Decoding the Secrets and techniques: Chart Patterns in Crypto Buying and selling

Associated Articles: Decoding the Secrets and techniques: Chart Patterns in Crypto Buying and selling

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Secrets and techniques: Chart Patterns in Crypto Buying and selling. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Secrets and techniques: Chart Patterns in Crypto Buying and selling

The cryptocurrency market, identified for its volatility and speedy value swings, can look like a chaotic panorama to the untrained eye. Nonetheless, beneath the floor of seemingly random value actions lie recurring patterns, referred to as chart patterns, that skilled merchants make the most of to foretell future value motion. Understanding and decoding these patterns can considerably enhance your buying and selling technique, serving to you determine potential entry and exit factors with larger confidence. This text will delve into the world of chart patterns in crypto buying and selling, exploring their significance, numerous varieties, and sensible purposes.

What are Chart Patterns?

Chart patterns are visually identifiable formations on value charts that signify the interaction of provide and demand. They’re created by the collective actions of consumers and sellers, reflecting the market sentiment and potential future value actions. These patterns are usually not foolproof predictions, however slightly probabilistic indicators that improve the probability of a selected value consequence. Their effectiveness hinges on correct identification, affirmation, and danger administration.

Sorts of Chart Patterns:

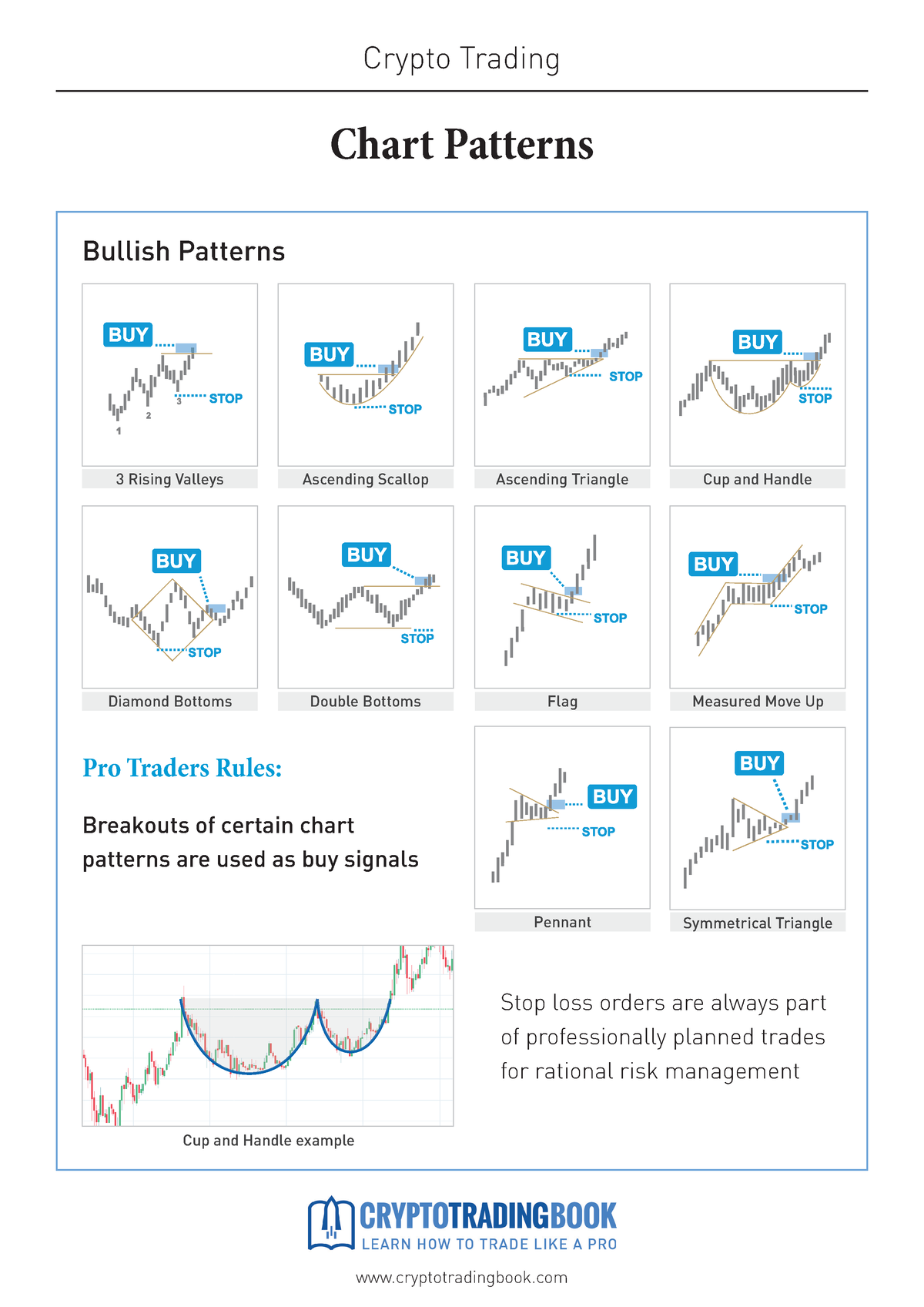

Chart patterns are broadly categorized into two important teams: continuation patterns and reversal patterns.

