Decoding the Decrease Highs Greater Lows Chart Sample: A Complete Information

Associated Articles: Decoding the Decrease Highs Greater Lows Chart Sample: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the Decrease Highs Greater Lows Chart Sample: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Decrease Highs Greater Lows Chart Sample: A Complete Information

The monetary markets are a posh tapestry woven with threads of worth motion, quantity, and sentiment. Chart patterns, recognizable formations on worth charts, present invaluable insights into the potential future route of an asset. Amongst these patterns, the "decrease highs greater lows" formation holds a singular significance, usually signaling a transition from a bearish pattern to a sideways or doubtlessly bullish section. Understanding this sample, its nuances, and how one can successfully commerce it’s essential for any critical investor or dealer.

This text delves deep into the decrease highs greater lows sample, exploring its traits, identification methods, affirmation methods, and threat administration issues. We’ll dissect real-world examples as an example its sensible software and focus on how one can keep away from frequent pitfalls.

Defining the Decrease Highs Greater Lows Sample

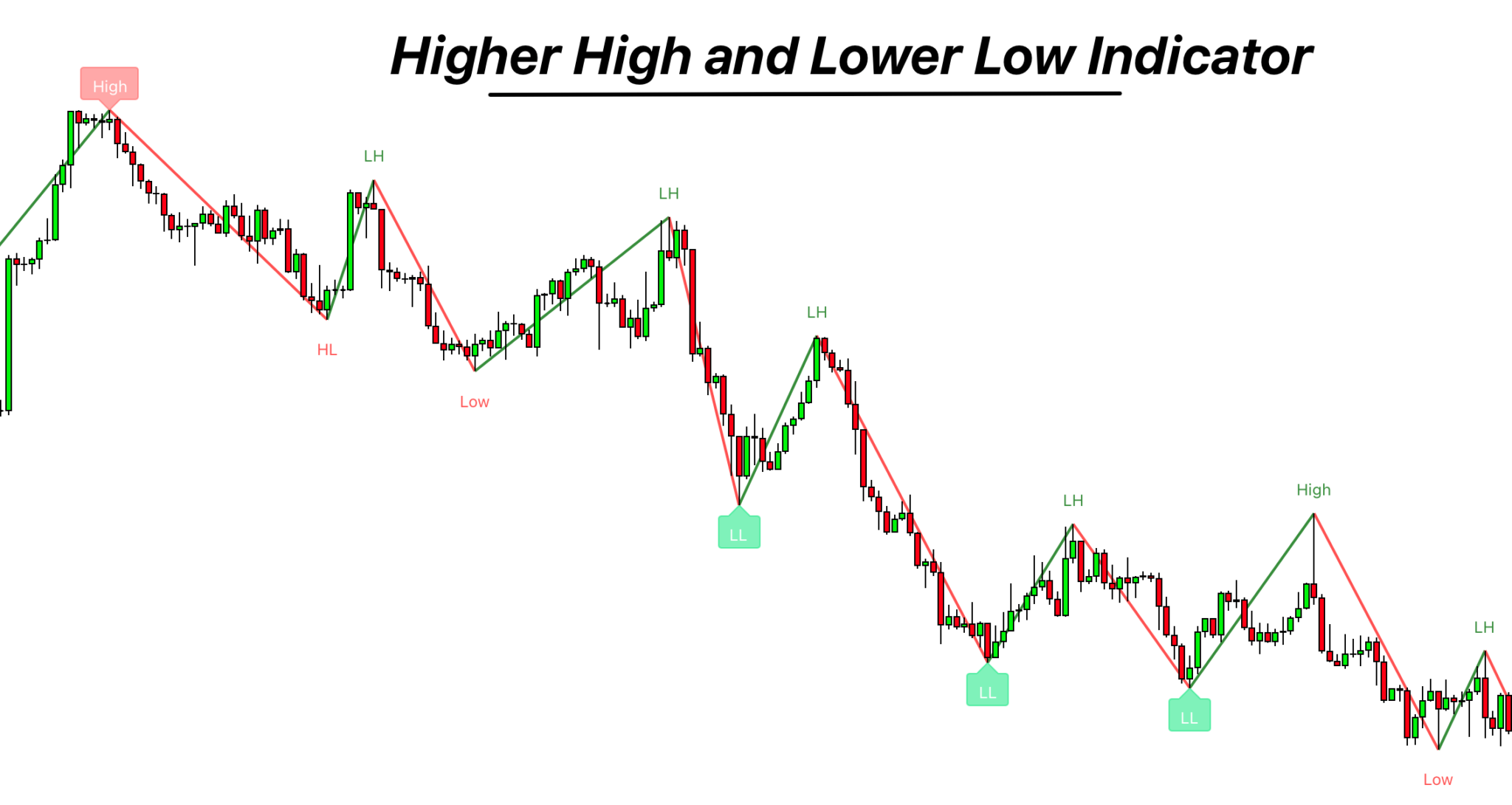

The decrease highs greater lows sample, often known as a bullish consolidation or a triangle sample (although not strictly a triangle in all its varieties), is characterised by a sequence of progressively decrease peaks (highs) and progressively