Decoding the USD Price Chart: A Complete Information to Understanding the US Greenback’s Worth

Associated Articles: Decoding the USD Price Chart: A Complete Information to Understanding the US Greenback’s Worth

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USD Price Chart: A Complete Information to Understanding the US Greenback’s Worth. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the USD Price Chart: A Complete Information to Understanding the US Greenback’s Worth

/value-of-us-dollar-3306268-FINAL-09a1c148ffca440d80b2c15eb099ae19.jpg)

The US greenback (USD) reigns supreme because the world’s reserve forex, impacting world economies and particular person funds alike. Understanding its value, nonetheless, requires extra than simply glancing at a every day alternate fee. The USD’s worth is a fancy tapestry woven from macroeconomic components, geopolitical occasions, and market sentiment. This text delves into the intricacies of the USD value chart, exploring its historic developments, influencing components, and implications for buyers and on a regular basis people.

The USD Price Chart: Extra Than Simply Numbers

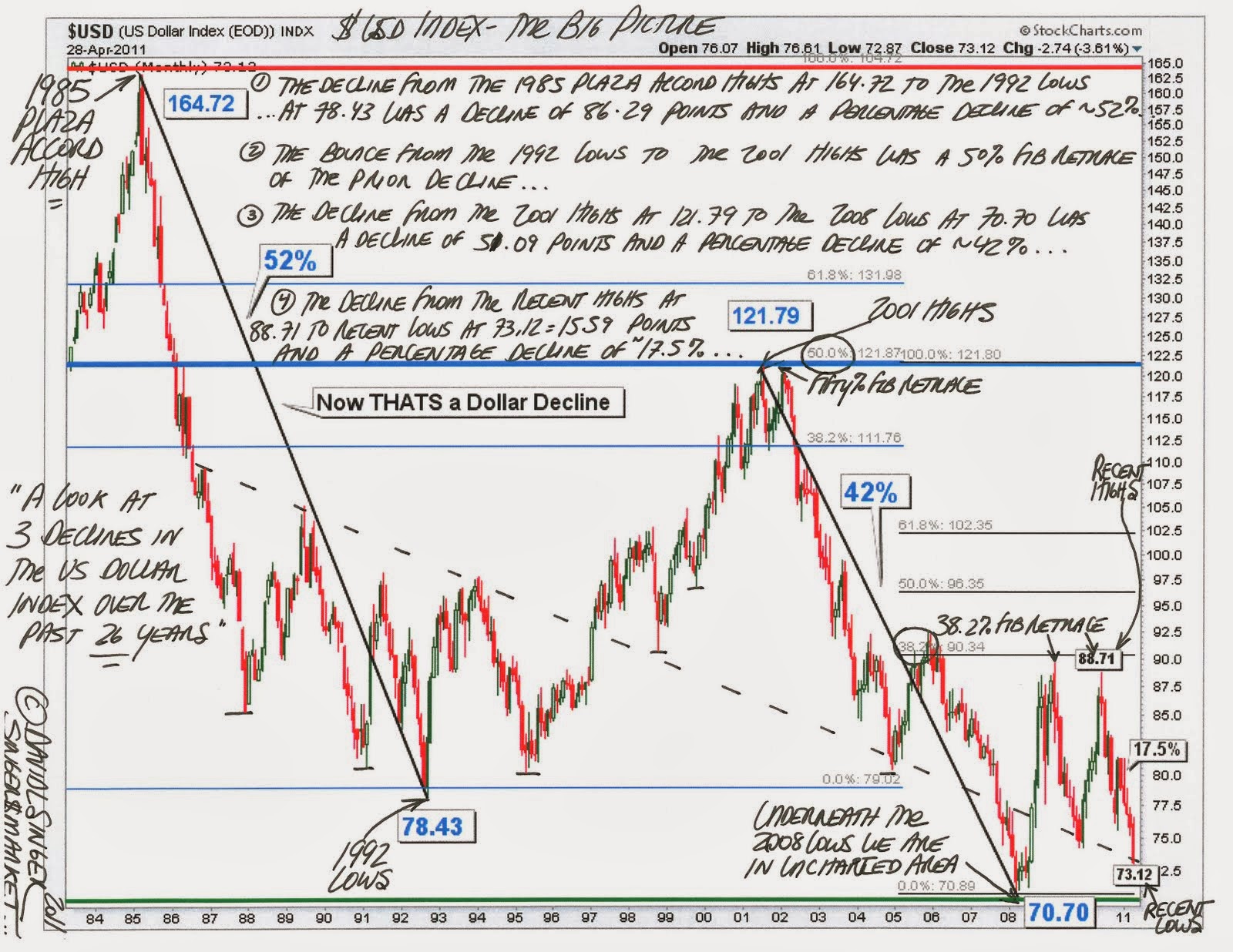

A USD value chart, usually displayed as a line graph, plots the USD’s alternate fee in opposition to different currencies over time. This seemingly easy visible illustration encapsulates a wealth of data, reflecting the relative energy or weak point of the greenback in comparison with its counterparts. Completely different charts would possibly deal with particular forex pairs (e.g., USD/EUR, USD/JPY), providing a nuanced view of the greenback’s efficiency in opposition to particular person economies. Others would possibly current a broader image, utilizing indices just like the US Greenback Index (DXY), which tracks the greenback’s worth in opposition to a basket of main currencies.