1. Continuation Patterns:

These patterns recommend that the prevailing development will seemingly proceed after a short lived pause or consolidation. They signify a interval of relaxation earlier than the dominant development resumes. Some frequent continuation patterns embody:

-

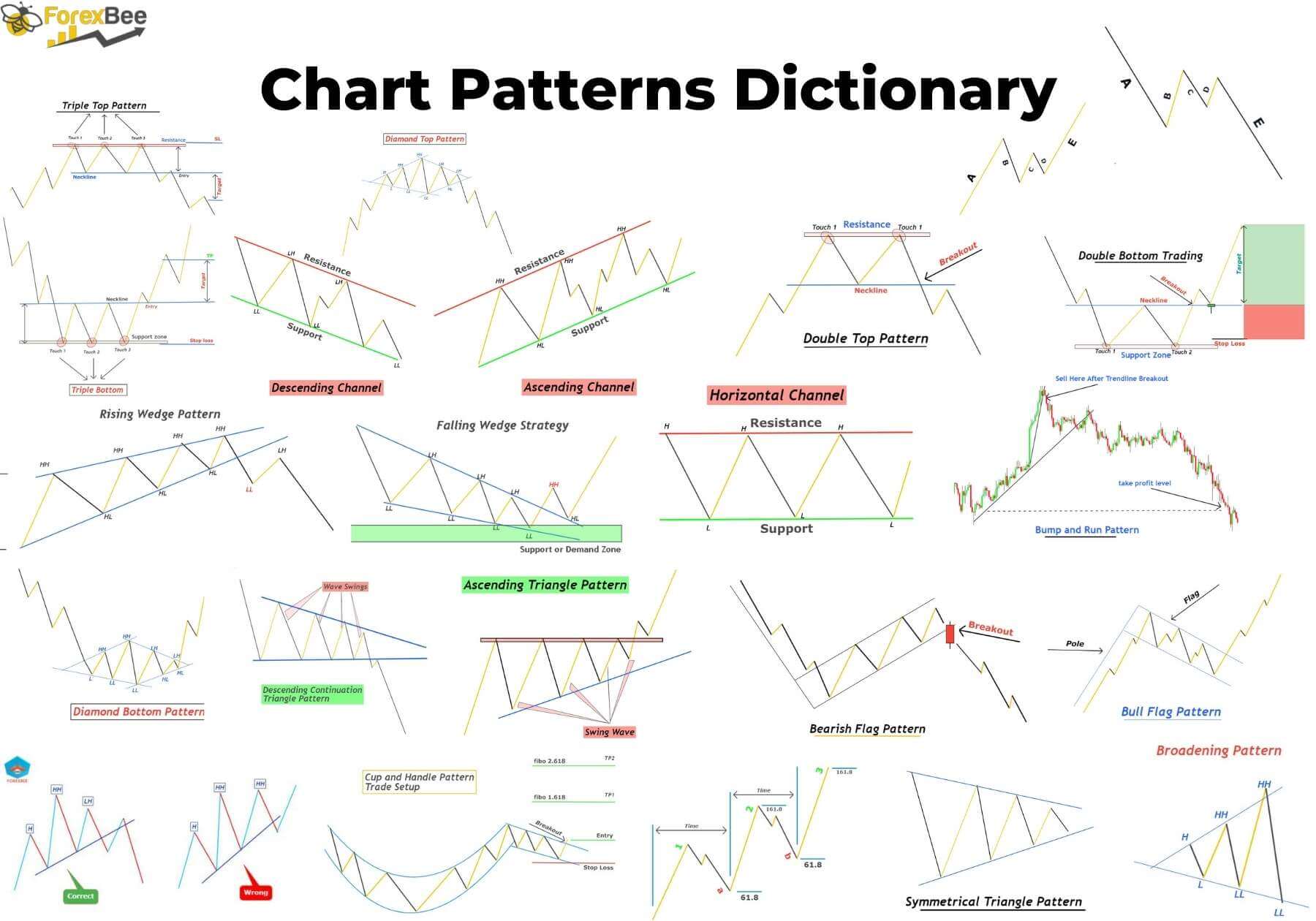

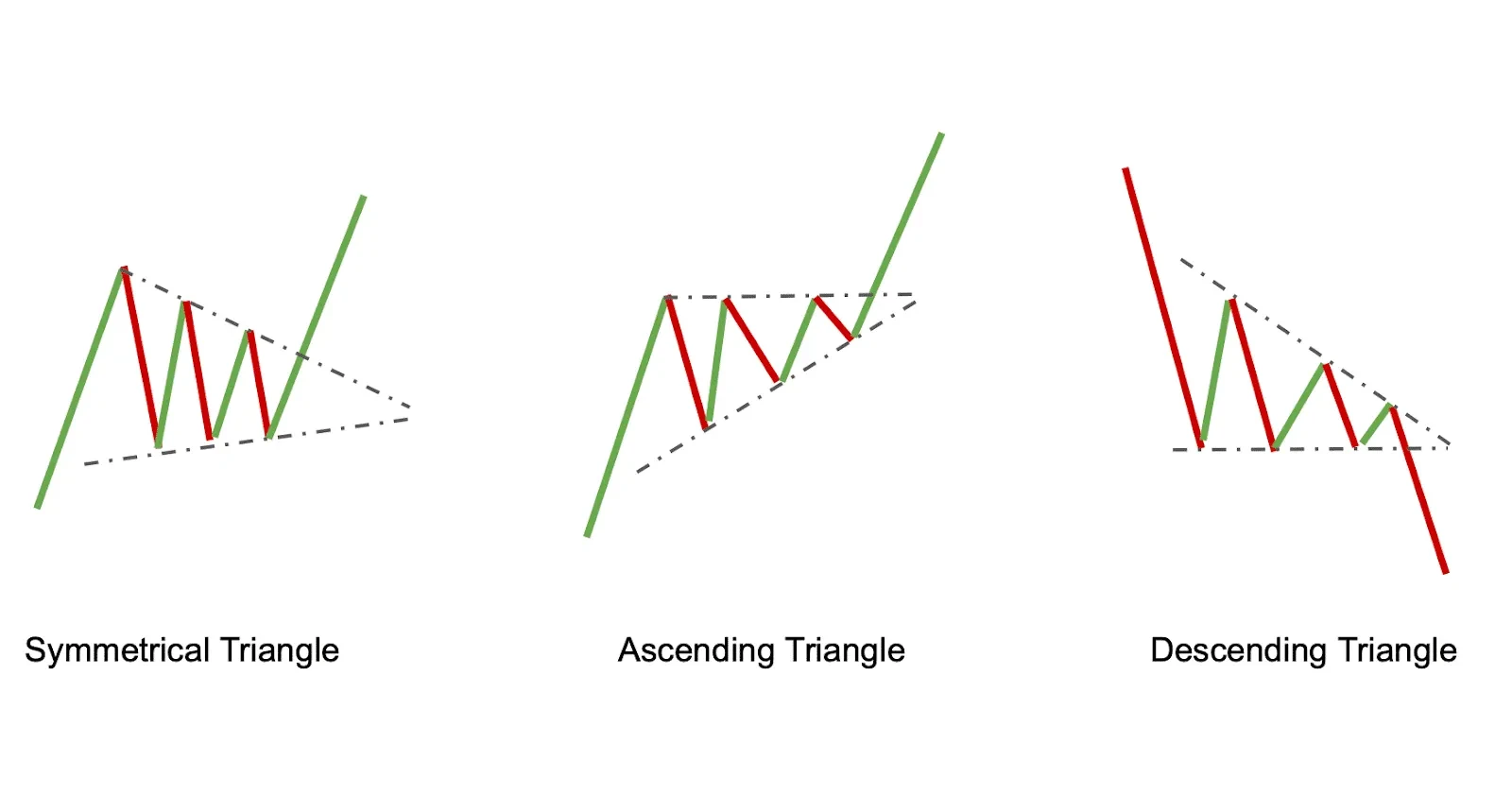

Triangles: Triangles are characterised by converging trendlines, forming a triangle form on the chart. There are three important varieties: symmetrical, ascending, and descending. Symmetrical triangles point out a interval of indecision, with neither consumers nor sellers gaining a transparent benefit. Ascending triangles recommend bullish momentum, whereas descending triangles trace at bearish stress. Breakouts from triangles sometimes happen within the route of the prevailing development.

