Decoding the Rounding Prime Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the Rounding Prime Chart Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Rounding Prime Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Rounding Prime Chart Sample: A Complete Information for Merchants

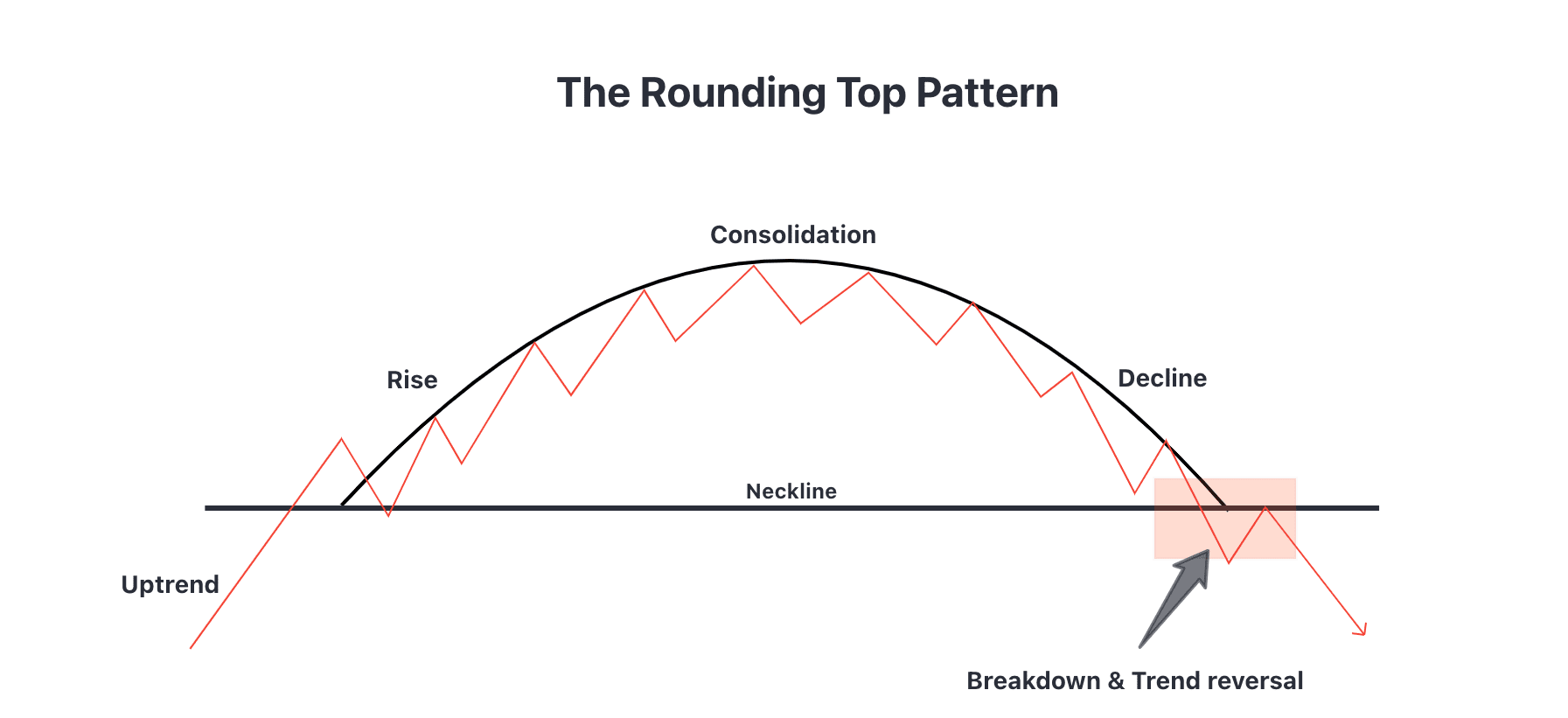

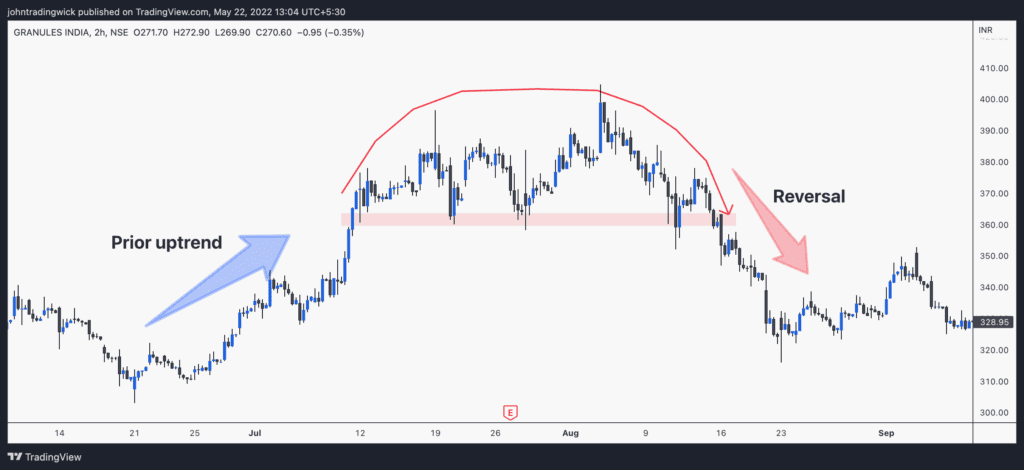

The rounding prime, also referred to as a head and shoulders prime in its extra pronounced kind, is a traditional chart sample that alerts a possible development reversal from uptrend to downtrend. In contrast to sharp, V-shaped reversals, the rounding prime unfolds progressively, providing merchants a extra refined however doubtlessly equally worthwhile alternative to anticipate a worth decline. This text delves into the intricacies of the rounding prime sample, protecting its identification, affirmation, potential pitfalls, and buying and selling methods.

Understanding the Formation of a Rounding Prime

A rounding prime is characterised by a gradual curving arc within the worth chart, resembling the highest of a dome or a rounded hill. It is shaped over an prolonged interval, sometimes a number of months and even years, and signifies a waning bullish momentum. The sample’s formation entails the next key phases:

-

Uptrend Section: The sample begins with a well-established uptrend. Costs constantly make increased highs and better lows, showcasing robust bullish sentiment.

-

Preliminary Peak: The value finally reaches a peak, which marks the start of the rounding prime formation. This peak is commonly not as pronounced as a pointy peak in different chart patterns.

-

Gradual Decline and Consolidation: After the preliminary peak, the worth begins a gradual decline, however not a pointy drop. As an alternative, it fluctuates inside a spread, forming a sequence of decrease highs and decrease lows. This consolidation section is essential in figuring out the rounding prime; the worth by no means decisively breaks out of the vary to proceed the uptrend. The value motion resembles a curve progressively sloping downwards.

