Decoding the QQQ Buying and selling Chart: A Complete Information

Associated Articles: Decoding the QQQ Buying and selling Chart: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the QQQ Buying and selling Chart: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the QQQ Buying and selling Chart: A Complete Information

The Invesco QQQ Belief (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index contains 100 of the biggest non-financial corporations listed on the Nasdaq Inventory Market, making QQQ a well-liked selection for buyers in search of publicity to the know-how sector and broader progress shares. Understanding the QQQ buying and selling chart is essential for navigating its worth fluctuations and making knowledgeable funding choices. This text will delve into varied elements of decoding the QQQ chart, from fundamental worth motion to superior technical evaluation methods.

I. Understanding the Fundamentals of the QQQ Chart:

A typical QQQ chart shows the ETF’s worth over time, often represented by candlestick patterns or line graphs. Every candlestick or line section represents a selected time interval (e.g., someday, one week, one month). Key components displayed on the chart embody:

- Value Axis (Y-axis): Exhibits the worth of QQQ at completely different deadlines.

- Time Axis (X-axis): Represents the time interval lined by the chart (e.g., every day, weekly, month-to-month, yearly).

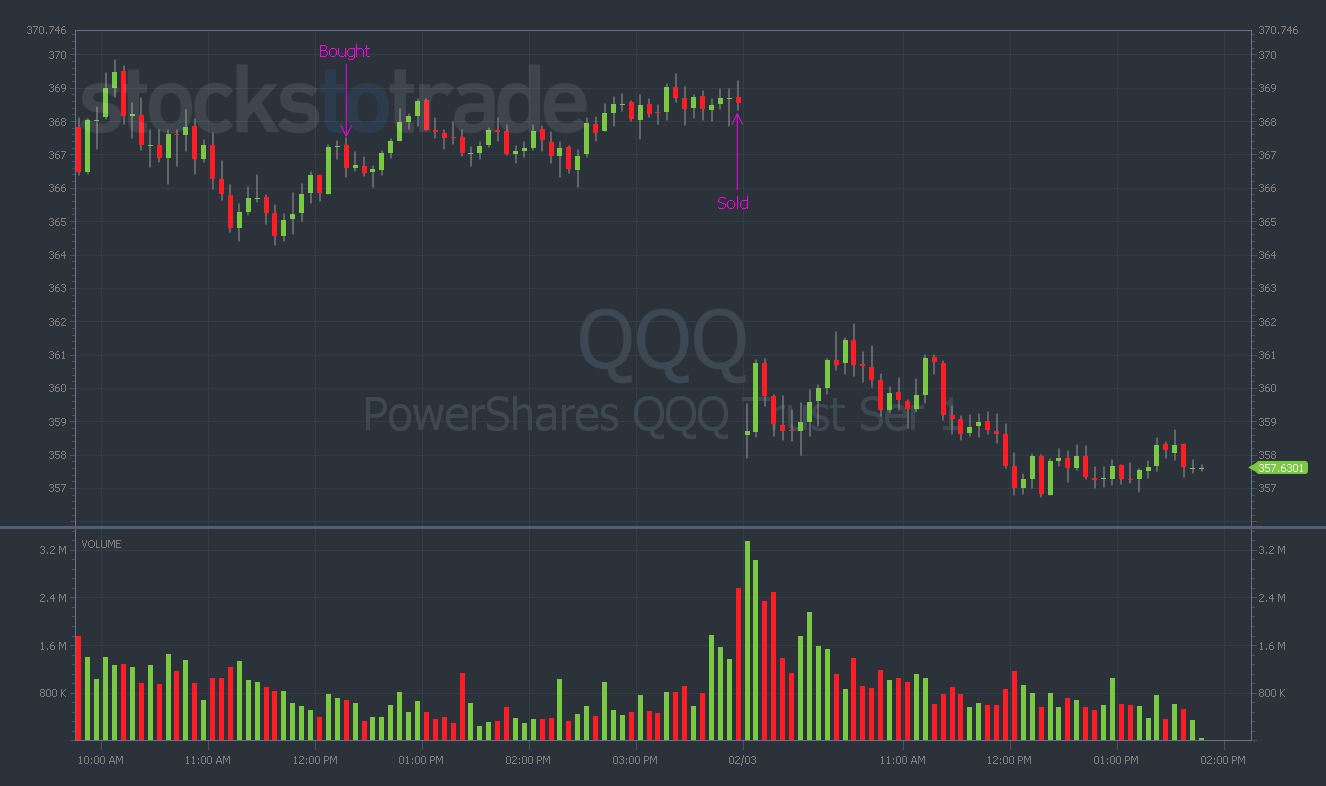

- Candlestick/Line Chart: Visible illustration of worth actions. Candlesticks present the opening, closing, excessive, and low costs for a given interval. Line charts merely join the closing costs.

