Decoding the H Sample: A Complete Information to Figuring out and Buying and selling This Highly effective Chart Formation

Associated Articles: Decoding the H Sample: A Complete Information to Figuring out and Buying and selling This Highly effective Chart Formation

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the H Sample: A Complete Information to Figuring out and Buying and selling This Highly effective Chart Formation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the H Sample: A Complete Information to Figuring out and Buying and selling This Highly effective Chart Formation

The world of technical evaluation is replete with chart patterns, every providing a novel perspective on market sentiment and potential value actions. Amongst these patterns, the "H" sample, whereas much less steadily mentioned than others like head and shoulders or double tops/bottoms, holds vital predictive energy for discerning merchants. Understanding its formation, traits, and buying and selling implications is usually a useful addition to any dealer’s toolkit. This text delves deep into the H sample, offering a complete understanding of its identification, interpretation, and strategic software.

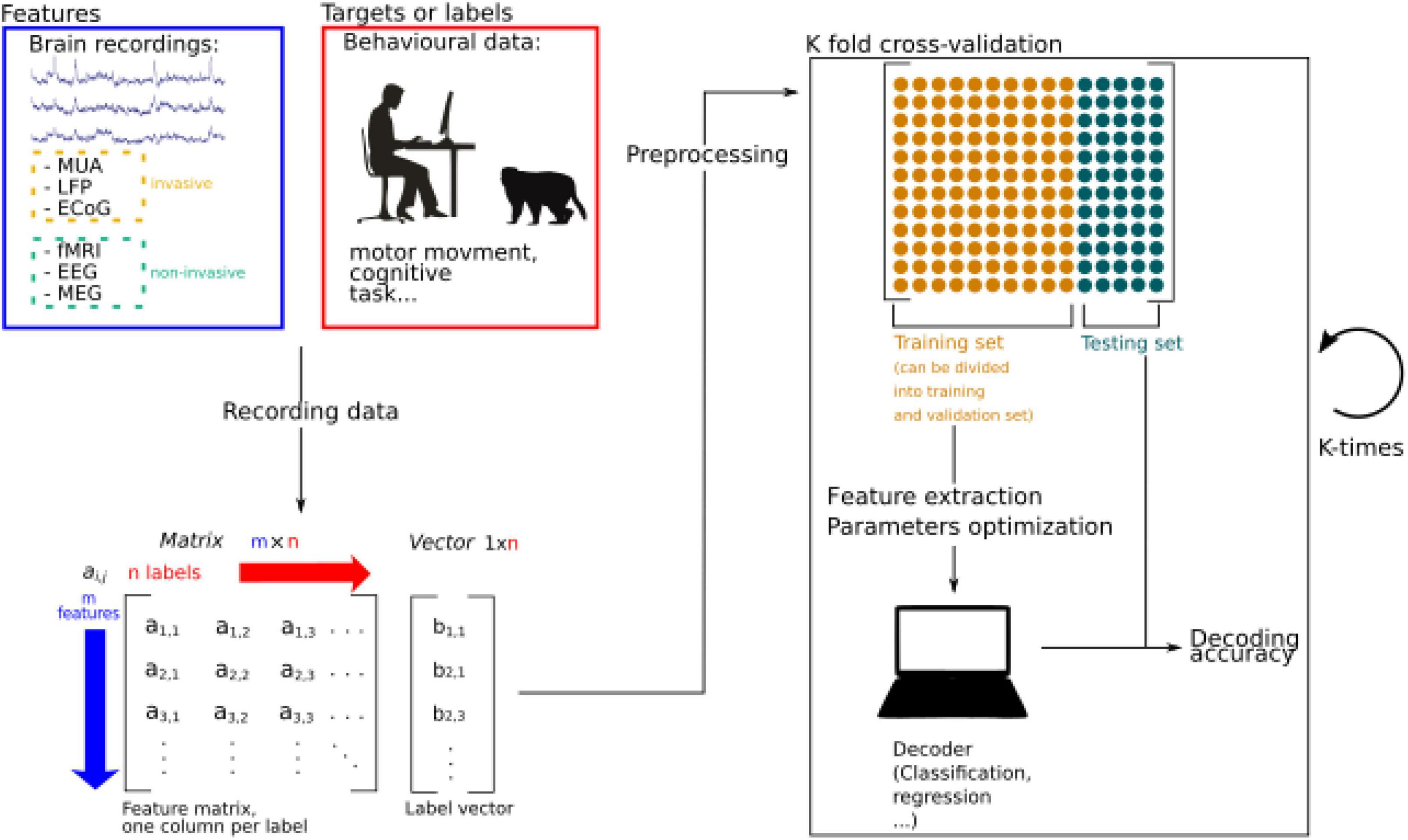

Understanding the H Sample’s Formation:

The H sample, additionally typically known as a double backside or double prime formation (relying on its orientation), is characterised by two distinct peaks or troughs that resemble the letter "H" on a value chart. It signifies a interval of indecision and consolidation available in the market earlier than a possible breakout. In contrast to the basic double prime/backside, the H sample entails a extra pronounced and outlined interval of sideways value motion between the 2 peaks or troughs. This era of consolidation usually features a increased diploma of quantity in comparison with the encompassing value motion.

