Decoding the Monero Worth Chart: Volatility, Adoption, and Future Prospects

Associated Articles: Decoding the Monero Worth Chart: Volatility, Adoption, and Future Prospects

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Monero Worth Chart: Volatility, Adoption, and Future Prospects. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Monero Worth Chart: Volatility, Adoption, and Future Prospects

Monero (XMR), a privacy-focused cryptocurrency, has captivated buyers and technologists alike with its dedication to untraceable transactions. Nonetheless, its worth chart, a fancy tapestry woven with threads of technological developments, market sentiment, and regulatory uncertainty, presents a difficult panorama for each seasoned merchants and newcomers. This text delves deep into the intricacies of the Monero worth chart, analyzing previous efficiency, figuring out key influencing components, and exploring potential future trajectories.

A Historic Overview: From Humble Beginnings to Notable Peaks

Monero’s journey started in 2014, rising from the CryptoNote protocol. Not like Bitcoin, which makes use of a clear blockchain, Monero employs ring signatures and stealth addresses to masks sender and receiver identities, guaranteeing enhanced privateness. This distinctive function has been a central driver of its enchantment, attracting customers involved about monetary surveillance and censorship.

The early years noticed a comparatively gradual worth appreciation, reflecting the nascent stage of the cryptocurrency market as a complete. Nonetheless, as consciousness grew and the demand for privacy-centric cryptocurrencies elevated, Monero skilled vital worth surges. These surges had been typically punctuated by durations of consolidation and correction, reflecting the inherent volatility of the cryptocurrency market. Main worth actions had been incessantly correlated with broader market developments, influenced by occasions similar to Bitcoin’s worth fluctuations, regulatory bulletins, and technological upgrades inside the Monero ecosystem.

Analyzing historic worth information reveals a number of notable peaks and troughs:

- Early Adoption Part (2014-2016): Characterised by gradual worth will increase, reflecting gradual however regular neighborhood progress and technological improvement.

- First Main Bull Run (2017): The broader cryptocurrency market increase propelled Monero to new highs, pushed by elevated media consideration and investor enthusiasm. This era showcased the excessive volatility inherent within the asset.

- Consolidation and Correction (2018-2019): A interval of worth decline reflecting the broader cryptocurrency market downturn and issues concerning regulation.

- Renewed Curiosity and Progress (2020-2021): A resurgence in curiosity, pushed by rising issues about privateness and information safety, led to a different worth improve. This era additionally noticed elevated adoption by decentralized purposes (dApps) and companies that prioritized consumer anonymity.

- Market Correction and Consolidation (2022-Current): Much like the broader cryptocurrency market, Monero skilled a major worth correction, reflecting macroeconomic components like inflation and rising rates of interest. This era has seen elevated deal with the long-term technological improvement and neighborhood progress fairly than short-term worth hypothesis.

Key Elements Influencing Monero’s Worth:

A number of interconnected components considerably affect Monero’s worth trajectory:

-

Market Sentiment: The general sentiment inside the cryptocurrency market considerably impacts Monero’s worth. Optimistic market sentiment, typically fueled by optimistic information concerning Bitcoin or different main cryptocurrencies, tends to result in worth will increase for Monero as effectively. Conversely, detrimental market sentiment can lead to vital worth drops.

-

Technological Developments: Monero’s improvement group constantly works on bettering the protocol’s safety and effectivity. Profitable exhausting forks, introducing new options or safety enhancements, can positively affect investor confidence and result in worth will increase. Conversely, delays or setbacks in improvement might negatively have an effect on the value.

-

Regulatory Panorama: The regulatory surroundings surrounding cryptocurrencies performs a vital position. Stringent rules or outright bans in main jurisdictions can negatively affect Monero’s worth, because it restricts its accessibility and adoption. Conversely, optimistic regulatory developments or readability can increase investor confidence.

