine.

Decoding the Gold Market Cap Chart:

A typical gold market cap chart will show the entire estimated worth of above-ground gold over time. The chart’s X-axis represents the time interval (e.g., years, months), whereas the Y-axis represents the market capitalization in a particular forex (often USD). The chart will usually present an upward development, reflecting the cumulative impact of newly mined gold and value appreciation.

The chart’s actions reveal a number of key insights:

-

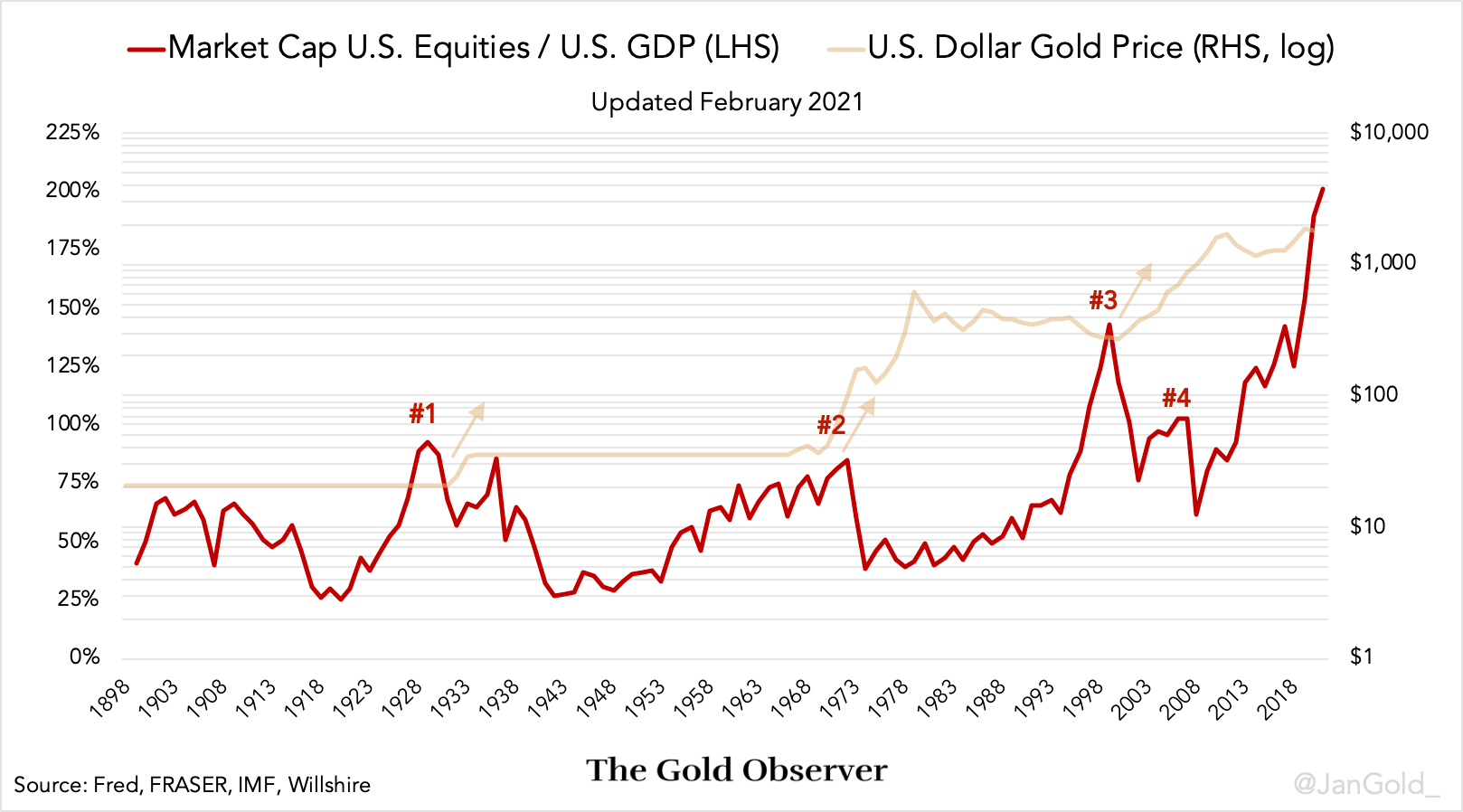

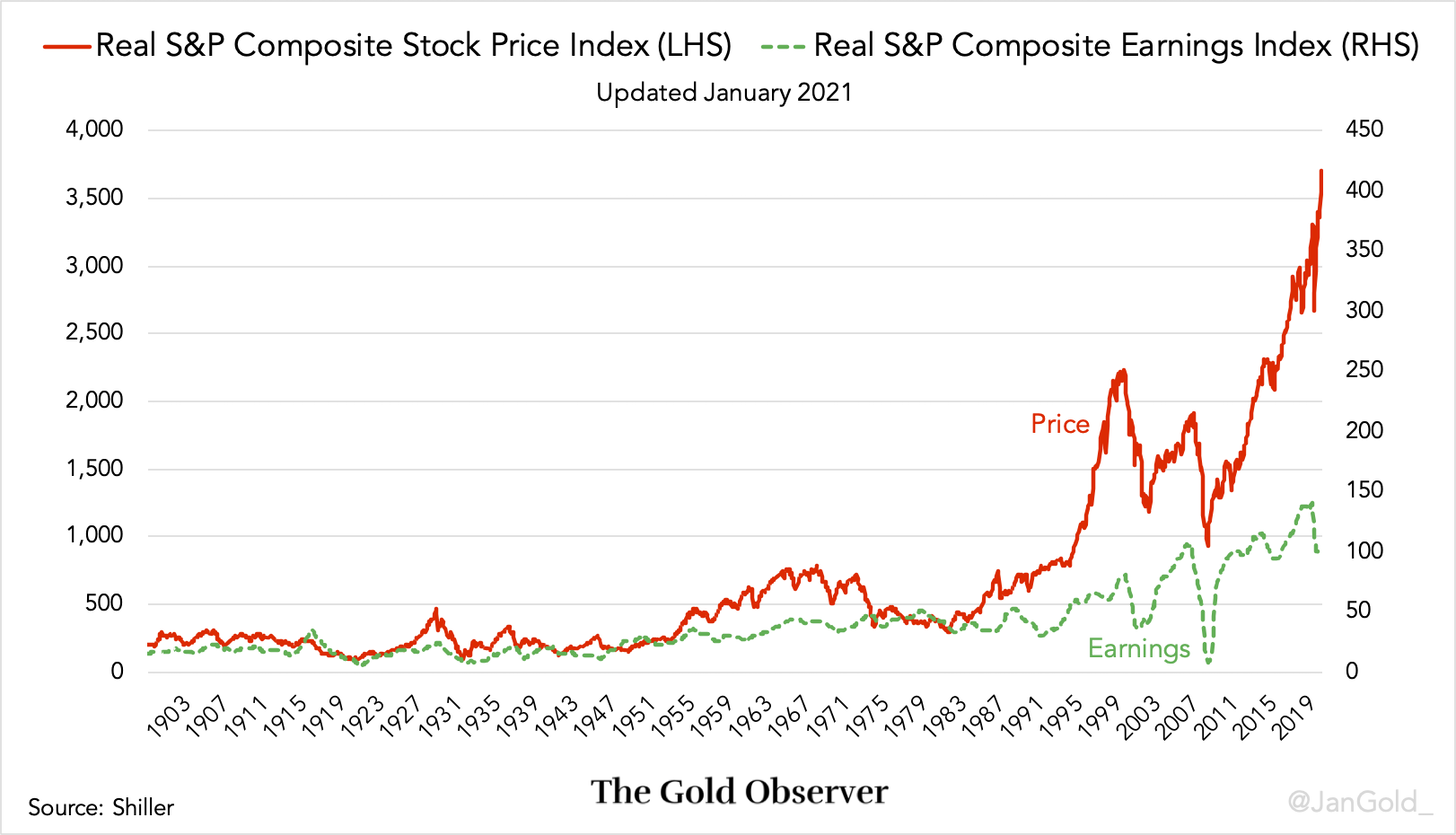

Lengthy-term Tendencies: The general development of the gold market cap chart often displays long-term financial cycles, geopolitical occasions, and shifts in investor sentiment. Intervals of financial uncertainty or inflation usually correlate with an increase in gold’s market cap, as buyers search refuge in its perceived security.