-

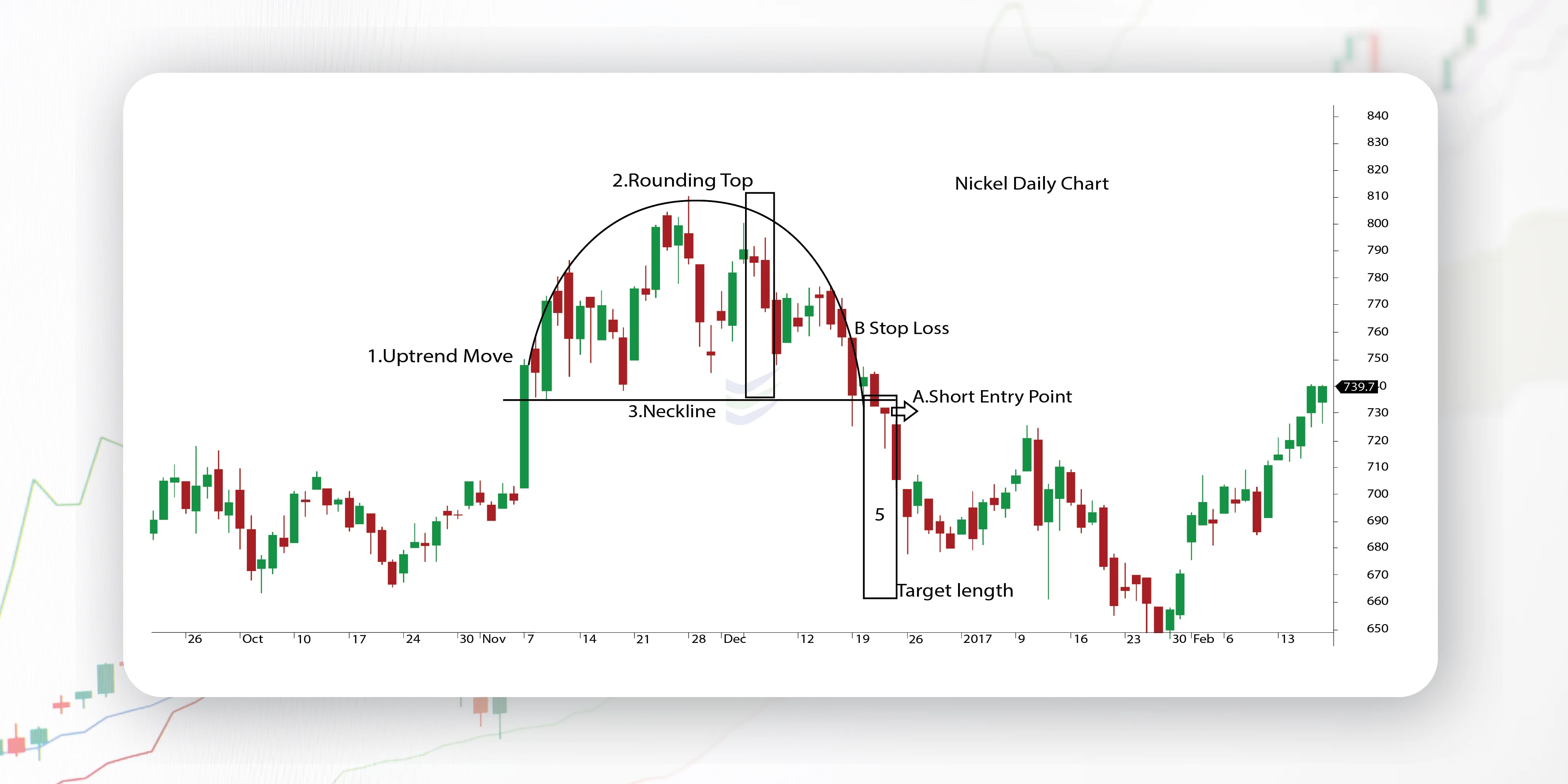

Affirmation of the Sample: The sample is confirmed when the worth decisively breaks under the neckline, a vital assist degree shaped by connecting the decrease lows through the consolidation section. This neckline break signifies a possible development reversal, and merchants typically use this as a sign to enter quick positions.

-

Downward Pattern: After the neckline break, the worth sometimes enters a downward development, with costs making decrease lows and decrease highs. The extent of the worth decline after the neckline break can fluctuate, nevertheless it typically mirrors the peak of the rounding prime formation.

Key Parts of a Rounding Prime Sample

Figuring out a real rounding prime requires cautious remark of a number of key components:

-

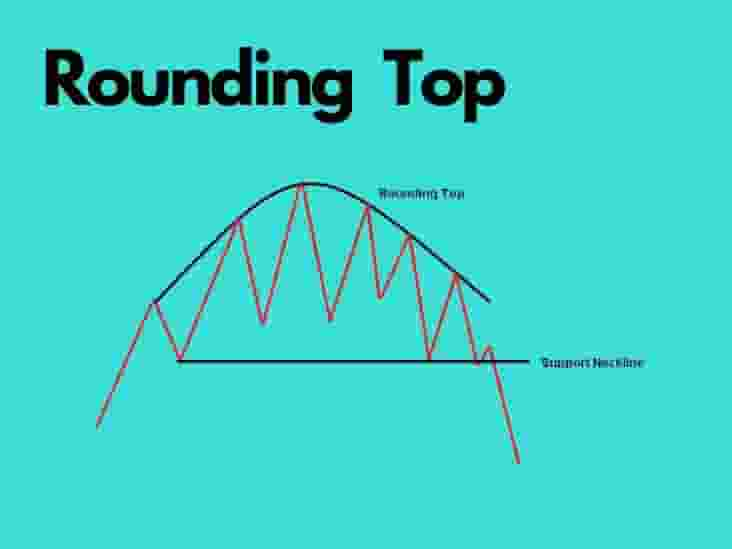

The Curve: Probably the most outstanding function is the sleek, rounded curve of the worth motion. The curve ought to be comparatively constant, with out sharp spikes or sudden reversals throughout the sample’s formation.

-

The Neckline: The neckline is a horizontal or barely sloping line connecting the decrease lows of the sample. This line acts as a vital assist degree. A break under this line confirms the sample and alerts a possible downtrend.

-

The Peak of the Rounding Prime: The peak of the rounding prime from the neckline to the best level of the curve gives an approximate goal for the potential worth decline after the neckline break. This top is commonly used as a worth goal for brief positions.

-

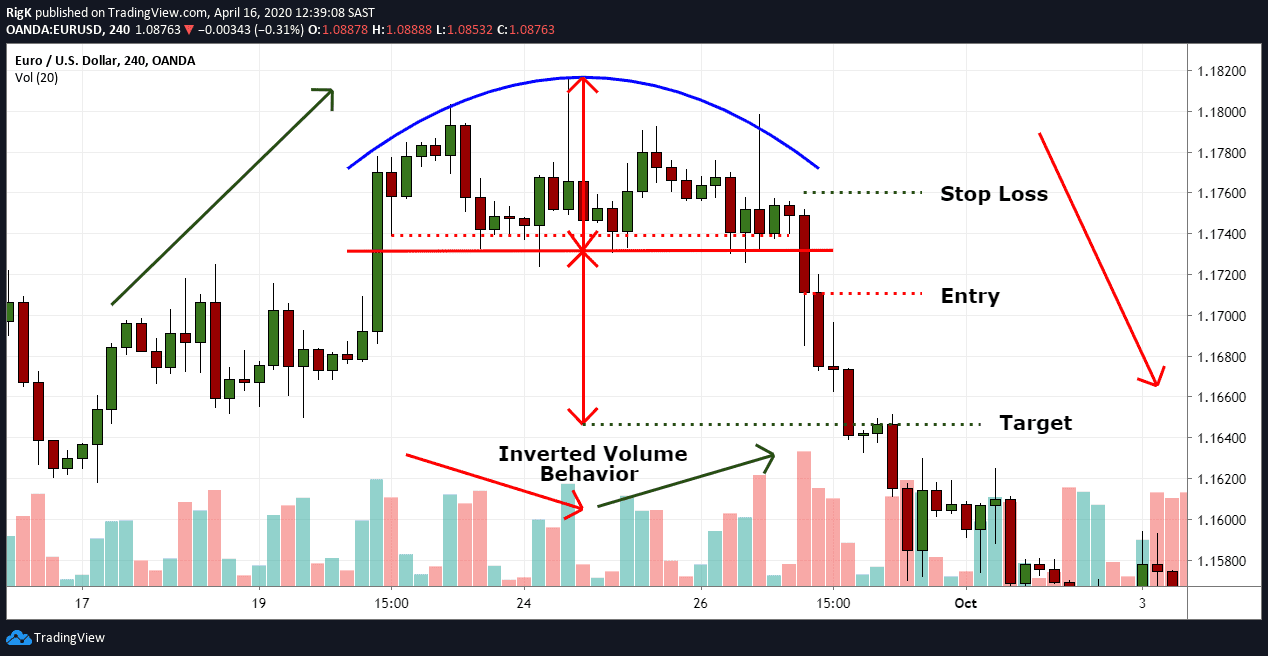

Quantity: Quantity performs a vital position in confirming the sample. In the course of the preliminary peak, quantity is often excessive, reflecting robust shopping for strain. As the worth consolidates and varieties the rounded prime, quantity sometimes decreases, indicating waning curiosity and a possible shift in sentiment. A surge in quantity accompanying the neckline break strengthens the bearish sign.