-

Adoption and Utilization: Elevated adoption of Monero by companies, people, and decentralized purposes (dApps) instantly correlates with worth will increase. Better utilization interprets to larger demand, pushing the value upwards.

-

Competitors: Monero competes with different privacy-focused cryptocurrencies. The success of competing initiatives can affect Monero’s worth, both positively or negatively relying on the aggressive dynamics.

-

Macroeconomic Elements: World macroeconomic components, similar to inflation, rates of interest, and geopolitical occasions, can considerably affect all the cryptocurrency market, together with Monero’s worth. Intervals of financial uncertainty typically result in elevated volatility and worth fluctuations.

-

Mining Issue and Hashrate: The issue of mining Monero and the general community hashrate have an effect on the safety and stability of the community. A excessive hashrate usually signifies a safe and strong community, which might positively affect investor confidence.

Analyzing the Worth Chart: Technical Indicators and Patterns

Technical evaluation of Monero’s worth chart includes inspecting varied indicators and patterns to foretell future worth actions. Whereas not foolproof, technical evaluation can present priceless insights:

-

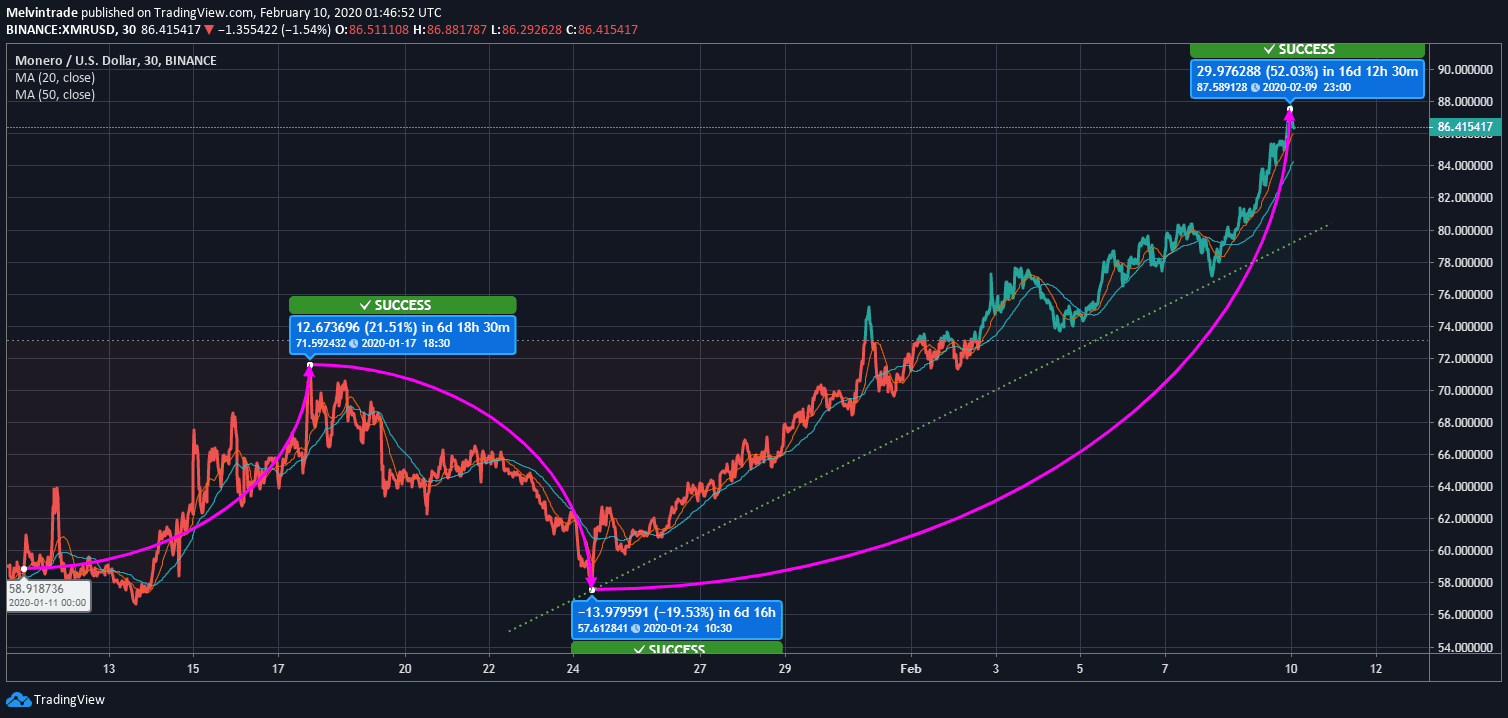

Shifting Averages: Analyzing shifting averages (e.g., 50-day, 200-day) might help determine developments and potential assist and resistance ranges. Crossovers of shifting averages can sign potential purchase or promote alternatives.

-

Relative Power Index (RSI): The RSI is a momentum indicator that helps determine overbought and oversold situations. An RSI above 70 suggests an overbought market, indicating a possible worth correction, whereas an RSI under 30 suggests an oversold market, probably indicating a worth rebound.

-

Quantity: Analyzing buying and selling quantity gives insights into the power of worth actions. Excessive quantity accompanying worth will increase suggests sturdy shopping for strain, whereas excessive quantity accompanying worth decreases suggests sturdy promoting strain.

-

Assist and Resistance Ranges: Figuring out historic assist and resistance ranges might help predict future worth actions. Assist ranges are worth factors the place the value has traditionally discovered assist, whereas resistance ranges are worth factors the place the value has traditionally confronted resistance.

-

Chart Patterns: Recognizing chart patterns, similar to head and shoulders, double tops/bottoms, and triangles, can present priceless insights into potential future worth actions.