- Quantity: Typically displayed under the worth chart, quantity signifies the variety of shares traded throughout every interval. Excessive quantity typically accompanies important worth actions.

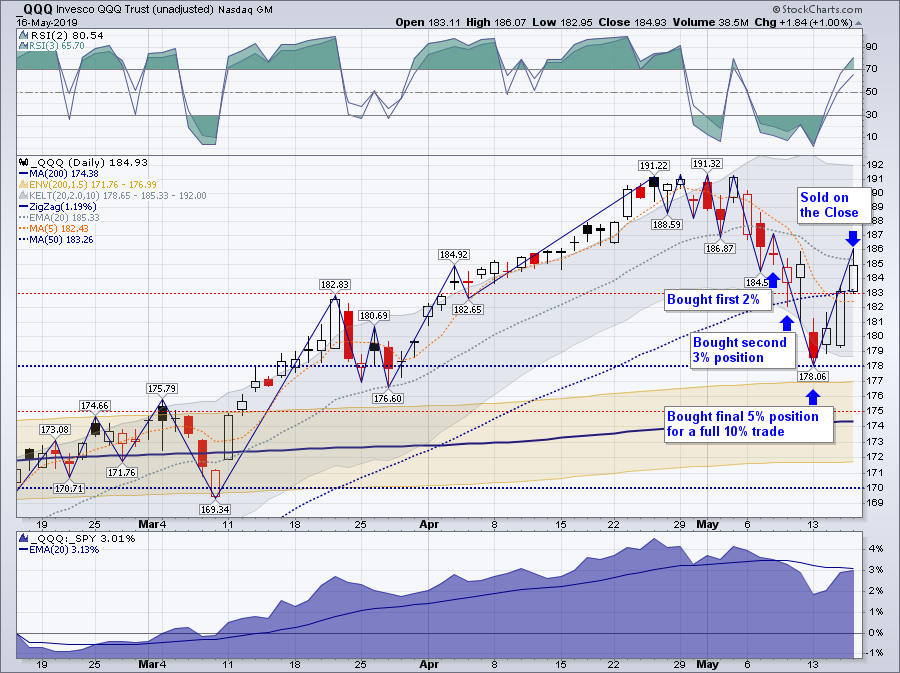

- Transferring Averages: These are strains plotted on the chart that easy out worth fluctuations and assist determine traits. Frequent transferring averages embody the 50-day and 200-day transferring averages.

II. Analyzing Value Motion:

Earlier than diving into complicated indicators, understanding fundamental worth motion is prime. This includes observing the path and magnitude of worth actions.

- Tendencies: Figuring out traits is essential. An uptrend signifies persistently larger highs and better lows, whereas a downtrend exhibits persistently decrease highs and decrease lows. A sideways or ranging market exhibits neither a transparent uptrend nor downtrend.

- Help and Resistance Ranges: Help ranges are worth factors the place the worth tends to search out shopping for stress and bounce again. Resistance ranges are worth factors the place promoting stress typically overwhelms shopping for stress, inflicting worth declines. Breaks above resistance or under assist can sign important development adjustments.

- Candlestick Patterns: Sure candlestick patterns can present insights into potential future worth actions. As an illustration, a bullish engulfing sample suggests a possible reversal from a downtrend, whereas a bearish engulfing sample suggests a possible reversal from an uptrend. Different patterns like hammer, hanging man, and doji also can supply beneficial clues.

- Gaps: Gaps happen when the worth opens considerably larger or decrease than yesterday’s shut. Gaps can signify sturdy momentum and infrequently get stuffed later.

