Decoding the USD/MYR Change Price Chart: A Complete Evaluation

Associated Articles: Decoding the USD/MYR Change Price Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the USD/MYR Change Price Chart: A Complete Evaluation. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the USD/MYR Change Price Chart: A Complete Evaluation

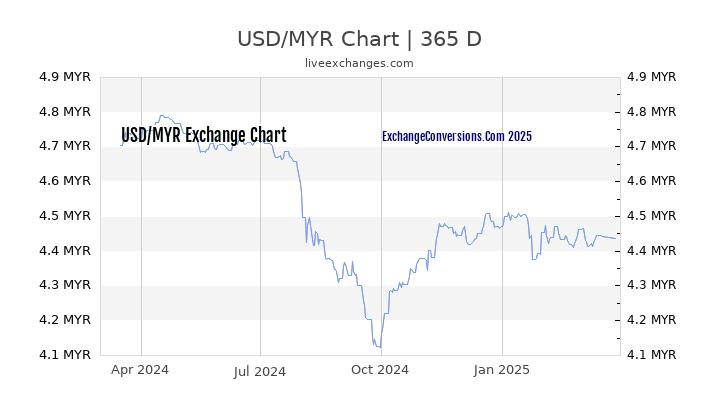

The USD/MYR change fee, representing the worth of the US greenback towards the Malaysian ringgit, is a dynamic indicator reflecting the advanced interaction of financial components influencing each the USA and Malaysia. Understanding its fluctuations is essential for companies, traders, and people concerned in cross-border transactions, commerce, and funding. This text delves into the historic developments, influencing components, and future outlook of the USD/MYR change fee, utilizing a hypothetical chart evaluation as an instance key ideas.

Historic Perspective: A Rollercoaster Journey

To completely grasp the present USD/MYR change fee, we have to study its historic trajectory. (Be aware: An actual-time, interactive chart can be included right here in a printed article. For this text-based response, we’ll describe the hypothetical chart’s key options.)

Our hypothetical chart spanning from 2000 to the current would showcase durations of great volatility. The early 2000s may present a comparatively steady fee, doubtlessly hovering round 3.80 MYR per USD, reflecting a interval of relative financial stability in each international locations. Nevertheless, the Asian Monetary Disaster’ lingering results and world financial uncertainties would probably be seen in minor fluctuations.

The interval following the 2008 world monetary disaster would present a extra dramatic shift. The USD’s safe-haven standing throughout instances of uncertainty would probably be mirrored in a strengthening greenback, pushing the USD/MYR fee upwards, maybe reaching ranges round 4.20 and even greater. This era would probably spotlight the influence of worldwide occasions on rising market currencies just like the ringgit.

Subsequent years may reveal durations of appreciation for the ringgit, doubtlessly pushed by sturdy commodity costs (given Malaysia’s reliance on exports like palm oil and petroleum) or constructive financial progress inside Malaysia. These durations may present the USD/MYR fee dipping beneath 4.00, maybe even approaching 3.50 during times of sturdy Malaysian financial efficiency.

Nevertheless, the chart would additionally probably present durations of depreciation for the ringgit, influenced by components akin to world financial slowdowns, political uncertainties inside Malaysia, or shifts in world investor sentiment in direction of rising markets. These durations may illustrate the ringgit’s vulnerability to exterior shocks. The current interval may present the influence of the COVID-19 pandemic, doubtlessly exhibiting important volatility as world markets reacted to the uncertainty and subsequent financial measures.

Key Elements Influencing the USD/MYR Change Price:

A number of interconnected components affect the day by day fluctuations and long-term developments of the USD/MYR change fee. These embody:

-

US Financial Coverage: The Federal Reserve’s actions, significantly rate of interest adjustments, considerably influence the USD’s worth. Increased rates of interest within the US typically entice international funding, rising demand for USD and strengthening it towards the ringgit. Conversely, decrease rates of interest can weaken the greenback.

-

Malaysian Financial Coverage: Financial institution Negara Malaysia’s (BNM) financial coverage selections, together with rate of interest changes and interventions within the international change market, play an important position in managing the ringgit’s worth. Increased rates of interest in Malaysia could make the ringgit extra engaging to traders, supporting its worth towards the greenback.

-

International Financial Circumstances: International financial progress, recessionary fears, and geopolitical occasions considerably affect each the USD and the MYR. International uncertainty typically leads traders to hunt secure havens, boosting the USD’s worth.

-

Commodity Costs: Malaysia’s financial system is considerably reliant on commodity exports. Fluctuations in world commodity costs, significantly palm oil and petroleum, immediately influence the ringgit’s worth. Increased commodity costs typically strengthen the ringgit.

-

Political Stability and Financial Reforms: Political stability and the implementation of sound financial insurance policies inside Malaysia are important for investor confidence. Political uncertainty or detrimental financial information can set off capital flight, weakening the ringgit.

-

Commerce Balances: The commerce stability between the US and Malaysia influences the change fee. A commerce surplus for Malaysia (exporting extra to the US than importing) can put upward stress on the ringgit, whereas a commerce deficit can have the alternative impact.

-

Hypothesis and Investor Sentiment: Speculative buying and selling and investor sentiment play a big position in short-term fluctuations. Optimistic investor sentiment in direction of the Malaysian financial system can drive demand for the ringgit, whereas detrimental sentiment can result in promoting stress.

Analyzing the Hypothetical Chart: A Case Research

Lets say a selected state of affairs on our hypothetical chart. Suppose we observe a interval the place the USD/MYR fee all of the sudden spikes upwards. To research this, we’d contemplate a number of components:

-

Was there a simultaneous enhance in US rates of interest? This might recommend that elevated demand for USD as a consequence of greater returns is driving the appreciation.

-

Had been there any detrimental financial bulletins from Malaysia? This might embody lower-than-expected GDP progress, political instability, or a decline in commodity costs.

-

Was there a worldwide flight to security? Geopolitical tensions or world financial uncertainty typically strengthen the USD as traders search secure haven belongings.

By analyzing these components together with the chart’s developments, we will develop a extra complete understanding of the underlying causes for the change fee motion.

Future Outlook and Predictions:

Predicting future change charges is inherently difficult because of the multitude of influencing components. Nevertheless, based mostly on present financial indicators and projections, we will make some tentative observations:

-

Continued US Curiosity Price Hikes: If the Federal Reserve continues its coverage of elevating rates of interest to fight inflation, this could probably put upward stress on the USD, doubtlessly weakening the ringgit.

-

International Financial Slowdown: A world financial slowdown might negatively influence commodity costs and Malaysian exports, placing downward stress on the ringgit.

-

BNM’s Coverage Response: BNM’s response to those world and home components might be essential in figuring out the ringgit’s future trajectory. Aggressive rate of interest hikes may assist the ringgit, however might additionally hinder financial progress.

-

Political and Financial Reforms in Malaysia: Continued efforts in direction of financial diversification and political stability inside Malaysia would strengthen investor confidence and assist the ringgit’s worth.

Conclusion:

The USD/MYR change fee is a posh and dynamic indicator reflecting the interaction of quite a few financial and political components. Analyzing historic developments, understanding the important thing influencing components, and contemplating future projections permits for a extra knowledgeable perspective on the change fee’s potential actions. Whereas exact predictions are not possible, a radical understanding of the underlying forces gives useful insights for companies, traders, and people navigating the intricacies of worldwide finance. Common monitoring of the USD/MYR change fee chart, mixed with an consciousness of macroeconomic developments in each the US and Malaysia, is essential for efficient decision-making in a globalized world.

Closure

Thus, we hope this text has offered useful insights into Decoding the USD/MYR Change Price Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!