greater troughs (lows). This creates a visually discernible sample on a worth chart that resembles a sideways vary, however with a definite upward bias. The sample suggests a battle between consumers and sellers, with consumers step by step gaining power.

Key Traits:

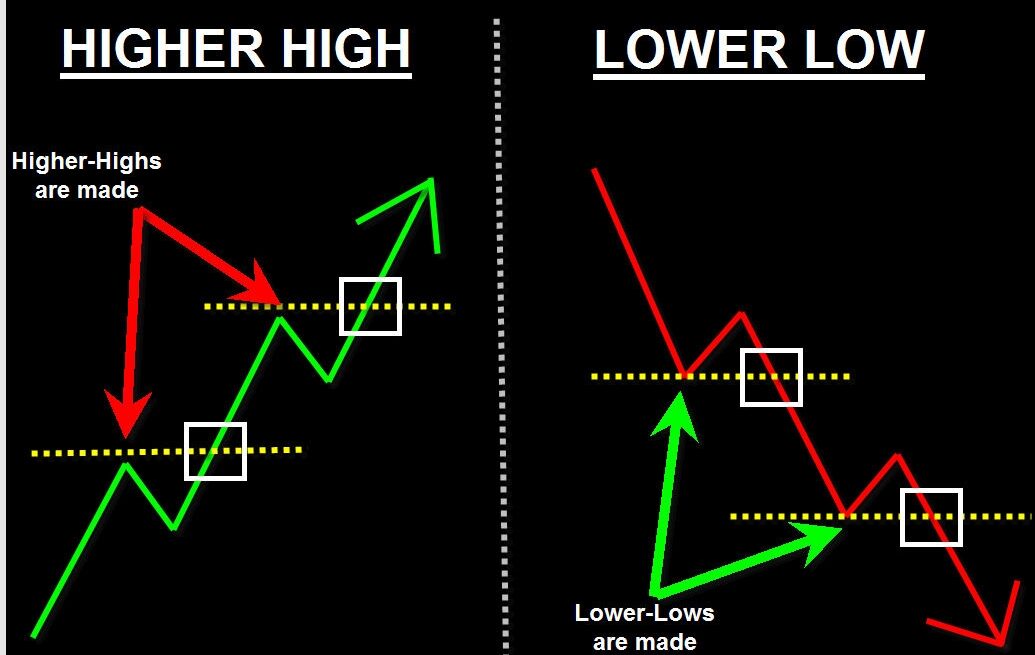

- Decrease Highs: Every successive peak is decrease than the earlier one. This means waning promoting strain.

- Greater Lows: Every successive trough is greater than the earlier one. This demonstrates growing shopping for strain.

- Consolidation Section: The sample usually develops throughout a interval of consolidation or sideways buying and selling after a previous downtrend.

- Slope: Whereas the general sample is sideways, the connecting line between the upper lows usually has a barely optimistic slope, additional reinforcing the bullish bias.

- Quantity: Ideally, quantity ought to lower because the sample develops, reflecting a discount in volatility and the market’s indecision. A surge in quantity on the breakout level is a powerful affirmation sign.

Figuring out the Sample:

Figuring out a decrease highs greater lows sample requires cautious commentary and evaluation of the worth chart. Whereas the sample is comparatively simple, a number of components can affect its accuracy and interpretation:

- Timeframe: The sample can seem on varied timeframes, from short-term (e.g., hourly, each day) to long-term (e.g., weekly, month-to-month). The timeframe chosen dictates the buying and selling technique and potential revenue targets.