-

Flags and Pennants: These patterns resemble flags or pennants on a flagpole. They’re characterised by a brief interval of consolidation following a pointy value motion. Flags are sometimes characterised by parallel trendlines, whereas pennants have converging trendlines. Breakouts from flags and pennants often happen within the route of the previous development.

-

Rectangles: Rectangles are characterised by two parallel horizontal trendlines, representing a interval of consolidation inside an outlined value vary. Breakouts from rectangles sometimes happen within the route of the previous development. The peak of the rectangle can be utilized to mission the potential value goal after the breakout.

2. Reversal Patterns:

These patterns recommend a possible change within the route of the prevailing development. They sign a shift in market sentiment, indicating a possible development reversal. Some frequent reversal patterns embody:

-

Head and Shoulders: This can be a basic reversal sample characterised by three peaks, with the center peak (the "head") being considerably larger than the opposite two ("shoulders"). A neckline connects the troughs between the peaks. A breakout under the neckline confirms the bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a possible bullish reversal. It options three troughs, with the center trough being considerably decrease than the opposite two. A breakout above the neckline confirms the bullish reversal.

-

Double Tops and Double Bottoms: These patterns include two comparable peaks (double high) or troughs (double backside), indicating a possible reversal. A breakout under the neckline of a double high or above the neckline of a double backside confirms the reversal.

-

Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs, signifying a stronger potential reversal.

Figuring out and Decoding Chart Patterns:

Efficiently using chart patterns requires cautious statement and evaluation. Listed below are some key concerns:

-

Quantity: The amount of buying and selling exercise ought to affirm the breakout from a chart sample. A big improve in quantity throughout a breakout strengthens the sign. Low quantity breakouts are sometimes thought of weak and unreliable.

-

Trendline Help and Resistance: Take note of the assist and resistance ranges shaped by trendlines. Breakouts above resistance or under assist are extra important.

-

Affirmation: Search for affirmation from different technical indicators, akin to shifting averages, RSI, or MACD, to extend the reliability of the sign.

-

Timeframe: Chart patterns can seem on numerous timeframes, from short-term (e.g., 1-hour charts) to long-term (e.g., day by day or weekly charts). The timeframe chosen depends upon your buying and selling technique and danger tolerance.

-

Context is Key: Chart patterns ought to be interpreted inside the broader market context. Take into account the general development, information occasions, and market sentiment when analyzing a sample.

Sensible Purposes in Crypto Buying and selling:

Chart patterns may be built-in right into a complete crypto buying and selling technique in a number of methods:

-

Entry Factors: Breakouts from continuation patterns present potential entry factors to experience the prevailing development. Breakouts from reversal patterns can sign entry factors in the wrong way of the earlier development.

-

Cease-Loss Orders: Place stop-loss orders under the assist stage for lengthy positions and above the resistance stage for brief positions to restrict potential losses.

-

Revenue Targets: Venture potential revenue targets primarily based on the sample’s dimensions. For instance, the peak of a rectangle may be projected after a breakout.

-

Danger Administration: All the time use applicable danger administration methods, akin to place sizing and stop-loss orders, to guard your capital.

Limitations of Chart Patterns:

Whereas chart patterns may be priceless instruments, it is essential to acknowledge their limitations:

-

Subjectivity: Figuring out chart patterns may be subjective, with completely different merchants probably decoding the identical sample in a different way.

-

False Breakouts: Breakouts from chart patterns can generally be false, resulting in losses if not managed correctly.

-

Not a Assure: Chart patterns are usually not ensures of future value actions. They supply probabilistic indicators, not certainties.

-

Market Manipulation: In unstable markets like crypto, manipulation can distort chart patterns, making them unreliable.

Conclusion:

Chart patterns supply a priceless analytical device for crypto merchants, offering insights into potential value actions. By understanding the varied sorts of patterns, their interpretation, and limitations, merchants can improve their decision-making course of and enhance their buying and selling efficiency. Nonetheless, it is essential to keep in mind that chart patterns ought to be used together with different technical indicators and elementary evaluation, and danger administration ought to all the time be a high precedence. Steady studying and expertise are important for mastering the artwork of figuring out and using chart patterns successfully within the dynamic world of cryptocurrency buying and selling. By no means rely solely on chart patterns, and all the time conduct thorough analysis earlier than making any buying and selling choices. The cryptocurrency market is inherently dangerous, and losses are a risk. Accountable buying and selling practices are paramount to success.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Secrets and techniques: Chart Patterns in Crypto Buying and selling. We admire your consideration to our article. See you in our subsequent article!