-

Time Body: The time-frame over which the rounding prime varieties is essential. Whereas it could actually kind over comparatively quick durations, a extra dependable rounding prime sometimes develops over a number of months and even years. This longer timeframe permits for a extra important worth motion after the sample’s affirmation.

Differentiating Rounding Tops from Different Chart Patterns

It is essential to distinguish a rounding prime from different related chart patterns to keep away from false alerts. Here is a comparability:

-

Head and Shoulders Prime: A rounding prime is basically a much less pronounced model of a head and shoulders prime. The top and shoulders sample has three distinct peaks, whereas the rounding prime has a extra gradual, rounded peak.

-

Double Prime: A double prime has two distinct peaks of roughly equal top, whereas a rounding prime has a single, rounded peak.

-

Consolidation Patterns: Consolidation patterns, akin to triangles or rectangles, typically contain worth actions inside an outlined vary. Nonetheless, not like a rounding prime, these patterns do not essentially point out a development reversal. A breakout from a consolidation sample may very well be bullish or bearish.

-

Easy Corrections: Minor worth corrections throughout an uptrend can generally resemble a rounding prime, however these corrections often lack the prolonged timeframe and the constant downward curve attribute of a real rounding prime.

Buying and selling Methods Based mostly on Rounding Tops

The rounding prime sample affords a number of buying and selling methods:

-

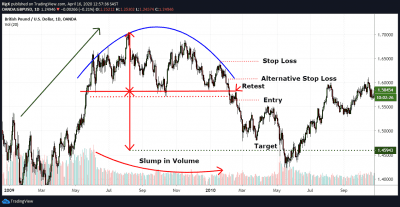

Quick Promoting: As soon as the neckline is damaged decisively, merchants typically enter quick positions, aiming to revenue from the anticipated worth decline. The peak of the rounding prime from the neckline to its peak typically serves as a worth goal.

-

Cease-Loss Orders: Putting a stop-loss order above the neckline is essential to restrict potential losses if the worth unexpectedly reverses and continues its uptrend.

-

Trailing Cease-Loss: As the worth declines, a trailing stop-loss order can be utilized to guard income and lock in positive aspects.

-

Affirmation with Indicators: Combining the rounding prime sample with technical indicators like RSI, MACD, or shifting averages might help affirm the bearish sign and enhance buying and selling accuracy. For instance, a bearish divergence between worth and RSI can strengthen the bearish sign.

Potential Pitfalls and Concerns

Whereas the rounding prime is a beneficial sample, it is important to pay attention to potential pitfalls:

-

False Breakouts: The value may break under the neckline briefly, making a false sign, earlier than resuming its uptrend. Utilizing quantity affirmation and different technical indicators might help mitigate this danger.

-

Indecisive Neckline Breaks: A weak or indecisive break under the neckline won’t result in a major worth decline. Merchants ought to search for a transparent and decisive break with elevated quantity.

-

Subjectivity in Identification: Figuring out the neckline and the extent of the rounding prime could be subjective. Totally different merchants may interpret the sample otherwise, resulting in various buying and selling selections.

Conclusion:

The rounding prime chart sample affords merchants a beneficial instrument for figuring out potential development reversals. Nonetheless, it is essential to know its formation, key components, and potential pitfalls. Combining the sample with different technical indicators and danger administration methods can considerably enhance buying and selling accuracy and profitability. Keep in mind, no chart sample ensures success, and thorough evaluation and danger administration are important for profitable buying and selling. All the time observe due diligence and contemplate consulting with a monetary advisor earlier than making any buying and selling selections.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Rounding Prime Chart Sample: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!