Decoding the Market: Selecting the Greatest Charts for Day Buying and selling Success

Associated Articles: Decoding the Market: Selecting the Greatest Charts for Day Buying and selling Success

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Market: Selecting the Greatest Charts for Day Buying and selling Success. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Market: Selecting the Greatest Charts for Day Buying and selling Success

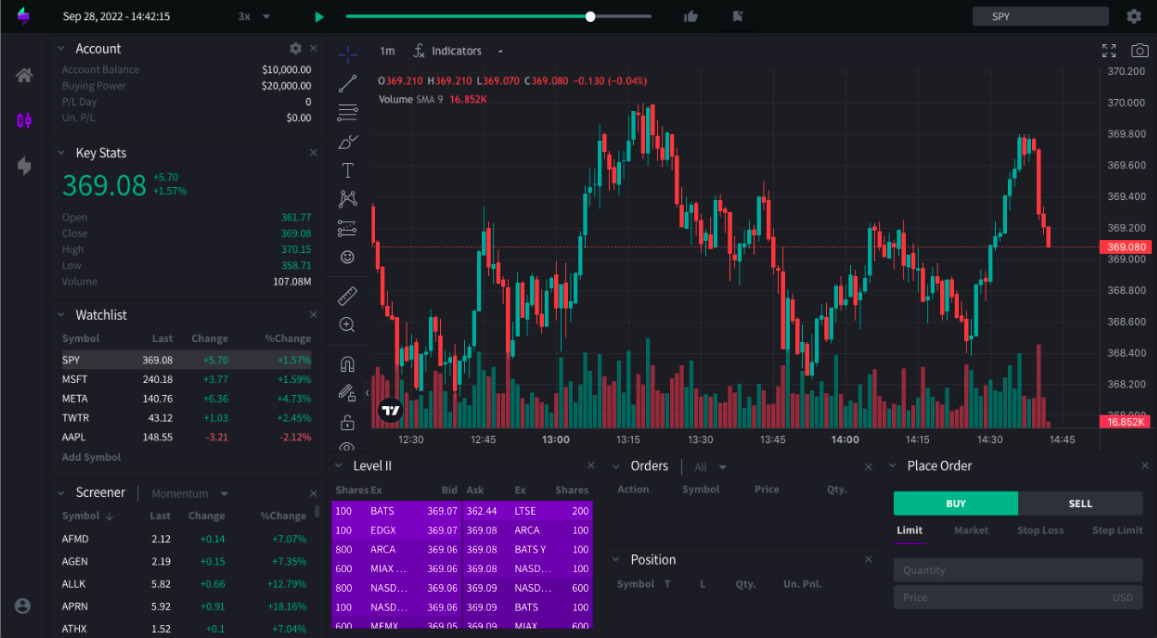

Day buying and selling, the artwork of shopping for and promoting belongings inside a single buying and selling day, calls for sharp remark and fast decision-making. A vital element of this course of is the power to interpret market information successfully, and that is the place charting is available in. Selecting the best chart kind and making use of applicable indicators can considerably improve your buying and selling efficiency, differentiating between profitable trades and dear errors. This text will delve into the perfect chart varieties for day buying and selling, exploring their strengths, weaknesses, and optimum purposes.

Understanding the Fundamentals: Chart Sorts and Their Functions

Earlier than diving into specifics, it is essential to know the elemental chart varieties out there to day merchants. These broadly fall into three classes:

-

Line Charts: These charts show the closing value of an asset for every interval (e.g., 1-minute, 5-minute, 15-minute intervals). They’re the best type of charting, focusing solely on value motion. Whereas visually clear, they lack the detailed info offered by different chart varieties. Line charts are greatest used for figuring out total traits and recognizing potential breakouts, particularly over longer timeframes. Their simplicity makes them very best for newcomers studying to interpret value actions.

-

Bar Charts: These charts present extra info than line charts, displaying the open, excessive, low, and shutting (OHLC) costs for every interval. The visible illustration of those 4 information factors permits for a extra complete understanding of value fluctuations inside a given timeframe. The "physique" of the bar represents the vary between the open and shutting costs, whereas the "wicks" (or shadows) prolong to the excessive and low costs. Bar charts are exceptionally helpful for figuring out value ranges, assist and resistance ranges, and potential reversals. They’re a staple for day merchants as a result of their stability of simplicity and informational richness.

-

Candlestick Charts: These are arguably the most well-liked chart kind amongst day merchants. Just like bar charts, they show OHLC information, however with a visually extra intuitive illustration. The "physique" of the candlestick is crammed, indicating whether or not the value closed greater (inexperienced or white) or decrease (purple or black) than it opened. The wicks, like bar charts, present the excessive and low costs. Candlestick charts are notably efficient at figuring out patterns like engulfing patterns, hammer formations, and doji stars, which might sign potential value reversals or continuation strikes. Their visible readability and sample recognition capabilities make them a most well-liked alternative for a lot of skilled merchants.

