Decoding the Pure Gasoline Worth Chart: A Complete Information

Associated Articles: Decoding the Pure Gasoline Worth Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Pure Gasoline Worth Chart: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Pure Gasoline Worth Chart: A Complete Information

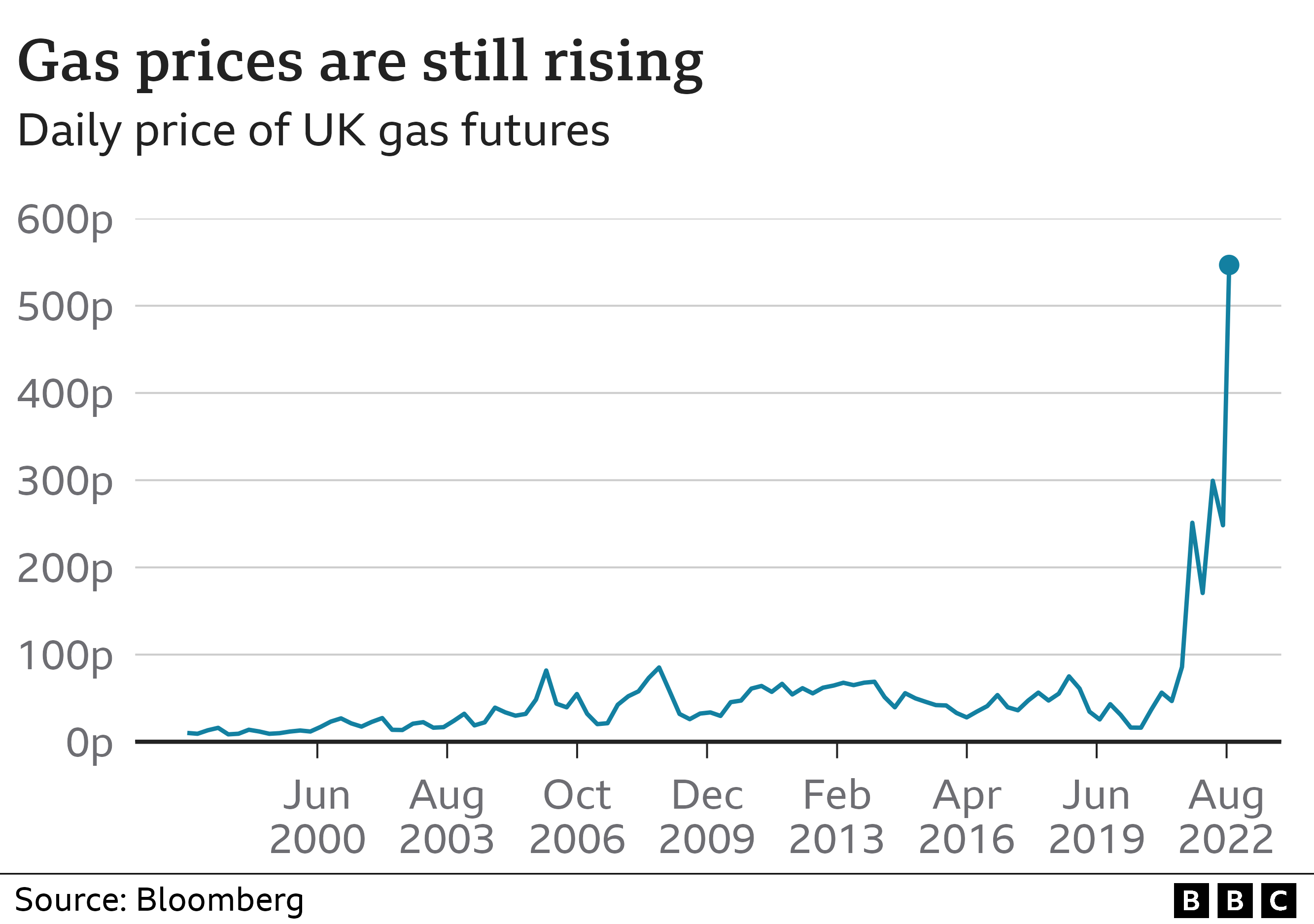

Pure gasoline, a vital power supply powering properties, industries, and electrical energy era, displays value fluctuations influenced by a posh interaction of things. Understanding these dynamics is significant for buyers, companies, and customers alike. This text delves into the intricacies of pure gasoline value charts, exploring the important thing drivers behind value actions, frequent chart patterns, and sensible methods for deciphering the info.

Understanding the Fundamentals: Provide and Demand Dynamics

Essentially the most elementary precept governing pure gasoline costs is the basic financial mannequin of provide and demand. A surge in demand, pushed by components like a chilly winter growing heating wants or sturdy industrial exercise, pushes costs upward. Conversely, ample provide, maybe attributable to elevated manufacturing or delicate climate decreasing heating demand, exerts downward stress on costs.