Analyzing a USD value chart requires understanding the underlying ideas of overseas alternate (foreign exchange) buying and selling. When the chart exhibits an upward development, it signifies the greenback is appreciating – that means it may purchase extra of one other forex. Conversely, a downward development signifies depreciation, the place the greenback’s buying energy relative to different currencies weakens. These fluctuations are hardly ever clean; the chart typically shows volatility, reflecting the dynamic nature of worldwide markets.

Historic Tendencies and Key Turning Factors

Inspecting the historic USD value chart reveals fascinating patterns and vital turning factors. The Bretton Woods system (1944-1971), which pegged the greenback to gold, supplied a comparatively secure interval. Nonetheless, the system’s collapse marked a transition to a floating alternate fee system, resulting in elevated volatility.

The Nineteen Eighties noticed a interval of sturdy greenback appreciation, pushed by excessive US rates of interest beneath the Reagan administration. This attracted overseas funding, rising demand for the greenback. Conversely, the late Nineteen Nineties and early 2000s witnessed intervals of greenback weak point, influenced by components just like the dot-com bubble burst and the September eleventh assaults.

The worldwide monetary disaster of 2008-2009 had a profound affect on the USD. Initially, the greenback strengthened as buyers sought secure haven property through the disaster. Nonetheless, subsequent quantitative easing (QE) applications by the Federal Reserve, designed to stimulate the US economic system, led to a gradual decline within the greenback’s worth.

Extra just lately, the COVID-19 pandemic and the next world financial slowdown triggered vital volatility within the USD value chart. The preliminary flight to security boosted the greenback, however subsequent financial restoration and diverging financial insurance policies throughout totally different nations led to fluctuating alternate charges. The continued geopolitical tensions, notably the battle in Ukraine, have additionally performed a big function in shaping the USD’s trajectory.

Elements Influencing the USD Price Chart

The USD’s worth is a multifaceted phenomenon influenced by a fancy interaction of things:

-

Curiosity Charges: Increased US rates of interest usually appeal to overseas funding, rising demand for the greenback and strengthening its worth. Conversely, decrease rates of interest can weaken the greenback. The Federal Reserve’s financial coverage selections are subsequently essential in shaping the USD value chart.

-

Financial Development: A robust US economic system, characterised by excessive GDP development and low unemployment, usually helps a stronger greenback. Financial weak point, then again, can result in depreciation.

-

Inflation: Excessive inflation erodes the buying energy of the greenback, resulting in depreciation. Central banks typically fight inflation by elevating rates of interest, which may have a counteracting impact on the greenback’s worth.

-

Authorities Debt: Excessive ranges of US authorities debt can increase considerations in regards to the nation’s long-term financial stability, probably weakening the greenback.

-

Political Stability: Political uncertainty or instability within the US can negatively affect investor confidence, resulting in greenback depreciation.

-

World Occasions: Geopolitical occasions, equivalent to wars, commerce disputes, and pure disasters, can considerably affect the USD’s worth as buyers search secure haven property or modify their portfolios primarily based on world threat perceptions.

-

Market Sentiment: Investor sentiment and hypothesis play a big function in driving short-term fluctuations within the USD value chart. Market psychology can amplify or dampen the affect of different components.

-

Forex Hypothesis: Massive-scale forex buying and selling by speculators can affect the USD’s worth, notably within the quick time period.

Implications for Traders and People

Understanding the USD value chart is essential for numerous stakeholders:

-

Traders: The USD’s worth instantly impacts funding returns. Traders holding property denominated in different currencies will see their returns fluctuate primarily based on the USD’s alternate fee. Forex hedging methods can mitigate these dangers.

-

Exporters and Importers: Fluctuations within the USD’s worth affect the profitability of worldwide commerce. A robust greenback makes US exports dearer and imports cheaper, whereas a weak greenback has the alternative impact.

-

Vacationers: The USD’s alternate fee instantly impacts the price of journey to and from the US. A robust greenback makes journey overseas cheaper, whereas a weak greenback makes it dearer.

-

Worldwide Companies: Multinational companies have to rigorously handle forex threat related to their worldwide operations. Fluctuations within the USD’s worth can considerably affect their profitability.

Conclusion: Navigating the Complexities of the USD Price Chart

The USD value chart is a dynamic and complicated illustration of the US greenback’s worth within the world economic system. Its actions mirror a mess of interacting components, making correct prediction difficult. Nonetheless, by understanding the important thing influences – rates of interest, financial development, inflation, geopolitical occasions, and market sentiment – people and buyers can acquire priceless insights into the greenback’s seemingly trajectory and make extra knowledgeable selections. Steady monitoring of the chart, coupled with a radical understanding of macroeconomic ideas, is crucial for navigating the complexities of the worldwide forex market and mitigating potential dangers. Whereas predicting the longer term is inconceivable, a complete understanding of the components influencing the USD value chart empowers knowledgeable decision-making in a world more and more interconnected by world finance.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the USD Price Chart: A Complete Information to Understanding the US Greenback’s Worth. We thanks for taking the time to learn this text. See you in our subsequent article!