Decoding the Nifty Smallcap 250 Index Chart: A Deep Dive into India’s Rising Market

Associated Articles: Decoding the Nifty Smallcap 250 Index Chart: A Deep Dive into India’s Rising Market

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Nifty Smallcap 250 Index Chart: A Deep Dive into India’s Rising Market. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Nifty Smallcap 250 Index Chart: A Deep Dive into India’s Rising Market

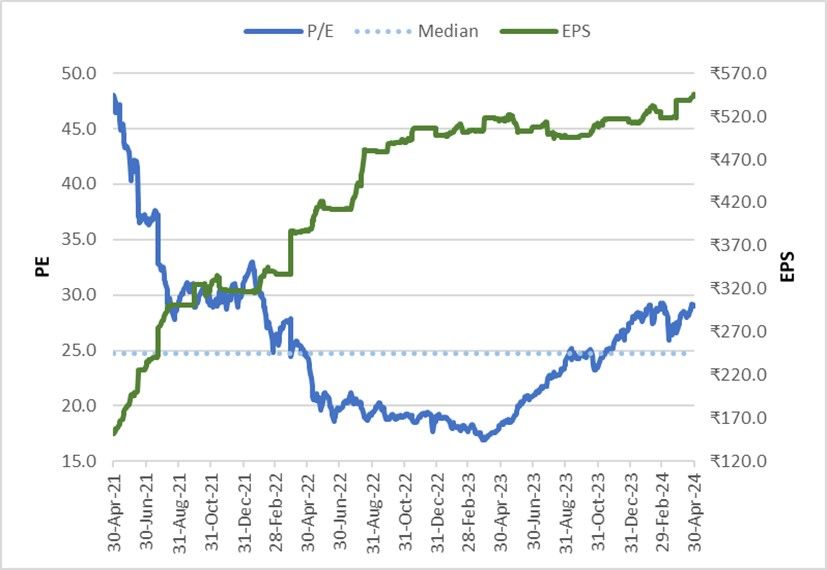

The Nifty Smallcap 250 index serves as an important barometer for India’s burgeoning small-cap market. This index, encompassing 250 corporations not included within the Nifty 500, affords a glimpse into the dynamism and volatility inherent on this section of the Indian fairness market. Analyzing its chart offers helpful insights into market tendencies, investor sentiment, and potential funding alternatives. This text delves deep into decoding the Nifty Smallcap 250 index chart, analyzing its historic efficiency, key technical indicators, and the elements influencing its fluctuations.

Understanding the Index Composition and Methodology:

Earlier than decoding the chart, it is essential to grasp the index’s composition and methodology. The Nifty Smallcap 250 index is a free-float market capitalization-weighted index, which means the burden of every constituent firm is set by its market capitalization adjusted for the free float (shares accessible for public buying and selling). This technique ensures the index precisely displays the market’s notion of the worth of those corporations. The choice standards prioritize corporations with a sturdy monetary monitor document, good company governance, and ample liquidity. The index is commonly rebalanced to replicate modifications out there capitalization and liquidity of its constituents. This dynamic nature makes understanding its chart much more essential for traders.

Historic Efficiency and Key Traits:

The Nifty Smallcap 250 index has exhibited a historical past of serious volatility, outperforming the broader market throughout bull runs however experiencing sharper declines throughout bear markets. Analyzing its historic efficiency requires a multi-faceted method. Wanting on the long-term chart (e.g., 5-year or 10-year view) reveals broader tendencies, like durations of sustained development punctuated by corrections. Quick-term charts (e.g., each day or weekly) spotlight the index’s day-to-day fluctuations and quick market sentiment.

As an illustration, durations of sturdy financial development in India typically coincide with strong efficiency within the Nifty Smallcap 250. Components like authorities insurance policies selling small and medium-sized enterprises (SMEs), elevated overseas funding, and bettering home consumption contribute to this optimistic correlation. Conversely, world financial downturns, home coverage uncertainties, or sector-specific headwinds can considerably influence the index’s efficiency, resulting in sharp corrections.

Decoding the Chart: Technical Indicators and Evaluation:

An intensive evaluation of the Nifty Smallcap 250 chart necessitates the usage of technical indicators. These indicators present quantitative insights into the worth tendencies, momentum, and volatility of the index. Some generally used indicators embrace:

-

Transferring Averages (MA): Easy Transferring Averages (SMA) and Exponential Transferring Averages (EMA) assist determine the pattern course. A bullish pattern is usually indicated when the short-term MA crosses above the long-term MA (a "golden cross"), whereas a bearish pattern is usually recommended by the other ("demise cross").