Key Traits of the H Sample:

A number of key traits differentiate a real H sample from random value fluctuations:

-

Two Distinct Peaks or Troughs: The sample is outlined by two clearly outlined peaks (for a bearish H sample) or troughs (for a bullish H sample) of comparatively related top. These peaks or troughs needs to be comparatively shut in value, signifying a value resistance or help stage.

-

Consolidation Interval: Between the 2 peaks or troughs, there is a interval of sideways value motion, usually characterised by decrease volatility than the previous and subsequent traits. This consolidation section is essential and represents a interval of indecision available in the market.

-

Neckline (or Assist/Resistance Line): A trendline connecting the 2 peaks (bearish) or troughs (bullish) types the neckline. This neckline acts as a key help or resistance stage. A decisive break of this neckline confirms the sample’s validity and indicators a possible pattern reversal.

-

Quantity Affirmation: Quantity performs an important position in validating the H sample. Sometimes, quantity needs to be increased in the course of the preliminary peak or trough formation after which lower in the course of the consolidation section. A surge in quantity accompanying the neckline breakout reinforces the sign.

-

Symmetry (Not Obligatory however Useful): Whereas not a strict requirement, a symmetrical H sample, the place the 2 peaks or troughs are almost equivalent in top and the consolidation interval is comparatively even, is taken into account a stronger sign.

Varieties of H Patterns:

The H sample can manifest in two main types:

-

Bullish H Sample: This sample is characterised by two distinct troughs adopted by a breakout above the neckline. It indicators a possible bullish reversal, indicating a shift from a downtrend to an uptrend.

-

Bearish H Sample: This sample options two distinct peaks adopted by a breakout under the neckline. It suggests a possible bearish reversal, indicating a shift from an uptrend to a downtrend.

Figuring out and Validating the H Sample:

Figuring out a possible H sample requires cautious commentary of the value chart and quantity knowledge. Merchants ought to search for:

-

Clear Formation of Two Peaks or Troughs: The peaks or troughs needs to be visually distinct and comparatively shut in value.

-

Properly-Outlined Consolidation Interval: The sideways value motion between the peaks or troughs needs to be clearly identifiable.

-

Significant Neckline: The neckline needs to be a well-defined trendline that connects the peaks or troughs.

-

Quantity Affirmation: Quantity ought to help the sample’s formation and breakout.

-

Breakout Affirmation: A decisive breakout above the neckline (bullish) or under the neckline (bearish) with elevated quantity confirms the sample’s validity.

Buying and selling Methods for the H Sample:

As soon as a validated H sample is recognized, merchants can make use of a number of methods:

-

Breakout Buying and selling: This entails coming into an extended place (bullish H sample) after a breakout above the neckline or a brief place (bearish H sample) after a breakout under the neckline. Cease-loss orders needs to be positioned under the neckline for lengthy positions and above the neckline for brief positions.

-

Pullback Buying and selling: After the preliminary breakout, the value might expertise a short lived pullback in the direction of the neckline. This pullback can present a second entry alternative with a decreased danger profile.

-

Goal Setting: Revenue targets could be set based mostly on the peak of the H sample. For instance, in a bullish H sample, the goal value may very well be the peak of the sample added to the breakout level.

Threat Administration Concerns:

Buying and selling the H sample, like another technical evaluation technique, entails danger. Merchants ought to at all times make use of correct danger administration strategies:

-

Cease-Loss Orders: Cease-loss orders are essential to restrict potential losses. They need to be positioned strategically under the neckline for lengthy positions and above the neckline for brief positions.

-

Place Sizing: Merchants ought to fastidiously handle their place measurement to keep away from extreme danger. This entails allocating solely a small proportion of their buying and selling capital to every commerce.

-

False Breakouts: It is important to pay attention to the potential for false breakouts. A value might briefly break the neckline however then reverse, resulting in a loss. Merchants ought to use affirmation indicators, resembling elevated quantity, to keep away from false breakouts.

Limitations of the H Sample:

Whereas the H sample is usually a useful buying and selling instrument, it is essential to acknowledge its limitations:

-

Subjectivity: Figuring out the precise peaks, troughs, and neckline could be subjective, resulting in completely different interpretations amongst merchants.

-

False Alerts: Like all chart patterns, the H sample can produce false indicators, leading to losses.

-

Time Sensitivity: The H sample might take time to develop, and the breakout might not happen instantly.

-

Context is Key: The H sample needs to be analyzed throughout the broader market context. Think about total market traits, financial indicators, and information occasions earlier than making any buying and selling selections.

Conclusion:

The H sample, though much less steadily mentioned, provides a strong instrument for figuring out potential pattern reversals. By understanding its formation, traits, and buying and selling implications, merchants can improve their buying and selling methods and enhance their risk-reward ratios. Nonetheless, it is essential to do not forget that no technical evaluation sample ensures success. Cautious commentary, danger administration, and a holistic strategy incorporating elementary evaluation are important for profitable buying and selling utilizing the H sample. Combining the H sample evaluation with different technical indicators and affirmation indicators can considerably enhance buying and selling accuracy and cut back the danger of false indicators. Steady studying and adaptation are key to mastering this and another technical evaluation instrument.

:max_bytes(150000):strip_icc()/headandshoulderschartformation-03e201b0256a48b8a6eaac370c8c1d02.jpg)

Closure

Thus, we hope this text has supplied useful insights into Decoding the H Sample: A Complete Information to Figuring out and Buying and selling This Highly effective Chart Formation. We admire your consideration to our article. See you in our subsequent article!