Key Elements Influencing Pure Gasoline Costs:

A number of components intricately affect the provision and demand equilibrium, resulting in the worth fluctuations seen on pure gasoline charts:

-

Climate: That is arguably probably the most important short-term driver. Unusually chilly winters in main consuming areas like North America and Europe dramatically improve demand for heating, main to cost spikes. Conversely, delicate winters dampen demand, leading to decrease costs. Summer season temperatures additionally play a task, impacting electrical energy era wants for air con.

-

Financial Progress: Sturdy financial development usually interprets to elevated industrial exercise and better power consumption, boosting demand for pure gasoline. Recessions or financial slowdowns have the alternative impact.

-

Geopolitical Occasions: World political instability, sanctions, or conflicts in main gas-producing or -consuming areas can considerably disrupt provide chains and affect costs. For instance, geopolitical tensions involving main exporters can result in value volatility.

-

Storage Ranges: Pure gasoline storage ranges present a vital buffer towards seasonal demand fluctuations. Low storage ranges heading into winter, for instance, recommend potential value will increase attributable to restricted provide cushion. Conversely, excessive storage ranges sign ample provide, doubtlessly main to cost declines.

-

Manufacturing Ranges: The quantity of pure gasoline produced considerably impacts provide. Technological developments in extraction strategies like hydraulic fracturing ("fracking") have elevated manufacturing in sure areas, affecting world provide and value dynamics. Manufacturing disruptions attributable to accidents, upkeep, or regulatory adjustments may affect costs.

-

Competitors from Different Fuels: Pure gasoline competes with different power sources like coal, oil, and renewable power (photo voltaic, wind). Adjustments within the relative costs of those alternate options can affect pure gasoline demand and, consequently, its value. For instance, a surge in renewable power adoption may scale back pure gasoline demand for electrical energy era.

-

Authorities Laws and Insurance policies: Authorities insurance policies relating to environmental laws, subsidies for renewable power, or taxes on carbon emissions can affect pure gasoline manufacturing, consumption, and in the end, pricing.

Deciphering Pure Gasoline Worth Charts: Technical Evaluation

Analyzing pure gasoline value charts entails using technical evaluation strategies to establish traits, predict future value actions, and make knowledgeable buying and selling or funding selections. A number of key points of technical evaluation are related:

-

Trendlines: Figuring out upward or downward sloping trendlines helps decide the prevailing development. A constantly upward-sloping trendline suggests a bullish market, whereas a downward-sloping trendline signifies a bearish market.

-

Assist and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt by. Assist ranges signify value flooring the place shopping for stress is anticipated to beat promoting stress, stopping additional value declines. Resistance ranges signify value ceilings the place promoting stress is anticipated to beat shopping for stress, stopping additional value will increase. Breakouts above resistance or beneath help can sign important value actions.

-

Shifting Averages: Shifting averages, equivalent to easy transferring averages (SMA) or exponential transferring averages (EMA), clean out value fluctuations and assist establish the general development. Crossovers of various transferring averages can generate purchase or promote alerts.

-

Candlestick Patterns: Candlestick patterns, fashioned by the day by day or hourly value motion, present visible representations of provide and demand dynamics. Sure patterns, like hammer, engulfing, or taking pictures star patterns, can point out potential value reversals or continuations.

-

Indicators: Technical indicators, equivalent to Relative Energy Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands, present extra alerts about momentum, development power, and potential overbought or oversold situations.

Basic Evaluation and its Position in Chart Interpretation

Whereas technical evaluation focuses on value charts and historic patterns, elementary evaluation considers the underlying financial and geopolitical components driving pure gasoline costs. Integrating elementary evaluation with technical evaluation gives a extra complete understanding of value actions. For instance, anticipating a very chilly winter primarily based on climate forecasts would inform your interpretation of technical chart patterns, doubtlessly suggesting a bullish outlook regardless of a short-term bearish sign.

Threat Administration and Buying and selling Methods

Buying and selling pure gasoline entails important danger attributable to its volatility. Implementing efficient danger administration methods is essential:

-

Place Sizing: By no means danger extra capital than you possibly can afford to lose on a single commerce.

-

Cease-Loss Orders: Set stop-loss orders to robotically restrict potential losses if the worth strikes towards your place.

-

Diversification: Diversify your portfolio to cut back general danger. Do not put all of your eggs in a single basket.

-

Hedging: Contemplate hedging methods to mitigate value danger.

Conclusion:

The pure gasoline value chart is a dynamic illustration of a posh market influenced by a mess of things. Efficiently navigating this market requires an intensive understanding of each technical and elementary evaluation, coupled with disciplined danger administration. By rigorously analyzing the interaction of provide and demand, contemplating key financial and geopolitical components, and using applicable chart studying strategies, buyers and companies could make extra knowledgeable selections and doubtlessly capitalize on the alternatives and mitigate the dangers related to this important power commodity. Do not forget that previous efficiency isn’t indicative of future outcomes, and thorough analysis and due diligence are important earlier than making any buying and selling or funding selections.

Closure

Thus, we hope this text has offered useful insights into Decoding the Pure Gasoline Worth Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!