-

Relative Power Index (RSI): This momentum indicator measures the magnitude of current value modifications to judge overbought or oversold situations. RSI values above 70 typically counsel an overbought market, indicating potential for a value correction, whereas values beneath 30 counsel an oversold market, hinting at a possible rebound.

-

MACD (Transferring Common Convergence Divergence): MACD identifies modifications in momentum by evaluating two transferring averages. A bullish sign is usually noticed when the MACD line crosses above its sign line, whereas a bearish sign happens when the other occurs.

-

Bollinger Bands: These bands plot normal deviations round a transferring common, illustrating value volatility. Wider bands point out elevated volatility, whereas narrower bands counsel decrease volatility. Value breakouts above or beneath the bands can sign vital value actions.

-

Quantity Evaluation: Analyzing buying and selling quantity together with value actions offers essential context. Excessive quantity throughout value will increase confirms the energy of the uptrend, whereas excessive quantity throughout value declines suggests a stronger bearish stress.

Components Influencing the Nifty Smallcap 250 Index Chart:

The Nifty Smallcap 250 index chart is influenced by a large number of things, each macroeconomic and microeconomic:

-

Financial Progress: India’s general financial development considerably impacts the efficiency of small-cap corporations. Sturdy GDP development usually results in elevated enterprise exercise and investor confidence, positively affecting the index.

-

Curiosity Charges: Adjustments in rates of interest affect borrowing prices for small-cap corporations. Greater rates of interest can improve borrowing prices, probably hindering development and impacting the index negatively.

-

Inflation: Excessive inflation erodes buying energy and might negatively have an effect on client demand, impacting the profitability of small-cap corporations.

-

Authorities Insurance policies: Authorities initiatives aimed toward supporting SMEs, bettering infrastructure, or easing regulatory burdens can positively affect the index.

-

World Market Circumstances: World financial occasions and geopolitical elements can influence investor sentiment in the direction of rising markets like India, influencing the Nifty Smallcap 250’s efficiency.

-

Sector-Particular Traits: Efficiency inside particular sectors represented within the index can considerably affect its general motion. Sturdy efficiency in sectors like know-how, healthcare, or client items can drive the index upward, whereas underperformance in different sectors can weigh it down.

-

Investor Sentiment: General investor sentiment in the direction of the Indian fairness market performs an important function. Durations of excessive optimism typically result in elevated funding in small-cap shares, whereas pessimism can result in sell-offs.

Threat Administration and Funding Methods:

Investing within the Nifty Smallcap 250 index includes larger threat in comparison with investing in large-cap indices. The upper volatility necessitates a sturdy threat administration technique. Traders ought to take into account diversifying their portfolio throughout completely different asset courses and sectors to mitigate threat. Greenback-cost averaging, a method of investing a hard and fast quantity at common intervals, may help scale back the influence of market volatility.

Analyzing the Nifty Smallcap 250 index chart is essential for knowledgeable funding choices. Nevertheless, technical evaluation must be complemented with basic evaluation, which includes assessing the monetary well being and development prospects of particular person corporations throughout the index. This mixed method offers a extra complete understanding of the market and helps traders make better-informed funding decisions.

Conclusion:

The Nifty Smallcap 250 index chart affords a dynamic and interesting view into the expansion and volatility of India’s small-cap market. By understanding the index’s composition, historic efficiency, related technical indicators, and the elements influencing its actions, traders can acquire helpful insights into potential funding alternatives and handle threat successfully. Nevertheless, it is essential to keep in mind that investing in small-cap shares includes larger threat than large-cap investments. Thorough analysis, diversification, and a well-defined threat administration technique are important for navigating this section of the market efficiently. Steady monitoring of the chart, coupled with basic evaluation, permits traders to adapt their methods and capitalize on market alternatives whereas mitigating potential losses. The Nifty Smallcap 250 index, due to this fact, presents a compelling funding panorama for these prepared to embrace the inherent dangers and rewards of India’s dynamic small-cap market.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Nifty Smallcap 250 Index Chart: A Deep Dive into India’s Rising Market. We thanks for taking the time to learn this text. See you in our subsequent article!