Decoding the Kitco Gold Chart (USD): A Complete Information to Understanding Gold Costs

Associated Articles: Decoding the Kitco Gold Chart (USD): A Complete Information to Understanding Gold Costs

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Kitco Gold Chart (USD): A Complete Information to Understanding Gold Costs. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Kitco Gold Chart (USD): A Complete Information to Understanding Gold Costs

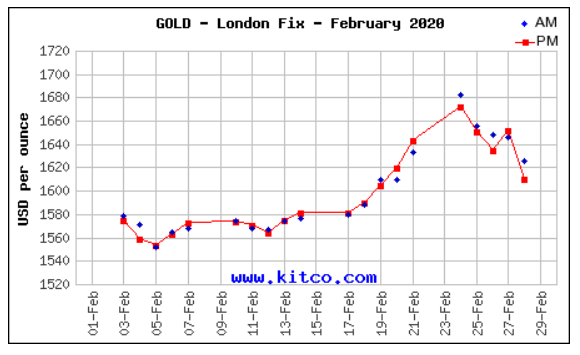

The Kitco Gold Chart, displaying the worth of gold in US {dollars}, serves as a vital barometer for the dear metals market. For buyers, merchants, and anybody within the world financial system, understanding this chart and its implications is paramount. This text will delve deep into the intricacies of the Kitco Gold Chart, explaining its performance, the elements influencing gold costs, learn how to interpret the chart’s actions, and the potential implications for varied market individuals.

Understanding the Kitco Gold Chart:

The Kitco Gold Chart presents a real-time visualization of the gold value, sometimes expressed in US {dollars} per troy ounce. It normally shows quite a lot of knowledge factors, together with:

- Spot Value: The present market value at which gold might be purchased or offered instantly. That is essentially the most essential aspect of the chart.

- Historic Information: A visible illustration of gold costs over a selected interval (e.g., every day, weekly, month-to-month, yearly). This permits for pattern evaluation and identification of patterns.

- Technical Indicators: Many charts combine technical indicators like shifting averages, relative energy index (RSI), and Bollinger Bands. These instruments assist merchants establish potential help and resistance ranges, predict value actions, and handle danger.

- Interactive Options: Kitco and related platforms typically supply interactive options like zooming, panning, and downloading knowledge, permitting customers to customise their evaluation.

Components Influencing Gold Costs:

The value of gold is a fancy interaction of varied macroeconomic and geopolitical elements. Understanding these elements is essential for decoding the Kitco Gold Chart precisely:

- US Greenback Energy: Gold is priced in US {dollars}. A robust greenback usually places downward strain on gold costs, because it makes gold costlier for holders of different currencies. Conversely, a weak greenback tends to spice up gold costs.

- Inflation and Curiosity Charges: Gold is usually considered as a hedge in opposition to inflation. When inflation rises, buyers typically flock to gold as a retailer of worth, driving up costs. Equally, rising rates of interest can typically negatively influence gold costs as they improve the chance value of holding non-yielding property like gold.

- Geopolitical Occasions: International uncertainty, political instability, and geopolitical dangers typically result in elevated demand for gold as a safe-haven asset, pushing costs larger. Wars, sanctions, and main political shifts can all considerably influence gold costs.

- Provide and Demand: Like all commodity, gold’s value is influenced by the steadiness between provide and demand. Components like mining manufacturing, central financial institution purchases, and jewellery demand play a job in figuring out the general provide and demand dynamics.

- Investor Sentiment: Market sentiment and hypothesis play a major function. Constructive investor sentiment can drive up costs, whereas unfavourable sentiment can result in value declines. That is typically mirrored in buying and selling volumes and volatility.

- Central Financial institution Insurance policies: Actions by central banks, notably the US Federal Reserve, have a major influence. Quantitative easing (QE) applications, which improve the cash provide, might be inflationary and supportive of gold costs. Nevertheless, rate of interest hikes can have the other impact.

Deciphering the Kitco Gold Chart:

Analyzing the Kitco Gold Chart requires a multi-faceted method, combining technical evaluation with an understanding of the elemental elements talked about above:

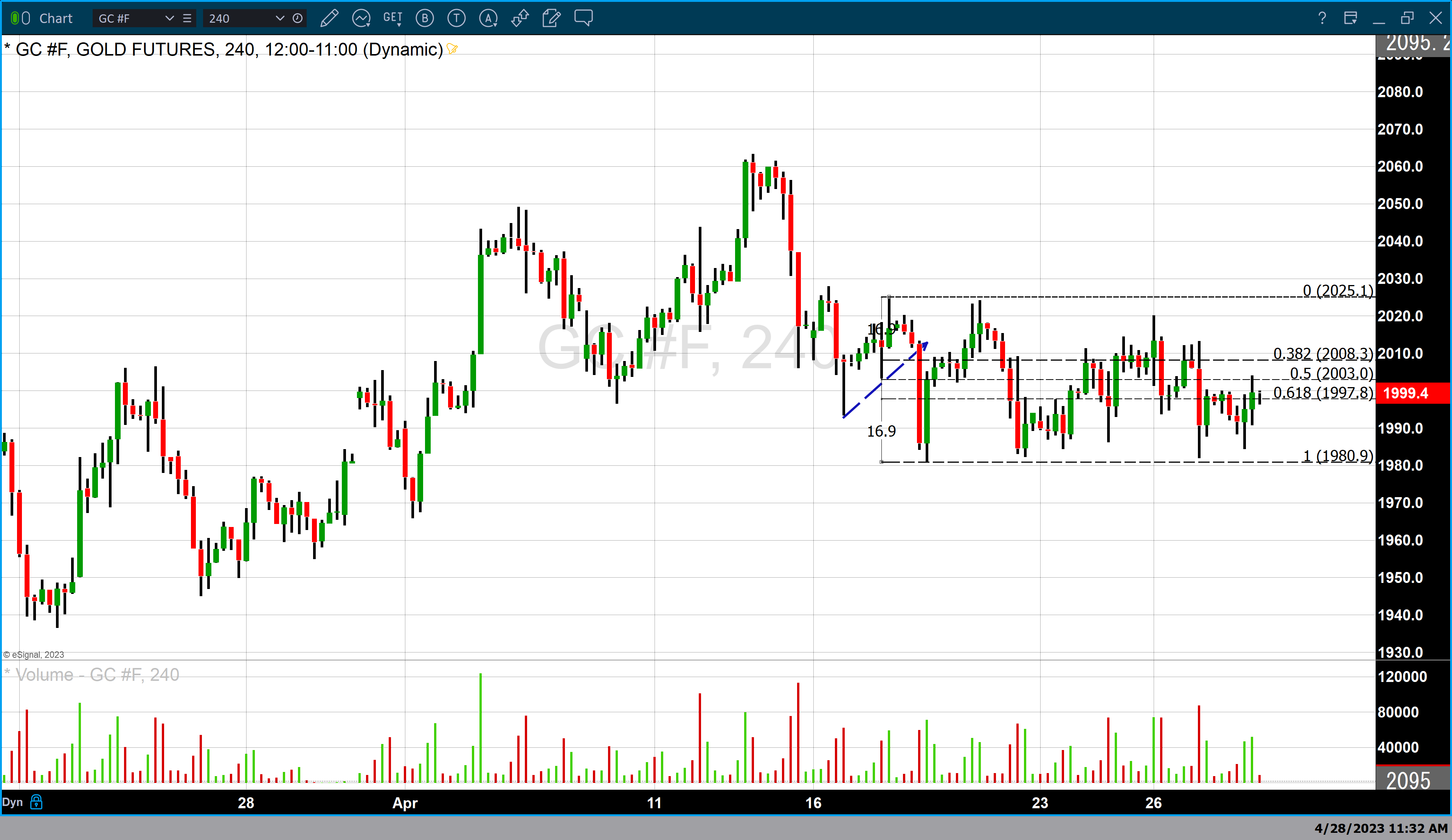

- Development Evaluation: Figuring out the general pattern (uptrend, downtrend, or sideways) is essential. This may be completed by observing the route of the worth over an extended interval. Shifting averages may also help verify the pattern.

- Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by. Help ranges characterize areas the place consumers are prone to step in, whereas resistance ranges characterize areas the place sellers are prone to dominate. Breaks above resistance or under help can sign vital value actions.

- Technical Indicators: RSI, Bollinger Bands, MACD, and different technical indicators present further alerts about potential value reversals, overbought or oversold circumstances, and momentum. Nevertheless, it is essential to do not forget that technical indicators should not foolproof and must be used along side different types of evaluation.

- Quantity Evaluation: Excessive buying and selling quantity accompanying a value transfer confirms the energy of the transfer, whereas low quantity suggests weak spot. Analyzing quantity may also help differentiate between real value modifications and momentary fluctuations.

- Information and Occasions: Staying knowledgeable about related information and occasions, resembling financial knowledge releases, geopolitical developments, and central financial institution bulletins, is essential for decoding value actions. Surprising occasions can considerably influence gold costs.

Implications for Market Members:

The Kitco Gold Chart holds totally different implications for varied market individuals:

- Traders: Lengthy-term buyers typically view gold as a portfolio diversifier and a hedge in opposition to inflation and financial uncertainty. They could use the chart to establish potential entry and exit factors primarily based on long-term developments and basic evaluation.

- Merchants: Quick-term merchants use the chart to establish short-term value actions and capitalize on volatility. They rely closely on technical evaluation and infrequently make use of leverage to enlarge their income (and losses).

- Central Banks: Central banks use gold as a reserve asset and infrequently monitor the chart to handle their gold holdings and assess the general market sentiment.

- Jewellery and Manufacturing Industries: The gold value straight impacts the price of uncooked supplies for jewellery producers and different industries utilizing gold. They monitor the chart to handle their buying methods and pricing.

Conclusion:

The Kitco Gold Chart (USD) is a robust instrument for understanding the dynamics of the gold market. Nevertheless, decoding the chart requires a complete understanding of the assorted elements influencing gold costs and a mix of technical and basic evaluation. Whereas the chart can present beneficial insights, it is essential to do not forget that gold costs are inherently risky and influenced by unpredictable occasions. Due to this fact, thorough analysis, danger administration, and a well-defined funding technique are important for anybody utilizing the Kitco Gold Chart to make knowledgeable selections. Relying solely on the chart with out contemplating different market indicators and financial elements can result in inaccurate predictions and probably vital losses. Steady studying and adaptation to altering market circumstances are key to profitable navigation of the gold market.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Kitco Gold Chart (USD): A Complete Information to Understanding Gold Costs. We hope you discover this text informative and useful. See you in our subsequent article!