III. Incorporating Technical Indicators:

Technical indicators are mathematical calculations based mostly on worth and quantity knowledge that assist merchants determine potential buying and selling alternatives. Some generally used indicators for analyzing the QQQ chart embody:

- Relative Power Index (RSI): This momentum oscillator measures the pace and alter of worth actions. RSI values above 70 are typically thought of overbought, suggesting potential worth corrections, whereas values under 30 are thought of oversold, suggesting potential worth rebounds.

- Transferring Common Convergence Divergence (MACD): This momentum indicator compares two transferring averages to determine potential development adjustments and momentum shifts. MACD crossovers (when the MACD line crosses the sign line) can sign purchase or promote alerts.

- Bollinger Bands: These bands include three strains: a easy transferring common and two commonplace deviation bands above and under the transferring common. Value actions outdoors the bands can counsel overbought or oversold circumstances.

- Quantity Indicators: On-Steadiness Quantity (OBV) and Chaikin Cash Movement (CMF) are examples of quantity indicators that assist affirm worth traits and determine potential divergences. Divergences happen when worth and quantity indicators present conflicting alerts.

IV. Combining Technical Evaluation with Basic Evaluation:

Whereas technical evaluation offers beneficial insights into worth actions, it is important to contemplate elementary evaluation. Basic evaluation includes evaluating the underlying belongings (the 100 corporations within the Nasdaq-100) to evaluate their monetary well being, progress prospects, and general worth. Components similar to earnings studies, income progress, technological developments, and trade traits can considerably impression the QQQ worth. Combining technical and elementary evaluation offers a extra holistic view of the market and reduces funding danger.

V. Danger Administration and Buying and selling Methods:

Buying and selling QQQ, like every other funding, includes dangers. Efficient danger administration is essential. This contains:

- Place Sizing: Figuring out the suitable quantity of capital to allocate to every commerce. Keep away from risking greater than a small share of your buying and selling capital on any single commerce.

- Cease-Loss Orders: Inserting stop-loss orders to restrict potential losses if the commerce goes in opposition to you.

- Take-Revenue Orders: Setting take-profit orders to safe income when the worth reaches a predetermined goal.

- Diversification: Do not put all of your eggs in a single basket. Diversify your funding portfolio throughout completely different asset lessons to scale back general danger.

Totally different buying and selling methods could be employed when buying and selling QQQ:

- Development Following: Figuring out and following established traits.

- Imply Reversion: Buying and selling based mostly on the idea that costs will revert to their common.

- Swing Buying and selling: Holding positions for a number of days or perhaps weeks to capitalize on worth swings.

- Day Buying and selling: Holding positions for a number of hours or minutes to revenue from short-term worth fluctuations.

VI. Decoding QQQ Chart Patterns in Totally different Timeframes:

The interpretation of QQQ charts varies considerably relying on the timeframe.

- Day by day Charts: Helpful for figuring out short-term traits and buying and selling alternatives. Merchants typically use every day charts for swing buying and selling or day buying and selling.

- Weekly Charts: Present a broader perspective in the marketplace, specializing in medium-term traits. Swing merchants and longer-term buyers typically make the most of weekly charts.

- Month-to-month Charts: Provide a long-term view of the market, ideally suited for figuring out main traits and long-term funding methods.

VII. The Significance of Backtesting and Apply:

Earlier than implementing any buying and selling technique on the QQQ chart, it is essential to backtest it utilizing historic knowledge. Backtesting helps assess the technique’s efficiency below varied market circumstances and determine potential weaknesses. Paper buying and selling (simulating trades with out utilizing actual cash) can be a beneficial device for training and refining your buying and selling expertise.

VIII. Conclusion:

The QQQ buying and selling chart provides a wealth of knowledge for buyers and merchants. By understanding fundamental worth motion, incorporating technical indicators, contemplating elementary evaluation, and using sound danger administration methods, merchants can enhance their probabilities of making knowledgeable choices and reaching their funding objectives. Nonetheless, keep in mind that buying and selling includes inherent dangers, and no technique ensures income. Steady studying, adaptation, and self-discipline are important for long-term success within the QQQ market. All the time keep up to date on market information and financial occasions which will impression the Nasdaq-100 and, consequently, the QQQ ETF. Seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the QQQ Buying and selling Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!