Timeframes: The Heartbeat of Day Buying and selling Charts

The selection of chart timeframe is as important because the chart kind itself. Day buying and selling includes short-term methods, and the timeframe choice immediately impacts the extent of element and the velocity of value actions noticed. Widespread timeframes used embody:

-

1-minute Chart: Supplies essentially the most granular view of value motion, very best for scalping – making very short-term trades based mostly on minor value fluctuations. Nonetheless, the excessive frequency of information could be overwhelming and susceptible to noise, making it difficult for newcomers.

-

5-minute Chart: Gives a stability between element and readability, appropriate for figuring out short-term traits and executing trades based mostly on minor value swings. It’s a preferred alternative for a lot of day merchants because it filters out a number of the noise current within the 1-minute chart.

-

15-minute Chart: Supplies a extra smoothed-out view of value motion, helpful for figuring out intermediate-term traits and potential breakouts. It’s much less inclined to noise than shorter timeframes, permitting for a extra strategic strategy.

-

30-minute Chart: Gives a broader perspective, very best for figuring out bigger traits and establishing trades based mostly on longer-term value actions. It’s usually used along side shorter timeframes for affirmation and threat administration.

-

60-minute (Hourly) Chart: Supplies the longest timeframe generally utilized in day buying and selling, appropriate for figuring out vital traits and establishing longer-term trades throughout the day. It is usually used for figuring out total market sentiment.

Combining Chart Sorts and Timeframes for Enhanced Evaluation

Many profitable day merchants make the most of a number of chart varieties and timeframes concurrently to realize a complete understanding of the market. For example, a dealer may use a 5-minute candlestick chart for figuring out entry and exit factors, whereas concurrently monitoring a 15-minute or 60-minute chart to evaluate the general development and make sure their buying and selling selections. This multi-timeframe evaluation helps filter out noise and enhance the accuracy of buying and selling alerts.

Past the Fundamentals: Incorporating Indicators

Whereas chart varieties and timeframes present the foundational framework for day buying and selling evaluation, incorporating technical indicators can considerably improve your capability to establish potential buying and selling alternatives. Some in style indicators embody:

-

Transferring Averages (MA): These easy out value fluctuations and assist establish traits. Generally used MAs embody the 20-period, 50-period, and 200-period MAs. Crossovers between completely different MAs can sign potential purchase or promote alerts.

-

Relative Power Index (RSI): This momentum indicator measures the velocity and alter of value actions. RSI values above 70 typically counsel overbought situations, whereas values under 30 counsel oversold situations. These ranges can sign potential reversals.

-

MACD (Transferring Common Convergence Divergence): This indicator identifies modifications in momentum by evaluating two shifting averages. Crossovers of the MACD line and sign line can sign potential purchase or promote alternatives.

-

Bollinger Bands: These bands present the volatility of an asset’s value. Worth actions outdoors the bands can sign potential breakouts or reversals.

-

Quantity: Analyzing buying and selling quantity alongside value motion is essential. Excessive quantity confirms value actions, whereas low quantity might counsel weak traits.

Selecting the Proper Instruments and Platforms

The effectiveness of chart evaluation relies upon closely on the standard of the charting platform used. Many platforms supply a variety of chart varieties, timeframes, and technical indicators, permitting for personalisation to particular person buying and selling kinds. Selecting a platform with sturdy charting capabilities, real-time information feeds, and user-friendly interface is essential for environment friendly day buying and selling.

Danger Administration: A Essential Consideration

Regardless of how refined your chart evaluation is, threat administration stays paramount in day buying and selling. Utilizing stop-loss orders to restrict potential losses and punctiliously managing place sizing are important for shielding your capital. Overtrading and emotional decision-making are frequent pitfalls that may considerably affect profitability.

Conclusion: Mastering the Artwork of Chart Interpretation

Selecting the best chart varieties and timeframes for day buying and selling is an important talent that takes time and observe to grasp. Whereas candlestick charts are favored by many as a result of their visible readability and sample recognition capabilities, the optimum alternative finally depends upon particular person buying and selling kinds and methods. By combining completely different chart varieties, timeframes, and technical indicators, and by incorporating sound threat administration practices, day merchants can considerably improve their capability to establish worthwhile buying and selling alternatives and navigate the dynamic world of short-term market actions. Do not forget that steady studying and adaptation are key to success on this difficult but probably rewarding subject. Experiment with completely different approaches, refine your methods based mostly in your expertise, and at all times prioritize threat administration to guard your capital and maximize your possibilities of long-term success.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Market: Selecting the Greatest Charts for Day Buying and selling Success. We thanks for taking the time to learn this text. See you in our subsequent article!