Decoding the Silver Value: A Actual-Time Chart Deep Dive

Associated Articles: Decoding the Silver Value: A Actual-Time Chart Deep Dive

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Silver Value: A Actual-Time Chart Deep Dive. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Silver Value: A Actual-Time Chart Deep Dive

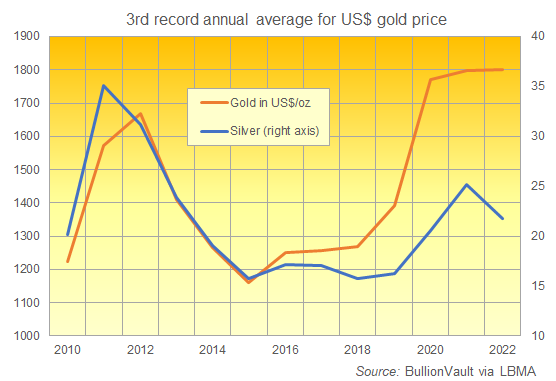

Silver, a lustrous white metallic prized for its conductive properties and inherent magnificence, has captivated traders and industrial customers for millennia. Its value, nevertheless, is a dynamic entity, fluctuating always primarily based on a posh interaction of things. Understanding these components and deciphering a real-time silver value chart requires a nuanced method, going past merely observing the present quantity. This text delves into the intricacies of silver pricing, exploring the weather that form its trajectory and offering a framework for analyzing real-time chart knowledge.

The Anatomy of a Actual-Time Silver Value Chart:

A typical real-time silver value chart, available from quite a few monetary web sites and buying and selling platforms, shows the value of silver (usually quoted in US {dollars} per troy ounce) over a selected time interval. This era can vary from a couple of minutes to a number of years, permitting for various ranges of research. The chart itself normally employs a candlestick or line graph format.

-

Candlesticks: Every candlestick represents a selected time interval (e.g., one hour, in the future). The physique of the candlestick reveals the value vary between the opening and shutting costs, whereas the "wicks" (or shadows) prolong to the excessive and low costs reached throughout that interval. Inexperienced or white candles usually point out a value enhance, whereas crimson or black candles sign a value lower.

-

Line Graphs: Line graphs join the closing costs of successive time intervals, offering a smoother visible illustration of value traits.

-

Technical Indicators: Many charts incorporate technical indicators, resembling transferring averages (e.g., 50-day, 200-day), Relative Power Index (RSI), and Bollinger Bands. These indicators assist determine potential traits, help and resistance ranges, and momentum shifts.

-

Quantity: The amount of silver traded throughout every time interval is commonly displayed alongside the value chart. Excessive quantity throughout a value transfer can recommend stronger conviction behind the pattern.

Elements Influencing Actual-Time Silver Costs:

The value of silver is influenced by a large number of things, making its prediction a difficult endeavor. These components may be broadly categorized as:

1. Industrial Demand: Silver’s distinctive electrical conductivity makes it indispensable in numerous industries. Its use in electronics (photo voltaic panels, smartphones, computer systems), vehicles, and medical units is essential. Sturdy industrial development interprets to elevated silver demand, pushing costs upwards. Conversely, financial slowdowns or technological developments resulting in diminished silver utilization can depress costs. Actual-time charts usually replicate shifts in industrial exercise, with elevated demand correlating with value will increase.

2. Funding Demand: Silver is taken into account a valuable metallic and a safe-haven asset. Buyers usually flock to silver throughout occasions of financial uncertainty or inflation, viewing it as a hedge in opposition to inflation and a retailer of worth. This funding demand can considerably impression silver costs, notably in periods of geopolitical instability or market volatility. Actual-time charts can vividly illustrate the impression of investor sentiment, with sharp value actions usually reflecting speculative buying and selling exercise.

3. Hypothesis and Futures Markets: The futures market performs a major position in shaping silver costs. Speculators purchase and promote silver futures contracts, influencing the value primarily based on their expectations of future value actions. This speculative exercise can result in important value volatility, typically decoupling the value from basic provide and demand components. Actual-time charts are notably helpful in observing the impression of speculative buying and selling, with fast value swings usually indicative of heightened hypothesis.

4. Forex Fluctuations: The value of silver is often quoted in US {dollars}. Fluctuations within the worth of the greenback relative to different currencies can affect silver costs. A weaker greenback usually makes dollar-denominated commodities like silver extra enticing to worldwide patrons, resulting in elevated demand and better costs. Conversely, a stronger greenback can depress silver costs. Actual-time charts usually present a correlation between greenback energy and silver value actions.

5. Provide and Demand Dynamics: Like all commodity, the fundamental ideas of provide and demand govern silver’s value. Elevated mining manufacturing or recycling can enhance provide, probably placing downward strain on costs. Conversely, restricted provide coupled with sturdy demand can drive costs larger. Whereas provide and demand are basic, their affect on real-time value actions is commonly overshadowed by different components, notably hypothesis.

6. Authorities Insurance policies and Laws: Authorities insurance policies, notably these associated to mining rules, environmental restrictions, and commerce tariffs, can impression silver manufacturing and provide. Adjustments in these insurance policies can have a major impact on silver costs, which can be mirrored in real-time chart evaluation.

7. Geopolitical Occasions: Geopolitical occasions, resembling wars, political instability, and pure disasters, can considerably impression silver costs. These occasions usually result in elevated uncertainty and safe-haven demand, driving up silver costs. Actual-time charts can present the speedy impression of such occasions, with value spikes usually reflecting investor anxieties.

Analyzing Actual-Time Silver Value Charts: A Sensible Strategy:

Analyzing a real-time silver value chart requires a multi-faceted method. Merely wanting on the present value is inadequate; understanding the context is essential.

-

Establish Traits: Observe the general route of the value motion. Is the value trending upwards, downwards, or sideways? Establish help and resistance ranges – value factors the place the value has traditionally struggled to interrupt by means of.

-

Think about Timeframes: Analyze the chart throughout a number of timeframes (e.g., short-term, medium-term, long-term) to achieve a complete perspective. Brief-term fluctuations could also be noisy, however long-term traits can reveal underlying market dynamics.

-

Make the most of Technical Indicators: Shifting averages may help easy out value fluctuations and determine potential pattern reversals. RSI and Bollinger Bands can present insights into momentum and potential overbought or oversold circumstances.

-

Assess Quantity: Excessive quantity accompanying a value transfer confirms the energy of the pattern. Low quantity throughout a value transfer suggests weaker conviction and potential for a reversal.

-

Monitor Information and Occasions: Keep knowledgeable about related information and occasions that would impression silver costs. This consists of financial knowledge, geopolitical developments, and industrial information.

-

Perceive Market Sentiment: Gauge the general market sentiment in direction of silver. Are traders bullish or bearish? This may present invaluable context for deciphering value actions.

Conclusion:

An actual-time silver value chart is a dynamic window into the complicated world of silver buying and selling. Understanding the components that affect silver costs, coupled with a disciplined method to chart evaluation, is crucial for navigating the market successfully. Whereas predicting future value actions with certainty is not possible, an intensive understanding of the underlying dynamics and the skillful interpretation of real-time chart knowledge can considerably enhance the chances of constructing knowledgeable buying and selling choices. Keep in mind that buying and selling includes threat, and it is essential to conduct thorough analysis and take into account looking for skilled monetary recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Silver Value: A Actual-Time Chart Deep Dive. We hope you discover this text informative and helpful. See you in our subsequent article!