Future Prospects: Challenges and Alternatives

Monero’s future worth trajectory is dependent upon a number of components, together with continued technological improvement, broader cryptocurrency market developments, and regulatory developments. A number of challenges and alternatives lie forward:

-

Sustaining Privateness: Continued efforts to boost privateness options and counter makes an attempt to interrupt Monero’s anonymity are essential for long-term success.

-

Elevated Adoption: Increasing adoption throughout varied sectors, together with e-commerce, decentralized finance (DeFi), and different purposes, is important for driving worth appreciation.

-

Regulatory Scrutiny: Navigating the evolving regulatory panorama is essential. Collaboration with regulators and selling accountable use of the expertise can mitigate dangers and foster a optimistic regulatory surroundings.

-

Competitors: Staying aggressive with different privacy-focused cryptocurrencies requires steady innovation and enchancment.

-

Technological Developments: Constantly upgrading the expertise to boost scalability, effectivity, and safety is paramount for attracting new customers and sustaining a powerful community.

Conclusion:

The Monero worth chart is a dynamic reflection of a fancy interaction of things. Whereas previous efficiency is just not indicative of future outcomes, analyzing historic information, understanding key influencing components, and using technical evaluation can present priceless insights. Monero’s dedication to privateness, coupled with ongoing technological developments and neighborhood assist, positions it as a probably priceless asset in the long run. Nonetheless, buyers ought to strategy the market with warning, acknowledging the inherent volatility and dangers related to cryptocurrency investments. Thorough analysis and a well-defined threat administration technique are essential for navigating the complexities of the Monero worth chart and making knowledgeable funding choices. The way forward for Monero, just like the cryptocurrency market as a complete, stays unsure, however its distinctive options and devoted neighborhood counsel a probably vibrant future, albeit one characterised by vital volatility.

![Monero [XMR] price chart painted green, soars up by 10% in a day](https://ambcrypto.com/wp-content/uploads/2018/08/1dmoneropricechart.jpg)

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Monero Worth Chart: Volatility, Adoption, and Future Prospects. We respect your consideration to our article. See you in our subsequent article!