-

Brief-term Fluctuations: Brief-term fluctuations within the chart are influenced by varied components, together with provide and demand dynamics, forex actions, rates of interest, and hypothesis. These short-term swings might be unstable, creating each alternatives and dangers for buyers.

-

Correlation with Different Belongings: Analyzing the gold market cap chart together with charts of different asset courses (e.g., shares, bonds, commodities) can reveal essential correlations and diversification alternatives. Understanding how gold’s market cap strikes relative to different belongings can inform funding methods.

-

Worth vs. Market Cap: Whereas the worth of gold per ounce is a vital issue, the market cap supplies a broader perspective. A rising value will naturally enhance the market cap, however a big enhance available in the market cap is also pushed by a rise within the estimated whole gold above floor (although it is a slower course of).

Elements Influencing the Gold Market Cap Chart:

A number of key components affect the actions of the gold market cap chart:

-

Inflation: Gold is usually thought of a hedge in opposition to inflation. When inflation rises, the buying energy of fiat currencies declines, driving buyers in the direction of gold as a retailer of worth, thereby growing its market cap.

-

Curiosity Charges: Greater rates of interest could make holding non-interest-bearing belongings like gold much less enticing, doubtlessly placing downward strain on its market cap. Conversely, decrease rates of interest can enhance gold’s attraction.

-

Geopolitical Occasions: Intervals of geopolitical instability or uncertainty usually result in elevated demand for gold as a safe-haven asset, pushing its market cap larger.

-

Forex Fluctuations: Modifications within the worth of the US greenback, the first forex for gold pricing, considerably influence the gold market cap. A weaker greenback typically results in larger gold costs and a bigger market cap.

-

Provide and Demand: The interaction of gold provide (mining manufacturing, recycling) and demand (jewellery, funding, industrial use) instantly impacts its value and, consequently, its market cap. Elevated demand relative to produce will push the worth and market cap upward.

-

Investor Sentiment: Market psychology performs a big function. Constructive investor sentiment in the direction of gold can drive up demand and the market cap, whereas detrimental sentiment can have the alternative impact.

-

Technological Developments: Technological developments in gold mining can doubtlessly enhance provide, impacting the market cap. Nonetheless, this impact is usually offset by different components, resembling elevated demand.

-

Central Financial institution Exercise: Central banks’ gold holdings considerably influence the market. Elevated purchases by central banks can assist gold costs and its market cap, whereas promoting can have the alternative impact.

Using the Gold Market Cap Chart for Funding Selections:

The gold market cap chart, whereas not a standalone predictor of future value actions, supplies helpful context for funding selections. By analyzing the chart alongside different market indicators and elementary components, buyers can acquire a extra complete understanding of the gold market’s dynamics. Nonetheless, it is essential to do not forget that:

-

Previous efficiency just isn’t indicative of future outcomes. Whereas finding out historic developments is essential, it is important to keep away from relying solely on previous efficiency when making funding selections.

-

The market cap is an estimate. The inherent uncertainty in estimating the entire quantity of gold above floor introduces a level of imprecision to the market cap determine.

-

Diversification is essential. Together with gold in a diversified funding portfolio might help mitigate danger, nevertheless it should not be the only funding.

-

Seek the advice of monetary professionals. Earlier than making any funding selections, it is advisable to seek the advice of with a professional monetary advisor who can present customized steering based mostly in your danger tolerance and monetary targets.

Conclusion:

The gold market cap chart provides a novel perspective on the general worth of the world’s gold reserves. Whereas not an ideal predictor, it supplies helpful insights into the long-term developments and short-term fluctuations of this valuable metallic. By understanding the components that affect the chart and utilizing it together with different analytical instruments, buyers could make extra knowledgeable selections about their gold investments. Nonetheless, it’s essential to strategy gold market cap information with a important eye, acknowledging its limitations and in search of skilled recommendation earlier than making important funding selections. The chart serves as a robust visible illustration of gold’s enduring attraction and its function as a safe-haven asset and a retailer of worth in a consistently evolving international economic system. Its continued evaluation will stay essential for navigating the complexities of the gold marketplace for years to return.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Gold Market Cap Chart: A Deep Dive into the King’s Efficiency. We recognize your consideration to our article. See you in our subsequent article!