- Variety of Swings: Ideally, the sample ought to exhibit at the least two, however ideally three or extra, distinct decrease highs and better lows to verify its validity. Fewer swings improve the chance of false alerts.

- Value Motion: The worth motion inside the sample ought to be comparatively orderly, with clear identifiable highs and lows. Erratic worth actions can obscure the sample and make interpretation difficult.

- Help and Resistance: The sample’s lows usually take a look at and respect a assist stage, whereas the highs take a look at and respect a resistance stage. These ranges play a vital function in figuring out potential breakout factors.

Affirmation Methods:

As soon as a possible decrease highs greater lows sample is recognized, affirmation is essential earlier than coming into a commerce. A number of methods may help verify the sample’s validity:

- Quantity Evaluation: Lowering quantity through the consolidation section and growing quantity on the breakout level strongly confirms the sample. Excessive quantity confirms a powerful transfer.

- Breakout Affirmation: A decisive break above the resistance stage, accompanied by elevated quantity, offers a powerful purchase sign. An in depth above the resistance stage on the next timeframe reinforces the sign.

- Technical Indicators: Shifting averages (e.g., 20-day, 50-day), Relative Energy Index (RSI), and MACD can be utilized to verify the bullish momentum. A bullish crossover of transferring averages and an RSI above 50 usually sign a bullish pattern.

- Basic Evaluation: Whereas primarily a technical sample, integrating elementary evaluation can present additional insights into the asset’s underlying worth and potential for progress. Optimistic information or robust earnings stories can strengthen the bullish outlook.

Buying and selling Methods and Threat Administration:

As soon as the sample is confirmed, merchants can make use of varied methods:

- Breakout Technique: Enter a protracted place as soon as the worth decisively breaks above the resistance stage with elevated quantity. Place a stop-loss order beneath the latest swing low to restrict potential losses.

- Pullback Technique: Await a slight pullback to the damaged resistance stage (now assist) after the breakout. This provides a doubtlessly higher entry level with diminished threat.

- Goal Setting: Revenue targets might be set based mostly on the sample’s peak. A typical goal is the peak of the sample projected upwards from the breakout level. Different targets would possibly embody key resistance ranges or Fibonacci retracement ranges.

- Cease-Loss Placement: A stop-loss order ought to at all times be used to restrict potential losses. Putting it beneath the latest swing low is a prudent method. Trailing stop-losses might be employed to lock in income as the worth strikes favorably.

Widespread Pitfalls to Keep away from:

- False Breakouts: The worth might briefly break above the resistance stage however fail to maintain the transfer, resulting in a false sign. Affirmation is essential to keep away from such eventualities.

- Poor Threat Administration: Lack of stop-loss orders or inappropriate goal setting can result in vital losses.

- Ignoring Quantity: Neglecting quantity evaluation can lead to inaccurate interpretations of the sample.

- Overreliance on the Sample: The decrease highs greater lows sample is only one piece of the puzzle. Integrating different technical and elementary evaluation is crucial for complete decision-making.

Actual-World Examples:

Analyzing historic charts of assorted property (shares, foreign exchange, cryptocurrencies) reveals quite a few cases of the decrease highs greater lows sample. These examples, when studied in context with quantity and different indicators, reveal the sample’s predictive energy and spotlight the significance of affirmation methods and threat administration. (Be aware: Particular examples require detailed chart evaluation which is past the scope of this written article. Readers are inspired to discover historic charts utilizing charting software program and apply the ideas mentioned above.)

Conclusion:

The decrease highs greater lows chart sample is a beneficial software for figuring out potential bullish reversals or consolidations. Nevertheless, it is essential to know its traits, make use of affirmation methods, and implement sturdy threat administration methods. By combining technical evaluation with elementary evaluation and a disciplined method, merchants can leverage this sample to boost their buying and selling efficiency and enhance their possibilities of success within the dynamic world of economic markets. Bear in mind, no buying and selling technique is foolproof, and steady studying and adaptation are important for long-term success.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Decrease Highs Greater Lows Chart Sample: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!